Aussie jumps after Fed move

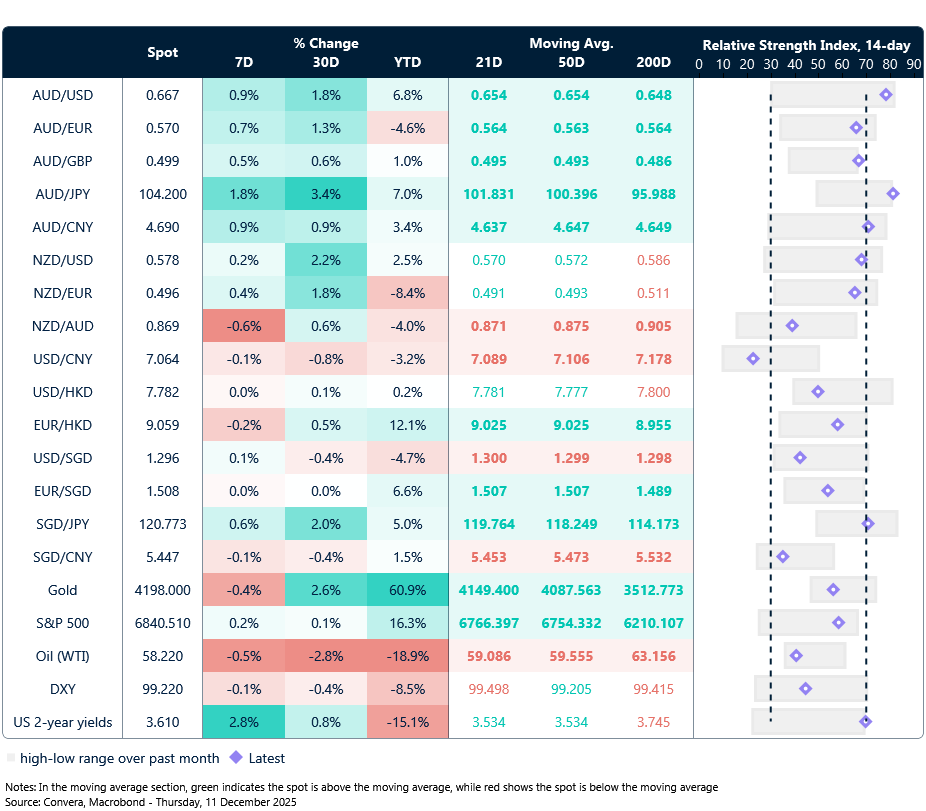

The Australian dollar moved towards the highest level of 2025 this morning after the Federal Reserve cut US interest rates to a new range between 3.50% and 3.75%.

The AUD/USD gained 0.5% as it neared the year’s high and major technical resistance at 0.6700.

The NZD/USD jumped 0.6% to reach two-month highs.

In Asia, the USD was lower, with USD/SGD down 0.4% to two-month lows and USD/CNH steady near one-year lows.

The Aussie held recent gains in other markets, with AUD/EUR at six-month highs, AUD/GBP near ten-month highs, and AUD/JPY at 18-month highs.

