Written by Convera’s Market Insights team

Dollar rebounds after strong retail sales

George Vessey – Lead FX Strategist

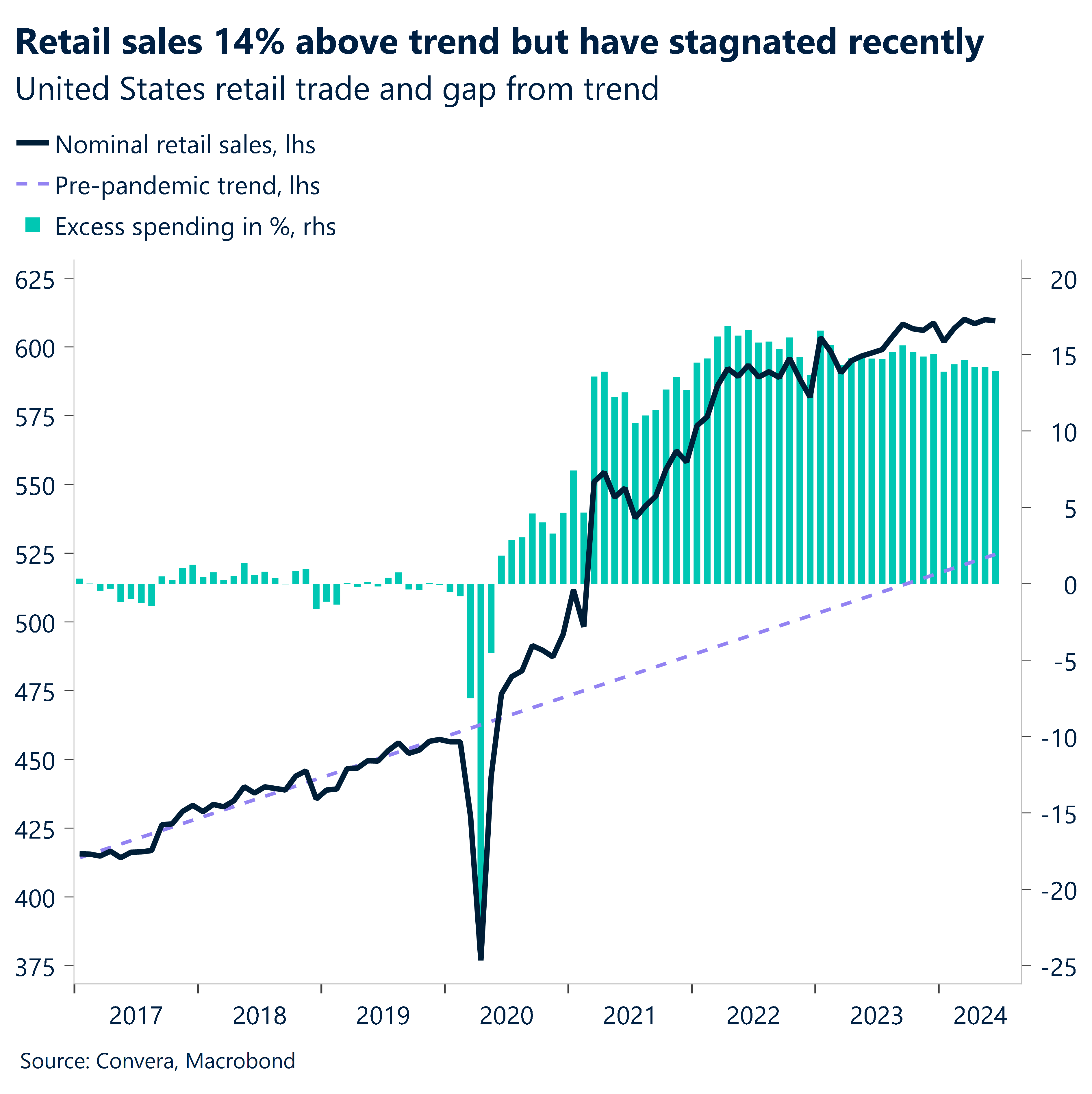

Headline US retail sales printed flat in June compared with May’s upwardly revised 0.3%, beating the consensus expectation for a 0.3% decline. Plus, the core metric rose the most since April last year, suggesting consumer spending remains robust, which gave equity and USD bulls something to cheer about.

