- Hole lot at stake. Powell left the door open to an interest-rate cut at the Fed’s Sept. 16-17 meeting, saying, “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” The Fed chair also said “the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.”

- Diplomarket deadlock. Away from the week’s relentless Fed-watching, global markets were mainly unmoved early in the week after the closely-watched Trump-Putin summit was unable to reach a Ukraine peace deal over the weekend. Recent White House talks between President Trump and European leaders have sparked renewed, but cautious, optimism for a Ukraine peace deal.

- Tentative resilience. Global PMIs released on Thursday mostly beat expectations, showing stronger activity in manufacturing and services. The UK, France, Germany, and the Eurozone all posted better-than-expected results. Australia showed improvement, while the US continued to lead.

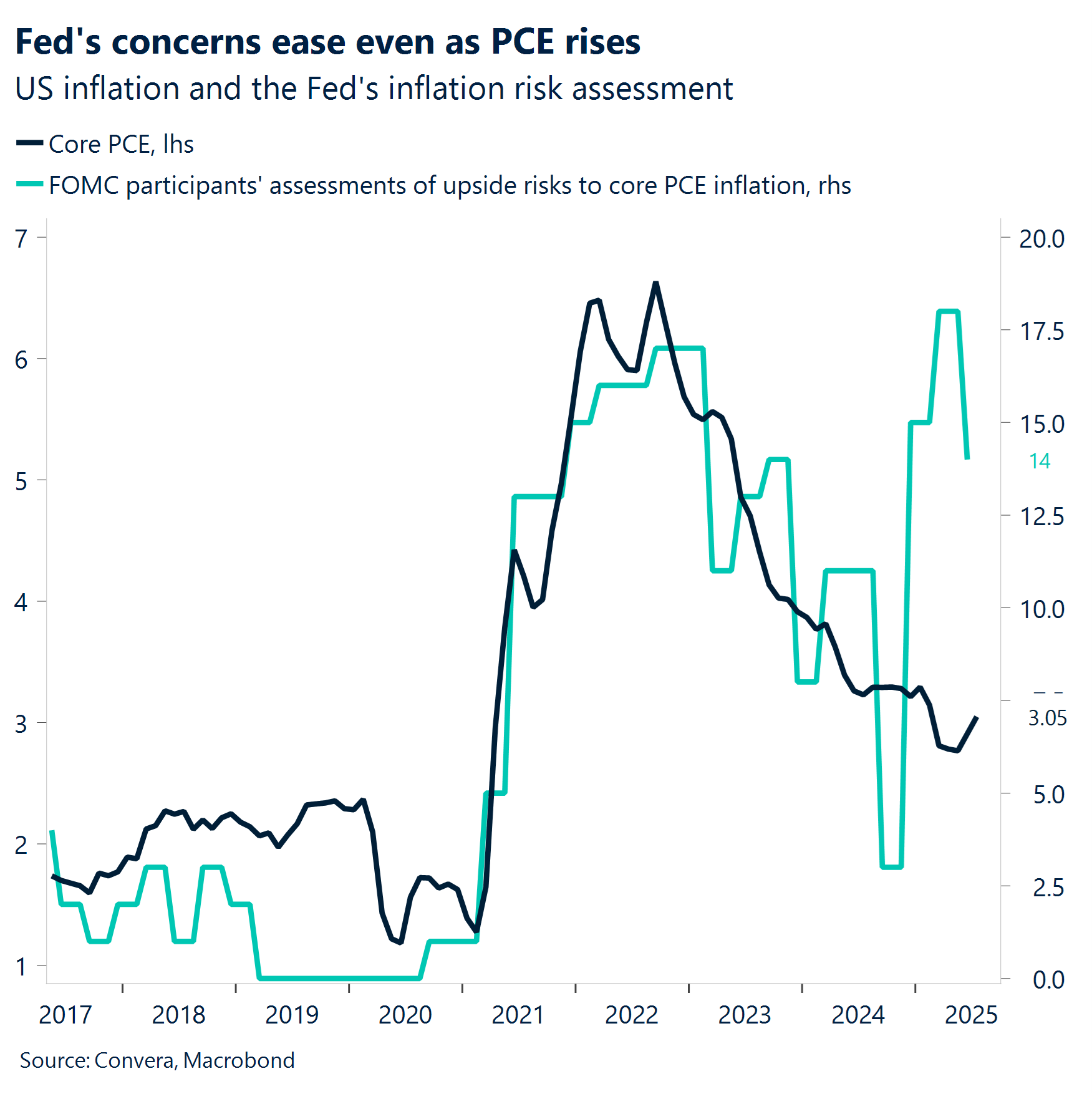

- Dollar drifts higher. The US dollar was mostly stronger over the week after Federal Reserve minutes suggested inflation remains the central bank’s top priority. Most board members viewed inflation as a bigger risk than the labor market. However, the 29–30 July meeting took place before the latest jobs report missed expectations, and earlier data was revised lower.

- Havens hold. Across markets, most major currencies were weaker versus the US dollar, with the commodity currencies of Australia and Canada the hardest hit. The safe haven Swiss franc and Japanese yen held up best but the safe-haven like, at least in 2025, euro slipped over 1%.

- Kiwi clipped. The New Zealand dollar slumped, down almost 2.0% and the worst in the G10 for the week, after the Reserve Bank of New Zealand cut interest rates by 25 basis points to 3.00% and flagged more easing ahead.

Global macro

Powell leaves the door open

Jackson Hole Symposium. Powell left the door open to an interest-rate cut at the Fed’s Sept. 16-17 meeting, saying, “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” The Fed chair also said “the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.”

