Written by Convera’s Market Insights Team (ahead of the US jobs report on Friday)

Global equity markets pulled back this week against the backdrop of rising geopolitical tensions, oil prices and inflation expectations. Oil prices topped the $90 mark as Israel attacked an Iranian embassy in Syria. The European stock index recorded its first weekly drop in two months.

The ISM surveys revealed that the US manufacturing sector is recovering, in parallel to the weakening of the services sector. Inflationary pressures are starting to rotate from the latter to the former as supply chain pressures rise again.

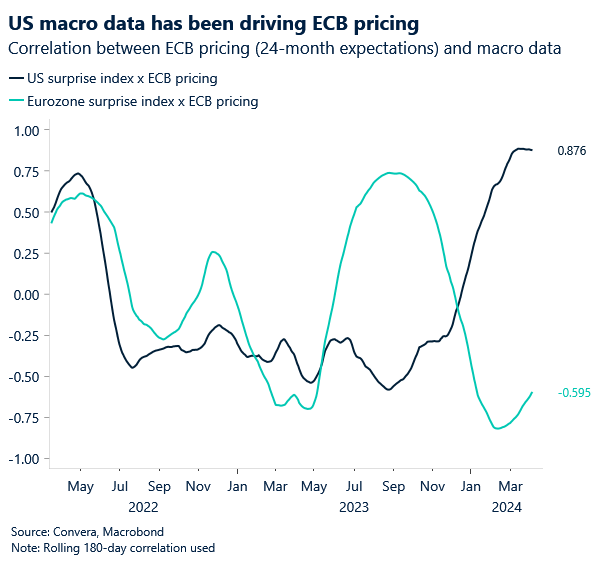

Inflation in Europe continues to fall and is setting the stage for a rate cut in June. ECB pricing has been more sensitive to (strong) US- than (weak) European macro data, most likely explaining why policy makers will not ease policy in April.

The rise of the oil prices, the USD and inflation expectations pose a risk to the base case of the G3 central banks cutting interest rates in June. The incoming macro data and developments on financial markets will therefore be closely watched.

The euro rebounded from a 7-week low this week as Eurozone services PMIs improved while weak services sector data punished the dollar.

Final Eurozone PMIs surprised to the upside, indicating the bottoming of the continent. The services PMI rose from 50.2 to 51.5 in March. Despite this, lagging data like German new orders and Eurozone retail sales surprisingly fell last month.

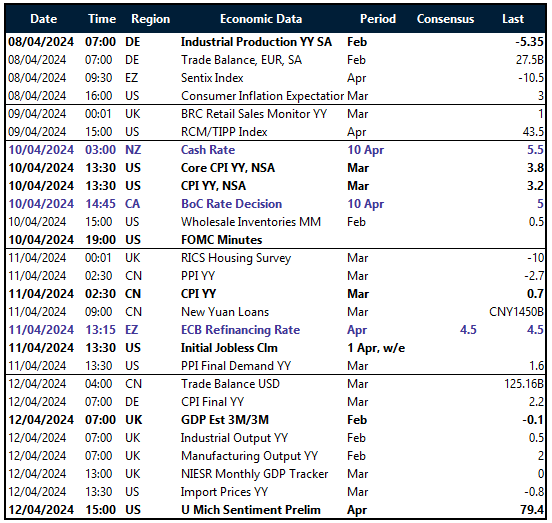

The Eurozone rate decision and US inflation (CPI) will be the main events over the coming days as investors parse how likely central banks are to cut in June.

Global Macro (1/2)

Fed to cut in June but risks of another delay

A trifecta of problems. A lot has happened on the macro front this week. From Eurozone inflation continuing its descent to the ISM PMI surveys showing a slow convergence between the manufacturing and services sector. However, the main overarching risk to central banks around the world and the current low-volatility regime lies in the ascent of commodity prices, the US dollar and inflation expectations so far in 2024. This strongly correlated trifecta of problems for risk assets will have to be closely watched in the coming weeks. Especially as the European equity index Stoxx 600 is on track to record its first negative week in more than two months and as the S&P500 is down the most since October.

