- Deal-led optimism. The mood overall has been pretty risk-on lately, as optimism has grown on the trade-war front. The Aug. 1 tariff deadline threat has eased, with EU diplomats signaling a likely deal with the US to set most import tariffs at 15%, mirroring Japan’s recent agreement.

- Highs may hide what’s still unhealed. The S&P500 index closed at another record and the Nikkei 225 climbed 5% this week dragging a gauge of Asian stocks to the highest since March 2021. Markets may be underestimating the turbulence ahead as the tariff regime shifts, but for now, traders are content to leave those concerns for another day.

- ECB hits pause. After seven straight 25bp cuts totaling 200bp since September 2023, the European Central Bank held rates steady. The bar for further cuts looks high but we can’t rule out another in September.

- Flash PMI data. Resilient service sector growth across advanced economies, continues to offset weakness in manufacturing. Modest expansion in the Eurozone, UK, Japan, and Australia, was dwarfed by the US, which is in a league of its own.

- No spark in the buck. The US dollar has shown little reaction to both the re-escalation of trade tensions and the recent wave of deal-making, suggesting any near-term rebound will depend more on economic data than tariff headlines — especially given the rising sensitivity of USD pairs to short-term rate differentials.

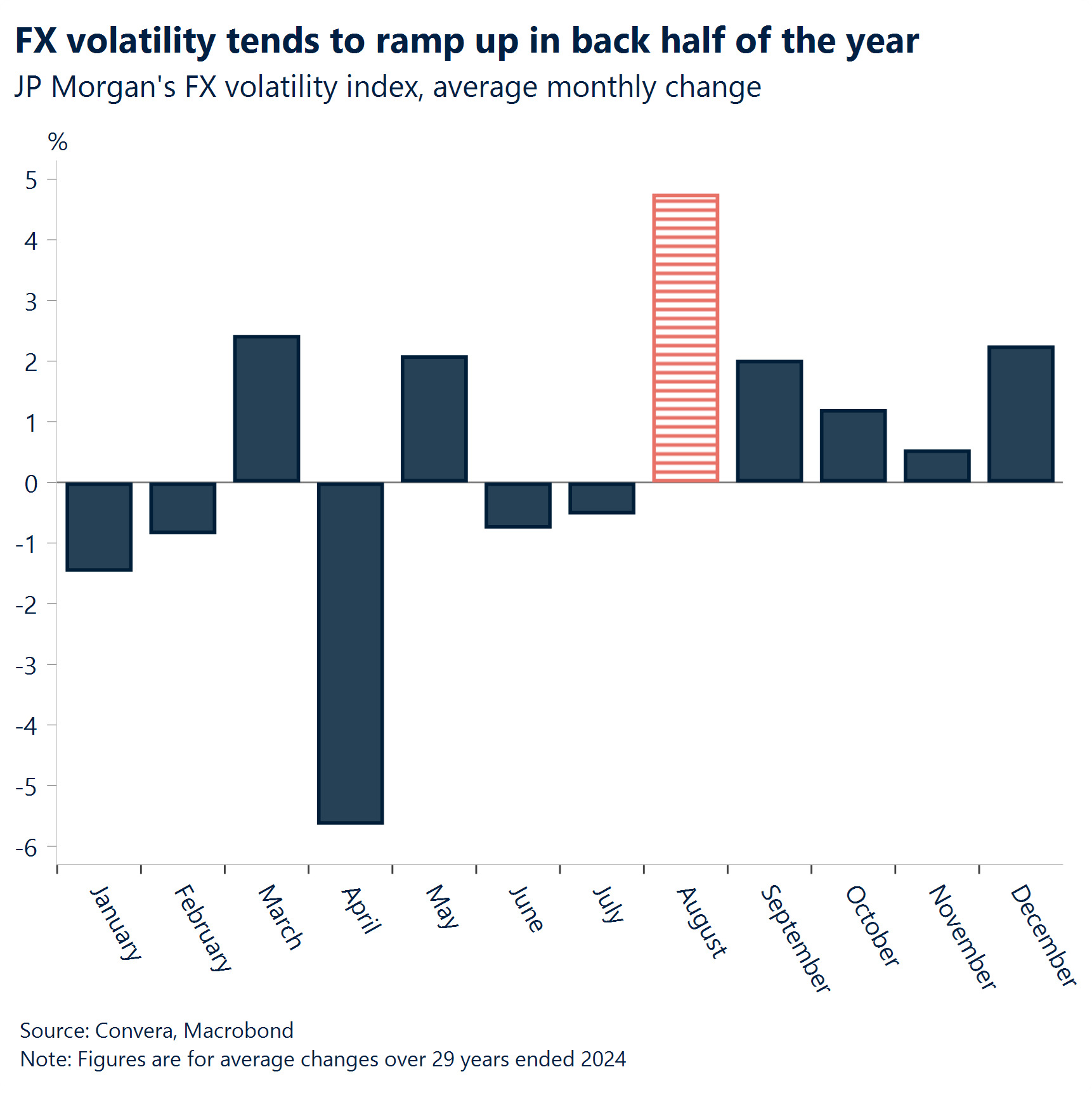

- Volatility may yet catch up. A seasonal spike in FX turbulence looms as August is historically the peak month for JPMorgan’s Global FX Volatility Index, and volatility tends to ramp up in the back half of the year.

Global Macro

Global PMIs show split between manufacturing and services

Services strong, manufacturing slips. In the US, according to the S&P Global PMI, business activity picked up in July, led by services, pushing the Composite PMI to 54.6. Manufacturing, however, shrank for the first time since December, with the PMI dropping to 49.5 as production, orders, jobs, and inventories fell. Delivery times improved, signaling supply chain relief but dragging on the index. Private-sector jobs rose, yet confidence dipped on fears of spending cuts and tariffs. Rising costs pushed inflation higher, with price growth among the steepest in three years.