Central banks. The Reserve Bank of New Zealand (RBNZ) cut its Official Cash Rate (OCR) by 25 basis points to 3.0%. The decision was a close one, with the Monetary Policy Committee voting 4-2 in favor of the cut, highlighting a divergence of opinions.

U.S. and Eurozone PMIs. Flash S&P Global PMI data for August showed an acceleration of business activity, with the U.S. composite PMI hitting an eight-month high. The Eurozone’s flash PMI also rose to a 15-month high, driven by a rebound in manufacturing. Both reports noted a concerning rise in inflationary pressures.

U.S. housing and manufacturing. U.S. existing home sales for July rose by 2.0% to a seasonally adjusted annual rate of 4.01 million units. However, the Philadelphia Fed Manufacturing Index came in at -0.3, which was a significant miss and points to a regional slowdown.

UK. Final July inflation data showed the Consumer Prices Index (CPI) rose to 3.8% on an annual basis, just shy of the 4% 2025 forecast set by the BoE. Meanwhile, UK’s August PMI rose to 53, way above the 51.6 expected and marking the fastest pace of private-sector growth in a year.

Japan: The country’s July trade balance unexpectedly swung to a deficit of ¥117.5 billion, as exports dropped for a third straight month amid weakened overseas demand. This was in contrast to core machine orders for July, which unexpectedly rose by 3.0% month-over-month. Finally, the S&P Global Japan Composite PMI for August came in at 51.9, rising for the fifth consecutive month to signal a steady expansion of business activity, despite the manufacturing component hovering just below the expansionary threshold.

Week ahead

Inflation numbers key this week

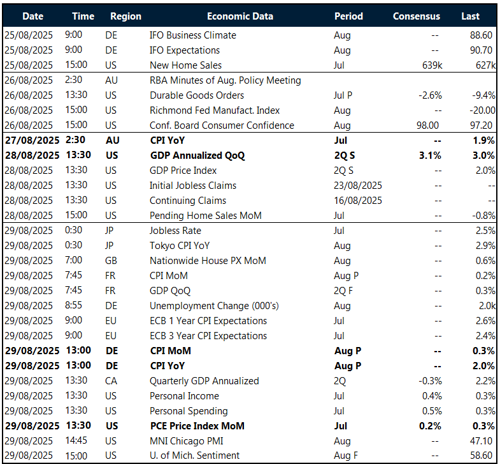

US PCE in focus. Inflation numbers will be critical for the upcoming week with the US’s personal consumption and expenditure numbers (PCE) – the Federal Reserve’s preferred measure of inflation – seen as most important.