The S&P 500 and Dow Jones hit new record levels yesterday as investors continue to digest key macro data, the monetary policy outlook, and earnings. Money markets are currently pricing in two Fed rate cuts before year-end, starting in September and likely again in December, but there’s a 65% probability of a November cut too. Therefore, the degree to which the weak dollar move of late extends in the short run seems limited. This is because the bar is now higher for more easing to be priced in, given the repricing, as well as several still-resilient activity indicators like yesterday’s retail sales. However, we do think that given the cooling labour market and slower income growth, consumer spending will likely remain tepid through year-end.

Meanwhile, rising odds of a second Trump presidency following a failed assassination attempt might continue giving some support to Treasury yields and the dollar. Trump’s policies are seen as inflationary, meaning the pace of Fed rate cuts could be hampered in 2025.

CAD suffers from soft CPI

Ruta Prieskienyte – Lead FX Strategist

The Canadian dollar is trading with a bearish bias amid USD-positive US political developments and increased conviction of a BoC rate cut on 24 July, following a softer than expected CPI print.

The annual inflation rate in Canada eased to 2.7% YoY in June, down from 2.9% in the previous month, contrary to market expectations that it would remain at 2.9%. Inflation fell considerably for transportation amid a sharp slowdown in the cost of petrol, coinciding with OPEC’s decision to gradually phase out production cuts. Although still elevated, inflation also dropped for shelter as rate cuts by the BoC in June and the subsequently lower bond yields eased mortgage rates and rental market competition. The trimmed mean core inflation rate remained unchanged at 2.9% YoY.

The latest report meets all the criteria for a back-to-back rate cut – economic growth is subdued, employment pressures have dissipated, and inflation is ticking lower. The money market implied probability of a BoC rate cut has solidified around 85%, up from 80% at the start of the week, and the Canadian 2-year bond yield fell to 3.77%, a 14-month low. A BoC rate cut next week would further erode the Loonie’s appeal as a high-yielding currency, which would see CAD depreciate as a result.

UK inflation remains at 2%

George Vessey – Lead FX Strategist

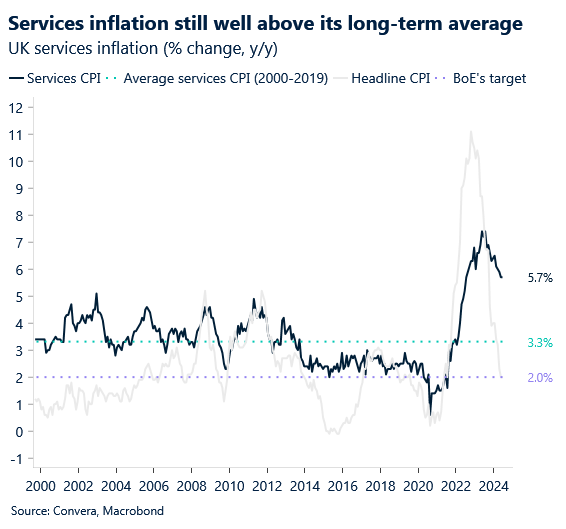

The highly anticipated UK inflation report was published this morning and showed headline unchanged at 2% YoY for a second consecutive month. The core print came in at 3.5% YoY and the Bank of England’s (BoE) closely watched services inflation at 5.7% YoY, also unchanged from the month prior. The market implied odds of an August rate cut have decreased to 49%, which has seen the pound strengthen in early European hours.

The star performer in the FX space this year has been the British pound, which has appreciated against over 70% of 50 global currencies we’re tracking. It’s up almost 3% versus the USD year-to-date and at almost 2-year highs against the euro. High real yields, and a stronger economic recovery have helped sterling, but also the optimism around the new Labour government, providing some welcome stability, which contrasts with the political uncertainty in France and the US.

Given the recent hawkish comments by BoE officials, including Chief Economist Huw Pill, today’s inflation report will support their cautiousness about moving too soon with rate cuts. As the UK core and service inflation failed to decelerate, we are unlikely to see the BoE cutting rates in the following month, which should keep the high yielding pound supported.

Given that no BoE speakers are scheduled before the 1 August meeting, there are no strong reasons to expect a major loss of momentum for the pound this week, unless CPI data surprises on the downside.

Pound remains strong across the board

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 15-19

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.