USD: Slow money, strong signal

After an initial Treasuries sell‑off following Wednesday’s upbeat NFP release – which triggered a bearish flattening – short‑end yields have now eased back to pre‑release levels. As highlighted in yesterday’s note (Euro section), the rebound reflects growing skepticism about the labour‑market trajectory: annual benchmark revisions lowered the average 2025 monthly job gain to just 15k. The picture remains one of a “low hire, low fire” equilibrium, and that hawkishness bias embedded in the front end of the curve struggled to hold up.

The dollar’s muted reaction fits the story. Not only was the anatomy of the macro‑warranted bullish bias weak, but the currency is already weighed down by soft sentiment. The dollar index is almost 1% lower week‑to‑date at a time when a resilient macro backdrop should have offered bulls some relief. Instead, traders may be treating any USD strength as an opportunity to sell on longer‑term considerations.

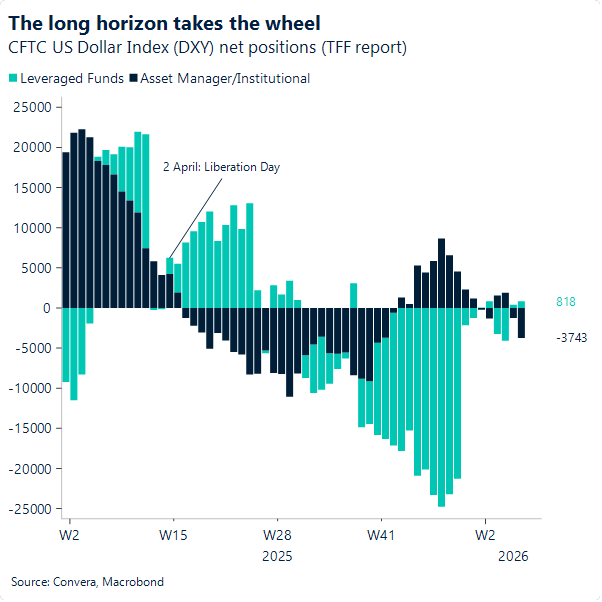

Here, the sharp reversal in institutional investors’ net bearish positioning in 2026 is instructive. These investors hold long‑horizon FX views and, when shifts are as pronounced as those captured in the February 3 snapshot, they tend to shape trading behaviour. Once the view is crystallised, their influence gradually fades. On the leveraged‑fund side, this week’s dollar price action suggests a net‑bearish DXY snapshot is likely in the next release – undermining the tactical trade they had anticipated, one built on selling into soft sentiment but buying into strong macro.

We see the dollar index continuing to tread water around the 97 level into the week’s close, with lingering soft sentiment and today’s inflation report – expected to show easing price pressures – capping any more meaningful upside.

EUR: Euro holds the line as US inflation takes the stage

EUR/USD remains comfortable in the 1.18 handle, with the February low at 1.1766 – which aligned with the unbroken 21‑day moving average – reinforcing that euro buyers are in firmer control and waiting for fresh catalysts to justify a leg higher. After pushing up and meeting resistance at 1.1930 on 9 February, the pair now hovers just above the upward‑sloping 21‑day average at 1.1814.

Today’s US inflation release could provide that catalyst. With Fed‑easing expectations pared back further after Wednesday’s US jobs report, confirmation of cooling inflation could see a re-test of the 1.19 mark.

Meanwhile, talks around boosting the euro’s international role are anything but dormant. We heard yesterday from ECB Executive Board member Piero Cipollone, who stressed that greater use of the euro in trade invoicing would make the eurozone less vulnerable to FX volatility and reduce the pass‑through of exchange rate shocks to domestic inflation. His intervention comes as eurozone finance ministers prepare to open discussions on how to reduce reliance on the dollar while expanding the use of the euro in trade invoicing. Overall, while such weekly developments have had little impact on the euro’s price action, they remain notable in the broader debate over diversifying away from the US dollar.