Otherwise, key inflation readings are due from Australia on Tuesday and individual European nations on Thursday. The European Central Bank’s inflation expectations measure is also due on Thursday. The Europe-wide CPI numbers are released on 2 September.

Tariffs to test growth. Major growth numbers are also due this week with the US’s June-quarter GDP numbers to be most closely watched Last month, these numbers surprised to the upside in the preliminary reading – will US growth exceed expectations again? French and Canadian GDP numbers are also due this week.

BoJ inches towards hike: While the rest of the world is cutting rates, the Bank of Japan continues to inch towards another rate hike. Japanese bond yields hit a 25-year high over the last week. In the upcoming week, the focus is on employment and inflation numbers. The Bank of Japan meets on 19 September.

FX views

From lull to leap

USD Waking up to reality. Waking up to reality. Ahead of the Jackson Hole economic symposium, financial markets began to adjust their expectations for a September interest-rate cut by the Federal Reserve. The probability of a rate cut, which was previously a near-certain 95%, had decreased to a still-optimistic 70%. This subtle change in market sentiment caused the U.S. Dollar Index (DXY) to rise above 98, reaching its highest level since August 12 and breaking out of its recent quiet period. However, Federal Reserve Chair Jerome Powell’s prepared remarks at the symposium introduced a new layer of complexity. Powell stated that a potential adjustment to the Fed’s policy stance, including an interest-rate cut, could be warranted by the “shifting balance of risks.” He also noted that the stability of the unemployment rate and other labor market measures would allow the Fed to “proceed carefully” when considering policy changes. These remarks, while not a definitive commitment, were seen by the market as leaving the door open to a September cut. In response, the U.S. dollar reversed course, falling back to the 98 level and erasing the gains it had made in the lead-up to the summit.

