Since the end of October, the S&P 500 has risen in all but two weeks and has gained 25 percent. Global investors have become comfortable pricing in the turn of the global monetary policy cycle to a more accommodative stance.

Fed Chair Jerome Powell and ECB president Christine Lagarde confirmed the base case of cutting interest rates this year, leaning slightly dovish.

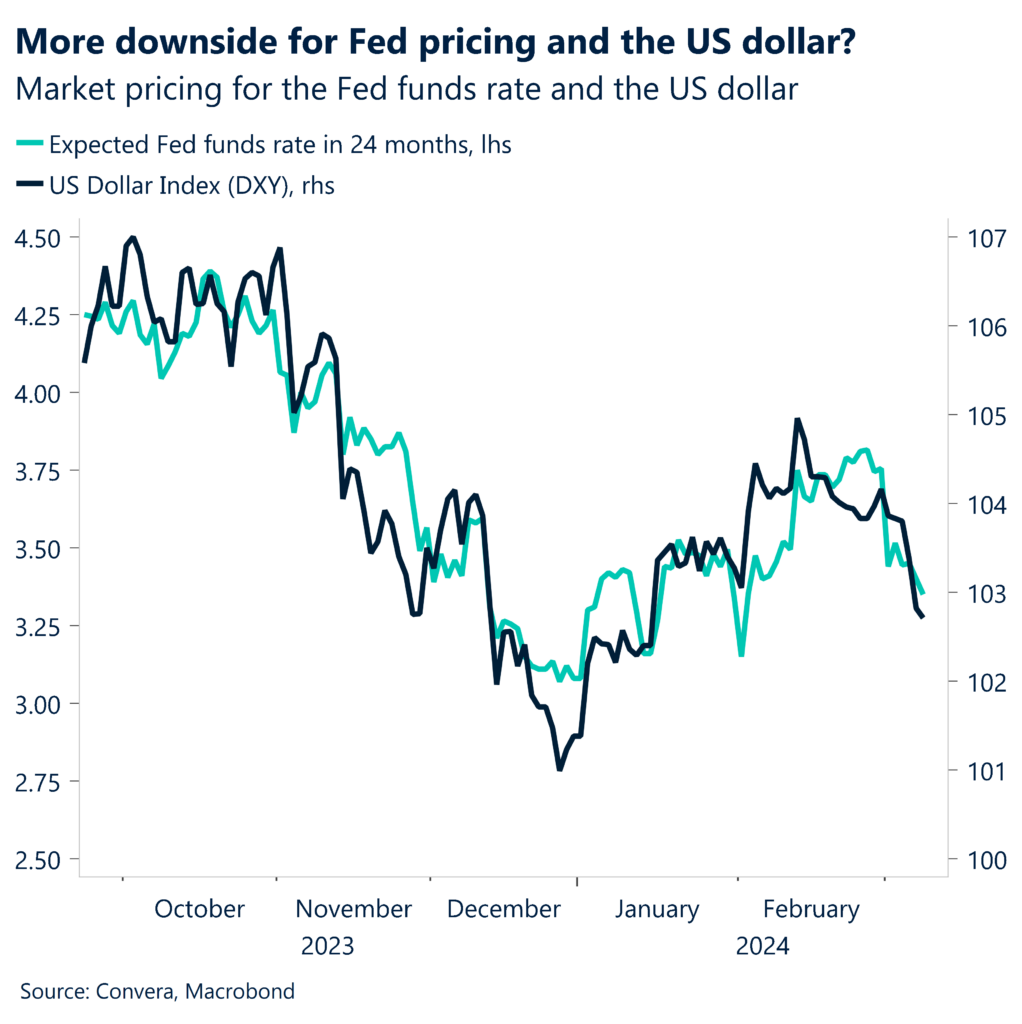

The US dollar suffered its worst day in a month on Wednesday and is on track to record its worst week so far this year amid a series of macro disappointments that have added another 25-basis point rate cut to the markets Fed pricing for 2024.

