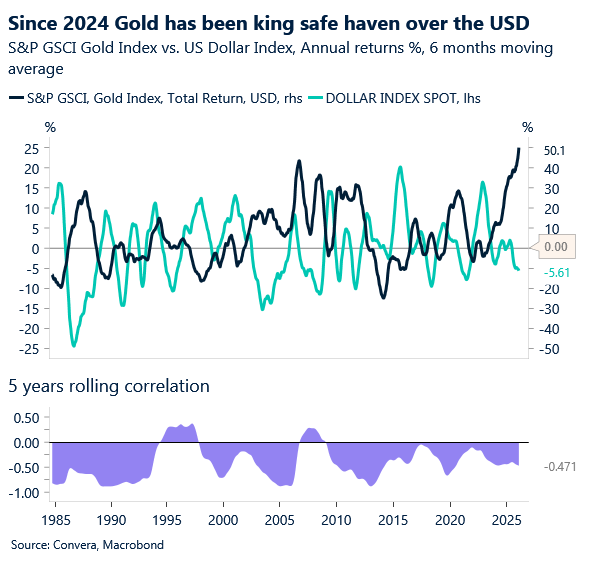

Gold, silver surge

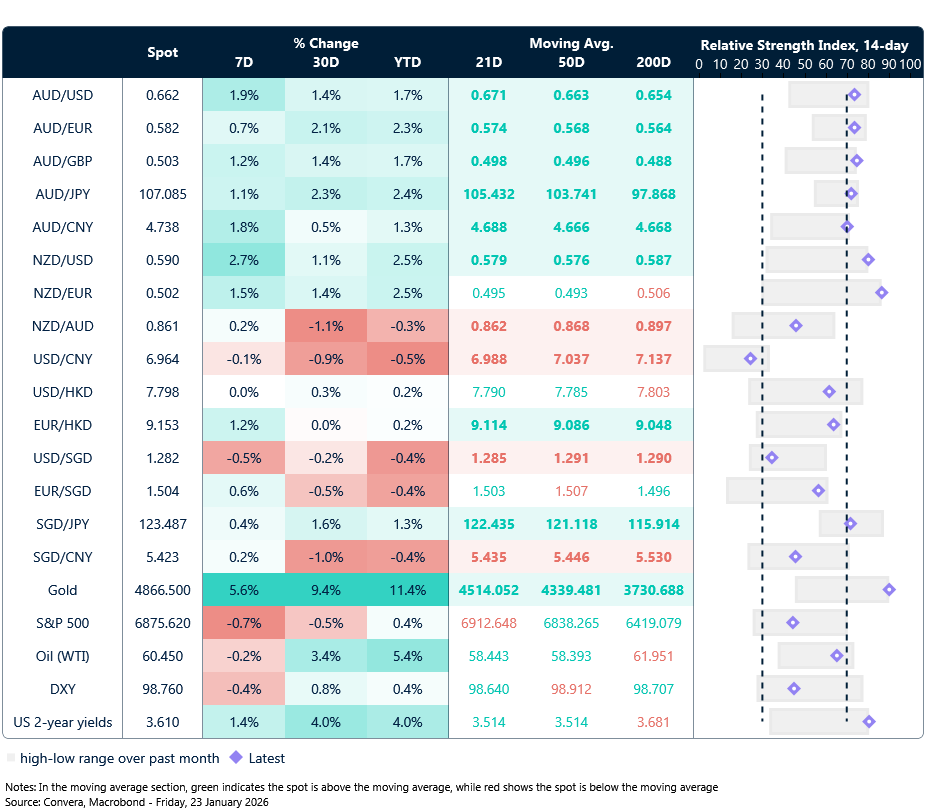

The Australian and New Zealand dollars both hit new highs overnight, boosted by the ongoing surge in precious metals.

Silver posted its strongest one‑day gain since 1985, jumping 14%, although prices reversed sharply after the London physical market closed. Gold pushed above USD 5,000 per ounce for the first time ever.

The AUD/USD gained 0.3% to reach its highest level since October 2024.

The NZD/USD climbed 0.4%, hitting its strongest level since September 2025.

