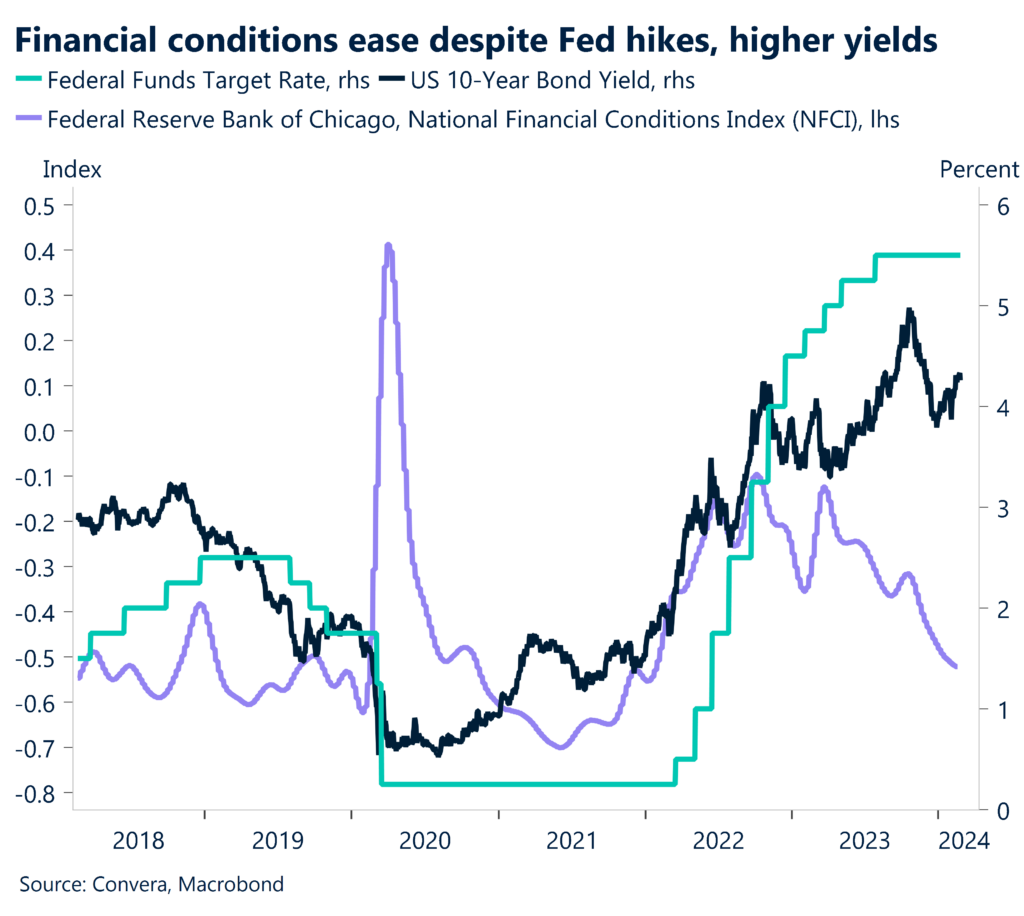

US shares make new highs. Thursday produced a massive day for US technology shares – the Nasdaq saw its best day since November as it climbed 3.0% thanks to very strong results from AI-firm Nvidia – but the moves didn’t have much impact on FX markets with volatility remaining low. Global shares have been boosted by the collapse in bond yields since November. As of 4Q23 and 1Q24, US financial conditions have changed from being a headwind to a tailwind for growth. In addition to the robust credit creation that has been observed since the year’s beginning, this suggests that there are upside risks to the US GDP and inflation projections for the upcoming quarters.

Global data eases in quieter week. In a quieter week for global data, purchasing manager indexes (PMIs) were the main releases. On balance, the February PMIs eased after the strong rebound in January. Most notably, Germany lost momentum while the UK was broadly steady. France extended last month’s gains. US manufacturing saw further gains but the US services sector eased to a still robust level.