We are starting to see some cracks emerge in the US economy’s armour as leading indicators are starting to turn more negative. We are looking for a confirmation of this theme from the incoming data.

The US economy added more jobs than expected in January but the rise in the unemployment rate and revision of the January number did put a dent on the report. We see the report as overall risk-positive as it confirms the orderly moderation of the labor market.

Bloomberg Economics’ latest inflation nowcast for the Eurozone has now dropped to 1.95% annually, a significant shift from February’s 2.6% and below the ECB’s inflation target of 2%. The latest macro data for the Eurozone has been promising as economists continue to await the final confirmation of the bloc bottoming.

Global Macro

Settling into a new regime

October was the start of a new regime. Global investors have become comfortable pricing in the turn of the global monetary policy cycle to a more accommodative stance. October last year saw interest rate cuts outstrip hikes for the first time since the end of 2020 in what has retrospectively become the starting point of a new regime. Coincidentally, the same month ended with the US dollar and global bond yields reaching cyclical multi-year highs as equities bottomed out.

Equity markets at record highs. Since then, the S&P 500 has risen in all but two weeks and has gained 25 percent. A feat that is even more impressive against the backdrop of bond yields and the Greenback having been somewhat supported throughout the first two months of the year amid a slight pullback in the expected easing central banks will provide this year. Equity investors have pushed that last development aside and focused on the fact that thee easing cycle, although postponed, has already started, which will see interest rates fall over the course of 2024 and 2025. We see the strength of the US dollar and bond yields as being temporary.

Paving the way for rate cuts. This week’s macro data disappointments and a plethora of institutional forecasts seeing inflation move back close to the 2% target in Europe and the United States this year have been welcomed news for markets, which are continuing to bet on central banks delivering rate cuts this year. While the easing expectations have been pared back in recent months, the monetary policy cycle has already turned more accommodative, supporting risk assets across the globe. Fed Chair Jerome Powell and ECB president Christine Lagarde did push back against premature easing this week. However, both central bankers confirmed the base case of cutting interest rates this year, sending positive ripples through markets. While January and February were about falling easing bets, March is shaping up to be about putting those bets back into pricing.

Some cracks in the US, but not a done deal. The outperformance of the US economy has been a major macro theme impacting market pricing over the last years. Productivity gains have more than compensated for higher wages and have led to US companies and therefore equity markets overshadowing its peers for some time now. We are now starting to see some cracks emerge in the US economy’s armour as leading indicators are starting to turn more negative. The upcoming data will be key to gauge where we are within this theme and our confidence to call the end of US exceptionalism.

Regional outlook

Gauging the momentum of the US economy

A week of data misses. The spree of downside data surprises in the US started with last week’s purchasing manager index for the manufacturing sector, which came in lower than expected (47.8 vs. 49.5) and therefore stayed in contractionary territory for the 16th month. The Institute for Supply Management published its other barometer for the services sector on Tuesday. The headline index came in below forecasts with the employment sub-index falling into contraction.

Employment indicators turning south. This has put particular attention on yesterday’s labor market data, which failed to ease investors’ worries about the loss of momentum. Both job openings (JOLTS) and the ADP private employment report came in short of the consensus number economists had been looking for. Job openings fell from 8.88 million to 8.64 million as the quits rate continued falling from 3.44 million to 3.38 million. Anecdotal evidence of the easing of labor market conditions had been present before. However, the recent data has added to concerns of job growth slowing in the US. The Fed’s economic report (Beige Book) saw the tight employment situation ease as well last month as consumer spending inched lower.

Mixed NFP print. The US economy has added more jobs than expected in February, with nonfarm payrolls rising by 275 thousand versus the consensus number of 200 thousand. However, the strength of the headline number got tamed by various details of the report. (1) The unemployment rose from 3.7% to 3.9% to a two-year high and (2) the January job growth was revised down from 317 thousand to 177 thousand. The downside bias on the revisions side has continued as 10 out of the last 12 months have been revised down. We see the report as overall risk-positive as it confirms the still orderly moderation of the labor market.