The Eurozone and UK PMI data, painted a similar mixed picture of economic momentum. Manufacturing across the Eurozone remained subdued, while service activity held steady, signaling a patchy recovery. In the UK, factory output showed signs of stabilizing, and the services sector continued its strong expansion.

Central bank decisions. The European Central Bank (ECB) held rates steady at 2.15%. ECB sentiment moved slightly hawkish during the presser, as traders scaled back their expectations for rate cuts this year. Markets now anticipate only 19bps of easing for the rest of 2025. People’s Bank of China (PBoC) kept its loan prime rates unchanged, after Q2 GDP rose 5.2%, slower than Q1 but above forecasts.

Mixed US labor data. US labor market data for the week showed mixed signals. Initial jobless claims fell by 4,000 to 217,000, the sixth consecutive weekly decline and the lowest level since mid-April, suggesting layoffs remain low and the market is still tight. However, continuing claims rose slightly to 1.96 million, pointing to longer spells of unemployment for those already laid off. The modest rise may reflect slower hiring, as businesses grow cautious amid tariff uncertainties and concerns over federal spending cuts.

Week ahead

The greenback’s compass: U.S. indicators

U.S. resilience rules, but uncertainty still clouds the Fed’s path. The economy continues to hold up despite Trump’s unpredictable trade agenda. With only Waller and Bowman leaning dovish, the Fed remains broadly committed to holding rates steady — especially after June’s mild inflation uptick.

The U.S. job market’s strength faces its next big test. While weekly claims have been drifting lower, rising continuing claims may lift up the unemployment rate, expected to uptick to 4.2%, placing next week’s July report in sharp focus.

Two data pillars, one verdict on stagflation fears. PCE and GDP will offer a clearer picture of inflation pressures and growth momentum for the U.S. economy — offering markets an opportunity to test out stagflation concerns.

Germany’s data in focus. With GDP, retail sales, and CPI on deck, investors will be watching how this week’s upbeat PMI and Ifo prints cope with economic reality.

ECB hawkishness hangs in the balance. Upcoming eurozone GDP and unemployment figures will test the durability of the ECB’s tough tone — and may expose just how fragile that stance really is.