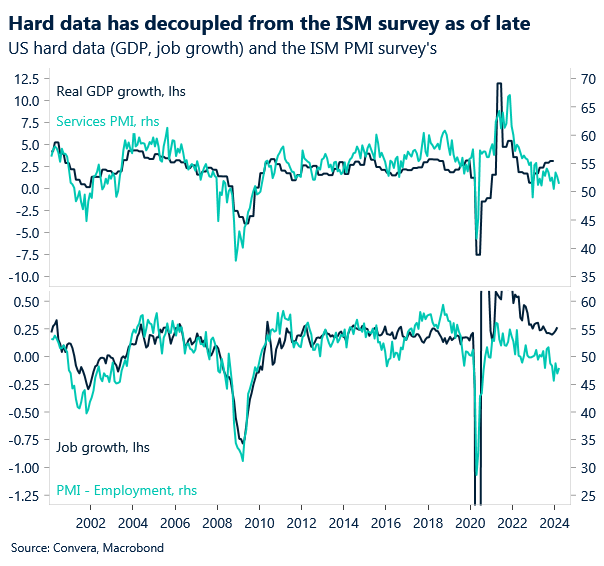

The week of the ISMs. The upside surprise of the ISM US purchasing manager index (PMI) for the manufacturing sector on Monday led investors away from both equities and government bonds as the likelihood of the Fed cutting interest rates in June shortly fell below 50%. The positive macro flow got extended into Tuesday with job openings and factory orders coming in slightly better than expected. However, the disappointing ISM PMI for the services sector on Wednesday reversed the dollar’s Monday gains with the currency turning negative on the week. Just from the ISM prints alone, we can put forth three critical theses: (1) The manufacturing sector is bottoming, while the services sector has peaked. (2) The US dollar continues to be data driven and sensitive to the macro environment. (3) The weak ISM PMIs have decoupled from still resilient hard (lagging) data points like GDP or jobs growth.

The big picture here is that for the first time in months, markets are now pricing in less rate cuts (2.6) than US policy makers have projected (3) for the year, highlighting how much sentiment towards the economy and Fed has shifted. However, most soft indicators have started turning south, supporting our call for a Fed cut in June, despite the risks of further increases in oil prices and inflation expectations.

Global Macro (2/2)

Central banks to decouple but watch out for shocks

Dependence on the Fed. The European Central Bank can thank US macro data for not having to cut in April. Both German and Eurozone inflation surprised to the downside this week. Despite disinflation continuing and growth prospects remaining weak, the ECB will most likely only cut rates in June after having laid the foundation for policy easing next week. This is in large part due to 1) policy makers not wanting to be wrong again on their inflation call and 2) global growth having outperformed expectations in Q1. The latter development and the consequent paring back of Fed cuts has given the ECB a bit more room to wait for two more months to cut. Even though the fundamentals would have justified reducing the policy rate in April. However, this dependence on US macro and the Fed will test their limits going into the second half of the year

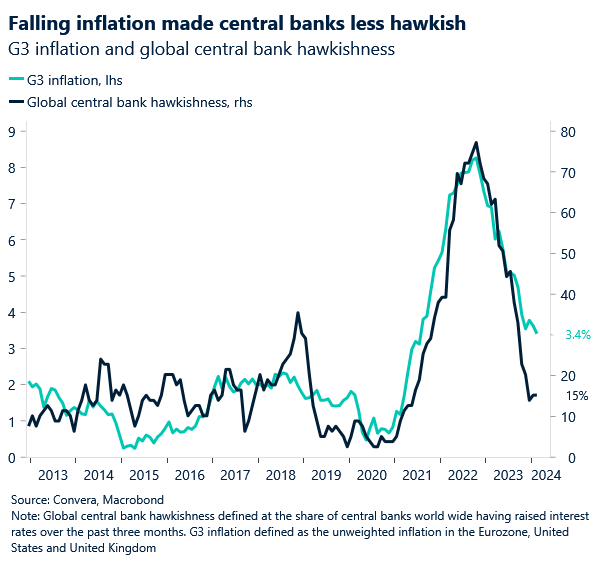

Shocks needed for an uptick in volatility. The events this week support our view that the eventual policy divergence between G10 central banks is unlikely to cause a significant increase in volatility if inflation remains anchored. In the current dovish policy regime, characterized by a bias to ease policy, only a renewed spike in inflation or an external shock (geopolitics, elections, market crash) would be able to meaningfully lift volatility rates from current levels. While important for FX trends, the divergence of policy rates won’t do the trick of bringing back volatility. And as was the case this week, higher volatility was caused by rising oil prices, geopolitical tensions in the middle east and investors paring back their expectations of Fed easing.

