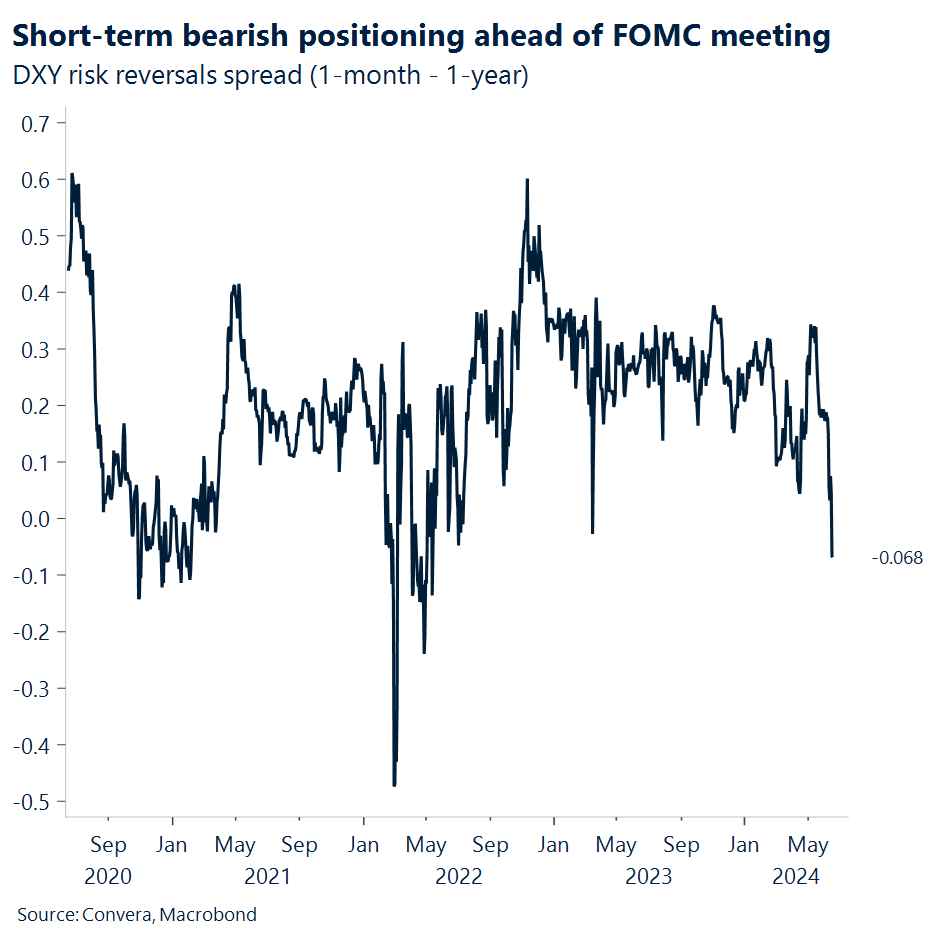

USD: Positioning into the FOMC

The latest US macro data and yesterday’s price action are telling different stories, and the tension looks tactical rather than structural. On the data side, the Bureau of Economic Analysis revised Q3‑2025 real GDP up to 4.4% SAAR, underscoring a still‑resilient US expansion as we head into 2026. On the tape yesterday, the dollar was broadly softer by roughly 0.4%, including declines against the euro and the pound even as equity volatility eases with the VIX drifting toward the mid‑teens. That combination, USD drifting lower with calmer risk, suggests position‑squaring into next week’s Fed rather than a fresh macro regime.

Under the surface, the GDP detail reinforces the idea that private‑sector momentum remains the main engine. On BEA’s industry contribution tables for Q3‑2025, Information, Finance & Insurance, and Professional, Scientific & Technical Services together contributed about 1.6 percentage points to the quarter’s growth, while Durable Goods Manufacturing added ~0.5 pp; by contrast, Federal government subtracted ~0.04 pp. Importantly, while the autumn government shutdown disrupted publication schedules and forced BEA to consolidate estimates, the agency does not attribute the government value‑added decline to the shutdown itself, so maybe this is a data‑release issue than a growth‑driver.