China acts after new year break. Chinese returned from the Lunar New Year holiday and immediately announced a larger than expected interest rate cut from the People’s Bank of China. While the one-year rate was held steady at 3.45%, the five-year rate was cut by a larger than expected 25 basis points from 4.20% to 3.95%. The market had been looking for a 10-basis point cut. The move was the first reduction in China’s benchmark loan prime rate since June last year.

Global Macro

Fed, ECB still open to cut

Fed minutes less hawkish than expected. The US Federal Reserve minutes signalled that while the US central bank remains still some distance from cutting rates, policymakers are also worried about keeping rates too high. The minutes from the January meeting continued to reiterate that incoming data would be critical and the Fed needs to be confident that inflation is sustainably headed back to its 2.0% target. However, the minutes were less hawkish than the market feared, and the USD fell after the announcement.

Fed speakers confirm minutes. Key Fed speakers confirmed the message from the minutes. Philadelphia Fed president Patrick Harker said markets should not expect any cuts “right now and right away” while Fed board member Christopher Waller said the US central bank should delay rate cuts after this month’s hotter than expected US inflation number. The US ten-year bond yield climbed to three-month highs.

US data keeps on keeping on. US data was mostly stronger over the last week with the labor market remaining resilient. The key weekly initial unemployment claims fell back to 201k – the lowest level in five weeks. Both manufacturing and services PMI numbers remain above 50 – the only major developed economy to see both key sectors in expansion.

UK data moderates. UK data mainly moderated over the last week with the UK manufacturing PMI broadly steady at a still-contractionary 47.1 while services was steady and growing at 54.3. Also, data showed consumer sentiment fell for the first time in four months in February as households took a gloomier view of their recent personal finances and the broader economic outlook.

ECB minutes join cautious chorus. The European Central Bank minutes were released and showed that the ECB is broadly pleased with the slowdown in inflation, but remains worried about strong wages growth and is not ready to declare victory in the war again inflation. The ECB said the risks to reaching the inflation target are now “balanced”. The ECB meets again on 8 March.

Germany remains the main concern. While PMI numbers were mostly mixed around the world, German manufacturing numbers saw another sharp loss and reiterated concerns that Europe will be unable to generate significant growth while Germany underperforms. German manufacturing PMI fell from 45.5 in January to 42.3 in February. The services PMI was moderately better, up from 47.7 in January to 48.2 in February.