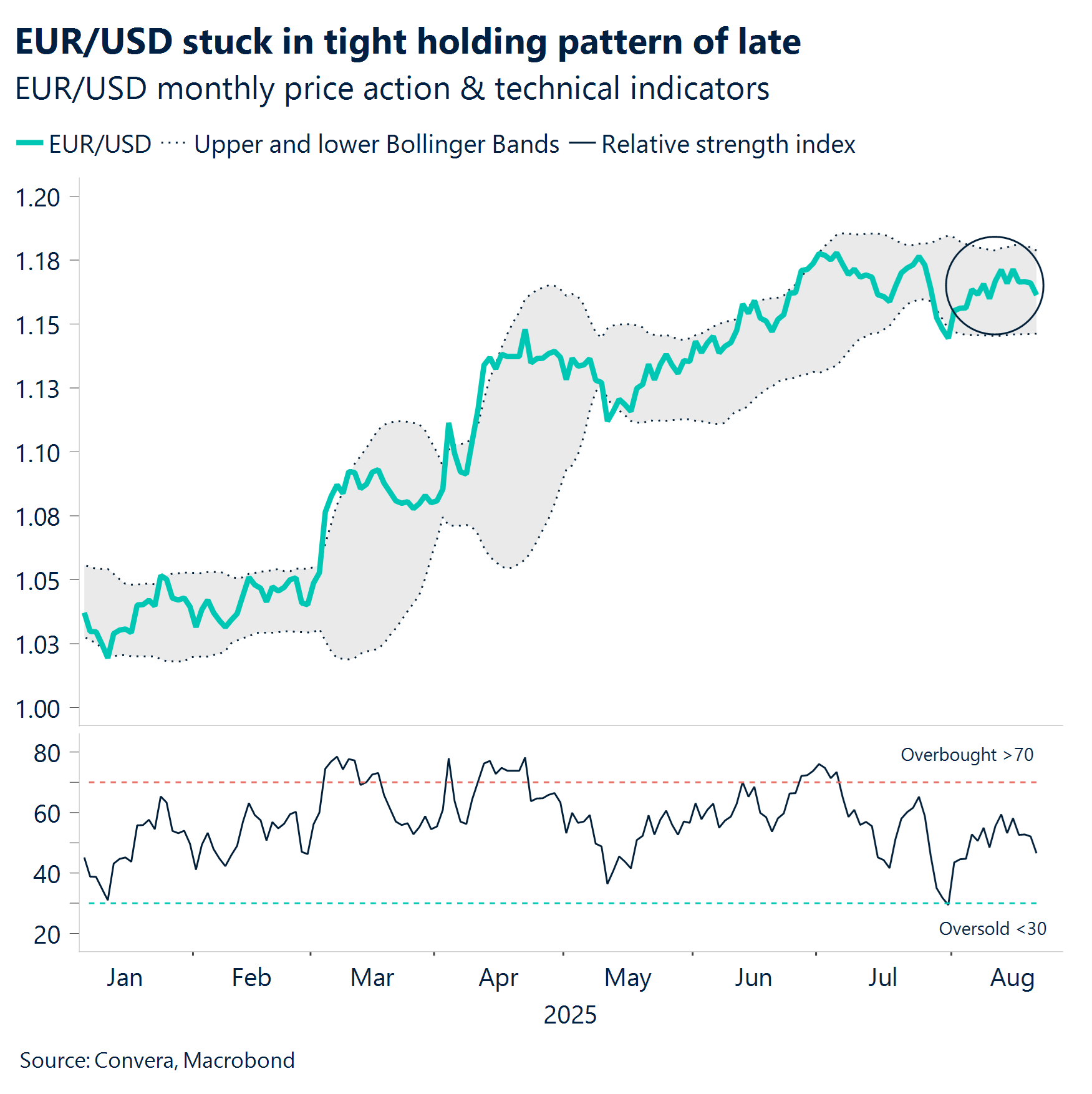

EUR Treading water. EUR/USD has been stuck in a tight holding pattern this month, with daily moves rarely exceeding 0.5% in either direction over the past week or so. The pair’s subdued price action reflects a broader lull in FX volatility, as traders await a catalyst to break the deadlock. Despite a strong year-to-date gain of 12%, bullish momentum has clearly faded, with the pair now consolidating around its 21- and 50-day moving averages. A break below $1.1560 could open the door to retesting the early August low near $1.14, while a move above $1.1730 would target the $1.1810 area, where a previous double top had formed. That said, the broader FX narrative is beginning to shift back toward growth differentials. While the euro area economy has shown resilience and could benefit from fiscal support later this year, signs of slowing momentum in the US may revive divergence themes – potentially reigniting euro upside if confirmed by incoming data.