We see volatility coming from external shocks, rather than the divergence of monetary policy between central banks. However, the dependence on US data and the Fed will have to weaken in the second half of the year as the regional growth outlooks diverge. This could drive FX directionally.

Regional outlook: US & UK

Mixed picture from the PMIs

Stronger manufacturing. The US manufacturing sector expanded in March with the PMI rising from 47.8 to 50.3. The monthly increase follows 16 months of contraction and is a testimony to how the pro cyclical and rates sensitive parts of the economy are starting to recover. Most sub-indicators from employment to new orders improved last month. Most notably, price pressures and production levels increased to 55.8 and 54.6 and therefore remain well in expansion territory.

Weaker services. Although the week began with an upside surprise in the US manufacturing PMI that saw the inflation sub-component rise to the highest level in one-and-a-half years, this reflationary data point was not echoed by the services sector. Instead, the services sector recorded its weakest price growth in four years in March. Employment remained in negative territory, despite rising slightly, so the focus shifted on to falling price pressures, supplier deliveries and backlogs. The report could already be outdated though, as the rise in commodity prices continues to push inflation expectations and input costs higher.

Upbeat UK. Revised data revealed the UK manufacturing PMI jumped to a 20-month high in March, signaling a modest rise in activity. The print rose above the break-even 50 level – finally in an expansion territory for the first time since July 2022.

Lower inflation. Data from the British Retail Consortium this week revealed UK shop price inflation eased from 2.5% in February to 1.3% in March – the lowest in more than two years – while food inflation decelerated to 3.7%, down from 5.0% previously. This supports our call for UK inflation continuing to trend lower in the coming months, putting pressure on the Bank of England to cut interest rates possible in June.

Regional outlook: Eurozone

Imminent cut as inflation falls

Getting closer to 2%. The headline inflation rate in Germany fell to a near 3-year low, dipping to 2.2% y/y in March from 2.5% y/y in the previous month. The preliminary Eurozone inflation report declined as well by more than expected, falling to 2.4% y/y in March and matching November’s 28-month low. The core rate cooled to 2.9% y/y, reaching its lowest point in over 2-years. The decline was driven by the goods sector, namely a decline in energy and a continued moderations in food prices, while the services component remained sticky at 4.0% y/y.

No cut in April. Although the overall drop is encouraging news for the ECB, it does not change the fact that the bank is unlikely to cut rates during its meeting next week. The labour market remains hot, with unemployment staying at 6.5%, an all-time low since the start of the Eurozone in 1999. Wage growth has started to cautiously retreat but remains elevated, and a tight labour market could add to that. Markets are anticipating a rate cut in June and some ECB members have publicly stated that they support such a move

Bottoming economy. Across the bloc, the services sector props the economy as manufacturing continues to decline. The latest data has the Eurozone services PMI rising to 51.5 in March 2024, up from 50.2 in February. The German reading improved to a revised 50.1, up from 48.3 in February, marking the first expansion in six months.

The ECB is likely to prepare the markets for a shift in monetary policy in June and we could see some dovish signals at next week’s meeting, which might weigh on the euro from an already vulnerable position.

Week ahead

ECB and US CPI to lead the way

Why macro matters. On the macro and monetary policy front, 2024 has so far been about US soft data surprising the consensus to the upside and investors paring back their expectations for rate cuts across the developed world. However, up until this week, equity investors continued focusing on the positive fact that the global rate cutting cycle had already started. Now, the rise of the dollar, oil prices and inflation expectations pose a risk to the base case of the G3 central banks cutting interest rates in June. The incoming macro data and developments in financial markets will therefore be closely watched.