The market, however, is focused on the near‑term policy event risk. The FOMC meets Jan 27–28, with the decision and Chair’s press conference slated for next Wednesday. With the federal funds target range at 3.50%–3.75% and the effective rate near 3.64%, traders appear to be trimming longs and leaning on technicals rather than making a high‑conviction macro call a week early. The result is a softer USD alongside lower equity vol, which is exactly what you would expect in a pre‑event, low‑visibility window, especially after a run of firm US growth prints.

Set against the global backdrop, the case for a durable, fundamental USD down‑trend is still weak without new information. The euro area grew 0.3% q/q in Q3‑2025 (≈1.2% annualized), far from a boom, while the US 10‑year has spent much of January cycling in the ~4.15%–4.30% zone, hardly a backdrop that screams “aggressive Fed cutting cycle.”

The fiscal/policy backdrop adds another layer. Late‑2025 legislation extended and expanded elements of the 2017 tax law (for example, rate schedules and the standard deduction) and adjusted the SALT cap structure for a period, changes that could support disposable income and consumption in 2026, with obvious caveats around implementation and behavior. If those enacted changes do provide a modest tailwind, they reinforce the notion that the US remains growth‑resilient relative to many developed peers heading into mid‑year, again complicating the case for an extended USD downswing absent a bond‑market or policy‑guidance shock.

Pulling it together, yesterday’s USD softness looks like tactical de‑risking and re‑positioning into the Jan 27–28 FOMC, not a referendum on US macro. The data still show a private‑sector‑led expansion with Q3 GDP at 4.4% SAAR; the global dispersion in growth and policy rates still argues for US yields holding a relative premium; and market volatility remains subdued. If the Fed’s tone next Wednesday reiterates that cuts are data‑dependent and the bond market keeps the 10‑year anchored near 4.2%, the fundamental current will continue to run against momentum‑driven USD shorts. In that setup, reversal risk is elevated: bears leaning on the calm may find themselves caught wrong‑footed if the policy path or term premium is repriced even modestly.

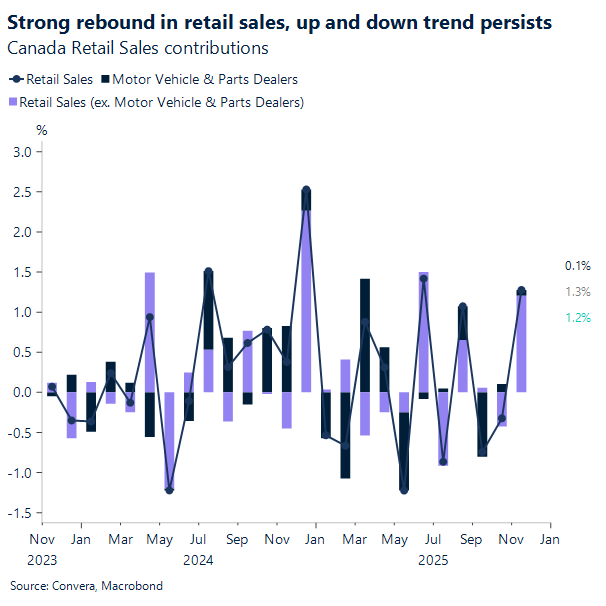

CAD: Retail resilience

Canada’s retail sector showed significant resilience in November 2025, with total sales rising 1.3% to reach $70.4 billion. This performance slightly exceeded market expectations of a 1.2% increase, according to the latest survey data. The growth was even more pronounced when excluding the automotive sector; “Ex Auto” sales jumped 1.7%, nearly double the anticipated 1.0% gain. While these figures are a few months old, they remain highly relevant as they signal a strong recovery from October’s revised -0.3% slump. Much of this rebound was concentrated in the food and beverage subsector (+3.0%), specifically driven by a massive 14.3% surge in alcohol sales as distribution returned to normal in British Columbia following prior labor disruptions.

