Written by Convera’s Market Insights team

Check out our latest Converge Market Update Podcast which looks at how recent economic data has called into question the timing of rate cuts and triggered some significant volatility across financial markets. Could this become more frequent as central banks begin policy easing this year? Join Lead FX Strategist George Vessey as he breaks down the latest in the global macroeconomic and FX landscapes.

Fed minutes lean hawkish

George Vessey – Lead FX Strategist

The minutes of the Federal Reserve’s (Fed) latest monetary policy meeting were published yesterday and leaned hawkish, with talk of concern that inflation might stall and worries about moving too quickly with interest rate cuts. FX and equity traders shrugged it off though, as the US dollar nursed losses against most major currencies, bar the yen, and US futures marched higher as Nvidia rallied in after-hours trading on an upbeat earnings report.

The Fed reinforced the future path of the policy rate would depend on incoming data and they were right to be wary given the hot consumer and producer inflation prints and strong payroll data released this month. These came in after the central bank’s meeting, therefore not taken into account in January’s policy decision. However, retail sales and industrial production disappointed, all triggering spates of volatility along the way. Markets have dialled back expectations for early and rapid rate reductions, but still a way off November’s level. Currently, there’s a 70% probability of a cut by the Fed’s June meeting.

The yield on the 10-year Treasury note rose above 4.3%, up 50 basis points since the start of the month and closing in on fresh 3-month highs. However, this was more likely a result of poor demand in the session’s 20-year bond auction. Interestingly, the US dollar didn’t benefit against many peers with the dollar index on track to fall for its sixth day out of seven, amounting to a 1% depreciation since its 3-month high earlier this month.

Strong PMIs boost pound

George Vessey – Lead FX Strategist

The British pound continues to drive beyond $1.26 versus the US dollar, briefly rolling over the $1.27 handle today, but sterling remains south of the €1.17 mark against the euro as market participants continue to digest economic data and its influence on the monetary policy outlook. Today’s stronger-than-anticipated UK PMI data suggests the UK’s technical recession is over. The UK 10-year government bond yield is back above the 4.1% mark as investors recalibrated their expectations for future rate cuts by major central.

This week, the Bank of England’s (BoE) Governor signalled interest rate cuts were on the horizon but pointed to signs that the UK economy is picking up. The CBI’s latest industrial trends survey revealed a net balance of 19% of firms reported a drop in output in the last quarter – worse than the 10% recorded in the three months to January, but manufacturers expect output to rise marginally in the quarter to May. Meanwhile, expectations for selling price inflation accelerated in February, climbing above their long-run average, which will be a concern to BoE policymakers and their fight against inflation. Today, the PMI data shows that the UK private sector expanded for the fourth consecutive month, the fastest since May 2023, supported by a strong service sector, whilst business activity in the service industry steadied at its highest level in eight months.

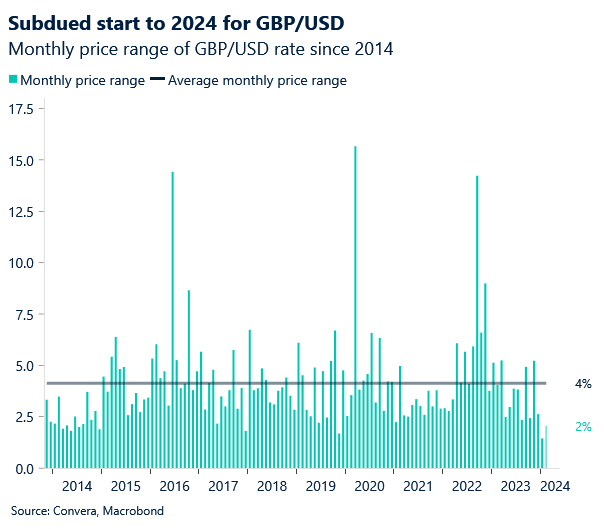

From an FX perspective, conditions remain relatively tranquil. Despite the pound’s uplift, GBP/USD is still trapped in narrow trading range of about 2% over the past two months. Over the past ten years, the average monthly trading range of GBP/USD was double this – at 4%. Even the median, which is not distorted by outliers, was 3.7%. As we’ve warned several times recently, such a period of low volatility often precedes a sharp spike in volatility.

