Written by Convera’s Market Insights team

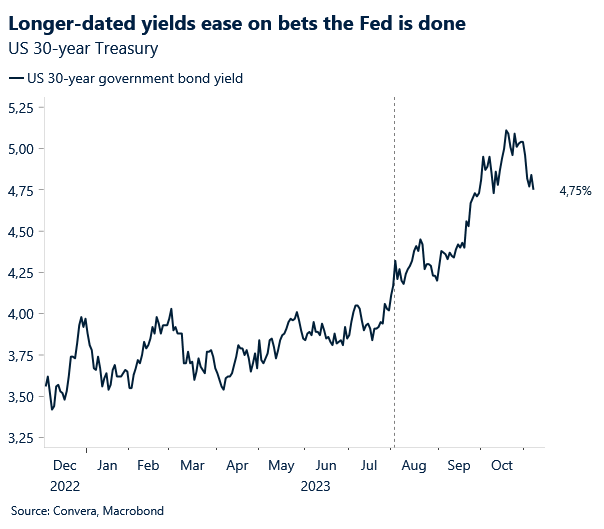

Retreatment of yields noted by the Fed

The US dollar regained its footing amid a plethora of Fed speakers cautioning about markets pricing in rate cuts for 2024 and before a crucial speech from Chair Jerome Powell coming up. The Greenback recorded the worst week since July after the US central bank paused its tightening cycle against the backdrop of slowing inflation and weaker economic growth. While the blowout Q3 US GDP print of 4.9% had shocked markets and the Fed, it is unlikely that such a growth rate will be repeated in the upcoming quarters with the Atlanta Fed Nowcast seeing growth of just 1.2% in Q4.

Economic data will be scarce this week with Fed speeches and non-US data driving price action. The US trade deficit widened again to $61.5 billion in September, slightly higher than the $58.7 billion recorded in the previous month. While the gap has decreased significantly from its record high reached at the beginning of 2022 at above $100 billion, the current deficit is still as wide as the previous high set in 2007.

In the meantime, Fed officials have not let go of the idea that another rate hike might be needed. Dallas Fed President Lorie Logan said on Tuesday that it seems like inflation is trending towards the 3% mark, inconsistent with the central banks 2% target. The retracement in the 10-year yield since the last meeting have also been noted and are being carefully watched. The US Dollar Index is set to rise for the third day in a row and has now erased about half of its post-FOMC losses. The speech from Jerome Powell will be the main risk event today.

BoE rate cut bets weigh on pound

George Vessey – Lead FX Strategist

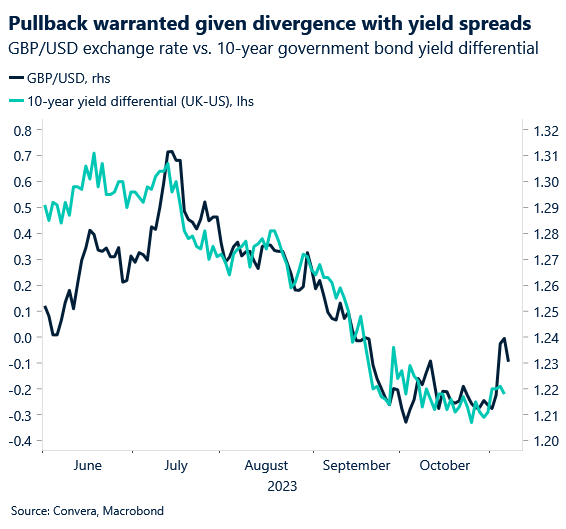

What a difference a few days make. A huge bullish breakout last week, followed by a sharp reversal this week. Interestingly, GBP/USD weakened yesterday whilst US stocks climbed, an unusual occurrence given GBP has the strongest positive correlation with the S&P500 out of the G10. It was the rise in Bank of England (BoE) rate cut bets that weighed heavy.