Despite this healthy “beat” of economic expectations, the data has had a limited immediate impact on the Canadian Dollar (CAD) as market attention remains fixed on broader currency trends. The loonie has strengthened significantly this week, moving from 1.3918 to 1.376 against the greenback, but this shift is primarily a byproduct of a weaker US Dollar rather than domestic retail strength. As the USD faces pressure from shifting geopolitical risks, the CAD has been able to capitalize on the greenback’s retreat. The November retail data essentially confirms that the Canadian consumer was on solid footing heading into the 2025 holiday season, even if the currency is currently taking its cues from the other side of the border.

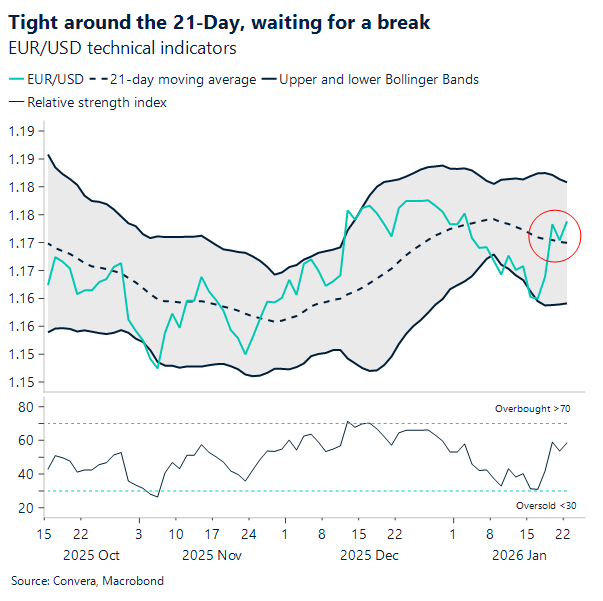

EUR: Still no break from 1.17

Yesterday the US dollar was broadly offered as markets continued to digest incoming geopolitical developments. EUR/USD remains reluctant to move away from the 1.17 zone, having re-explored it yesterday after finding clear support at the 50‑day moving average near 1.1670. With uncertainty still surrounding events in Greenland, technicals may dominate in the near term before the US-led macro narrative takes clearer shape next week (FOMC policy meeting). 1.1760 capped the upside yesterday. After this week’s mean‑reversion back toward the 21‑day moving average, the line remains the key pivot, making today’s close a clearer test of whether bulls still hold the advantage. A close below the average would simply fold back into the prevailing mean‑reversion pattern.

Key US data releases confirmed solid GDP growth and stable labour‑market conditions, setting the stage for what we expect will be a more confident assessment of the US economy at next week’s Fed meeting on the 28th. This should limit any further testing of the 1.17 zone. We continue to favour a move lower toward 1.16 in the coming days. Meanwhile, the ECB’s December meeting minutes showed a highly divided Governing Council on the inflation outlook, with some members focused on downside risks and others on upside threats. The path ahead will depend on incoming data and shifts in ECB communication, but for now the stance remains neutral at 2%.