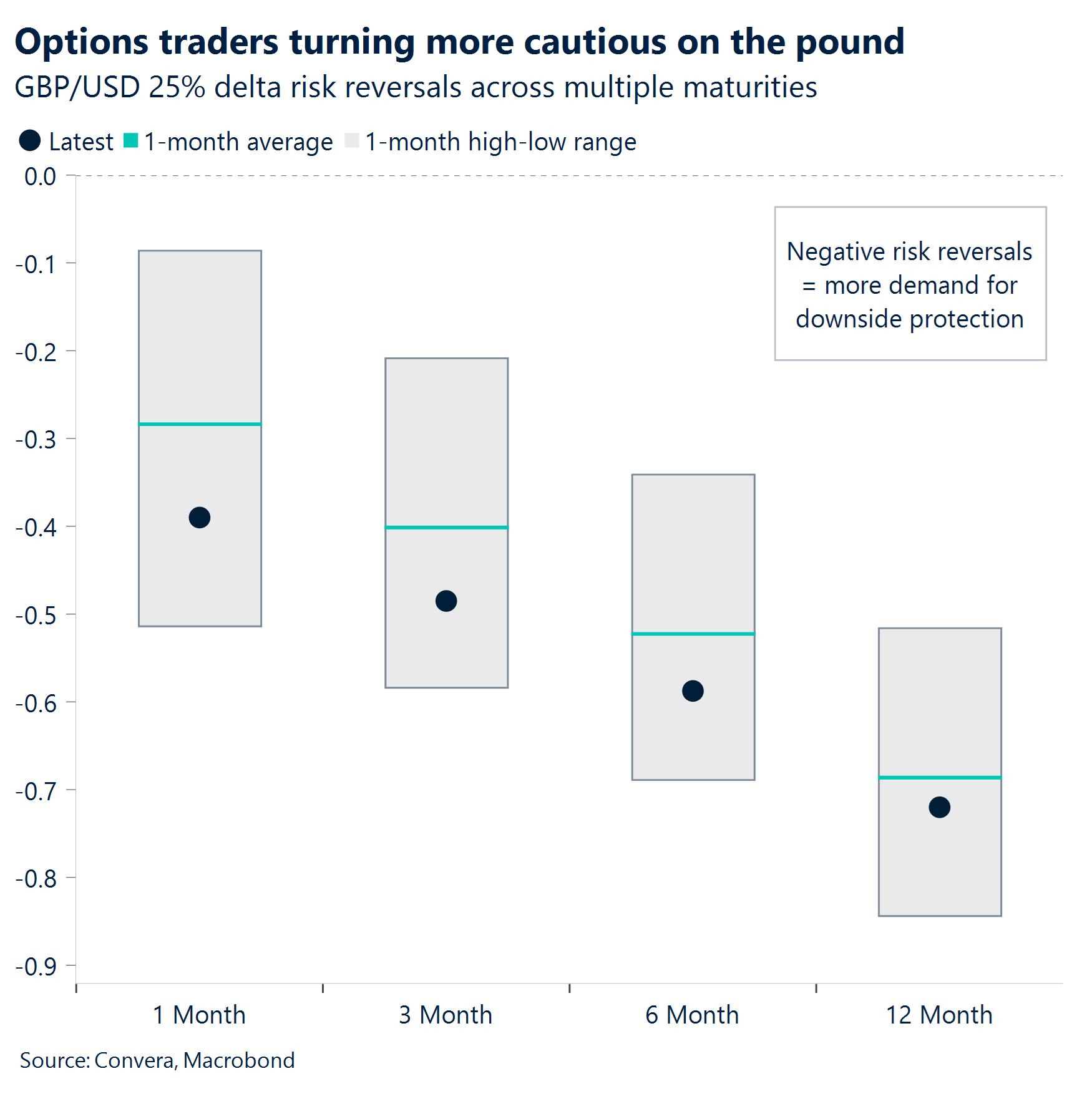

GBP Losing interest. UK real interest rates have declined sharply over the past year, dropping from a peak of 3.3% in September 2024 to just 0.2% today, following the upside surprise in UK inflation data and reduction in the BoE’s Bank Rate. The implication for the pound could be broadly negative over the longer-term. Lower real yields reduce the relative attractiveness of UK assets, especially when compared to economies like the US, where real rates remain firmly positive. The FX options market have already begun to reflect this shift in sentiment, with risk reversals skewing more negatively for GBP as investors seek protection against further depreciation. Indeed, the pound has weakened against all major peers of late (barring the Antipodeans), falling to a one-week low of $1.3435 versus the USD. GBP/EUR stalled at its 50-day moving average near €1.16 — a level it hasn’t convincingly breached since mid-June. The upcoming UK budget presents a key test for sterling, with fiscal credibility and growth strategy likely to shape market sentiment amid its lack of real yield appeal.

CHF Franc-ly bearish. Despite a modest rebound for the Swiss currency this week, the franc is facing its steepest bearish bias in over two years, driven by a combination of zero borrowing costs, elevated U.S. tariffs, and the risk of central bank intervention. One-month risk reversals have shifted in favor of the euro, with demand for EUR/CHF options reaching a four-month high – particularly concentrated around strikes at 0.95 and above. Despite recent positive Swiss growth data, lingering trade uncertainty and policy divergence are expected to weigh further on the franc, with EUR/CHF poised for continued upside in the near term. As for USD/CHF – a break above the July peak at 0.8151 could open the door to further upside, with the pair supported by a yield differential of over 400 basis points. This substantial rate advantage continues to attract carry traders, reinforcing bullish momentum amid diverging monetary policy paths.