FX Views

Tight ranges and turning points

USD Little data, little direction. The U.S. dollar index (DXY) declined over 1% this week, as a lack of meaningful data let sentiment take charge, weighing on the greenback. It was certainly a week of indecision — the dollar didn’t start off overtly bearish, but even relatively minor data releases were enough to trigger daily declines. The week was instructive in revealing the dollar’s heightened sensitivity to economic data as a barometer for the U.S. economy’s health, especially in light of Trump’s erratic trade agenda. Most of the data leaned soft, with the exception of jobless claims, which dropped for a sixth consecutive week, and PMIs, pushing the dollar higher. Even trade deals — with Japan having finalized one and Europe nearing another — are proving less influential than concrete indicators. With the downtrend still struggling to resume amid the absence of more meaningful data misses, the dollar remains stuck in a tight range, hovering above key support at 97. Next week’s heavy data calendar could be pivotal, either sparking a deeper move lower or reigniting a rebound.

EUR Riding the sentiment wave. This week illustrated how the euro remains the market’s favorite over the dollar, at least for now. It’s in quiet weeks on the data front that we can better assess how sentiment alone drives price action. EUR/USD closed over 1% higher week-to-date, flirting with the $1.18 resistance. A more hawkish repricing following the ECB rate meeting on Thursday — with odds of another cut by year-end now lower — should help the euro feel more comfortable near the $1.18 highs, which it failed to breach convincingly in early July. The real catalysts here that would make that breach reality are soft U.S. data and rising expectations of Fed rate cuts. Although the overall Fed’s tone remains hawkish, some dovish whispers have contributed to the euro’s outperformance this week.

GBP Lowest close since 2023 versus euro. GBP/USD failed to hold above its 21-day moving average in a sign that the modest rebound this week may be short-lived. The pair remains largely tethered to USD sentiment, but the latest UK data dump offers little domestic support too as stagflation fears still loom large. The pair has broken south of its 2025 uptrend channel and looks poised to suffer its first monthly decline in six. We see $1.33 as a tactical downside target over the next week or two. This underperformance is also weighing on GBP/EUR, which closed below €1.15 for the first time since late 2023. The currency pair has now declined in seven of the past nine weeks, shedding roughly 3.5% as markets increasingly price in a more dovish BoE stance relative to the ECB. With the eurozone showing signs of resilience and the ECB nearing the end of its easing cycle, the policy divergence could keep pressure on sterling through the summer despite relative rate differentials and implied volatility signals suggesting the pair is undervalued. The upcoming BoE meeting in August will be a key test for sterling; a rate cut is priced in, but focus will be on whether the central bank cuts one or two more additional times before year-end.

CHF Softer amid elevated risk appetite. It’s been another quiet week for the franc, strengthening against the dollar but weakening against the euro, albeit with moves well under 1%. Optimism around trade deals between the US and EU, plus easing concerns over the Fed’s independence, have reduced the franc’s safe-haven appeal. Subdued volatility across financial markets has also been a dampener of CHF demand, though the so-called summer lull may be coming to end. Meanwhile, sight deposits at the Swiss National Bank (SNB) surged by CHF 11.2 billion, sparking speculation about possible currency intervention to weaken the franc. However, this may be due to routine liquidity operations, not active FX market intervention. We still expect the SNB to step in if EUR/CHF approaches the 0.9200–0.9250 zone, a level historically associated with intervention.

CAD Range bound close to 2025 lows. Despite fading chances for a Canada–U.S. trade deal before August 1st and growing expectations of extended tariff uncertainty, the USD/CAD has edged lower this week. A dip in the U.S. Dollar, coupled with the U.S.–Japan trade deal, helped several major currencies, including the USD/CAD, which neared its 2025 low, touching a weekly low of 1.357 before rebounding closer to Friday above 1.361. The CAD has now spent eight straight weeks consolidating between 1.355 and 1.374. Reviewing monthly flows, foreign investors began cutting exposure to Canadian assets ahead of President Trump’s re-election, with outflows peaking at $10 billion in February and continuing through May. Tensions with the U.S. and heightened volatility fueled the sell-off, though the pace has since eased, suggesting a potential bottom and softer sentiment against the Canadian dollar. A busy week lies ahead. The Bank of Canada is expected to hold its rate at 2.75%, while May’s advanced GDP is projected to remain flat. Tariff developments could prove most pivotal, with the U.S. aiming to finalize deals with Europe and South Korea following its agreement with Japan. However, expectations for a Canada–U.S. deal remain low. If one materializes, markets may reprice swiftly, with the Canadian Dollar likely to break below 1.36. Key data releases also include non-farm payrolls and the Fed meeting, rates are expected to hold steady, but investors will watch closely for signs of dovish dissent among FOMC members.

