Equity benchmarks on both sides of the Atlantic were going into the US non-farm report at record highs. Investors had struck a positive tone this week as the economic data continued to show a moderate cooling of the labour market.

However, the downside surprise on inflation, the ISM PMI miss on Monday and weaker than expected job openings on Tuesday were not confirmed by the official US labor market report, which showed hiring accelerate to 272k.

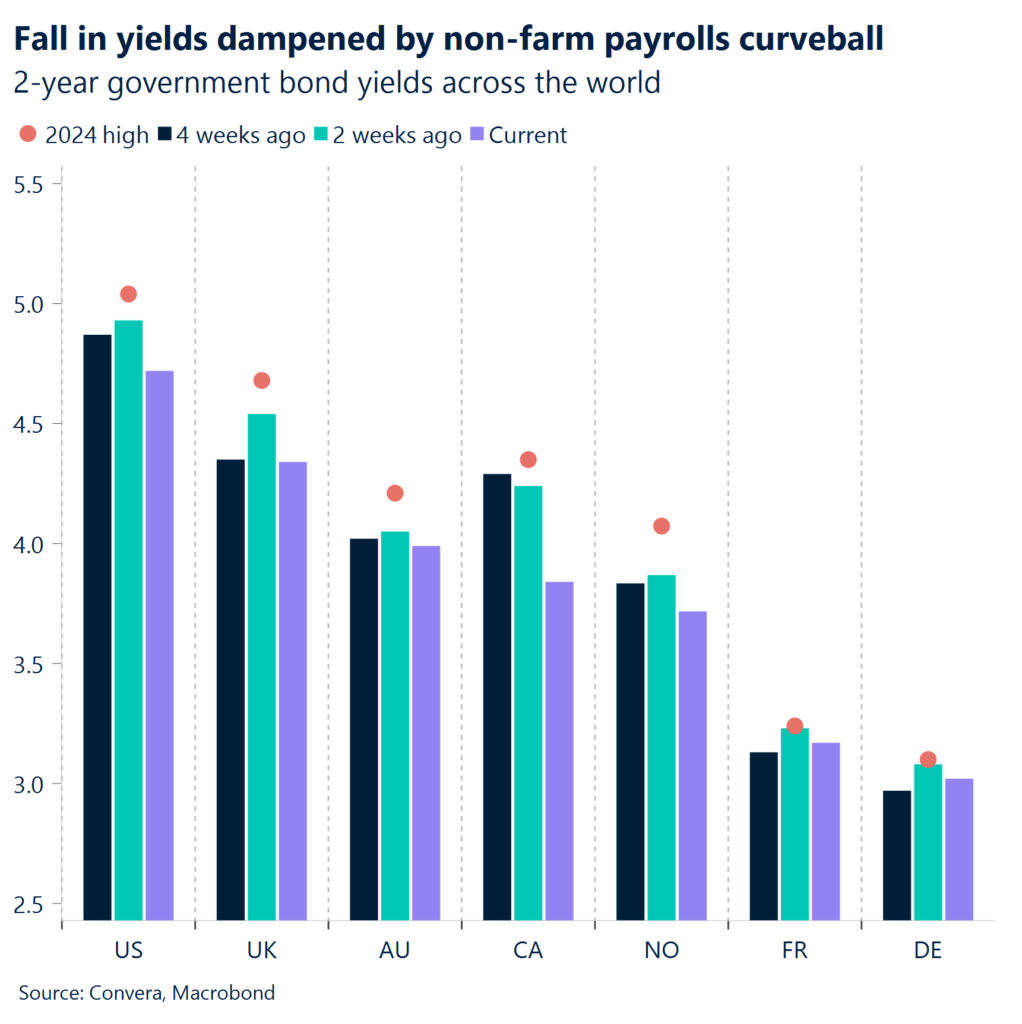

US Treasury yields on the long had been on track to record their largest weekly drop year-to date but reversed course after the NFP-print. Investors cut back their bets on rate cuts and see the first easing coming in December.

As expected, the European Central Bank (ECB) lowered its benchmark rate by 25 basis points to 3.75%. More importantly, the ECB all but ruled out a July rate cut whilst also raising its inflation outlook for this year and next.

The European Central Bank, Bank of Canada, Swiss National Bank and Swedish Riksbank have started their easing cycle over the past month. The Federal Reserve will not follow suit and is expected to leave policy rates unchanged next week.

The euro continues to benefit from a risk friendly environment and the falling bond yields. The magnitude of the appreciate has been limited low FX volatility though.