Regional outlook

ECB to cut four times as inflation falls to 2%?

Lower inflation expected. The European Central Bank held the benchmark policy rate at a record high of 4% as expected. The latest round of staff projections brought the expected downward revision to growth and inflation forecasts. The ECB staff now expect inflation to come in at 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026, with underlying inflation at 2.1% in 2025 and 2.0% in 2026.

Soon at 2%? This comes at a time when the Eurozone producer price inflation fell by 8.6% year-on-year in January, moderating from the previous month’s decline. As a result, Bloomberg Economics’ latest inflation nowcast has now dropped to 1.95% annually, a significant shift from February’s 2.6% and below the ECB’s inflation target of 2%.

Waiting on more wage data. Despite the downward revision and PPI down beat, Lagarde stressed the risks to high domestic inflationary pressure remain, with two key threats as follows: (1) Services inflation remains too high, stuck at about 4% and only dropping a touch in February; (2) Policymakers want assurance that wage increases are under control, data on which won’t be available until the end of Q1. June will be the point where enough data points will be available, either confirming that inflation has really been tamed or pointing to renewed upward pressure on prices.

Four rate cuts for 2024. Interest-rate traders are positioning for a Q2 rate cut with 100bps of cuts by year-end, compared with some 92bps before today’s rate decision. The latest data on negotiated wages growth displayed the first signs of easing pressures since May 2022. Even though slowing, 4% y/y wage growth is still too high for the ECB’s comfort, particularly given the feeble productivity growth in recent quarters.

Bottoming economy. The latest macro data for the Eurozone has been promising as economists continue to await the final confirmation of the bloc bottoming. Eurozone retail sales edge up in January, expanding slightly by 0.1% m/m in January 2024. The composite PMI hit an 8-month high as well, showing continued economic stabilization, with service sector growth since July, though manufacturing contracted. Regional variations persisted, with Ireland, Spain, and Italy seeing modest growth while France and Germany remained in contraction.

German industrial production hint at signs of recovery. The latest print for January showed a gain of 1.0% m/m, up from -2.0% in December – the first expansion in nine months. There are signs that the sick man of Eurozone is bottoming out, but the numbers still point to another economic contraction in Q1 and a long road to recovery ahead. Industrial production remains over 5% lower than a year ago and around 10% below its pre-pandemic level. Meanwhile, factory orders over the same time period contracted by -11.3% m/m – the second largest drop since 2020.