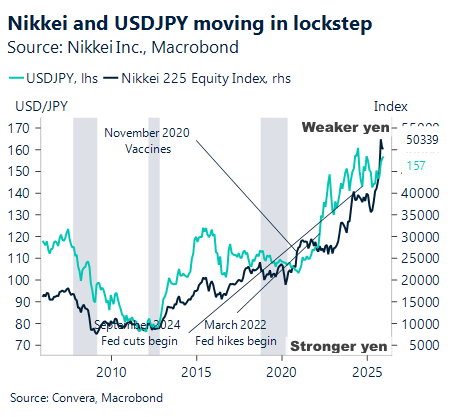

USD/JPY slides as intervention fears grow

The USD/JPY has broken below the 154.70–155.00 zone that had held since mid‑November and continues to fall. With Japan’s Lower House election approaching, traders had largely been focused on the risk of LDP seat losses. A joint intervention by Japan and the US wasn’t on the radar, yet speculation of coordinated action is now driving the move lower.

A break below 155 puts 152 and 150 in focus, levels last tested in October during the so‑called Takaichi trade. If those levels give way, attention could shift back to 140, a level that unsettled markets in April last year.

The pair now sits at a more‑than‑two‑month low. On the topside, resistance stands at the 50‑day average near 156.16, followed by the 21‑day average at 157.08.

Trump warns Canada over China deal

President Trump warned on Truth Social that if Canadian leader Carney proceeds with a plan to ease trade barriers on electric vehicles, he will impose 100% tariffs on Canadian goods entering the US. Trump accused Carney of attempting to turn Canada into a “drop‑off port” for Chinese products destined for North America. The proposed agreement would allow 49,000 Chinese EVs into Canada at a 6.1% tariff, down from 100%.

US Treasury Secretary Bessent also criticized the proposal, saying he could not understand why Prime Minister Carney would strike an EV tariff deal with China. Speaking to ABC, he noted that Canada had joined Europe and the US in imposing steep tariffs on China over steel dumping, and now appeared to be reversing course.

The dispute has unsettled currency markets, with traders watching developments closely.

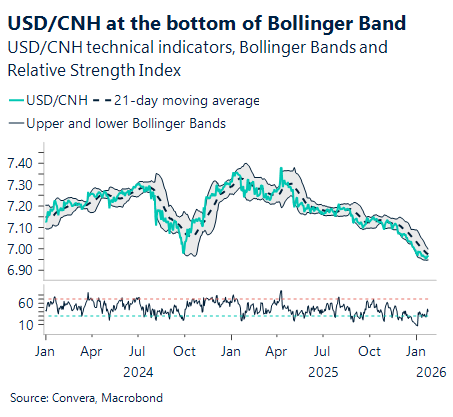

In APAC FX, the next key resistance for USD/CNH is the 21‑day EMA at 6.9760, followed by the 50‑day EMA at 7.0145.

USDCNH now trades 0.1% above its recent low of 6.9441.

Aussie, kiwi at highs

Table: seven-day rolling currency trends and trading ranges

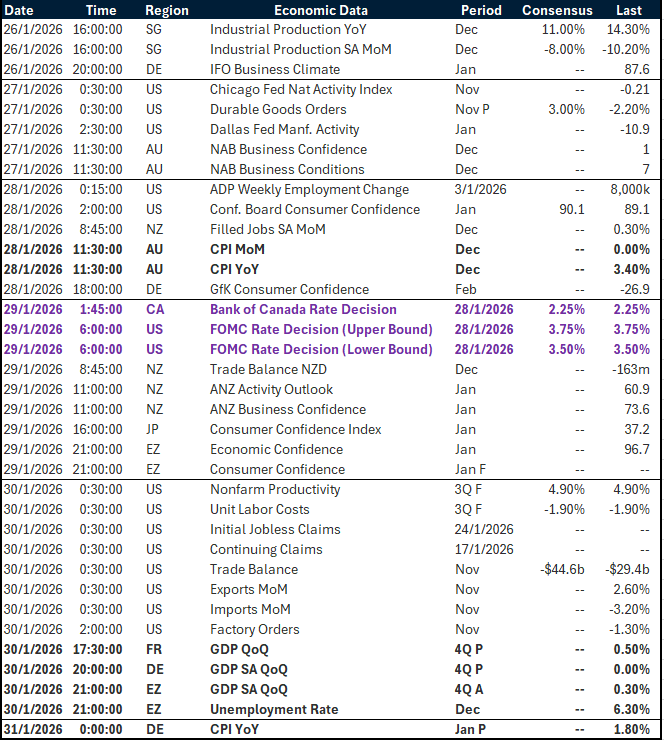

Key global risk events

Calendar: 26 – 31 Jan

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.