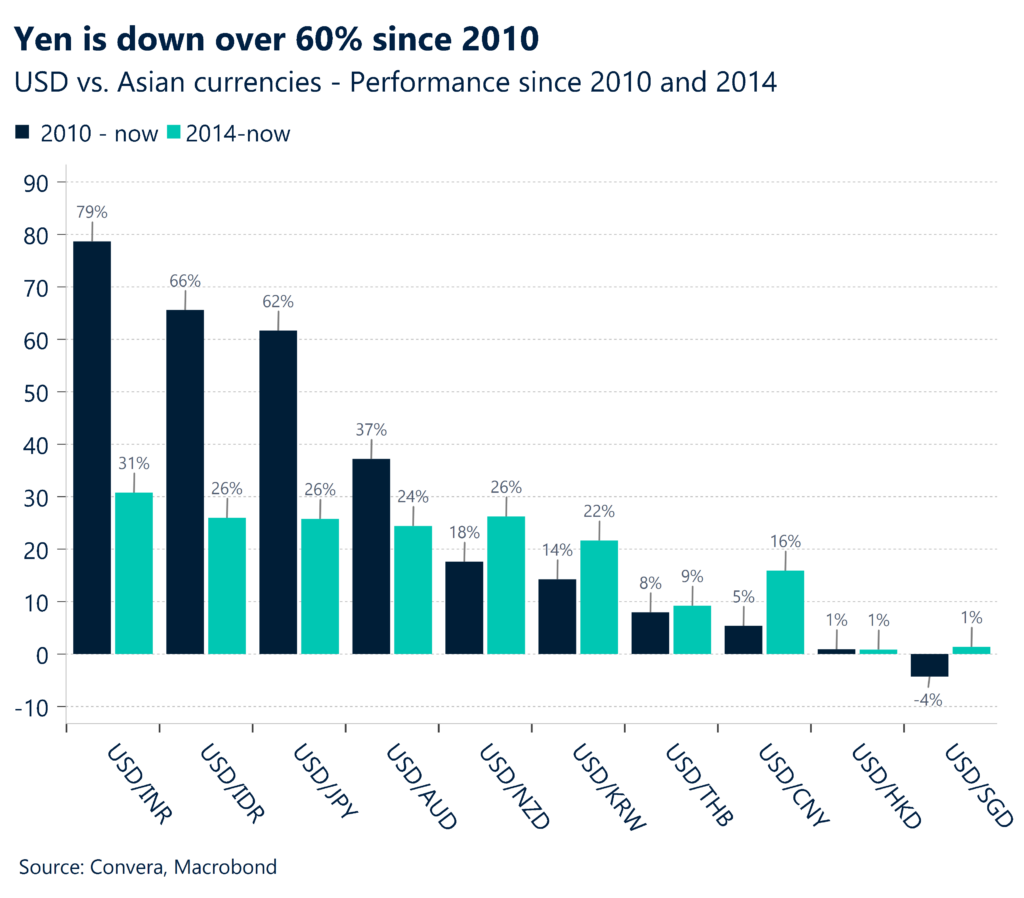

Japanese growth continues to stagnate. After last week’s GDP data showed the Japanese economy fell into recession in the December quarter, more up-to-date data also signalled a slowdown in activity. February manufacturing PMI fell from 48.0 to 47.2. The Bank of Japan is still expected to hike rates in the first-half of 2024 but the recent weak data does mathematically make a move less likely. The Japanese yen was weaker with the USD/JPY back above 150.00 over the last week.

Australian wages data higher, but no cause for alarm. Australian wage price index data – at 4.2% in annual terms – was broadly in line with expectations. Markets saw the data as not hot enough to force the Reserve Bank of Australia to raise interest rates.

Canadian CPI eases .The last week’s biggest news on the inflation front was the steep drop in Canadian price pressures. Annual headline inflation fell from 3.5% in December to 3.3% in January while the core number (known as trimmed in Canada) fell from 3.9% to 3.4%. The Bank of Canada meets next on 6 March and while no change is expected at the upcoming meeting, financial markets see an almost 60% chance of a cut in April (source: Reuters).

Global Macro

US, Eurozone inflation to drive cut expectations

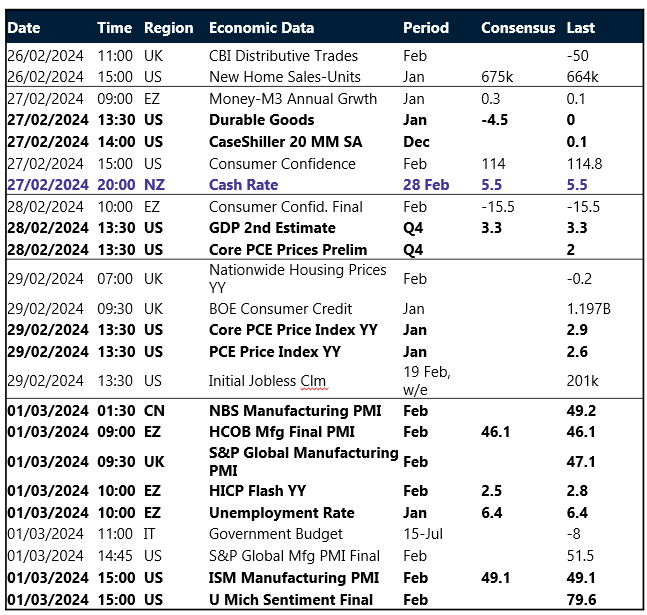

US PCE, Eurozone CPI due The big question for FX in the first half of 2024 will be which of the Federal Reserve and European Central Bank will cut first. The most recent minutes suggested both central banks are willing to cut rates, but need to see more evidence. We get more evidence in the upcoming week with the US’s personal consumption and expenditure (PCE) release – the Fed’s preferred measure of inflation – due on Thursday and Eurozone inflation due on Friday.

