From Australia to Europe, the recent hawkish recalibration in central banks’ policy paths into 2026 – sparked by ECB’s Schnabel’s early-week remarks – should be seen as a sneak peek of what monetary policy may look like next year, rather than as a material short-term FX driver. As much as the thrust of global monetary policy remains dovish, the extent to which that dovishness will actually materialize is becoming increasingly uncertain. In fact,a pervasive tone of caution and dissent is set to dominate, underpinned by expectations of a stronger economic outlook, with notable catalysts: Germany’s fiscal stimulus, the US “Big Beautiful bill,” and a still-elevated inflation environment.

USD: Greenback holds steady ahead of Fed

The dollar firmed in Asia, then steadied later in the session as markets await tonight’s all-important US Federal Reserve decision.

Market pricing sees a 90% chance of a rate cut to a new range between 3.50% and 3.75%. The Fed decision is due on Thursday at 6:00 am AEDT.

The USD/JPY gained 0.6%. The USD/CNH fell 0.1%, while the USD/SGD was flat.

The euro and GBP both weakened.

The Aussie bucked the trend, with the AUD/USD up 0.3% after yesterday’s Reserve Bank of Australia decision. The NZD/USD gained 0.1%. The Bank of Canada also meets tonight, with the BoC expected to hold.

Views on the Fed meeting

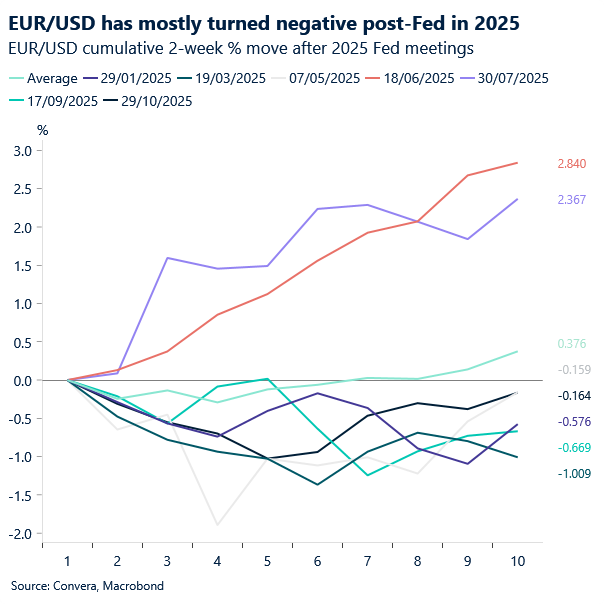

A stronger US dollar is the risk tonight, with three rate cuts priced in between now and the end of 2026 (including tonight’s likely cut). Will the Fed’s commentary meet market expectations?

Global markets have clearly tilted toward pricing in further Fed easing. The bar is high to shift expectations for further cuts: a full cut is priced in for tonight, Trump ally Kevin Hassett is viewed as the likely next Fed president, and an assumed terminal rate near 3% reinforces the entrenched dovish bias.

Yet this stance looks increasingly fragile against a still-uncertain data backdrop, elevated inflation, and the possibility of a pause in the cutting cycle early in 2026.