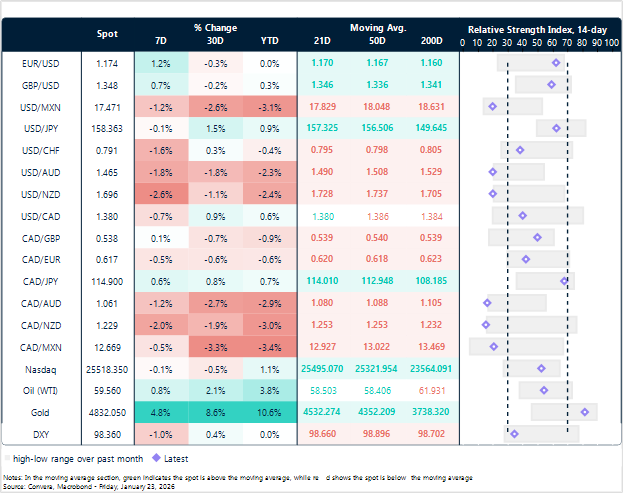

Market snapshot

Table: Currency trends, trading ranges & technical indicators

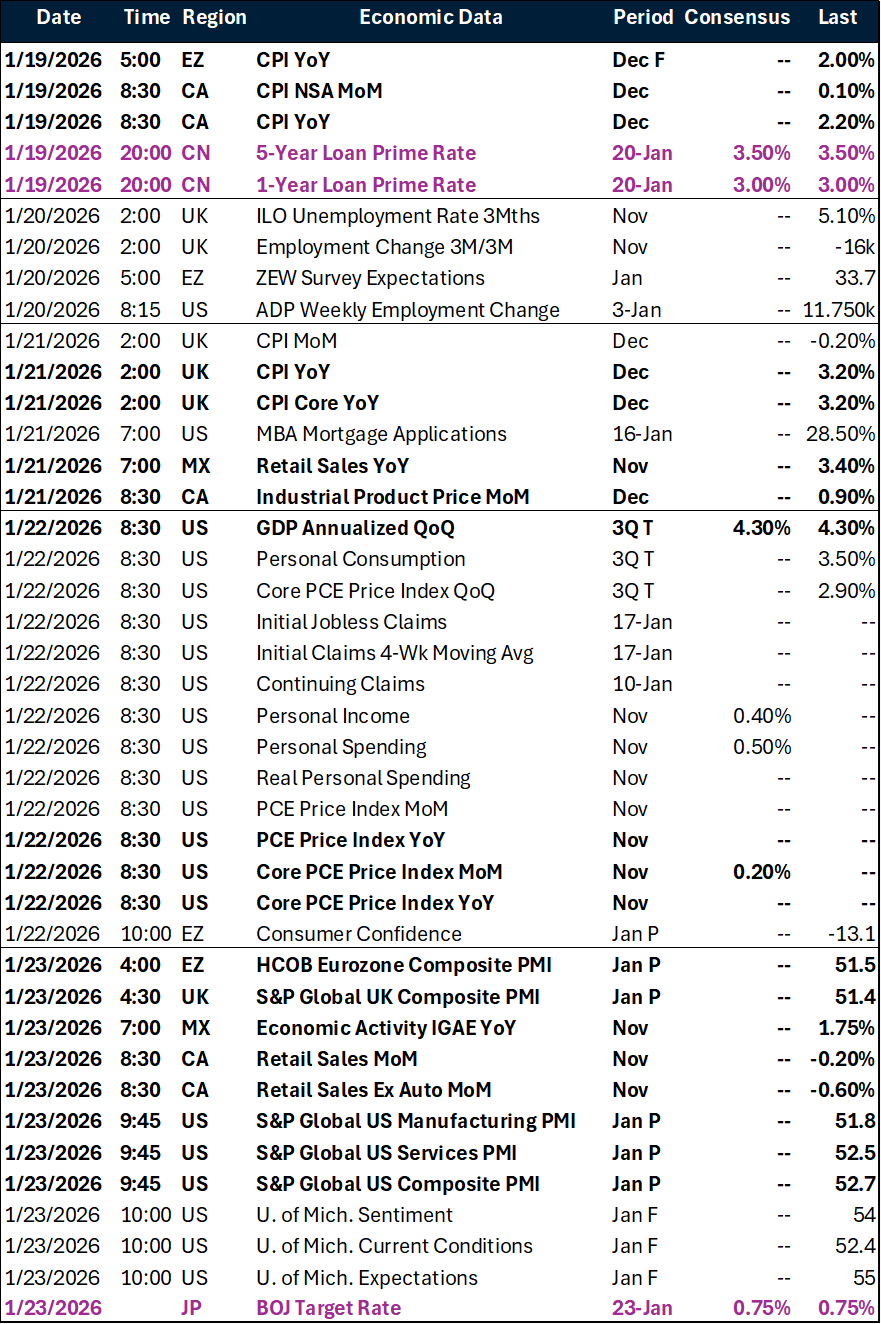

Key global risk events

Calendar: January 19-23

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.