Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

RBA decision looms, Aussie traders brace

Markets traded in narrow ranges overnight, with little movement across rates, equities, and FX. US ISM manufacturing for October missed expectations at 48.7 (vs 49.5 forecast), but the focus quickly shifted to upcoming jobs data and central bank commentary. US tech outperformed on continued AI optimism, but broader indices lagged. The next key data point is the ADP employment report (Thursday).

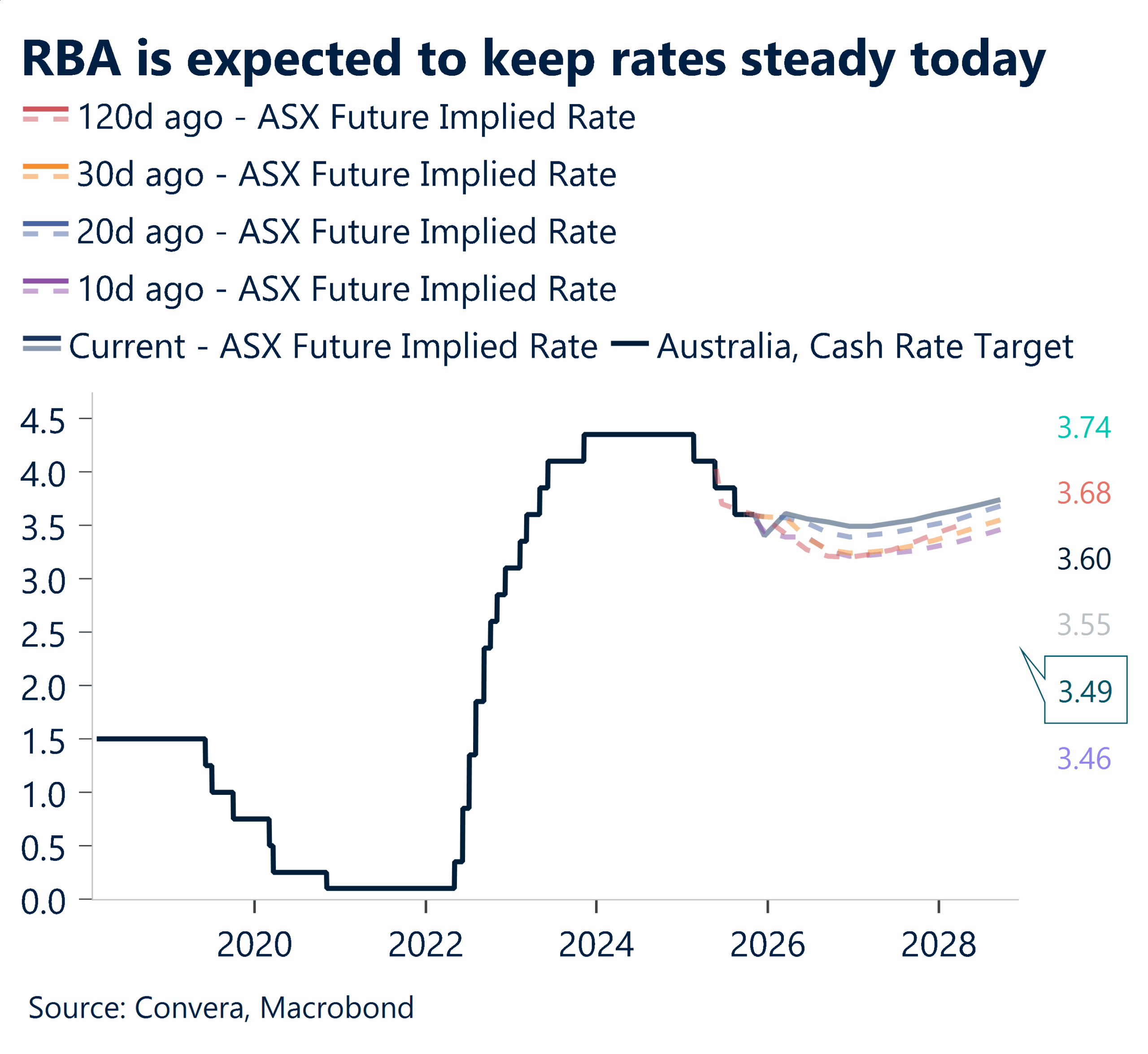

AUD is in the spotlight ahead of the RBA decision at 2:30pm AEDT. Consensus expects no change in rates, but a hawkish tilt from Governor Bullock and upgraded inflation forecasts could support the currency. With inflation running hot, the risk is for a more hawkish message that could push out rate cut expectations for 2026.