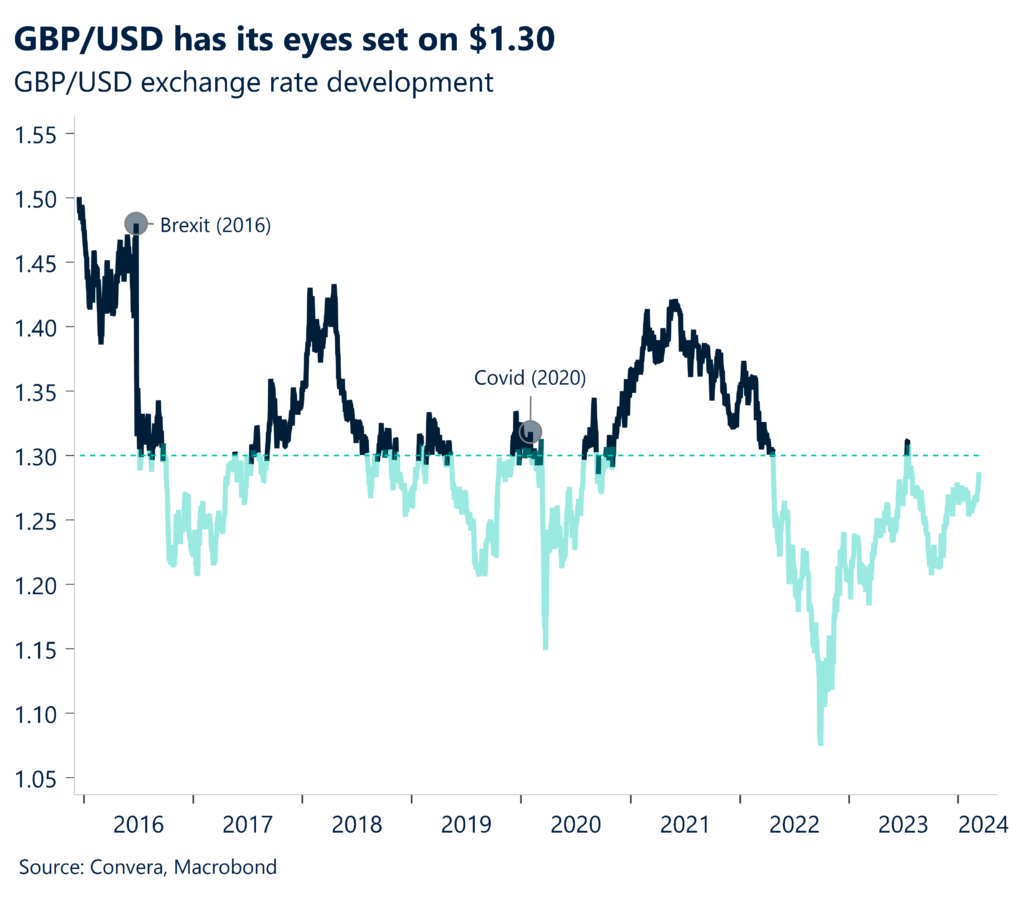

UK budget a nonevent. Elsewhere in Europe, the UK Budget was a damp squib and UK gilts held fairly steady, given the government’s borrowing plans for the coming financial year came in broadly in line with expectations. News that the OBR is forecasting UK inflation back at target in a few months briefly sent the pound lower, given the implications for the Bank of England and its future pace and scale of interest rate cuts. Chancellor Jeremy Hunt also implemented a 2p cut in the rates of employees’ and self-employed national insurance contributions, along with another freeze in fuel duty, which accounted for almost all of the net £13.9bn (0.5% of GDP) loosening of fiscal policy in 2024-2025. However, the boost to household spending power from lower headline tax rates still only mitigates around half of the drag from the long-running freeze on income tax and NICs allowances and thresholds. Neither gilts nor sterling showed much reaction overall in the end, which is unsurprising given how heavily the bulk of the measures were trailed in advance.

Global Macro

US inflation on Tuesday to dictate sentiment

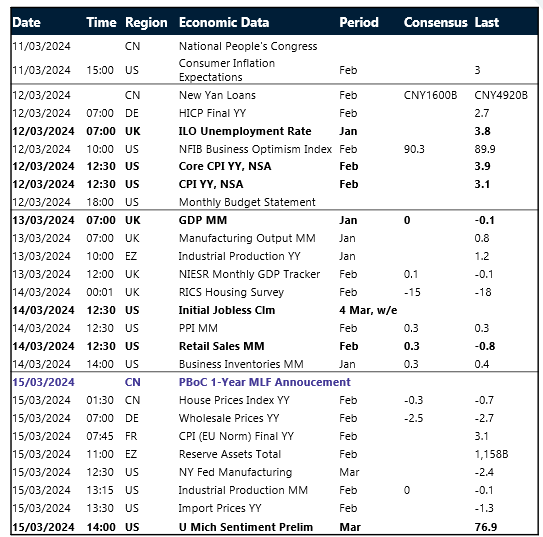

Starting point. Our starting point going into next week is the following. Markets are not expecting any rate cuts for major central banks in March. However, bets on policy easing for June have piled up for the ECB and Fed and have been strengthened by this week’s inflation projections and weaker than expected US data. Equity markets continue to rise against the backdrop of the global monetary policy cycle having turned more accommodative. The US dollar and yields have pulled back and cut back their year-to-date performance from January and February by a large margin.