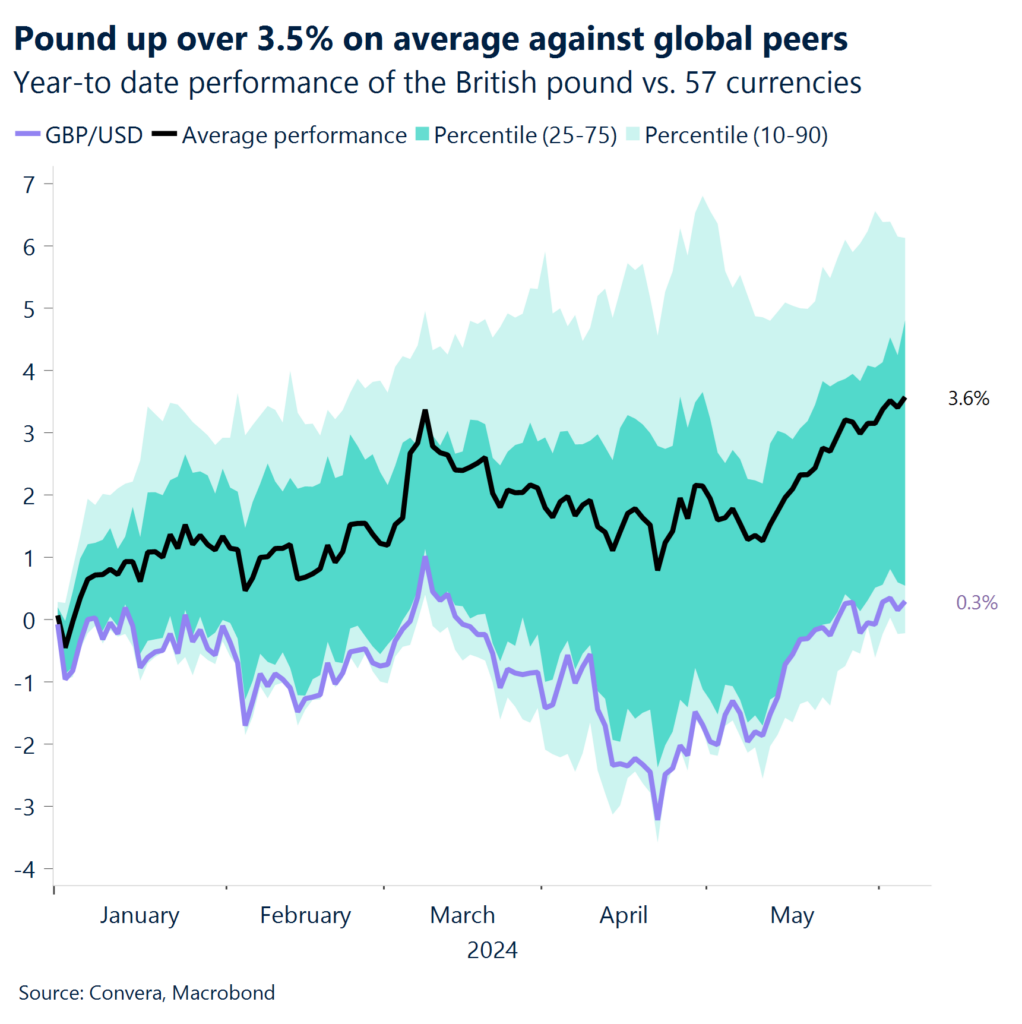

Sterling remains over 3.5% higher, on average, against global peers year-to-date and is the only G10 currency to sustain gains against the dollar this year.

Global Macro

US labor market print changes markets course

New (negative) bias for yields? Surprisingly, sticky inflation and the delayed easing cycle from the Federal Reserve have anchored short-dated bond yields at elevated levels this year. Around 80% of possible yield curves constructed for the United States are inverted. While a strong recession signal in the past, fixed income has been largely ignored by investors in the current cycle with some throwing its predictive power into question. This has been the story for the better half of the past six months. However, the recent string of data coming out of the US has disappointed expectations, throwing into question the narrative of US exceptionalism. However, the downside surprise on inflation, the ISM PMI miss on Monday and weaker than expected job openings on Tuesday were not confirmed by the official US labor market report, which showed hiring accelerate to 272k.

NFP print puts goldilocks in question. Equity benchmarks on both sides of the Atlantic were going into the US non-farm report at record highs. Investors had struck a positive tone this week as the economic data continued to show a moderate cooling of the labour market. The non-farm payrolls report is now throwing this thesis into question. If this strength continues, it will not allow the Federal Reserve to ease policy by 50 -75 basis points by the end of the year as the data is not signaling an imminent recession. The pace of the economic moderation therefore remains crucial for keeping the goldilocks scenario (cuts, no recession) alive.