US tech stocks led gains on fresh AI news and forward revenue guidance, but the broader Nasdaq 100 lagged.

USDJPY pair remains in a tight range, but the path of least resistance appears higher in the near term, with 155 eyed as a possible target. Intervention risk remains if the yen weakens further, but saber-rattling alone may not be enough to turn the tide.

Fed’s inflation fight heats up as Cook signals bold action

Federal Reserve Governor Lisa Cook says she’s ready to “act forcefully” if inflation driven by tariffs keeps climbing. Speaking at the Brookings Institution, Cook emphasized that risks to jobs outweigh inflation concerns, which led her to support a rate cut in October.

She expects inflation to stay elevated for another year before easing to 2% once tariff pressures fade. Cook also pointed to immigration as a key factor behind recent payroll declines.

In Asia, the dollar is gaining ground against the yuan, climbing past last week’s highs. The next hurdle sits near 50-day EMA of 7.1333, followed by 100-day EMA of 7.1540.

Aussie inflation creeps up as RBA holds fire

Australia’s inflation gauge ticked higher for the second month in a row, driven by rising housing and leisure costs. While the pace eased slightly to 0.3% in October from 0.4% the month before, the cost of living continued to climb. Annual inflation has now pushed past the Reserve Bank’s 2–3% comfort zone.

Despite the pressure, the RBA is expected to keep rates steady today, likely holding at 3.60% for the foreseeable future.

