CPI bolsters cause for a Fed pause

US headline inflation ticked up slightly less than forecast in July, whilst core inflation rose 0.2% for a second month, the smallest back-to-back gains in more than two years and reinforcing speculation the US Federal Reserve (Fed) can hold interest rates steady at its next meeting in September. The US dollar dropped initially on the news but reversed course late in the day.

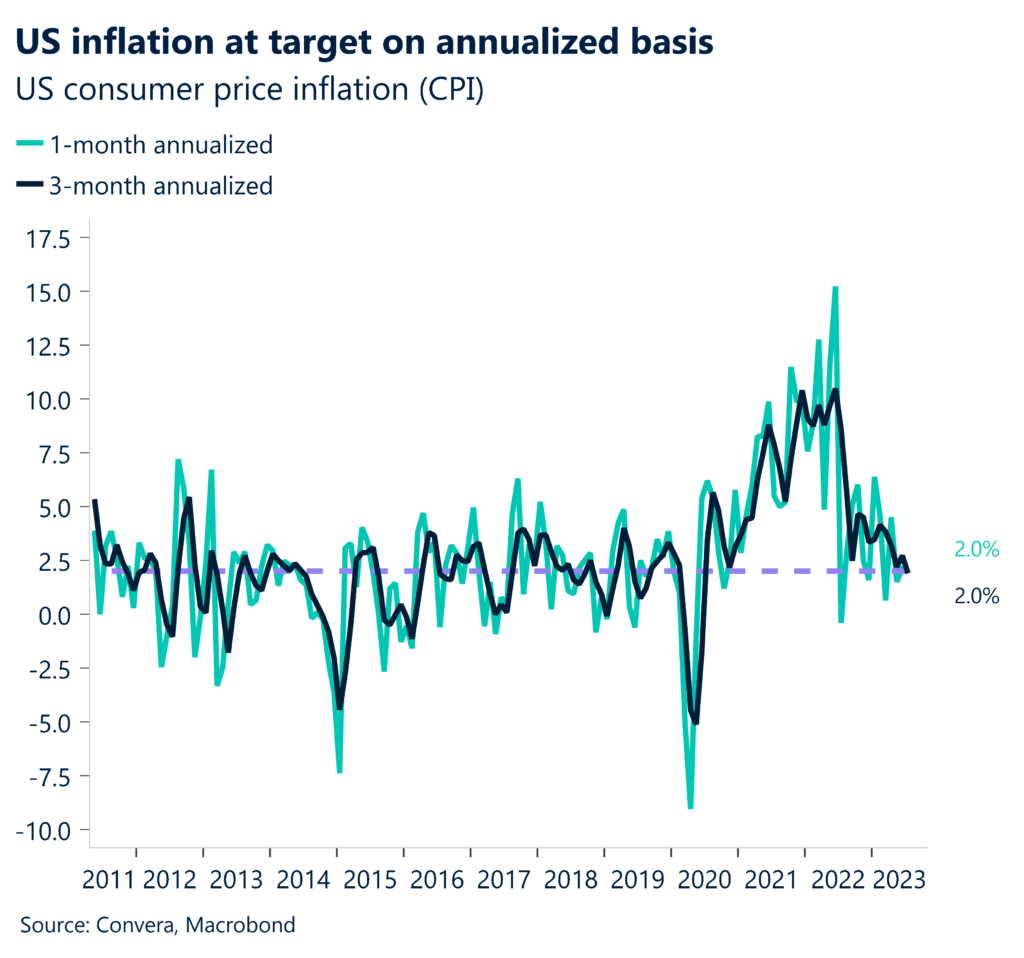

Market participants continue to process the latest US inflation report. The headline consumer price index (CPI) climbed 3.2% in the 12 months through July, up from a 3.0% rise in June and core inflation slowed to 4.7% from 4.8% as expected, whilst super core fell to 2.6% from 2.8%. The 3-month annualised rate for US CPI fell below 2% for the first time since the middle of 2020, continuing its multi-month downward trend. So, while there have been some signs of inflation reaccelerating and not going back to the 2% target on a headline year-on-year basis, leading indicators do point to inflation dropping below 3% again as soon as base effects decrease after the August print. This is what initially sent US Treasury yields lower and the dollar weakened versus the euro and most other currencies, with GBP/USD stretching towards $1.28. However, the dollar and yields sharply reversed course later in the day following hawkish comments from the Fed’s Mary Daly stating more progress is needed to tame price pressures and after a weaker-than-expected Treasury auction. Risk aversion gripped markets once more, favouring the dollar, which likely also benefited from safe haven flows following re-emerging geopolitical concerns after Washington banned certain US technology investments in China.