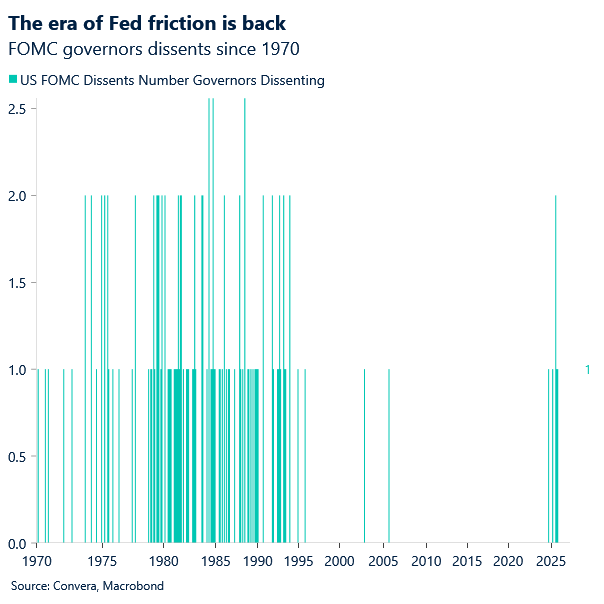

The Fed is now much closer to neutral, and with dissenters expected to speak up today (at least two anticipated), holding off on further cuts until the data picture becomes clearer may seem reasonable. If so, the USD might extend the recovery seen since its September bottom.

EUR: Euro awaits validation from US data

EUR/USD pushed briefly lower yesterday on better‑than‑forecast October JOLTS job‑openings data. It neared what we identified as the second line of support at 1.1620 before retreating into the 1.1630/70 range later in the session, as the less supportive details of the JOLTS report were better digested.

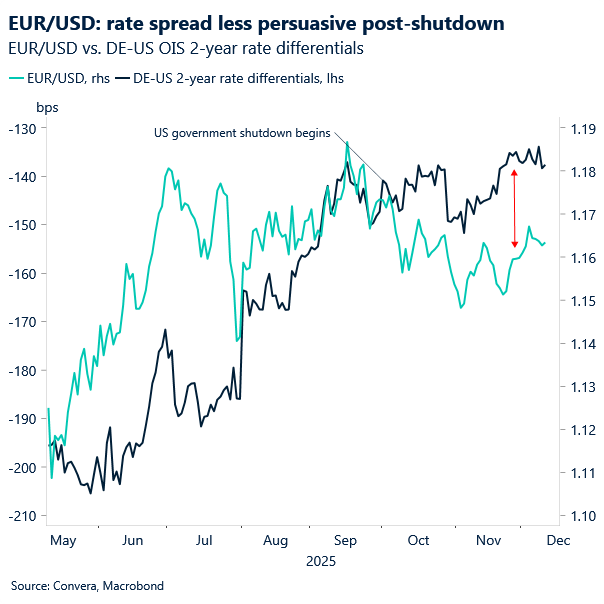

The euro seems to have broadly ignored ECB’s Schnabel’s early‑week remarks, with the USD leg in the EUR/USD 2‑year rate differential clearly stealing market attention from the euro side. We believe that until incoming US data provides a clearer picture of the economy – crystallizing the anticipated dovish path ahead for the Fed – the credibility of any euro‑rates‑driven hawkish expectations in moving the common currency remains unfounded.

Since the start of the US government shutdown (early October), EUR/USD has in fact abandoned tracking rate differentials as diligently, suggesting that the USD leg, as a proxy for Fed policy expectations, may have been hollowed out of some FX‑moving power.

For today, we expect EUR/USD to re‑test 1.16 as the cut is delivered with a cautious tone, accompanied by more concrete hawkish messaging – compared with the previous two meetings – centred around a pause at the January meeting until the data picture becomes clearer.

