Global markets surge on trade deal

News of the US-Japan trade boosted markets around the region on Wednesday with the Australian dollar one of the main beneficiaries.

US president Donald Trump announced the trade deal saying Japan would invest USD550 billion into the US economy and the US would lower tariffs on Japanese imports from 25% to 15%.

Global sharemarkets were higher yesterday with the Japanese Nikkei leading the charge, up 3.5%. The US’s Dow Jones gained 1.1%.

In FX markets, the Aussie and kiwi were best.

The AUD/USD gained 0.7% as it reached the highest level since November last year.

The NZD/USD also gained 0.7%.

Soft Aussie growth might slow AUD/USD’s climb

The primary drags on Australia’s June Westpac–Melbourne Institute leading economic indicator were sentiment, hours worked, and commodity prices, which caused it to decline from 0.11% in May to 0.03%.

Although this growth rate is not weak, the around-trend reading indicates that activity will stay soft during the second half of the year and is a significant step-down from the slightly above-trend momentum that was shown at the beginning of the year.

If US growth slows, markets sell off, or the outlook for RBA rate cuts improves, the index may go negative once more.

The central bank is expected to slash 25 basis points at its next meeting on August 12 (fully priced in by the market), after surprising markets by remaining on hold in July.

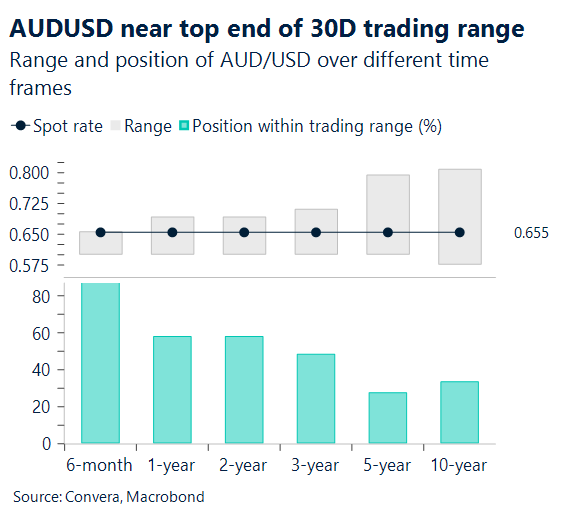

From a technical lens, AUD/USD is reaching near the top end of 30-day trading range.

The next key psychological resistance at 0.6600 looms. AUD/USD is consolidating near YTD highs, at 0.6595 last seen at the time of the US election.

Next key support for the pair includes 21-day EMA of 0.6532 and 50-day EMA of 0.6497.

USD/SGD near decade low amid chatter of Trump-Xi meeting

President Donald Trump said he may visit China “in the not-too-distant future” to meet with President Xi Jinping, noting that relations between the two countries are “very good” and his personal ties with Xi remain “healthy.”

According to Reuters, one option for the meeting could be the APEC summit in South Korea, running from October 30 to November 1. Another possibility is a visit to Beijing on September 3 for a World War II commemoration—an event expected to include Russian President Vladimir Putin.

In FX, USD/SGD is about 1% above its decade low of 1.2698.

USD buyers may look to take advantage at recent levels. Note that MAS will be announcing its rate decision on July 30th. The next key resistance lies at 21-day EMA of 1.2810, and 50-day EMA of 1.2869

AUD/USD at new highs

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 21 – 25 July

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.