Comments from the BoE’s Chief Economist Huw Pill late on Monday suggested that interest rate cuts currently being priced in by financial markets in August next year were not “totally unreasonable”. This is a bit of a contrast to last week’s BoE meeting, where officials stressed rates will remain high for an extended period. Traders seized on the dovish remarks and markets are now pricing in at least three 25 basis point rate cuts in the main bank rate over the course of 2024. UK gilts rallied sharply as a result, with the yield on the interest rate-sensitive two-year gilt falling to its lowest level since June. In turn, yield spreads remain in favour of GBP/USD downside in the short-term, Plus, risks to sterling may be asymmetrically tilted to the downside in reaction to soft UK data, hence this Friday’s raft of UK activity indicators will might see the pair slide closer towards $1.20 especially if US data holds up.

Overall, the pound remains stronger than about 80% of 50 selected currencies year-to-date, but over the past three months sterling has appreciated against less than 20% of these, due to rising UK recession fears and rising BoE rate cutting expectations.

Disappointing German data hurts euro

Ruta Prieskienyte – FX Strategist

The euro surrendered some of its Friday winnings after last week’s risk-on sentiment took a breather. EUR/USD fell by 0.2% against the US dollar on Tuesday amid weak German data but the common currency gained 0.6% against the Aussie dollar after its central bank raised interest rates but hinted the hike was the cycle’s last. Most European stocks finished the day lower with STOXX 50 down by -0.2% on the day.