ECB laying the foundation to cut. The European Central Bank is expected to leave policy rates unchanged at record highs. However, recent commentary from Governing Council members suggests a broadening consensus of starting the easing cycle in the first half of the year. With inflation falling and growth prospects remaining subdued, the June cut is likely to be followed by further easing this year.

Watching US inflation. Inflation in the United States has hovered around the 3% – 4% range since the middle of last year, showing how the disinflationary impulse has slowed. However, markets took comfort in the continued fall of core inflation, which has eased to 3-year lows in February. This trend must continue to support risk assets and for the probability of a June rate cut to be maintained.

The Eurozone rate decision and US inflation (CPI) will be the main events over the coming days as investors parse how likely central banks are to cut in June.

FX Views

Macro still in the driver’s seat of the FX market

USD Firm but fragile. The low volatility rate in the FX space means that while the US dollar rose against 78% of its global peers in the first quarter of 2024, the year-to-date gain has only been slightly above 3%. It will get harder for the US dollar to sustain momentum given (1) how much Fed easing has already been priced out and (2) that the business cycle is turning positive. However, the surprising strength of the US economy has so far shielded the dollar from negative headwinds. After hitting a 2-month low at the start of March, the US dollar index has climbed over 2% and hit a fresh 5-month high this week after data showed the US manufacturing sector back in expansion after 16 months in contraction. A softer services sector report quelled the dollar’s gains though and the 105 level proved a resistance barrier to the DXY once again. The very high sensitivity of rates and FX markets to US data is unlikely to fade, but we do think the dollar has an asymmetric reaction function to the data given the scaling back of easing bets already this year. Should US data prove benign enough to allow the Fed to cut rates, the dollar should sell off more than if strong US data keeps the Fed in a holding pattern.

EUR Poised for the best Q2 performance since ‘15. The euro rebounded from a 7-week low this week as Eurozone services PMIs improved while weak services sector data punished the dollar. EUR/USD is on track to break its bearish 3-week performance streak after firmly closing above its key 200-day moving average. FX volatility remains extremely low though, with 1-month EUR/USD realised volatility at 4.40% (Yang-Zhang basis, annualised) – a 29-month low. The pair has bounced between $1.07-$1.10 for all but one of the trading days in 2024. For now, there is nothing to suggest that this regime is going to change any time soon. During the rate decision next week, the ECB is likely to prepare markets for a shift in policy in June and some dovish signals may temporarily weigh on the euro. However, the fact that a June cut is fully priced in limits significant EUR/USD downside pressure, leaving the currency in position to rally back to the topside. Seasonality effects also favour the common currency within the range bound parameters as historically we tend to see EUR/USD appreciate on average in the month of April.

GBP Choppy but rangebound. Sterling appreciated against 70% of its global currency peers in Q1 but depreciated by 0.7% versus the US dollar. After hitting a 7-month high near $1.29, GBP/USD reversed course after the dovish Bank of England (BoE) meeting last month and fell below its Q1 interquartile trading range of around $1.263-$1.272. Bearish alarm bells were ringing when the pair closed below its 200-day and 50-week moving averages, but GBP bulls cheered softer US services sector data and revised UK data showing the UK manufacturing expanded in March for the first time in 20 months. Although the pound is largely being driven by US data and expected total G3 policy developments, the recent convergence of the UK rate outlook in line with the US and Eurozone has weakened the pound’s yield advantage. This week, data revealed UK shop price inflation fell to a 2-year low and a BoE’s survey of inflation and wage growth expectations provides further evidence that UK inflation is heading lower and thus risks lean towards an even more dovish BoE than expected. Nevertheless, seasonality has been strong for GBP/USD in April, which has rallied in 16 out of the last 20 years with most gains arising towards month-end due to strong dividend repatriation flows.