US macro data will be key. The first test to last week’s risk on capital rotation will come in the form of the US CPI report. Last month saw consumer prices rise by 0.4% in what has been a solid upside surprise. We are expecting a moderation of both the monthly and yearly inflation print as one-off effects from January subside. Investors will also keep an eye on retail sales, industrial production and the producer price index, which are all coming up after the CPI print next week.

BoE as the hawkish outlier to persist? The pound has benefited from the dovish repricing in the US and Eurozone. Now, the British currency will have to stand the test of data to confirm this narrative. The employment and GDP reports on Tuesday and Wednesday will be closely watched by market participants.

FX Views

Crack in US armour dents dollar appeal

USD Cracks show in dollar’s reign. The US dollar has lost significant momentum in recent trading sessions, suffering its biggest 2-day decline since December. The buck’s 1.3% fall for the week thus far is set to be its steepest in nearly three months, whilst the 2-year Treasury yield has erased over half of its 2024 gains over the past two weeks amid renewed expectations that the Fed will cut interest rates four times this year instead of three. A spree of disappointing US data and less-hawkish comments by Fed Chair Jerome Powell, prompted the dovish repricing. The dollar is only up against 6% of global currencies month-to-date, down from 43% in February and 73% in January. Cracks are clearly starting to show in the US currency’s reign with the DXY back below 103 for the first time since climbing above it mid-January. Three weeks ago, highlighting the failure of the DXY to hold above the 105 level and its 100-week moving average, we suggested the peak of the US dollar in 2024 may already be behind us. Next week’s US CPI inflation report will help confirm or confound this call. Either way, expect some choppy price action given 1-week implied volatility jumped after capturing this key data release.

EUR ECB June rate cut in play. The ECB voted to keep its rates unchanged at 4% during the rate decision this week as the core message remained unchanged: the borrowing costs will remain elevated for as long as necessary. Lagarde signaled June as the most likely time for rate cuts, an objectively dovish remark, but continued to link monetary easing with developments not only in inflation but also wages. That helped the euro recover during the press conference, while the big dollar decline, on the back of dovishly-perceived Powell congressional testimony, provided an additional boost. The euro reversed half of its January losses, surging towards $1.0950 (7-week high) and is trading at the top of its 30-day range. EUR/USD is looking to post the largest weekly gain (+0.8%w/w) over the past 10 weeks but could soon run out of steam. The bullish rally faces a psychological resistance barrier at $1.0950, with the RSI now firmly in overbought territory. The pair is likely to surrender some of the gains and depreciate towards $1.09 handle – the level above which it has traded only 24% of the time in 2024.

GBP Jumps to 7-month peak. The British pound rose to its highest level in seven months against the US dollar, and has broken above its 200-week moving average – a level that’s acted as a key resistance barrier for the best part of two years. The pound is on track for its biggest weekly advance of 2024, supported by elevated global risk appetite, low cross-asset volatility and falling US yields. Bullish speculative GBP bets remain well above their long-term median with net bets on the pound rising equivalent of $3.7bln, almost double that of net long USD bets. Sentiment is clearly optimistic on sterling appreciating further, but this overcrowded bet may also prove a limiting factor to $1.30 being achieved any time soon. This week lacked top-tier UK data, barring a retail sales miss, whilst the Budget was a damp squib with UK gilts holding fairly steady, given the government’s borrowing plans for the coming financial year came in broadly in line with expectations. Overall, the pound is up against over 90% of its global peers month-to-date and we still believe the path of least resistance for GBP/USD is higher through 2024, but as already evidenced, it could be a gradual ascent. Next week’s UK jobs report is a key risk event, with all eyes on UK wage growth.