GBP: Sterling buckles under risk aversion

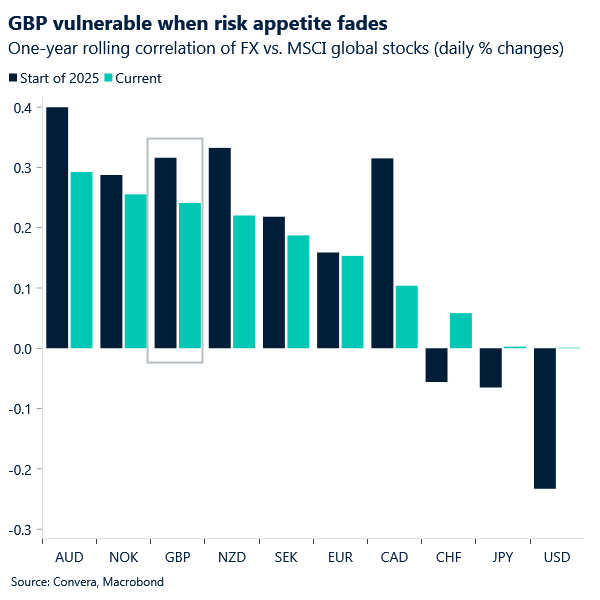

Sterling is one of the higher‑beta currencies in the G10, so yesterday’s equity sell‑off naturally weighed on the pound. When risk sentiment deteriorates, GBP tends to underperform alongside other pro‑cyclical currencies, while the likes of CHF and JPY attract inflows. The move wasn’t dramatic, but it was consistent with the broader risk‑off tone.

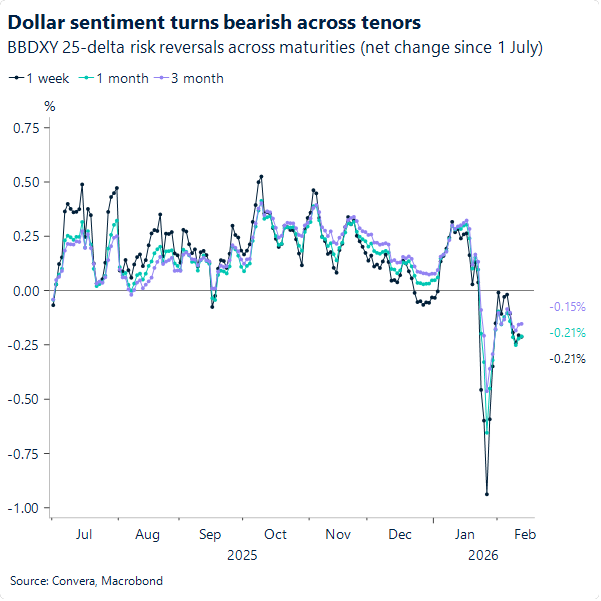

GBP/USD is grappling to stay above the $1.36 handle this morning, and a close below that level would take out the 21‑day moving‑average support — a break that would hint the recent uptrend is losing steam. The options market also shows signs of caution with negative risk‑reversals the further out the time horizon, reinforcing the market’s preference for GBP downside protection over longer tenors.

GBP/EUR is also lacking directional impetus, with the 100‑day moving average remaining the key support level in focus. The cross has spent the past few sessions drifting sideways, reflecting a broader lack of conviction on both sides: eurozone data hasn’t been strong enough to fuel a sustained EUR rebound, while sterling’s own high‑beta tendencies have been dampened by softer risk sentiment.

The domestic backdrop is also bleak for sterling. The UK economy grew by just 1.3% in 2025, leaving the UK on course for its weakest decade of growth since the 1920s — effectively the most dismal ten‑year performance in a century. The backward‑looking nature of the figures limited their immediate market impact, but they reinforce the sense that next week’s jobs and inflation data will matter far more for near‑term pricing.

Against this backdrop, further Bank of England rate cuts are likely needed simply to keep the economy on an even keel, especially with demand still fragile and productivity trends uninspiring. In a market environment where relative rate expectations are the dominant driver of currency moves, that dynamic leaves sterling vulnerable, in the short term at least.

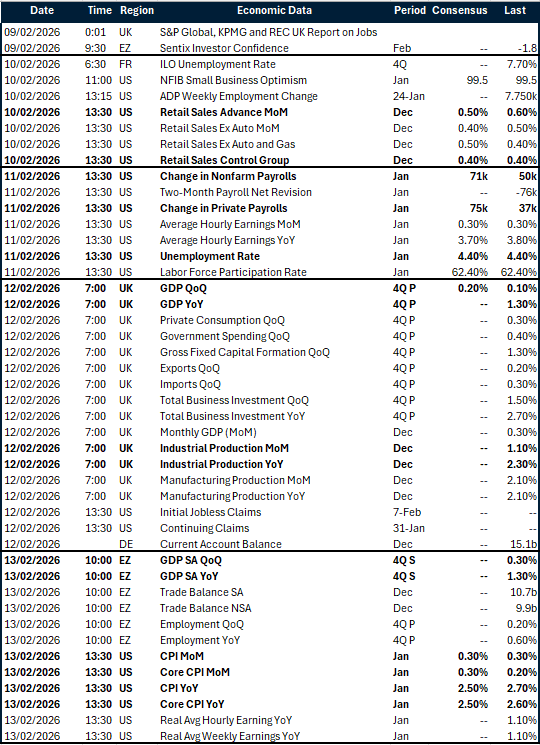

Key global risk events

Calendar: February 9-13

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.