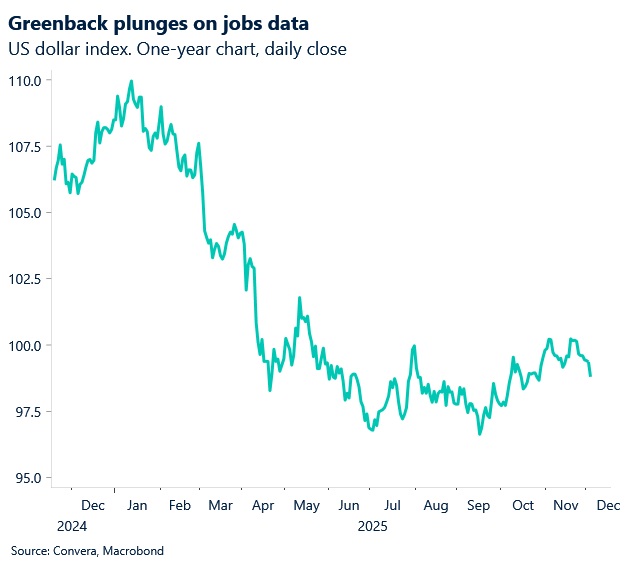

USD weakest since October

The US dollar was sent sharply lower overnight after a big miss in the November ADP jobs report hit sentiment.

With the official US job figures still delayed by the US government shutdown – November non-farm payrolls aren’t due until 17 December – the private-sector ADP numbers were always going to be closely watched. The 32k loss is the second drop in three months and paints a more negative outlook for the US jobs market.

The greenback plunged as the USD index fell 0.5% to the lowest level since 29 October.

The AUD/USD gained 0.6% while NZD/USD climbed 0.7%.

In other markets, the British pound was best, with GBP/USD up 1.1% as sterling’s post-budget recovery continued.

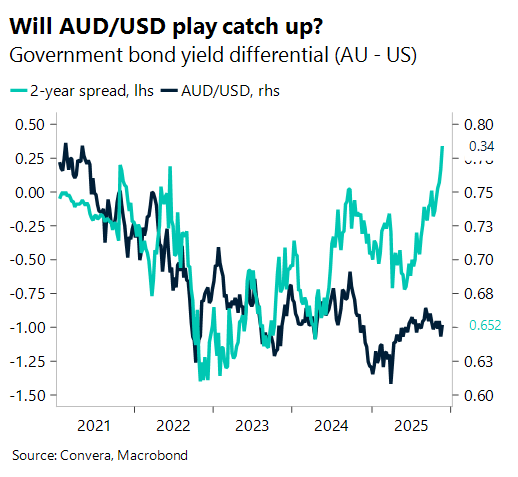

Aussie growth slows but AUD/USD hits one-month high

The Aussie was higher even after a weaker economic growth reading.

Australia’s Q3 GDP grew 0.4% quarter-on-quarter, missing forecasts of 0.7% and down from a revised 0.7% previously. Year-on-year growth hit 2.1%, just shy of the 2.2% estimate and slightly above the prior 2%.

Despite the miss, the Aussie dollar jumped to a one-month high. The below chart shows dichotomy between AUD/USD and rate differentials, which may bode well for AUD/USD.

The next key support lies at the 50-day EMA of 0.6527, followed by the 21-day EMA of 0.6523.

China services lose steam but yuan rallies

China’s RatingDog services PMI slipped to 52.1 in November from 52.6, marking the slowest pace of growth in five months. The sector stayed in expansion, though momentum weakened slightly.

The composite PMI came in at 51.2, down from 51.8.

This private survey still looks brighter than official data, which showed both non-manufacturing and composite PMIs contracting.

The yuan has strengthened, with USD/CNH dropping to its lowest level in over thirteen months.

Resistance sits at 7.0931 on the 21-day average, followed by 7.1116 on the 50-day average.

Across Asia, the USD/JPY fell 0.4% while USD/SGD lost 0.2%.

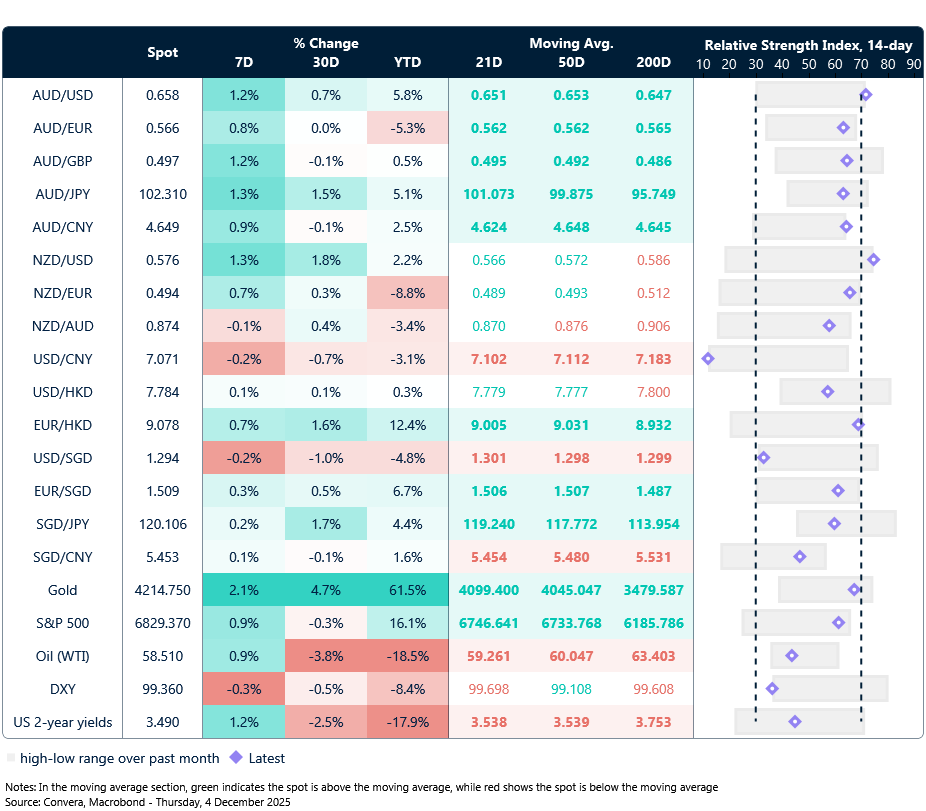

Aussie hits new highs

Table: seven-day rolling currency trends and trading ranges

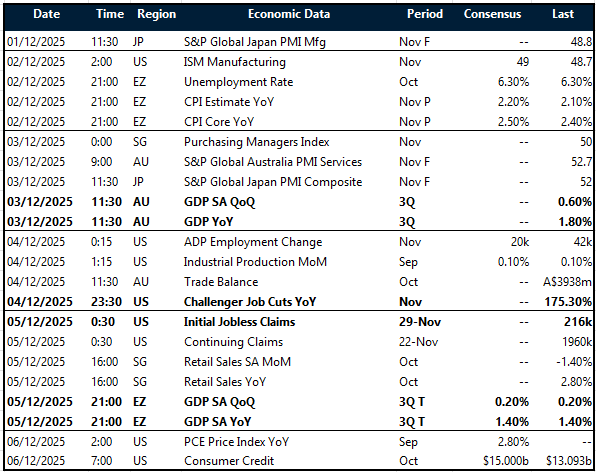

Key global risk events

Calendar: 1 – 6 Dec

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.c