Fed cuts as job market worries trump inflation

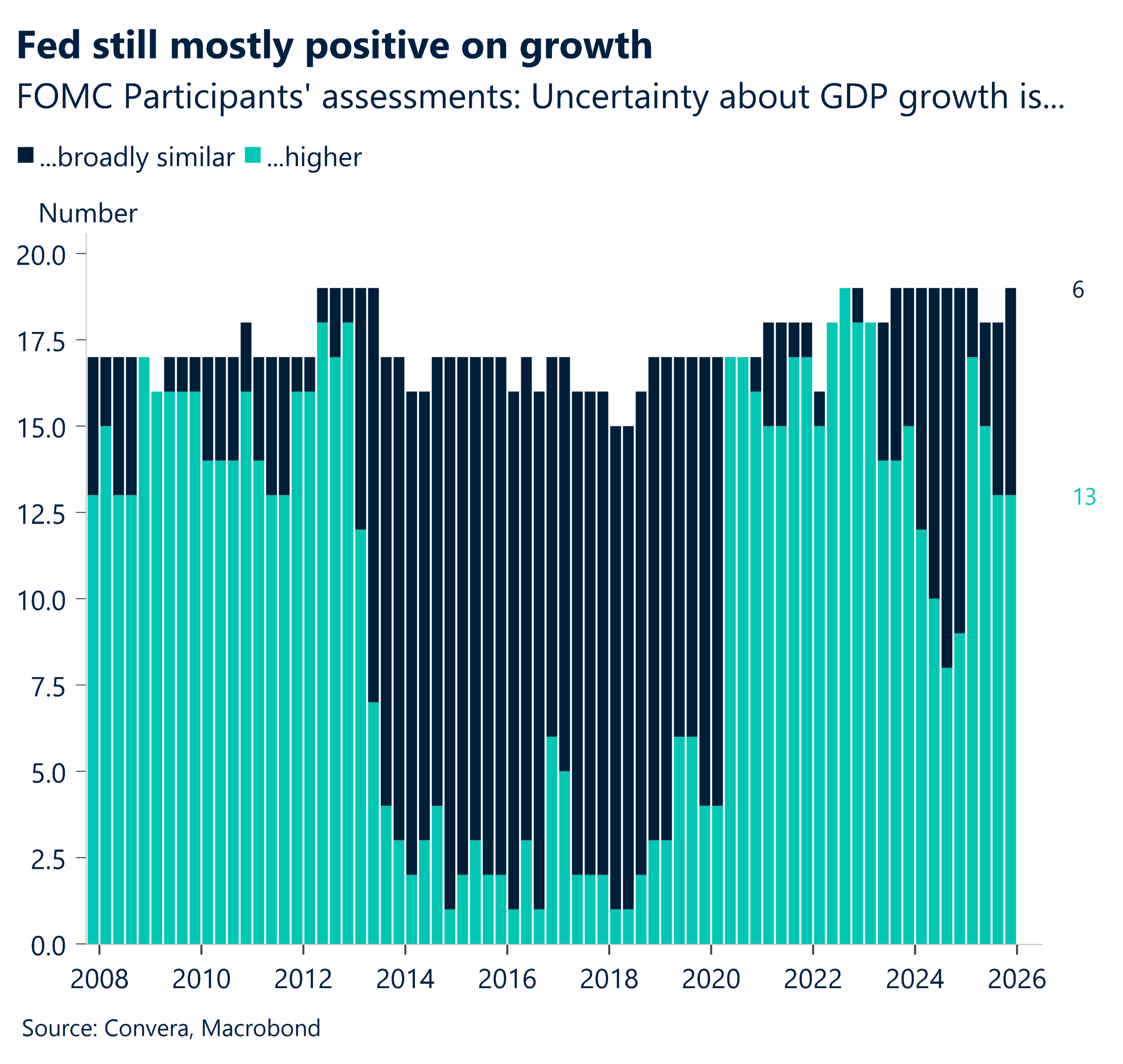

The Fed’s move to cut interest rates was a highly disputed decision, with the 9-3 split a sign of the level of division in the Federal Open Market Committee (FOMC).

The three dissents were the highest number of objections in six years.

The Fed board is divided with the weakening in the jobs market occurring at the same time as inflation rises.

Fed Chair Powell said the labour market took precedence because the Fed believes the rise in inflation is mostly driven by tariffs and the non-tariff components of inflation are cooling.

The US dollar was weaker after the announcement, with the benchmark USD index falling to a two-month low and causing the broader greenback index to fall back into a short-term downtrend.

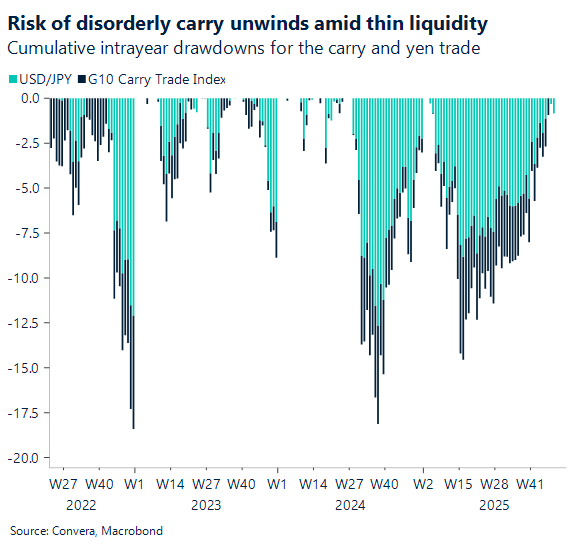

Yen sell-off continues despite BoJ hike expectations

The Japanese yen has continued to drift lower this week, even as Japanese officials point to a likely rate hike next week.

Bank of Japan Governor Kazuo Ueda told the Financial Times on Tuesday that the BoJ is nearing its inflation target, saying: “We are closer to 2% inflation on a sustained basis… I can say that I think.”

However, slowing data this week, including a drop in Economy Watchers Sentiment, has weighed on JPY.

USD/JPY has also gained as the greenback recovered, hitting a two-week high and sitting just 1.5% below its 2025 peak. The USD/JPY fell after the Fed, however.

In APAC, yen losses have been even more meaningful, with the JPY at multi-month lows across markets.

Aussie at highs

Table: seven-day rolling currency trends and trading ranges

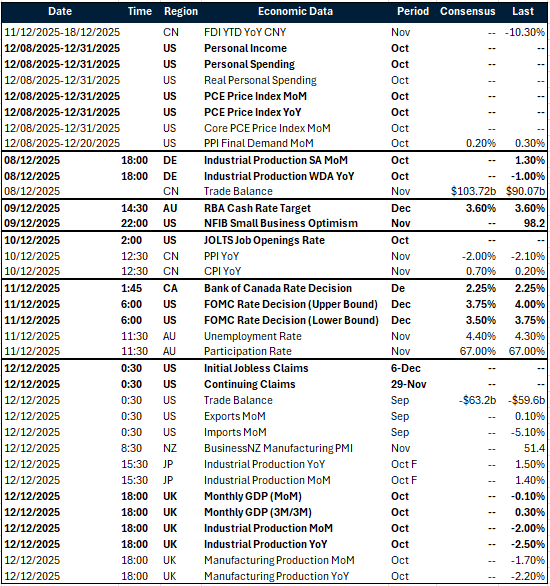

Key global risk events

Calendar: 8 – 12 Dec

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.