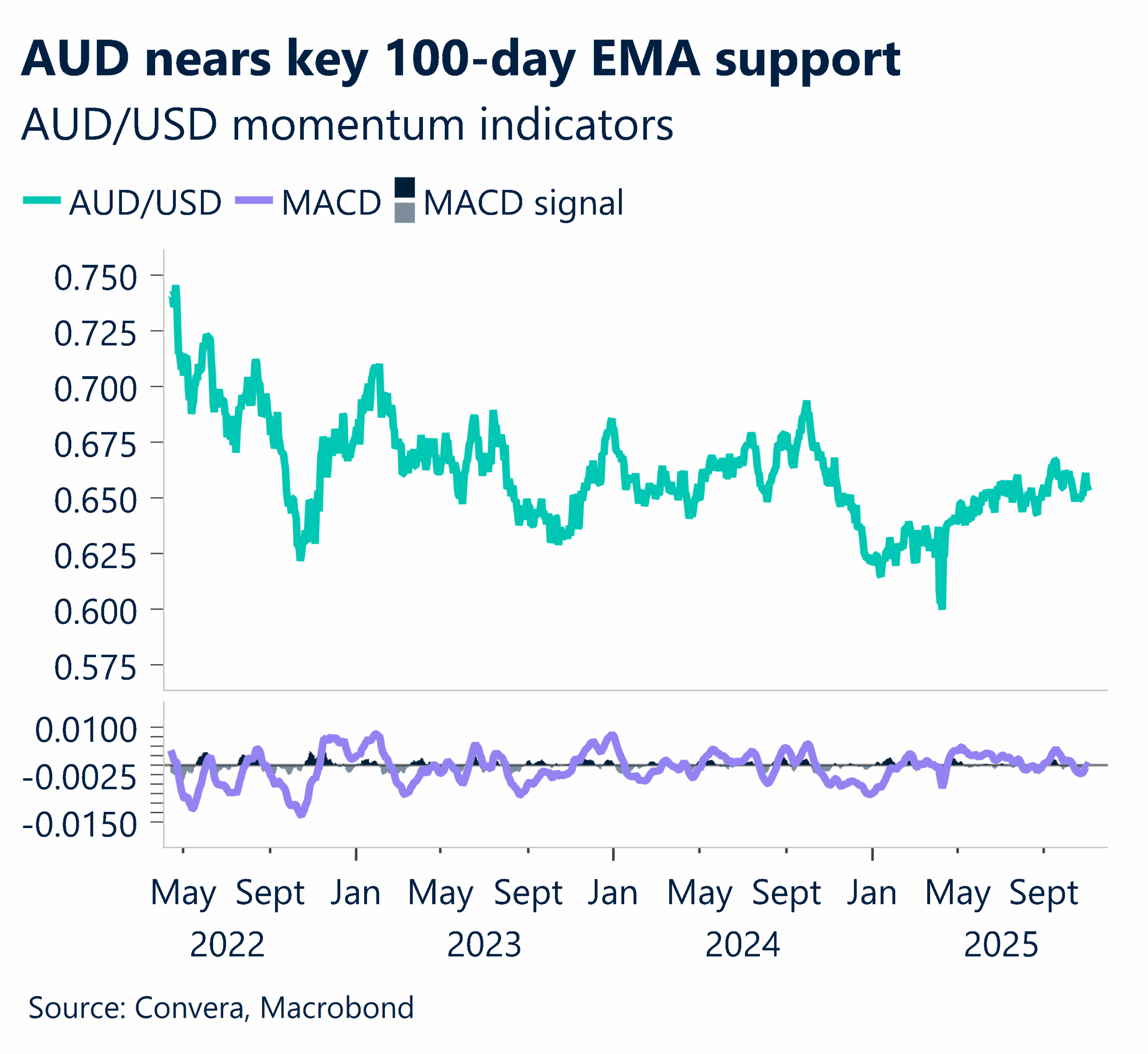

In currency moves, the Aussie dollar has pulled back and is approaching a key support level near 100-day EMA of 0.6523. If it dips further, AUD buyers may look to take advantage around 0.6500.