It’s a slow process. The German economy is recovering from a horrible past year. But the pace of economic improvement is painstakingly slow. April was another disappointing month for Europe’s largest economy. Factory orders remained subdued and industrial production decreased by 0.1%. The consumer has started to brighten up, but we are still waiting for a positive turn of the inventory cycle.

Regional outlook: Europe & US

ECB remains cautious as US ambiguity lingers

A hawkish rate cut. As expected, the European Central Bank (ECB) lowered its benchmark rate by 25 basis points to 3.75%. More importantly, the ECB all but ruled out a July rate cut whilst also raising its inflation outlook for this year and next. ECB President Christine Lagarde reiterated data dependency throughout her news conference, leaving investors guessing about the timing of its next interest rate cut. German bond yields, that had jumped immediately after the statement, steadied by the end of the day. Further complicating the situation for investors was the ECB’s take on growth and inflation. It now expects the Eurozone economy to grow 0.9% this year, an impressive revision from 0.6% just three months earlier. It revised HICP inflation to be 2.5% this year rather than the 2.3% it estimated in March and the most significant piece of revision lay in the inflation estimate for 2025, with the central bank now projecting HICP at 2.2%, which was 0.2 percentage points higher. So, ECB policymakers don’t expect inflation to converge to 2% for at least another year-and-a-half. This is why the cut was perceived as hawkish. The ECB will only be able to cut rates in July again if we see a meaningful deterioration of US growth.

Gauging US economic momentum. Investors are trying to figure out how long the narrative of US exceptionalism can last and are looking at the data for guidance. On Monday, the US manufacturing PMI started off the week for global markets with a downside surprise. The headline index declined from 49.2 to 48.7 in May, dragged down by the fall of new orders and backlogs. The price sub-component declined by more than three points, pushing down the US 10-year yield below 4.43%. The string of weak data was continued by the job openings print and initial jobless claims. However, the ISM Services PMI surprised the consensus to the upside, even though the employment sub-index remained in negative territory.