RBNZ decision still live Not all central banks are considering rate cuts. The Reserve Bank of New Zealand is facing stubborn inflationary pressures and a red-hot employment market. The RBNZ decision, due Wednesday, could buck the global consensus that the next move for rates will be lower.

Macro risk events

Monday (26.02) – US New Home Sales

Tuesday (27.02) – Japan National CPI

Wednesday (28.02) – Australian CPI, RBNZ, US GDP

Thursday (29.02) – German CPI, US PCE

Friday (01.03) – China PMI, Eurozone CPI

All dates GMT

FX Views

Dollar’s dominance starting to fade?

USD Punished by buoyant risk appetite. The US dollar is on track to record a weekly fall for the first time in 2024 as investors take a breather after reducing bets for future Fed rate cuts, which had supported the buck of late. Interestingly, the dollar didn’t benefit against many peers this week despite US Treasury yields rising to 3-month highs. Improved risk sentiment, supporting demand for global equities and high beta currencies has likely weighed on the USD. Nevertheless, given the dollar’s ongoing yield advantage, it’s unlikely we’ll see a big shift in sentiment away from the USD, but we’re already witnessing signs of exhaustion to the upside. The failure of the dollar index (DXY) to hold above its 100-week moving average and pulling back sharply from the 105 level begs the question: have we’ve seen the top of the DXY for 2024 already? US dollar has been the clear outperformer so far this year as markets have repriced the outlook for global rate cuts and as the US economy continues to show resilience, but we think once the Fed starts cutting interest rates, the dollar will lose its shine. For more cues, attention turns to the Fed’s preferred measure of inflation (PCE index) next week.