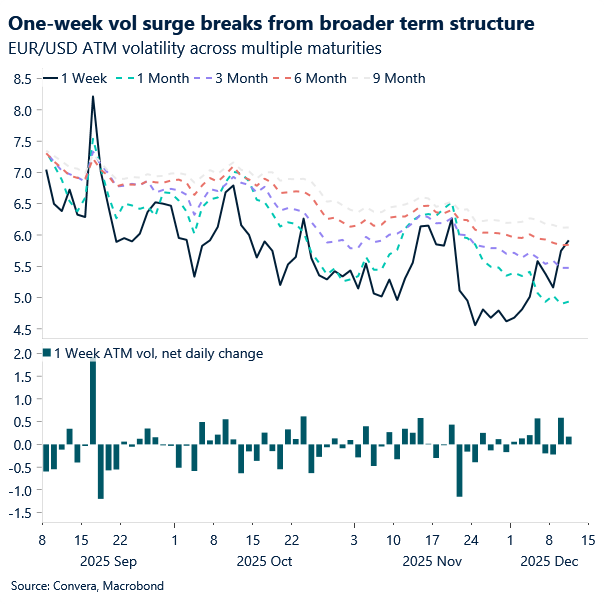

As the options market shows, front‑end volatility (1‑week) has risen to its highest since September, with the tenor now encompassing next Tuesday’s release of the November jobs report. This indicates that beyond today’s Fed decision – with much already priced in, namely a cut and a likely hawkish tone – markets remain hungry for further data, as the increasingly variable macro backdrop keeps investors searching for firmer evidence to anchor confidence in the path ahead.

Meanwhile, on the domestic front, French Prime Minister Lecornu narrowly survived a crucial test as the country’s divided parliament voted in favour of the 2026 social security budget bill. This was welcome news, sparing the government from sliding into a fresh crisis. Risks, however, linger as the main budget vote is still due before year‑end. Despite yesterday’s win, deep divisions cast doubt on the likelihood of a second victory, leaving France’s political backdrop a persistent bearish force that could weigh on the common currency at any moment.

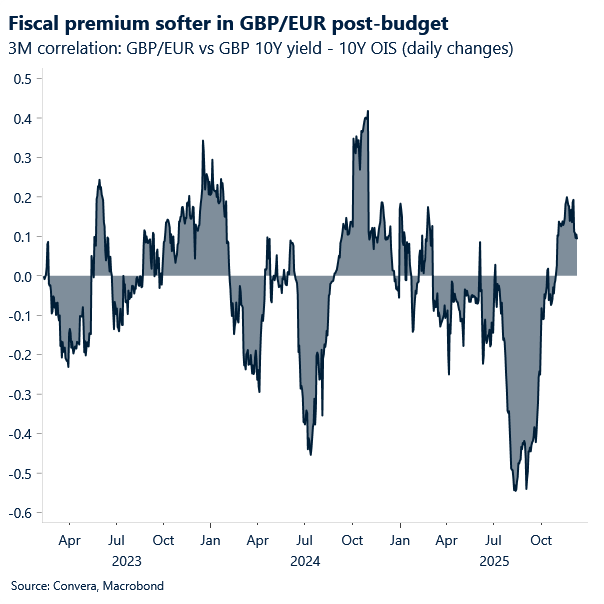

GBP: Sterling’s dovish test vs steady euro

GBP/EUR appears to be the pair where the extent to which the BoE may turn dovish – and, in turn, the impact on sterling – will be best expressed over the next 10 days. Meanwhile, cable remains at the mercy of US developments. This week remains quiet, but next week, with the UK jobs and inflation reports alongside the BoE policy meeting, we are likely to see, with greater clarity, the BoE’s path ahead. On the euro side, a hold next week is widely expected, as well as for the months ahead, unless the inflation or growth outlook were to significantly undershoot expectations.

1.1460 appears as a solid resistance level, tested for several days now, while support at 1.1420 should also hold through the week, even as Friday brings the UK’s October industrial production and monthly GDP. In other words, expect range‑bound price action on the pair until next week.

Meanwhile, GBP/USD, also in a range‑bound mood (1.3300–1.3350), is likely to be swayed by today’s Fed meeting outcome, which could see the pair break south of the range.

Yesterday, members of the MPC board spoke during a hearing with Parliament’s Treasury Committee, with the overall tone tilting slightly more dovish, though divisions were evident. Notably, Ramsden stated that the case for cutting interest rates is stronger today than in November, while Dhingra highlighted concerns about lingering softness in the labour market. Mann, however, balanced her fears, highlighting both inflation risks and labour market softness. Meanwhile, Lombardelli struck a more hawkish tone, voicing greater worries about upside risks to inflation. The hearing laid bare the growing divides within the Monetary Policy Committee, with a tight vote expected to be decided by Governor Andrew Bailey.