AUD “Shooting star” threatens fade from eight-month highs. The Australian dollar remains supported after RBA Governor Michelle Bullock delivered a hawkish message, underscoring the central bank’s reluctance to cut rates without clearer progress on inflation. Her remarks reinforced the RBA’s gradual stance, noting that fewer rate hikes translate to fewer cuts—providing a cushion for AUD amid global easing trends. However, AUD/USD has retreated from eight-month highs, with the “shooting star” candlestick pattern suggesting a potential negative reversal. Technical traders are eyeing key support levels at the 21-day EMA of 0.6544 and the 50-day EMA of 0.6505. A break below these would imply negative price momentum. Looking ahead, Australia’s upcoming CPI, building approvals, retail sales, and PPI releases will be crucial in shaping rate expectations and determining whether the RBA’s hawkish lean can persist.

CNH Bessent’s Beijing talks steady yuan. Stability in US-China trade relations is helping anchor the yuan, as US Treasury Secretary Scott Bessent prepares for a third round of trade discussions in Stockholm with Chinese officials. While the talks aim to extend the tariff truce and address broader economic imbalances, the US is also expected to voice concerns over China’s ties to Russia and Iran. Fundamentally, the diplomatic tone is constructive, limiting downside risks for the yuan in the near term. Technically, USD/CNH continues to trade in a tight range, with 7.1500 providing a floor and 7.2000 acting as resistance, reflecting market indecision. The next resistance of 21-day EMA of 7.1721 and 50-day EMA of 7.1872 remain key levels to watch. The focus now shifts to a raft of Chinese data, including composite, manufacturing, non-manufacturing, and Caixin PMIs, which could provide the catalyst for the next directional move if growth surprises or policy hints emerge.