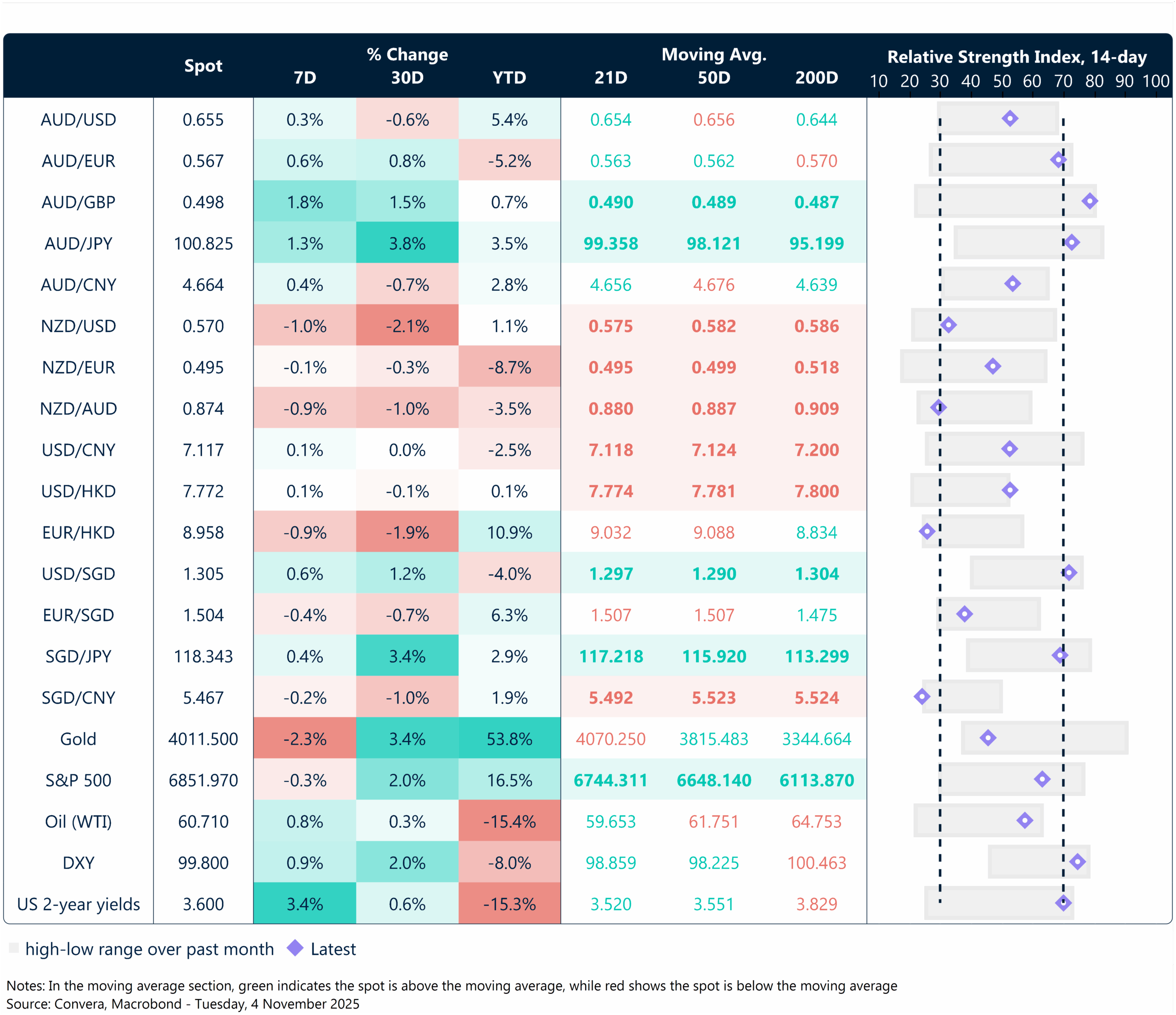

Antipodeans dip as Dollar up

Table: seven-day rolling currency trends and trading ranges

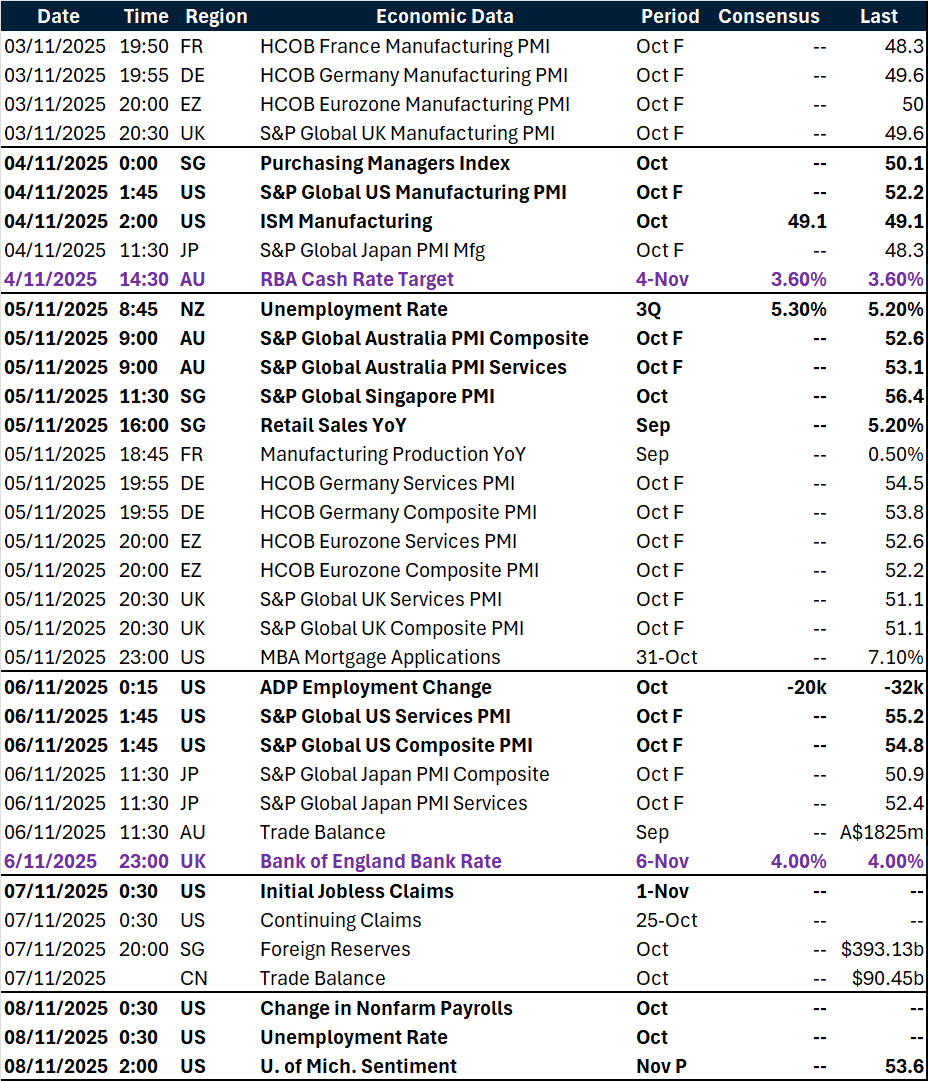

Key global risk events

Calendar: 3 – 7 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.