Euro up against safe-havens

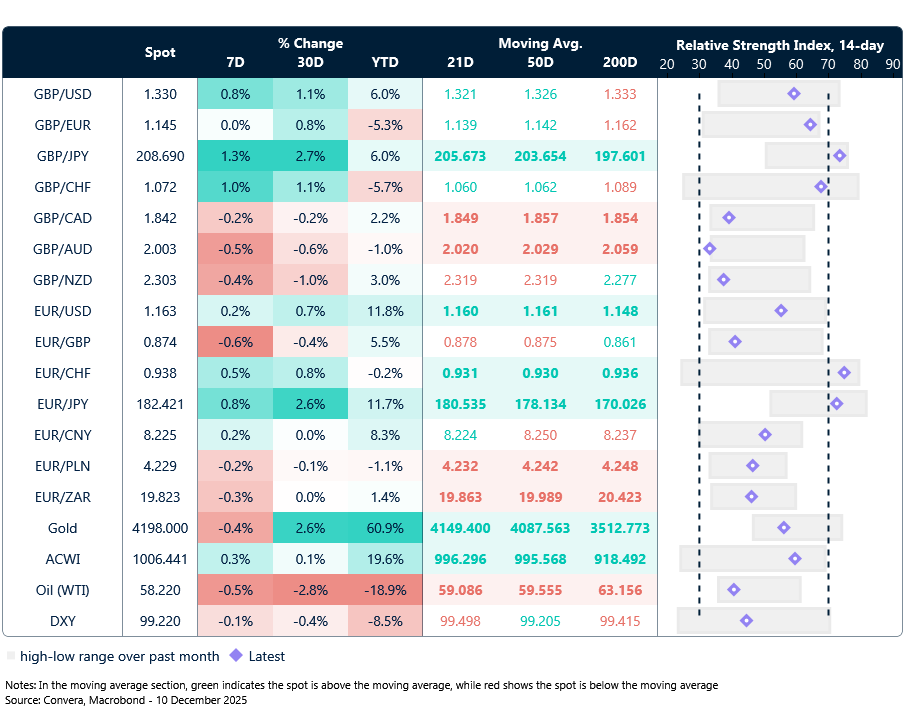

Table: Currency trends, trading ranges and technical indicators

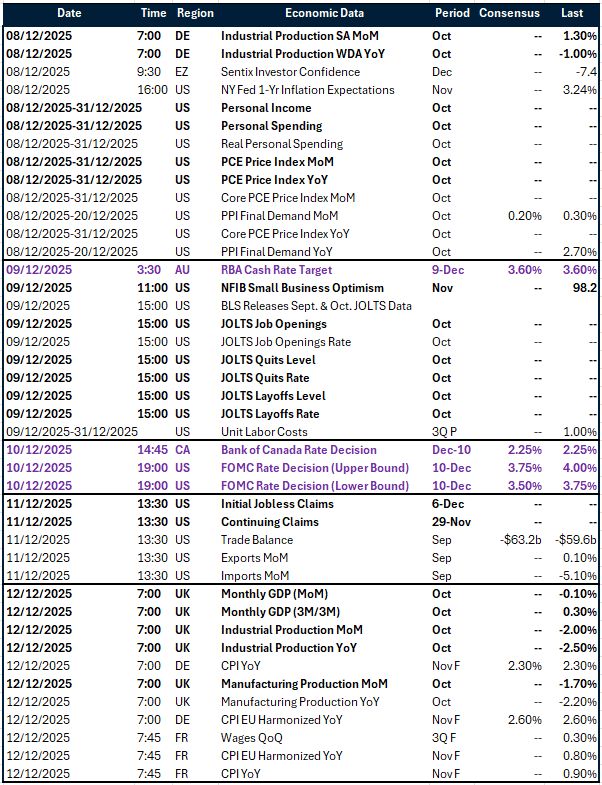

Key global risk events

Calendar: December 8-12

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.