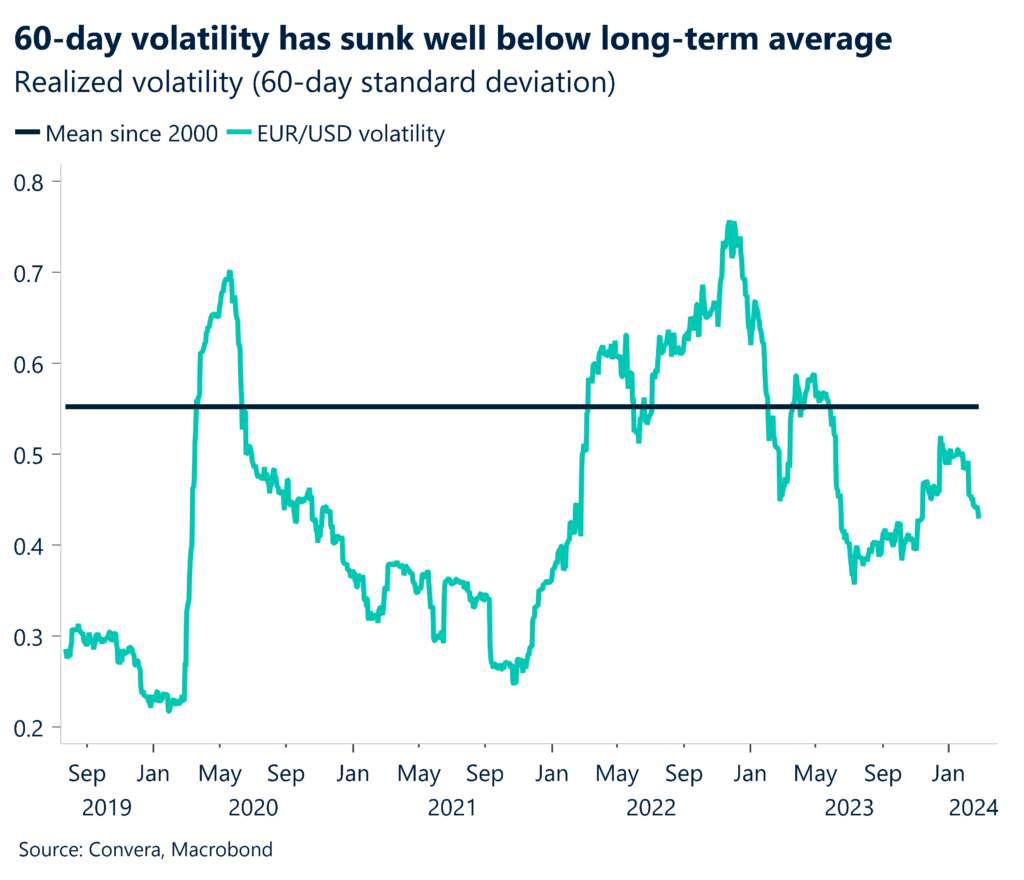

EUR 3-week peak. The euro is on track to record its best weekly performance against the US dollar since late last December after hitting a 3-week high this week. EUR/USD is flirting with its 50-week moving average around $1.0840 after breaking above its 200-day moving average earlier this week as the Eurozone’s composite PMI readings indicate that the bloc’s economic slump is easing. However, Germany’s economic conditions remain bleak, likely capping the euro’s appreciation in the short run. The minutes of the ECB’s policy meeting were also released and confirmed rate cuts will be highly unlikely by Spring. The release of key data points including inflation and unemployment next week may give the ECB a better idea of when/whether rates can be cut later this year. Markets have pared back easing bets and Eurozone bonds have been marching higher with the German 10-year bond yield reaching a 3-month high, further supporting the euro. A strong finish to February increases the chances of EUR/USD staging a recovery back towards $1.12 by the summer.