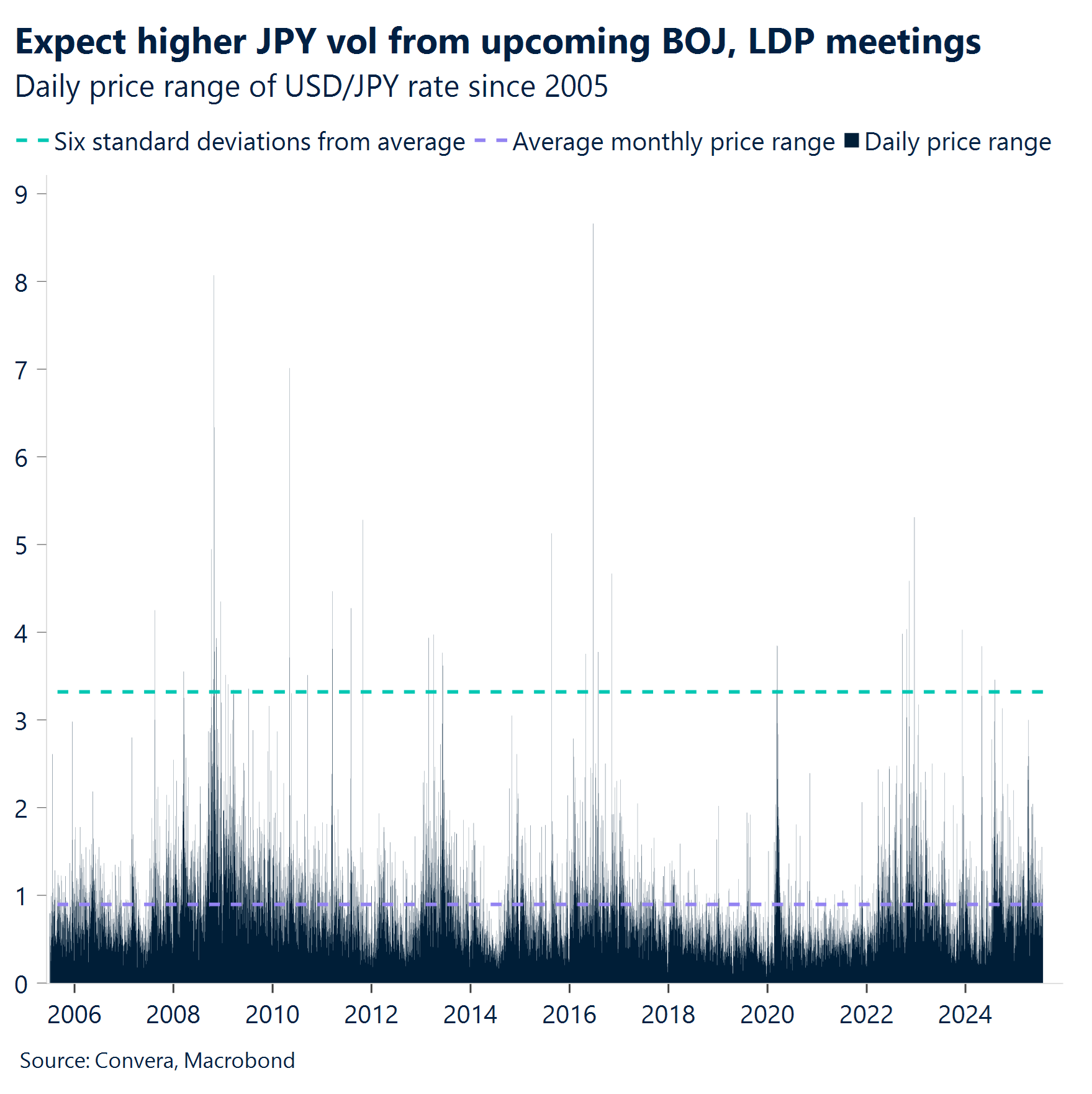

JPY Political uncertainty clouds yen. Political uncertainty in Japan is keeping markets on edge, with scenarios ranging from coalition reshuffles to potential leadership challenges in the ruling LDP, all of which could impact fiscal and monetary policy direction. For now, the Bank of Japan remains cautious about tightening, offering little support for the yen despite the risk backdrop. The market is currently pricing in 80% likelihood of a December rate hike. USD/JPY has bounced off the key support levels of 100-day EMA of 146.51 and 21-day EMA of 146.66 and now eyes the psychological barrier at 150. Upcoming Japanese industrial production numbers, the BoJ Monetary Policy Statement, and the policy rate decision are in sharp focus. Political tension is rising, a key LDP meeting taking place on 28 July and an extraordinary Diet session – both could stir market sentiment.