Week ahead

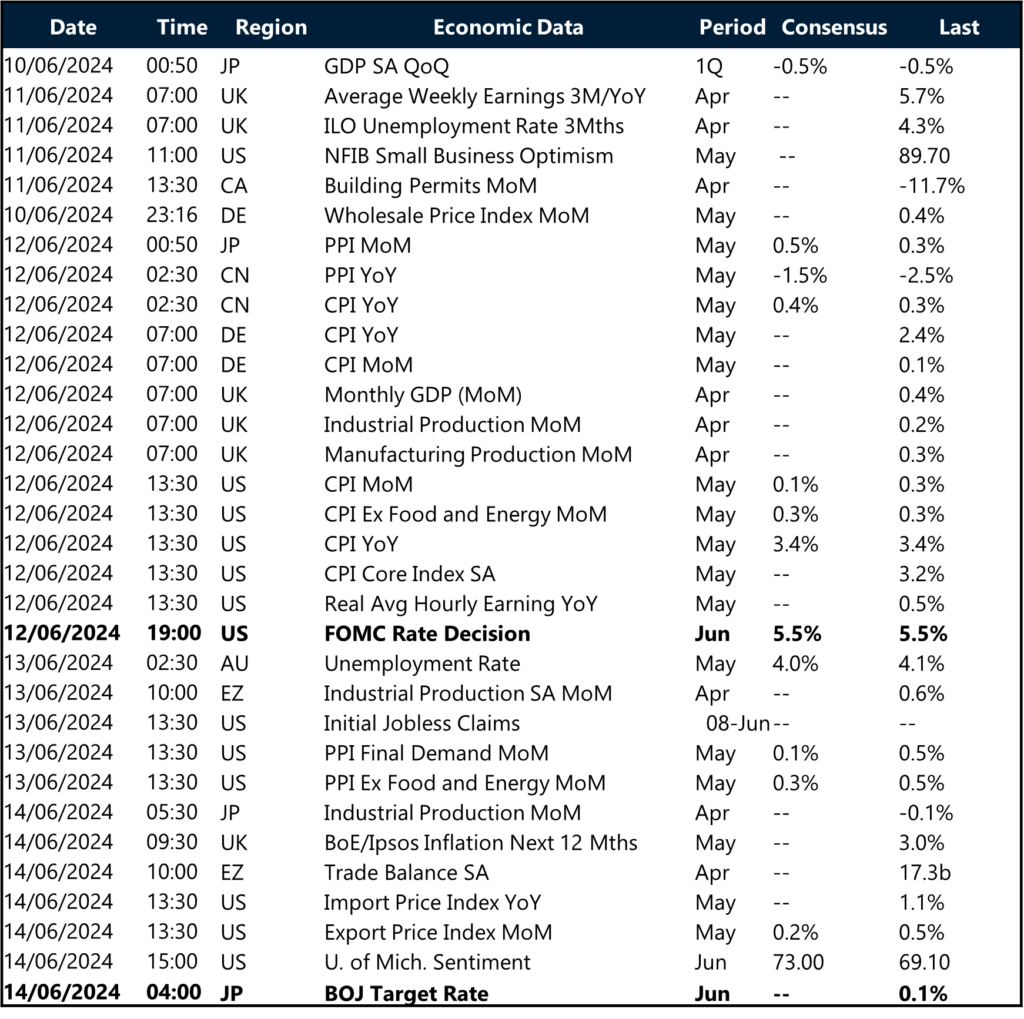

Fed and markets to converge on H2 cuts

Fed to distance itself from peers. The European Central Bank, Bank of Canada, Swiss National Bank and Swedish Riksbank have started their easing cycle over the past month. The Federal Reserve will not follow suit and is expected to leave policy rates unchanged next week. And even a rate cut in July looks unlikely given the upside surprises of inflation in Q1. This means that September continues to be the markets base case for the first policy easing. The dot-plot accompanying the FOMC meeting on Wednesday is likely to show policy makers preference for two cuts this year. This is currently the markets base case as well.

Disinflation near its end. Inflation on the other hand is expected to continue its slow descent. The fall in energy prices could push the monthly headline inflation rate to just 0.1%, which would see annual inflation come down from 3.4% to 3.3%. It is currently hard to see the Fed easing policy by more than 50 basis points given the expected uptick in inflation over the second half of the year. Staying on the inflation theme, UK wage growth is once again expected to rise marginally from 6% to 6.1%. The main question now is how much elevated wage growth will hinder the BoE to join other central banks in cutting interest rates.

Watching China. Chinese economic data will be closely watched as well after exports soared by more than expected in May (7.6%). High frequency data suggests that Q2 has seen an uptick in activity. New social financing is set to bounce in May as well as fiscal stimulus continues to be pushed into the economy. Inflation, however, is likely to stagnate and highlight the weakness of the consumer. This illustrates the dichotomy between the industry and households taking place.

FX Views

Volatility erupts after jobs report

USD Reverses course after NFP. The US dollar index hit a 9-week low recently but rebounded after the stronger-than-expected non-farm payrolls print, which saw volatility spike across FX markets. The 2-year Treasury yield had declined for six consecutive days, falling from 5.0% to 4.7%, as investors bet the Fed may deliver its first-rate cut in September. That changed after the NFP print. Yields staged a two-standard deviation jump higher on the day, the biggest climb since April’s hot CPI report. Markets pushed back expectations of the first rate cut by the Fed to December and dollar demand resurged, highlighting the ongoing importance of economic date. We also note that the USD has also been caught in the crossfire of the carry trade unwind lately too, surging higher against the Mexican peso, but sliding versus the low-yielding Japanese yen. Looking ahead, the Fed will leave rates unchanged, but while cyclical factors are still playing into the dollar’s favour, if the upcoming US CPI report on June 12 comes in softer than expected, the downside USD bias will likely gain momentum.

EUR Hawk talk supports. The European currency continues to benefit from a risk friendly environment and falling bond yields. The magnitude of the appreciation has been limited by overall FX volatility being suppressed by various factors though. This explains why EUR/USD is only up 2.4% despite having risen in seven out of the last eight weeks. We are approaching the high $1.09 level, but the main trading range established from December onwards between $1.05 and $1.12 still holds. This is true after the US labor market report put a top on the currency’s strength. Both the ECB decision and European macro have not been market moving for the euro this week, confirming our thesis of US dominance over financial markets. Markets perceived the rate cut on Thursday as hawkish as it likely won’t be followed by another cut in July. The economic calendar is lacking meaningful volatility catalysts in Europe, which is why US inflation, and the Fed meeting will set the euro’s direction.

GBP Keeps calm and carries on. It’s been a quiet week for the British pound amidst a lack of top-tier domestic economic data. However, Sterling remains over 3.5% higher, on average, against global peers year-to-date and is the only G10 currency to sustain gains against the dollar this year. GBP/USD has fallen back from near 3-month highs though and snapped a four week winning streak after the NFP print. Still, sterling remains supported by improving rate differentials as markets dial back Bank of England rate cut bets following the stickier services inflation number a few weeks ago. Moreover, hopes that a Labour Party victory in the UK general election next month could help narrow the pound’s so-called Brexit risk premium, is also a supporting factor. Still, measures of volatility that cover the run-up to and aftermath of the July 4 vote are all near multi-year lows. That signals investors don’t necessarily see the election as a factor to imminently change the pound’s course.