CHF SNB’s FX trend is your friend. The Swiss franc enjoyed some modest support at the start of the week as Swiss February inflation came in a fraction higher than expected at 1.2% y/y. However, it was still a fresh 28-month low and well within the SNB’s 0-2% target range, whilst core inflation was even lower at 1.1%. This arguably should’ve strengthened the case for a rate cut by the Swiss National Bank (SNB) and weaken the franc, however, markets now price just a 45% probability of a rate cut in March, down from 66% late last week, helping the franc snap a 5-week losing streak against the US dollar. The SNB’s latest FX reserves data is important to keep track of though and last week saw reserves rose for a third consecutive month in February, with the Fr15.4bln increase nearly double January’s rise. The 3-month change of Fr35bln was also the largest increase since the pandemic. In a sign that the SNB is no longer pursuing CHF-strengthening policies now that inflation is under control. EUR/CHF hit a fresh 3-month high and has recorded five weekly advances in a row, amounting to a more than 2.5% rise.

CNY Caixin PMI miss. China’s Caixin services PMI for February registered at 52.5, slightly lower than the anticipated 52.9 and the previous month’s 52.7. While still indicative of expansion for the 14th consecutive month, the growth rate is the slowest in three months. This contrasts with the official survey from the previous week, which surpassed expectations, depicting a faster pace of services activity. Caixin attributes the subdued growth to low prices, insufficient domestic and foreign demand, alongside a contracting job market. The Composite PMI remains unchanged at 52.5. USD/CNH is nearing initial upside targets (re Weekly Jan 19th publication: targeting 7.239-7.2665 resistance) after consolidating between November-January. Attention next week shifts to house prices and the China Thomson Reuters IPSOS PCSI index.