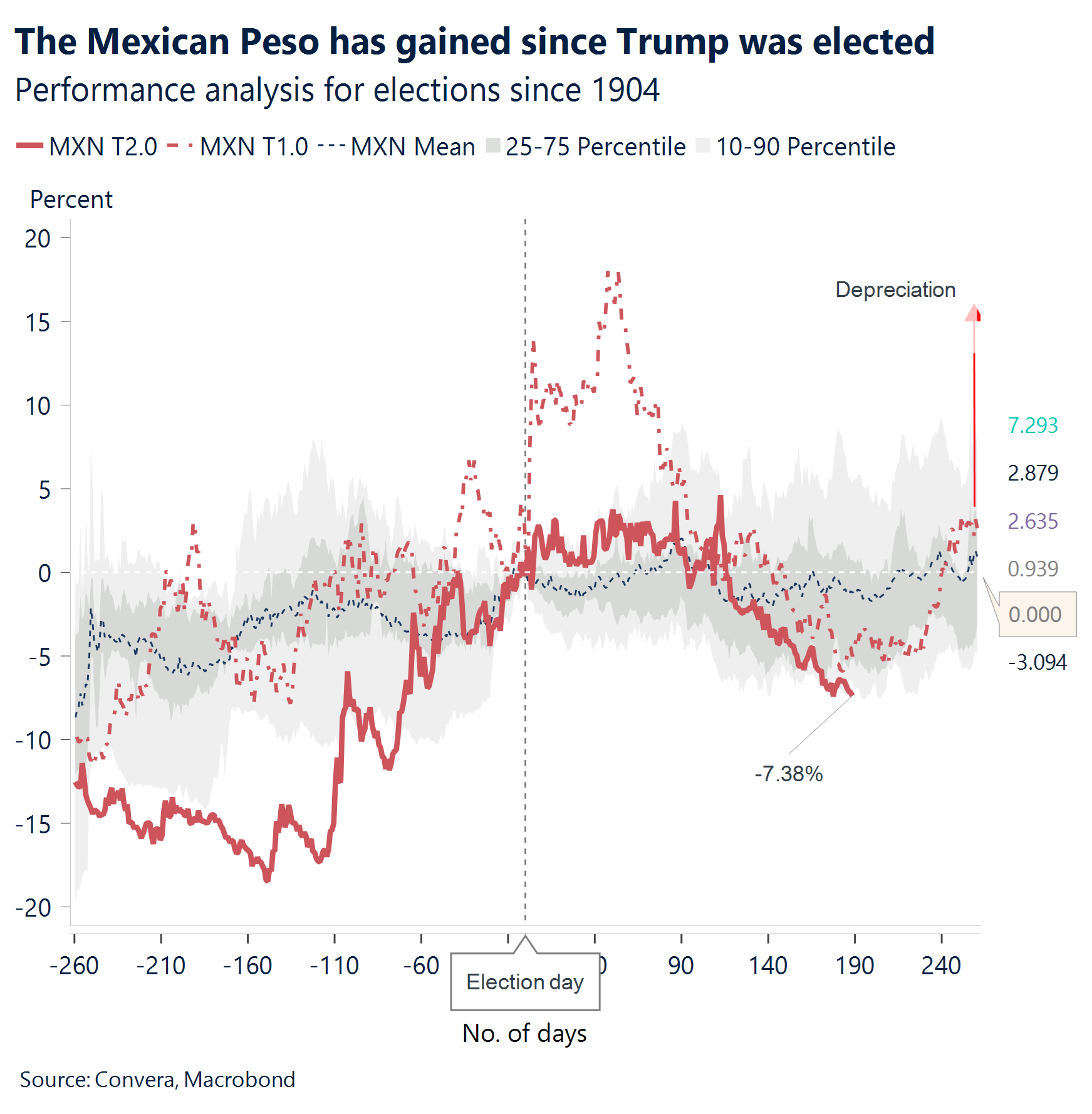

MXN A new 2025 low. The Brazilian Real and Mexican Peso led regional currency gains this week, buoyed by renewed momentum in emerging market assets following continued US dollar weakness and the US-Japan trade announcement. Optimism has returned, but with the August 1 trade deadline looming, both economies face the risk of punitive import tariffs. The Mexican Peso broke below its 100-week moving average of 18.59, hitting a new 2025 low and extending its rally to six consecutive months. Year-to-date gains now stand at 12%, erasing the tariff premium that had built in since Donald Trump’s re-election. Market participants will closely watch next week’s data docket, with expected updates on U.S. trade, Non-Farm payrolls on Friday, as well as Mexico’s unemployment rate and trade balance (Wednesday), and Q2 advanced GDP (Thursday). On the macro side, Mexico’s retail sector showed signs of resilience in May. INEGI reported a 2.7% year-over-year increase in retail sales, led by robust growth in online/catalog purchases, textiles, and personal goods. Employment and wages continued to edge up, driving a 1.8% rise in real income. Yet broader economic momentum stalled. The Global Indicator of Economic Activity was flat, with a 0.4% contraction in services, particularly entertainment, wholesale trade, and professional services, dragging down the composite. Early July inflation eased to 3.55%, undershooting forecasts and falling comfortably within Banxico’s target range, reinforcing expectations for a 25-bp rate cut at the upcoming policy meeting. Retail strength points to durable consumer demand, but persistent weakness in services underscores the uneven nature of Mexico’s post-pandemic recovery.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.