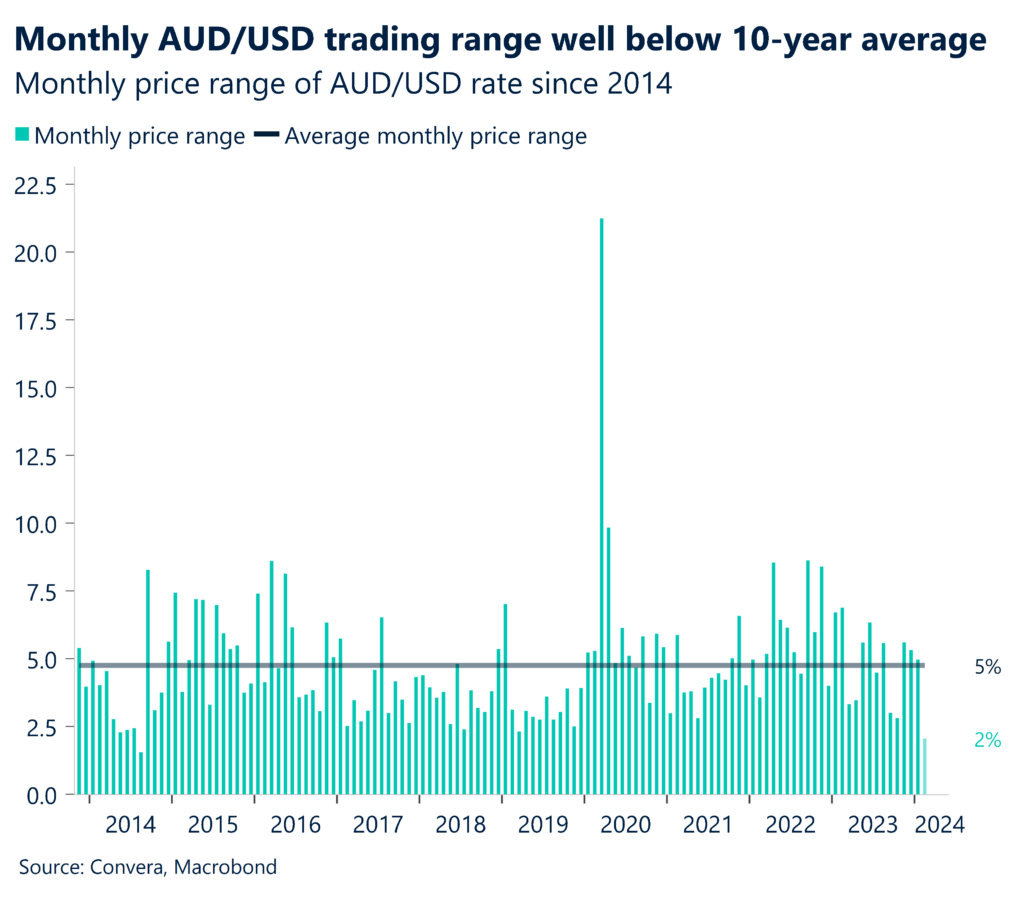

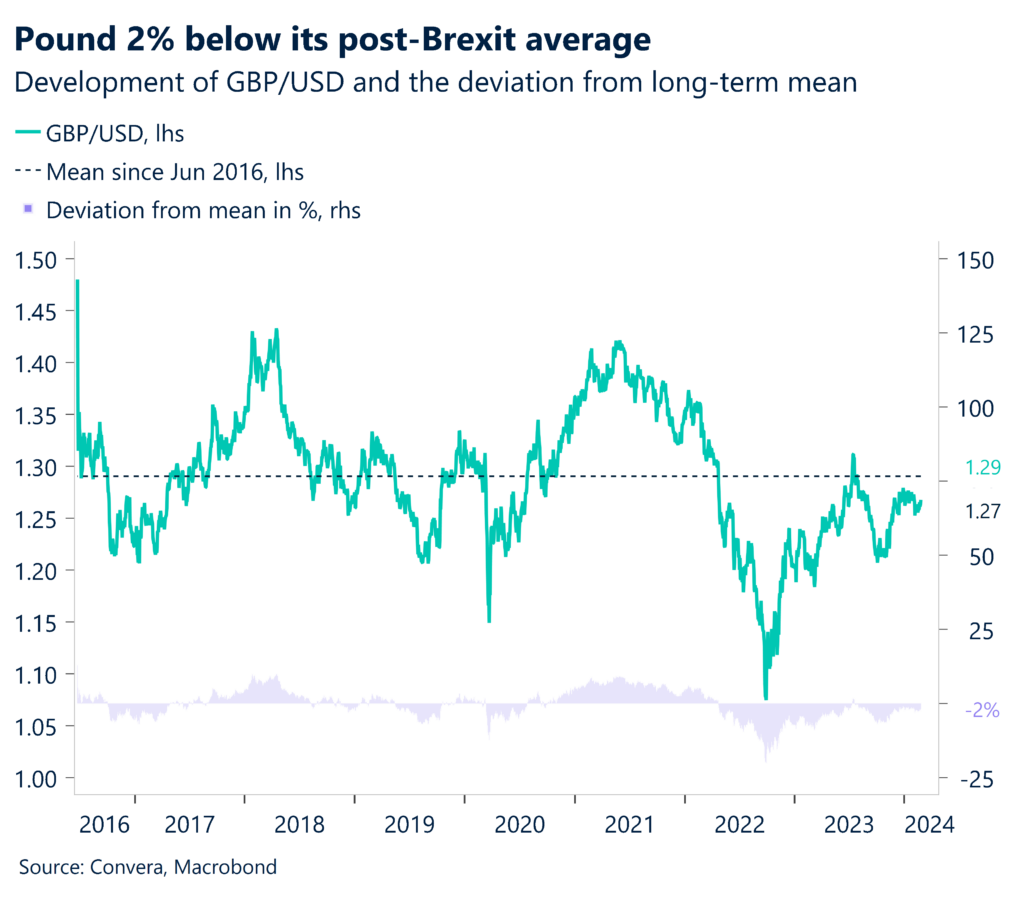

GBP Best week of 2024. The risk-sensitive British pound was supported by global stock gains after AI darling Nvidia’s stunning results sparked a wave of record highs across sharemarkets. The pound’s weekly performance against the dollar was its best year-to-date, ending a 3-week slump prior. GBP/USD was supported by its 200-day moving average and is attempting to hold above the $1.27 handle. Sterling shrugged off weak UK consumer morale figures and hung onto the stronger-than-expected PMIs, which sent UK gilt yields marching higher – now up over 60 basis points since the start of the year. The high yielding pound cheered and has now appreciated against 70% of 57 global peers month-to-date, up from 40% at the start of February. Still, GBP/USD is a cent below its 5-year average of $1.28 and remains over 2% away from its post-Brexit (2016) average of $1.29. The currency pair is still trapped in narrow 2% trading range this year. Over the past ten years, the average monthly trading range was double this – at 4%. Even the median was 3.7%. Will volatility pick up? The worry for sterling is that markets are already pricing in less BoE rate cuts compared to its major counterparts so there is little room for further hawkish repricing. Plus, positioning is a major headwind as speculative traders hold an overcrowded bet on the pound appreciating, which paradoxically increases downside risks.