Euro eying best week of 2024

George Vessey – Lead FX Strategist

The euro is on track to record its best weekly performance against the US dollar since late last December in the wake of a 5-week slump. EUR/USD is flirting with its 50-week moving average around $1.0840 after breaking above its 200-day moving average today as investors digest the Eurozone’s composite PMI rising from 47.9 to 48.9 in February, indicating that the bloc’s economic slump is easing.

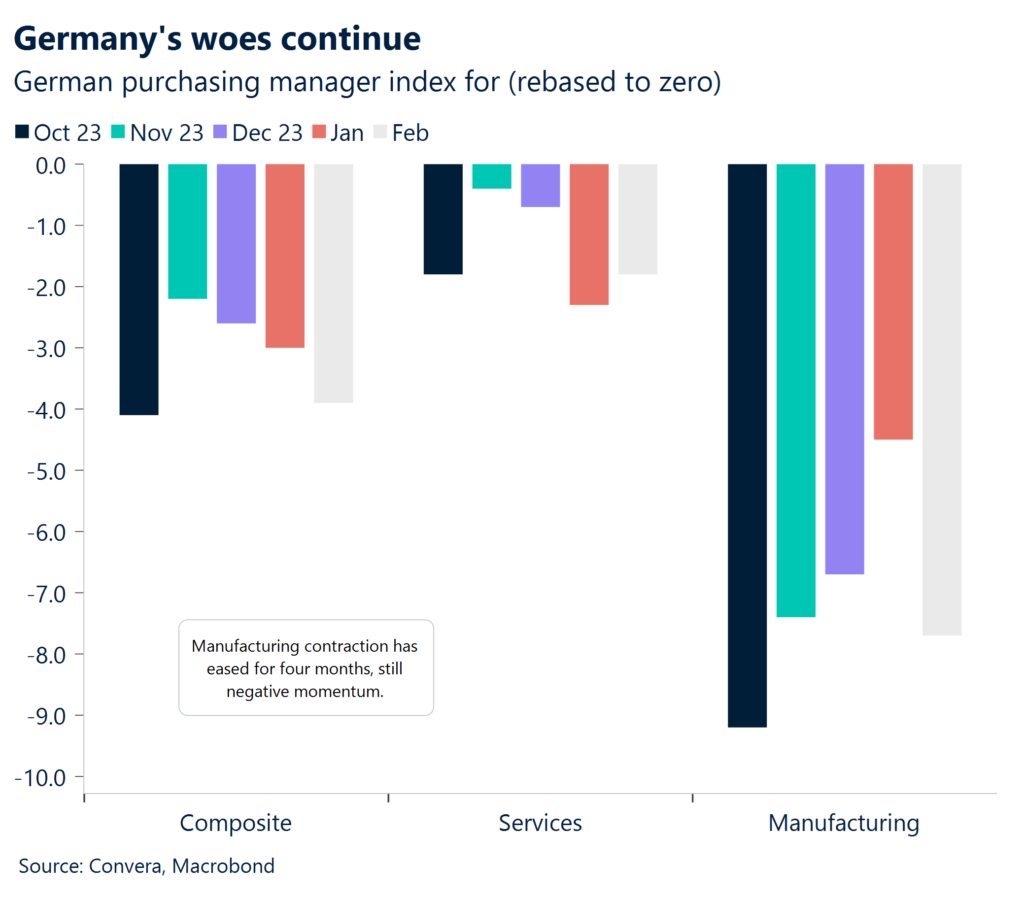

The gap between the Eurozone economies is widening though as France experienced the best PMI in nine months, while Germany’s decline accelerated for a fourth successive month, deeper into contraction territory. The Eurozone as a whole saw a stabilisation of output in the service sector, which offset a further steep downturn in manufacturing. With services sector activity improving, Eurozone bonds have been marching higher with the German 10-year bond yield reaching a 3-month high. European Central Bank (ECB) policymaker Pierre Wunsch supported yields too with some hawkish comments yesterday. He stated that the ECB should wait to get more data about wages, which are now regaining some of the ground lost to inflation in the past two years and are a driver of price growth. Investors are putting a 50% chance on the ECB reducing interest rates by 25 basis points in June, with just under four cuts priced in by the end of year.