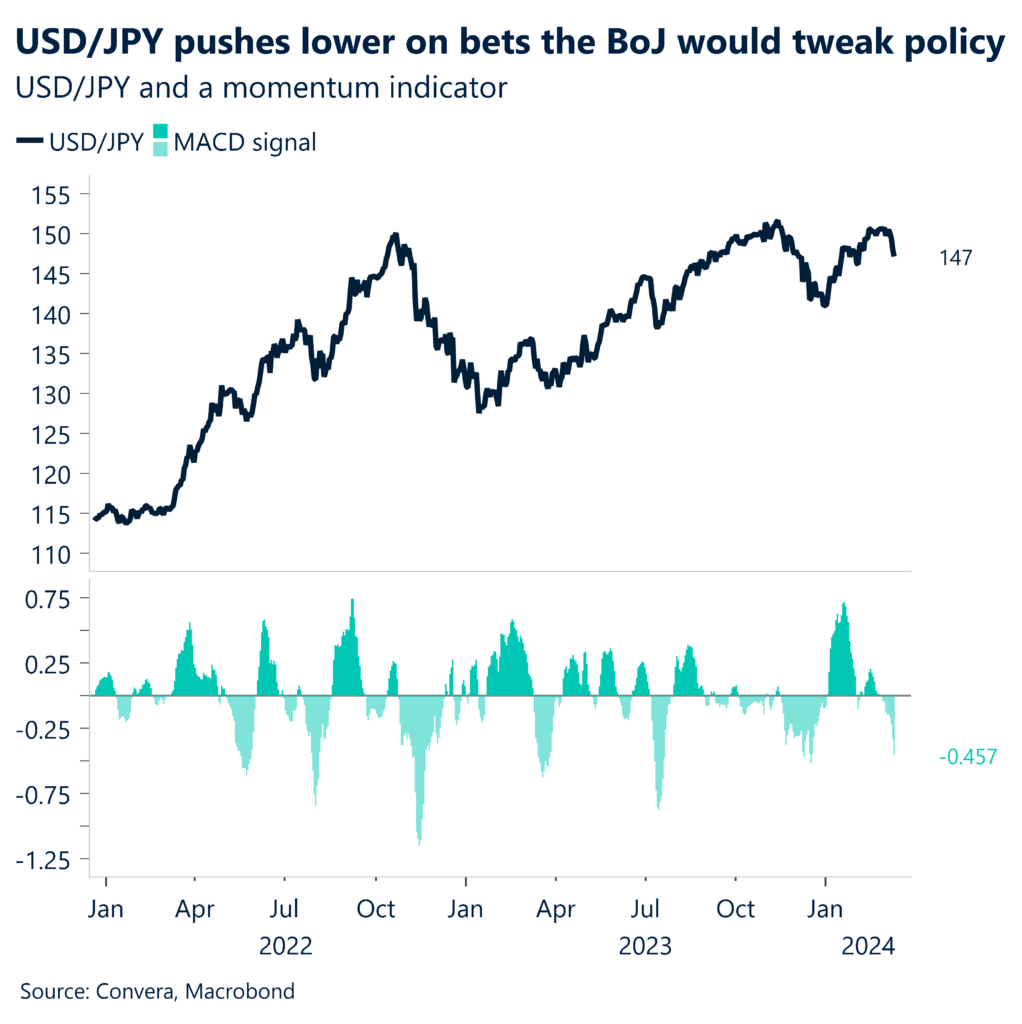

JPY USD/JPY rally stalls amid Japan’s deflation denial. Japan’s February CPI inflation slightly surpasses estimates at 2.6%, with core CPI in line at 2.5%. However, the services PMI figure for February show a sequential weakening compared to January’s readings. In response to speculation regarding the end of deflation amid rising prices, Japan’s top policymakers, including Economy Minister Yoshitaka Shindo and Finance Minister Shunichi Suzuki, have denied such considerations. They affirm the government’s commitment to ensuring that wage growth outpaces inflation, aiming to prevent a return to prolonged periods of price declines. While the USD/JPY bounce slows near the 151.945 peaks of 2022-2023, a sustainable break of the 148.815 tactical support is crucial to halt the rally momentum. USD/JPY has returned +5.1% Year-To-Date. Key economic indicators to monitor include GDP, PPIs, and BSI large manufacturing conditions in the upcoming week.

CAD BoC remains cautions. The Canadian dollar rallied to a 4-week high at $1.3444 against the US dollar on the back of a hawkish BoC decision and a widespread weakness in the Greenback. The BoC held its target for the overnight rate at 5% for the sixth consecutive time, emphasizing the need for further progress in core consumer prices while defying expectations that easing references would have been introduced given the recent progress in headline inflation. It is increasingly unlikely that the BoC will loosen policy before summer. Money markets are pricing in a 68% probability of a rate cut in June and cumulative 80bps cuts by year-end. A widening in CA-US rate differential to a 12-week high, driven by a slide in US yields, erased US dollar advantage against Loonie. USD/CAD has further room to fall, eyeing $1.3440 as the next support level.

AUD AUD/USD resilient as Melbourne’s inflation eases. Melbourne, Australia, sees a moderation in inflation for February, with a year-on-year increase of 4%, but a slight month-on-month decline of 0.1%. This aligns with recent trends, following a softer-than-anticipated official CPI reading in January. The easing inflationary pressure strengthens the argument for potential monetary policy easing by the Reserve Bank of Australia (RBA). Concurrently, AUD/USD showed upward movement ahead of the release, maintaining levels above 0.6520. However, January’s building approvals fell short of expectations, dropping by 1% month-on-month instead of the anticipated 4% rise. Despite signals indicating a rebound in AUD/USD post the February momentum divergence, it failed to sustain momentum and retreated from the initial resistance zone of 0.6611-0.664. AUD/USD has returned ~-3% Year-To-Date. The upcoming focus for next week lies on the NAB business confidence and survey results.