CNH Yuan won’t budge. The Chinese yuan was broadly unchanged over the last week with the USD/CNH trading in a tight range between 7.1715 and 7.1930. The Chinese yuan held steady in the face of a stronger U.S. dollar in a sign that the People’s Bank of China might be reluctant to allow the CNY to face significant devaluation as US-China trade talks continue. In terms of economic data, markets continued to react to weaker results after the August release of industrial production, retail sales and fixed asset investment all missed forecasts. For now, downside targets are to 7.1710 with topside targets are to 7.1970. PMI numbers due 24 August will be closely watched.

JPY Yen weaker despite rising yields. The Japanese yen was weaker in recent trading with the USD/JPY climbing to a three-week high despite a rise in Japanese bond yields. The Japanese 10-year bond yield climbed to 1.61% over the week – the highest level since 2008. However, while rising bond yields usually support a currency, the JPY eased as the stronger US dollar, boosted by faster-rising US yields ahead of the Jackson Hole meetings, dominated in Asian FX trading. The market sentiment toward the pair has turned more positive with the USD/JPY above the 50- and 100-day moving averages. Downside targets are to 147.50 with topside targets are to 149.50. Friday sees unemployment, Tokyo CPI and retail sales.

CAD Lowest in three months versus USD. Some repositioning and markets re-pricing ahead of Jackson Hole, as the odds of a cut from a near-lock of 95% two weeks ago are down to a still-optimistic 70%. This pushed the USD/CAD to three-month highs at 1.39. CAD’s weakness has also been notable against other majors, particularly the EUR, where the cross has hit its lowest level since 2009 at 1.618 taking the YTD loses to 7%. However, as Powell leaves the door open for a September cut, the CAD has dropped below 1.39.

Next week’s key macro releases could further support the Canadian dollar’s weakness against major currencies. The final print of the Q2 GDP at month-end is expected to show a slight contraction in domestic production. Additionally, the US PCE (Personal Consumption Expenditures) report, also released on Friday, will be a highly relevant indicator to watch.

AUD Aussie falls to two-month low. The Australian dollar has been mostly pressured since the Reserve Bank of Australia cut interest rates on 12 August – their third rate cut for the year – despite the RBA signaling it is likely to only gradually cut further. The AUD weakened for the majority of the last week hitting a two-month low. On the macro front, Australian consumer sentiment jumped to its highest level in over three years, with the Westpac-Melbourne Institute index rising 5.7% to 98.5 in August. The recent rate cut from the RBA appears to have lifted spirits. The AUD/USD is now in a clear downtrend, with the 50- and 100-day moving averages pointing lower. RBA minutes on Tuesday are the next key release.

MXN Quiet week. Low volatility, little price movement for the Mexican Peso this week, which has been trading in a tight range between 18.7 to 18.8. Since July, the USD/MXN pair has been unable to break below its 2025 low of 18.51, a key technical level. This has signaled a potential bottoming formation and suggests the pair could be consolidating, likely trading within a range between 18.55 and 18.90. The momentum for the Mexican Peso, along with other high-yielding emerging market currencies, appears to be losing steam. The extended “risk-on” sentiment, supported by subdued volatility and a soft dollar, has pushed valuations for many emerging market and Latin American assets to very high levels. After four months of strong performance, investors may now be looking to lock in profits and explore opportunities outside of high-yield currencies, as the carry-appeal weakens. This shift in sentiment is supported by growing concerns about global growth and a recent drop in commodity prices. These factors create a challenging environment for the Mexican Peso to continue appreciating against the U.S. dollar, increasing the likelihood of a sustained period of range-bound trading.

In the macro front, Banxico’s August minutes reflect a cautious but continued shift toward monetary easing, with the Board voting 4–1 to cut the policy rate by 25 bps to 7.75%. The decision was underpinned by a notable drop in headline inflation to 3.51%, driven by a sharp decline in non-core components like fruits and energy. Looking ahead, Banxico signaled openness to further rate cuts, but emphasized a data-dependent and gradual approach, with inflation convergence to the 3% target still expected by Q3 2026.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.