Nevertheless, the inflation report supports the “soft landing” scenario of a slowdown in inflation allowing the Fed to stop hiking and eventually cut rates next year, which catches the slowing economy in time to prevent a recession. This should support risk sentiment and continue to weigh on the US dollar over time.

Will the ECB pause in September as well?

The downside surprise on US inflation had boosted the euro in yesterday’s trading, given the decreased likelihood of another rate hike by the Fed in September. However, this begs the question of what the European Central Bank (ECB) will do in an environment of stagnant growth and falling inflation rates. According to economists polled by Reuters, European policymakers will follow their US peers in stopping their tightening cycle to evaluate the impact of monetary policy on the real economy.

The case for a pause is less clear cut for the ECB than it is for the Fed. Core inflation is still running near an all-time high of 5.3% and wage growth continues to remain elevated. Headline inflation has come down significantly in recent months and growth has decelerated, with Germany not having grown for three consecutive quarters. However, the late beginning of the tightening cycle gives the ECB less flexibility and more room for error. How high the central bank raises its benchmark interest rate and how long it stays at elevated levels will decide how much backing the euro gets from monetary policy.

Economic data for the Eurozone has been scarce this week with the main FX drivers coming from the US. EUR/USD has therefore been more volatile during the US trading session with the European market open being less interesting. The currency pair is on track to rise for the third day in the row but is stuck in range bound trading between $1.09 and $1.1250.