EUR/USD is consolidating its gains above the $1.0850 threshold as we await the US PMIs later today which could further rock the boat. A beat of expectations could reignite dollar demand whilst a miss could see the world’s most traded currency pair testing $1.09 soon.

EUR/USD jumps 1.2% to 3-week high

Table: 7-day currency trends and trading ranges

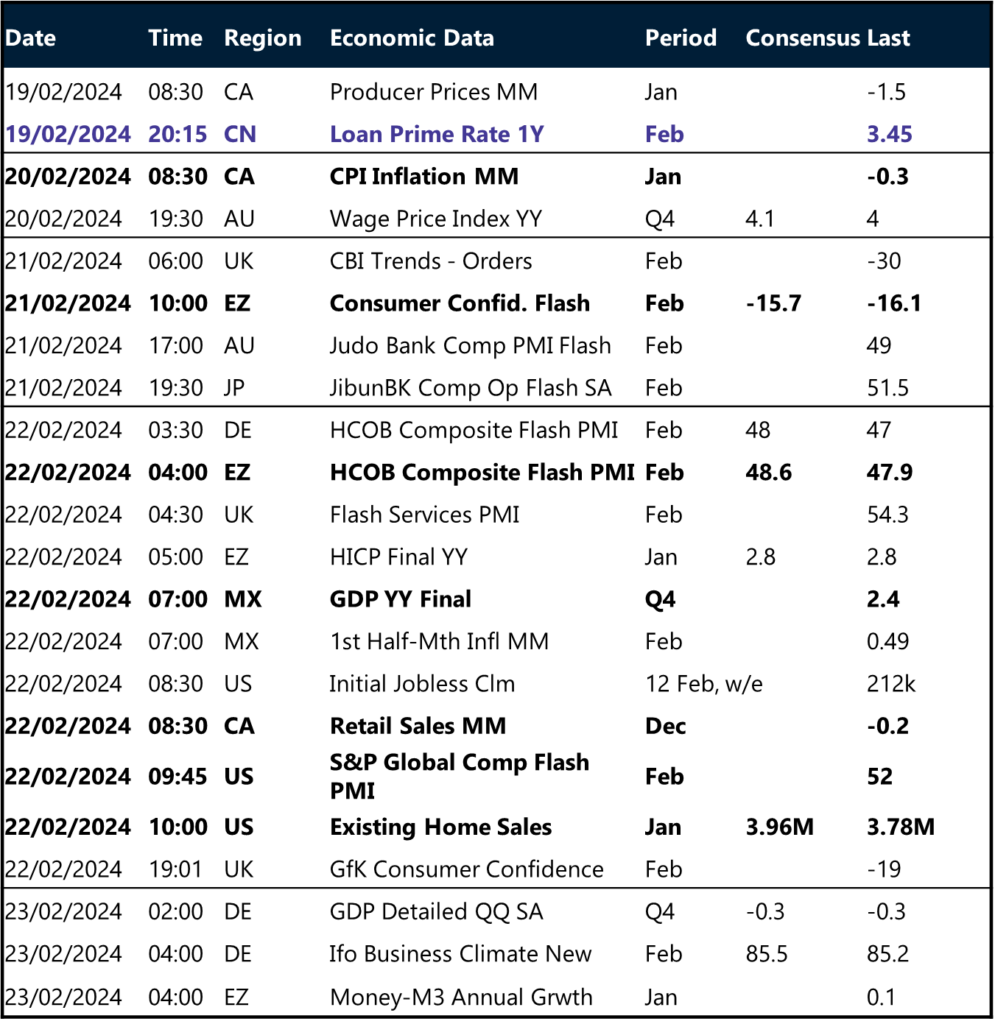

Key global risk events

Calendar: February 19-23

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.