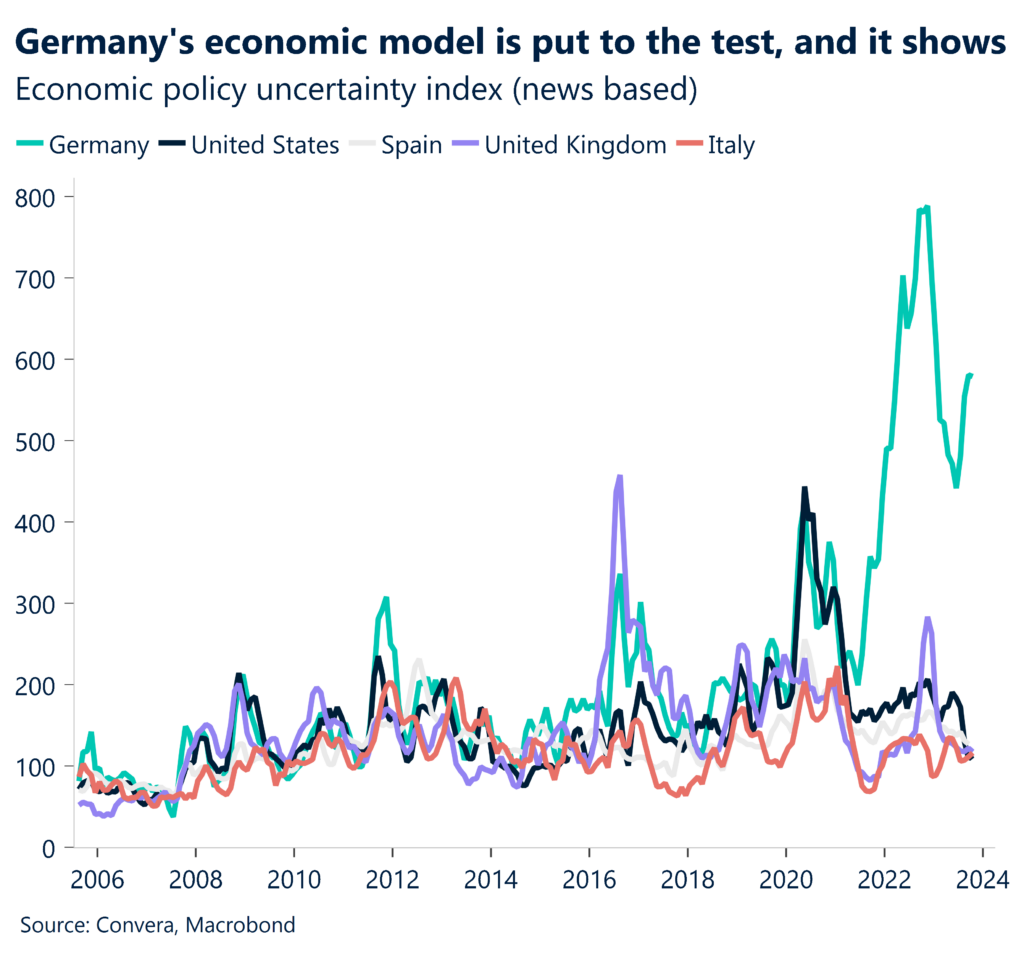

German industrial production dropped once again in September for the fifth consecutive month, highlighting the challenge that Europe’s largest economy faces in averting a recession. The index contracted by 1.4%, below market expectation of -0.1%, and is now down 17% from its pre-pandemic trend. Momentum does not appear to be turning positive any time soon either. German construction PMIs hit the lowest point since April 2020, signalling the health of its construction sector continues to worsen. The downturn in total activity is led by the housing sector, with construction companies recording one the fastest rates of decline in work on residential projects in the series history since 1999. To add fuel to the fire, IWH reported that the number of insolvencies in Germany for the month of October were 44% higher than a year ago and is expected to rise significantly again in the coming months.

As the euro story remains weak, the only potential for EUR/USD rally could come from a weak US story triggering some clear bullish flattening of the US yield curve. Despite a faltering domestic economy, the ECB remains on guard. ECB policy maker Nagel urged the need to remain “vigilant” because inflation in the Eurozone may still come in higher than expected, fuelled by wage growth, and shrinking labour supply. The ECB currently predicts a return to the 2% goal only in the second half of 2025.

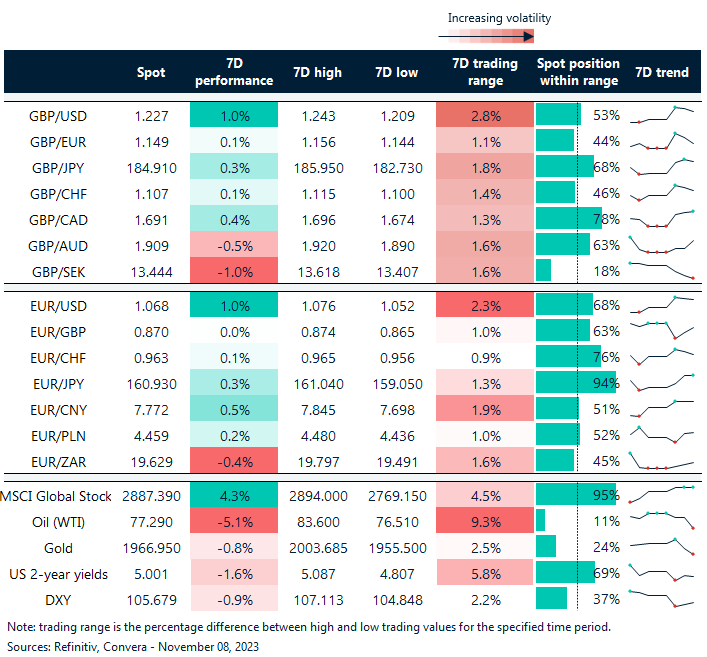

GBP/USD swings almost 3% in a week

Table: 7-day currency trends and trading ranges

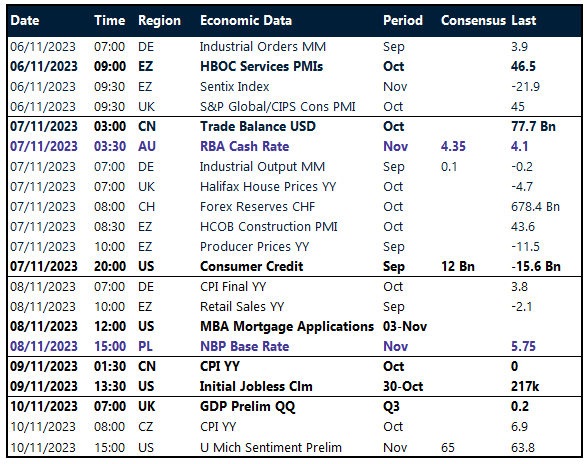

Key global risk events

Calendar: November 06-10

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.