CHF Bearish case is building. The Swiss franc has depreciated over 5% against the US dollar this year but the USD/CHF pair was down 9% in 2023, so there is more room for franc weakness if rate cut bets increase for the SNB Swiss National Bank (SNB). With the annual rate of inflation in Switzerland at 1.3%, the lowest since October 2021, and the lowest out of the G10 bar Italy, the market is looking for the SNB to cut rates before its G10 peers, with a 50% probability of a pivot in March. Also pressuring the franc is the fact the SNB increased its foreign exchange reserves for the second month running in January, pointing to a rebound from the sustained decline in the past two years that took reserve levels to 7-year lows. USD/CHF is trading less than 1% away from its 3-month low of 0.8888, whilst EUR/CHF has rallied to 0.95 this week, though still below its 200-day moving average, currently seen at 0.9565. This will be a key test to break above from the downward channel that has been in place for most of 2023.

CNY Policy support but headwinds persist. China cut the 5y LPR rate by 25bps, the first reduction in eight months, which should aid the property sector and support equities. But bank margins may compress. CNY has weakened in 2022 amid amplified financial stress and continued economic disappointment. The move offers stimulus but headwinds persist. USDCNH initially spiked higher before giving back gains as the market digested the implications. USDCNH YTD performance stood at +1.29%. USD/CNH is nearing initial upside targets (re Weekly Jan 19th publication: targeting 7.239-7.2665 resistance). Core focus next week will be on China composite, manufacturing, non-manufacturing and Caixin manufacturing PMIs.

JPY Machinery orders rebound but recovery fragile. USD/JPY almost hit fresh 2-decade highs near 152 handle after nearly breaching resistance levels at 149.442-150.80. A bearish reversal from resistance with momentum divergence sell signals could trigger declines. As we wrote last week, keep an eye on 157 handle which looms as a potential ‘red line’ given past reactions to 5% monthly moves. Japan’s core machinery orders rose in December, the first increase in two months, driven by manufacturing demand. But the volatile data remains below year ago levels. Investment is growing in some areas but stalled overall. While further gains are likely limited by headwinds, the increase offers some optimism. Core focus next week will be on National Core CPI, Industrial Production, Retail Sales, Unemployment rate, au Jibun Bank Japan Manufacturing PMI.

CAD Brave Loonie fights back. The Canadian Dollar fell across the board earlier this week after Canadian inflation numbers for January undershot expectations and raised the odds of a rate cut at the Bank of Canada happening as early as April. Canadian bond yields slipped, dragging the CAD to less than 0.3% away from its 2-month low against the USD. However, the Loonie fought back, pouncing on the bruised dollar as global risk appetite ebbed as the week went on. USD/CAD slipped back under its 200-day moving average but remains in the higher realms of C$1.34 for now. The 50-day moving average nearer C$1.34 on the nose is a key downside target and we still expect a decline in USD rates to unlock downside potential for the pair in the second half of the year, even with the BoC cutting at the same time as the Fed.

AUD Signs of improvement but monthly AUDUSD trading range well below 10-year average. Australia’s composite PMI returned to growth in February, driven by services. But manufacturing PMI hit a 45-month low. Sentiment remained positive and activity rose after five months of contraction. However, price pressures intensified amid high rates and inflation. The data implies the soft landing may be over and weakens the case for near-term RBA easing. The improvement in activity and price increases suggest balanced policy risks. AUD/USD is bearishly pressuring key support near 0.65. Inability to surpass 0.664-0.6657 resistance could trigger declines toward 0.617-0.6296 support. Zooming into the trading range, the monthly AUD/USD trading range is currently at 2%, vis-à-vis the 10-year average trading range of 5% . Focus next week will be on monthly CPI, housing credit, private sector credit and retail sales.