Pound buoyed by GDP beat

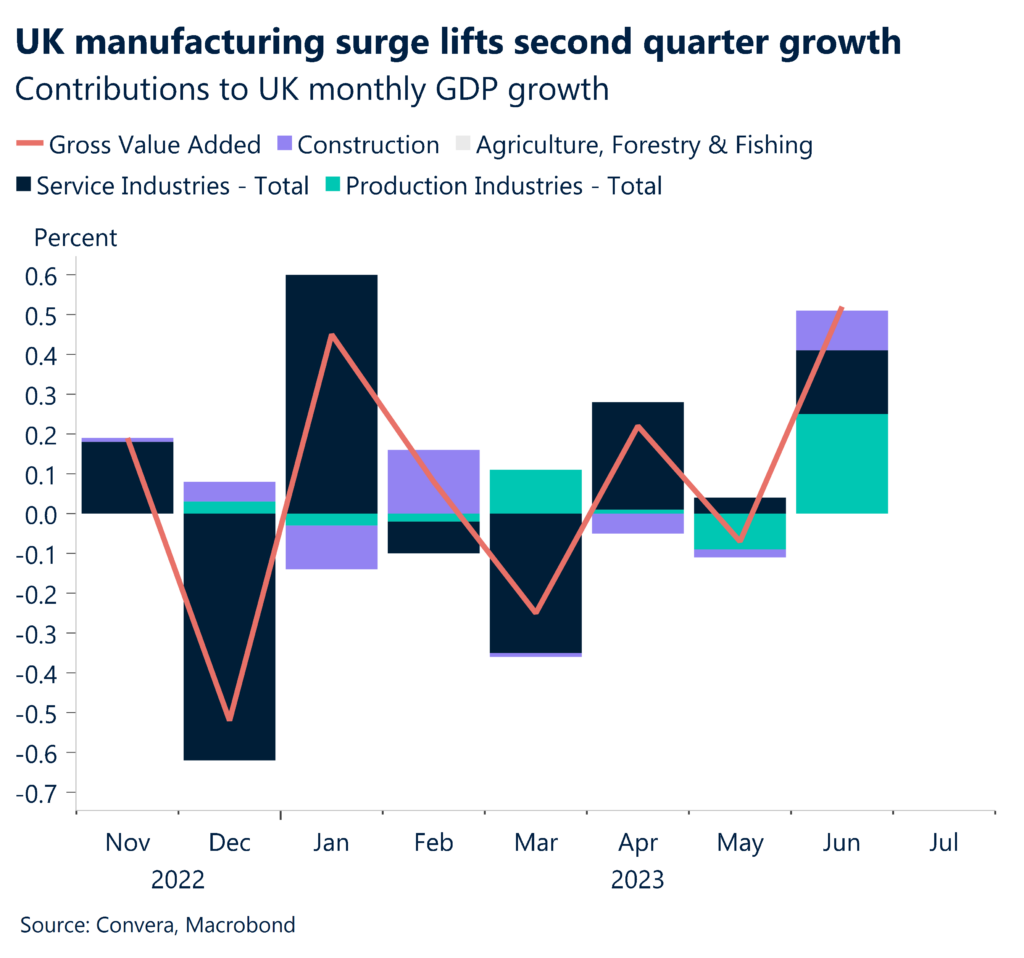

Once again, the pound reversed from the higher $1.27 region against the US dollar, closing back within a descending trend channel that’s been in place since its 2023 peak above $1.31 last month. The UK’s second quarter GDP results dropped in this morning though, beating forecasts, and offering the pound some much-needed support.

British economic output grew by 0.5% in June, beating forecasts of a 0.2% reading. The economy expanded 0.2% on quarter in the second quarter of this year, following a 0.1% growth in Q1 and beating forecasts of a flat reading. Month-on-month growth in industrial (1.8%), manufacturing (2.4%) and construction (1.6%) production all smashed expectations too. Consumer spending during the quarter rose 0.7%, its biggest quarterly increase in more than a year and business investment climbed 3.4%, a similar pace to the previous quarter. The UK economy continues to defy expectations of a slowdown in the face of soaring borrowing costs, heaping the pressure on the Bank of England (BoE) to continue raising interest rates and supporting demand for the British pound.

Despite the pound’s rebound this morning, GBP/EUR is trading back in the €1.15 area after falling nearly 1% over the past two trading days to a 3-week low. With money markets currently pricing a 70% chance the BoE will hike again in September, next week could see a repricing as GBP traders await fresh UK inflation and labour market data.

Japanese yen on the defensive

Table: 7-day currency trends and trading ranges

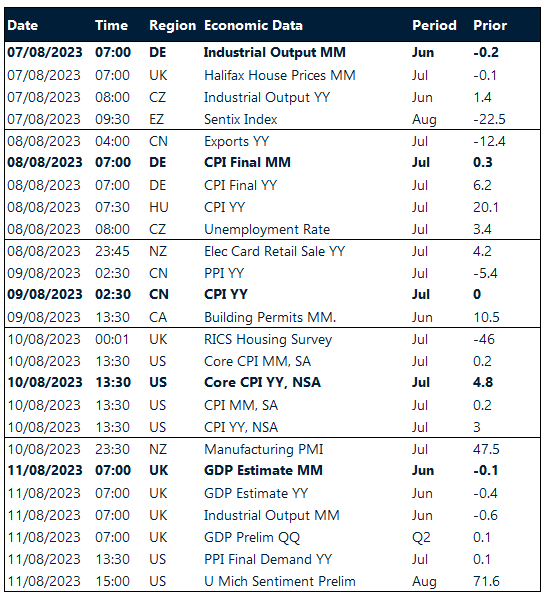

Key global risk events

Calendar: August 7-11

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.