CHF More SNB rate cuts to weigh on franc. The Swiss franc appreciated against just 16% of global currency peers in Q1, the weakest 3-month performance since 2007. It is the 2nd worst performing major currency YTD, down over 8% against the US dollar and 6% against the euro. Specifically, EUR/CHF is trading at an 11-month high and has risen for 9 weeks on the trot – its longest ever weekly winning streak. Closing above its 100-week moving average for the first time since late 2021, strengthens the case of EUR/CHF reaching parity soon. The Latest CFTC data also shows hedge funds grew their net short Swiss franc position to the largest in almost five years. What’s driving this bearish franc narrative? Last month, the Swiss National Bank (SNB) became the first G10 central bank to cut rates this current cycle, reducing its key rate to 1.5%. This makes the franc a more viable G10 funding currency for carry trades in this low volatility environment. Markets are pricing in more easing too, with a 76% chance of another SNB cut in June. Swiss inflation data cooling to 1% y/y in March, lower than expected, supports this view and thus we expect the franc to continue depreciating throughout Q2 and 2024.

CNY China’s service sector sustains growth momentum. The Caixin/S&P Services PMI climbed to 52.7 in March, surpassing expectations and signaling continued expansion for the fifteenth consecutive month. This private survey echoes the positive trend observed in the official non-manufacturing PMI. Coupled with the Caixin/S&P manufacturing PMI at 51.1, the composite PMI reached its highest level since May 2023, underscoring signs of economic recovery despite headwinds in the property sector. New business orders grew at the fastest pace this year, while business confidence improved, though employment declined. Price pressures moderated, with selling prices rising at a slower rate amidst easing cost inflation. Chart shows historically, monetary easing has often corresponded with weakening of CNY, as the increased liquidity will put downward pressure on the currency. Next week’s focal points include key data releases on CPI, PPI, and the trade balance.

JPY Japan’s service sector gains traction on robust demand. Japan’s final au Jibun Bank services PMI for March rose to 54.1, reflecting the fastest growth in activity and new business in seven months, buoyed by improved domestic and inbound tourism demand. The services sector has remained in expansionary territory for 19 consecutive months, contrasting with the contraction in manufacturing. While cost pressures intensified to their highest level in five months, business confidence regarding the 12-month outlook remained robust and well above long-term averages. Firms attempted to pass on higher costs through increased selling prices, though the rate of price hikes was relatively unchanged from the previous month. Inflationary dynamics, coupled with the Bank of Japan’s recent shift away from negative interest rates, pose potential downside risks to the private sector. The USD/JPY rebound challenges key technical resistance levels, with the next hurdle at 153.057. Upcoming economic indicators to monitor include current account and industrial production data.

CAD USD/CAD ticks higher with an ascending channel. This week, the Canadian dollar has remained largely stable around $1.3550 amid mixed US data as well as a continued streak of weak domestic data. Despite WTI crude oil futures approaching a near 6-month high, Loonie has failed to capitalise on such strength. In fact, it appears the correlation between crude oil prices and CAD has decoupled, and the rise in the price of black gold now favours the Greenback via a more favourable terms of trade channel. USD/CAD has been in a steady upward movement since January 9 but needs more of a boost to have a clear bullish trend. Given the current spot positioning, US dollar bulls appear to be running out of steam as the pair converges towards the firm resistance level of $1.36. Ahead of the BoC rate decision on April 10, the Canadian dollar looks set to remain weak as cyclical and structural factors point to Canadian rates falling earlier and faster than in the United States. A dovish BoC tilt could see USD/CAD break past the sticking point of $1.36 and rally towards November ’23 highs of $1.38.

AUD Aussie services gain momentum as global outlook clouds. Australia’s services sector exhibited robust growth in March, with the Judo Bank flash services PMI rising to 54.4, marking the fastest expansion since April 2022. This upswing was driven by an influx of new business orders, though export demand remained subdued due to softening global conditions. Supply chains tightened, leading firms to bolster staffing levels, particularly in transport, storage, and consumer services. Inflationary pressures eased to the lowest level since October 2021, fueling optimism among service providers. Higher copper and oil prices have helped the pro-cyclical Aussie climb almost 2% this week with AUD/USD jumping towards its 100-day moving average at 0.66 and back above a month-long descending trend channel. Looking ahead, the NAB business confidence data will be closely watched next week.