CHF Bears running out of steam. The Swiss franc continues to build on recent gains, now trading 2.4% stronger than the euro compared to two weeks ago when it hit a 12-month low. Against the US dollar, the franc has recouped over 1.5% over the past week, its best weekly performance since early December 2023, but bumping into resistance at the 200-day moving average at 0.889. While Switzerland’s CPI stood steady at 1.4% in May, running below the SNB’s 2% inflation target, it’s surprised marginally higher recently, calling into question an SNB rate cut in June that was priced in by markets a few weeks back. Evolving domestic and global cyclical dynamics imply that Swiss bears are potentially running out of momentum. Recent remarks by the SNB’s Thomas Jordan regarding the neutral rate likely to be on the rise is also consistent with the higher-for-longer narrative seen in some of Switzerland’s peers. This has somewhat weakened the yield-driven near-term Swiss bearish dynamics. Meanwhile, any deteriorating geopolitics and associated risk-off moves could also revive Swiss bulls via safe-haven flows, though these have proven to have only short-term bullish impact in recent episodes.

CNY China services PMI beat offers limited CNY support. The Caixin/S&P Global Services PMI for China exceeded expectations in May, climbing to 54.0 and indicating a robust expansion in the services sector. New business, export orders, and employment levels all recorded notable gains. However, business confidence dipped amid global economic uncertainties and inflationary pressures. While the private survey painted an optimistic picture, the official non-manufacturing PMI fell short of estimates, highlighting the outperformance of smaller enterprises. Overall, the Chinese economy displayed resilience, but the Chinese yuan’s outlook remained subdued due to limited spillovers from the equity market rally and elevated US-China interest rate differentials. Traders will monitor domestic data releases, such as CPI and PPI, for further insights into the CNY’s trajectory.

JPY BoJ’s Nakamura doubts wage growth staying power. Bank of Japan (BoJ) board member Toyoaki Nakamura expressed skepticism about the sustainability of wage growth and inflation in Japan. He cited weak household purchasing power and the need for substantial disposable income increases to boost consumption. Nakamura also questioned whether companies would maintain their recent shift toward higher wages after decades of cost-cutting. His comments suggest that the BoJ is unlikely to alter its ultra-loose monetary policy anytime soon, as the central bank remains cautious about the durability of inflationary pressures. Chart shows that the options markets has mean reverted which indicate a stabilization in market expectations and actual Yen movements. USD/JPY next crucial resistance is at 159.76-160.45. Market participants will closely watch the upcoming BoJ rate decision and other key domestic data releases, such as the adjusted current account, GDP, and industrial production, for further insights into the policy outlook and the Japanese yen’s performance.

CAD Holding steady after BoC cut. The Canadian dollar briefly weakened to a one-month low versus the US dollar after the Bank of Canada (BoC) initiated its easing cycle. The yield on the Canadian 10-year government bond dipped to around 3.42% in June, marking a twelve-week low and sending US-CA yield spreads higher. Canada’s more-advanced economic cycle vs. the US justifies the early policy action from the BoC and validates the yield-driven CAD bearish case against the US dollar, euro and sterling. Nevertheless, USD/CAD has been trading in a tight 1.2% trading range for the past couple of months, and its year-to-date range is currently its narrowest since the turn of the 21st century. June is usually a tougher month for the USD though, so despite the BoC rate cut likely to keep the Loonie soft, a breakout to the upside from the recent range seems unlikely in the short-term.

AUD Australia GDP miss, clouds AUD outlook. Australia’s first-quarter GDP growth came in weaker than anticipated, with the economy expanding at a sluggish 0.1% quarter-on-quarter and 1.1% year-on-year. This underperformance against forecasts weighed on the Australian dollar, as investors reassessed the domestic growth outlook. The Reserve Bank of Australia (RBA) governor acknowledged the subdued growth but maintained a data-dependent stance, leaving room for further rate hikes if inflation remains elevated or potential easing if economic conditions deteriorate significantly. Despite the GDP miss, AUD/USD struggles to capitalize on its recent range-break above 0.664-0.667. A cautiously bullish stance remains, provided the pair holds above the 0.6534-0.6564 moving averages, echoing recent moves in cyclically sensitive markets. Market participants will closely monitor upcoming Australian economic releases, such as business confidence, employment, and unemployment data, to gauge the RBA’s next policy move and the Australian dollar’s trajectory.