Written by Convera’s Market Insights team

Pressure mounts on dollar

Boris Kovacevic – Global Macro Strategist

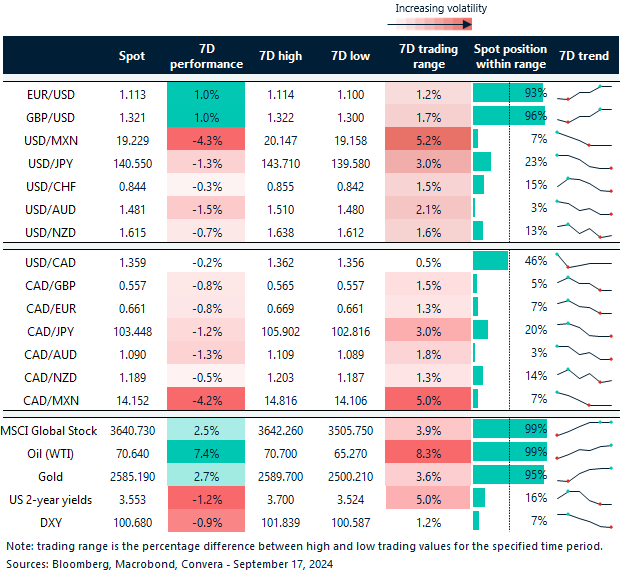

The US dollar continues to weaken under the weight of the expected easing cycle from the Federal Reserve. Markets see the decision to cut interest rates by 25 or 50 basis points as a coin toss, assigning a 50% probability to both scenarios. This has dragged the yield on two-year US bonds back toward the lowest level in two years and the US dollar index to its weakest since January.

The ambiguity surrounding the Fed decision and possible jumbo rate cut have marked the dollar as an unwanted asset from an investors perspective. In fact, GBP/USD propelled to a near 3-week high, above $1.32 in Monday’s trading, gaining over 0.6% week-to-date thus far. The short-term outlook favours the bearish dollar narrative as we anticipate the PCE report to come in soft at the end of the month. This should give the Fed the green light to cut again at the next meeting and continue the easing cycle with back-to-back cuts. Indeed, traders are paying more for put options that bet on a weaker dollar than for calls that look for a stronger dollar in the next week and month.

The upcoming US election In November could throw investors another curveball that could keep the dollar from falling too quickly, too soon. However, the determinant of the Fed’s policy path and the dollar will be the labour market. A significant depreciation of the buck and the beginning of a real rotation into other currencies would likely have to come from an increase in US recession probabilities, which would justify the current aggressiveness of easing bets.

Euro elevated by jumbo Fed cut bets

Ruta Prieskienyte – Lead FX Strategist

The euro started Fed week on a strong note, rallying above the $1.11 level and gaining over 0.4% on Monday. This surge was primarily driven by a sharp rise in Fed Funds positioning, as traders increased wagers on a potential half-point rate cut by the Federal Reserve. However, sentiment across other euro-denominated assets was mixed: equities were trending lower, while bonds remained in demand.

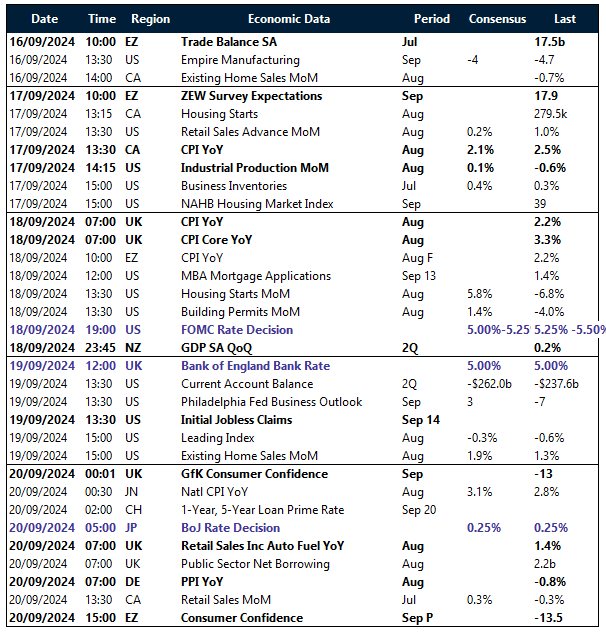

On the domestic front, Monday’s calendar was light. The final Italian CPI for August was revised down to 1.2% year-on-year, below the preliminary figure of 1.3%. The market’s primary focus, however, was on the European Central Bank (ECB) speeches. ECB’s Kazimir indicated that the central bank is unlikely to cut rates at the October meeting, maintaining the current quarterly pattern. He remarked that the Governing Council “will almost surely need to wait until December for a clearer picture” before making any further moves, and would only consider back-to-back cuts if there was “a significant shift, a powerful signal concerning the outlook.” Similarly, ECB’s Chief Economist Philip Lane endorsed a cautious, gradual approach, in line with past signalling of ECB policy shifts.

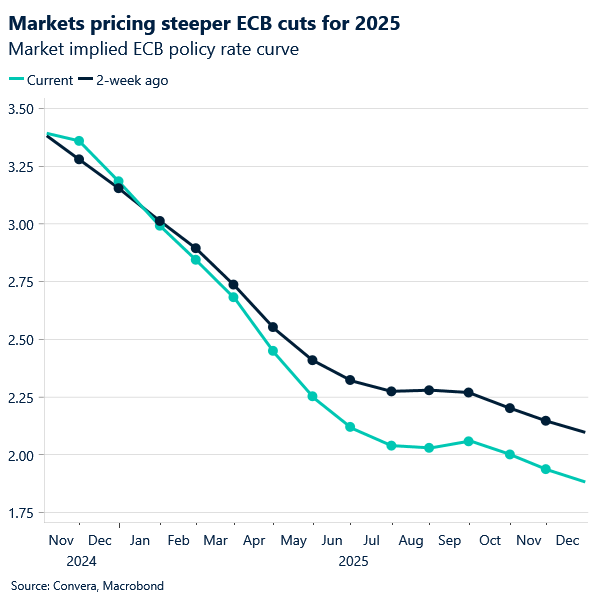

As a result, the market-implied probability of an October rate cut, reflected in the OIS curve, dropped from over 45% on Friday to around 30%. Further repricing on the short end is expected as the week progresses. However, participants continue expecting sharper ECB rate cuts in 2025, just as the Fed is expected to start slowing. In the options market, the 1-week EUR/USD at-the-money implied volatility has continued to rise for a second consecutive day but remains around the year-to-date average. Given the uncertainty surrounding the Fed’s meeting tomorrow, volatility is expected to climb further over the next 36 hours as traders position for the event.

Elsewhere, EUR/GBP remains under pressure as the BoE is not expected to change its monetary policy at the upcoming meeting on Thursday. Consequentially, the pair has retreated to an over 1-week low near 0.8420 level, but may get a boost if the UK CPI print tomorrow comes softer than expected, encouraging dovish BoE cut bets.

Gold breaks another all-time high

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: September 16-20

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.