Written by Convera’s Market Insights team

US labor softness threatens soft landing

Boris Kovacevic – Global Macro Strategist

Investors hoping to get some clarity on the trajectory of the US labor market and therefore Fed policy from the nonfarm payrolls report have been disappointed. Wage growth accelerated and the unemployment rate ticked down from 4.3% to 4.2%. However, the disappointing headline number of 142k coupled with the downward revision of last month’s already weak print from 114k to 89k will likely put enough ambiguity into the release for the Fed not to pre-commit to either a 25- or 50 basis point cut just yet. Nonetheless, the direction the labor market is heading to is clear and so is the justified dovish stance of the Fed. August saw 3-month average private sector hiring fall to below 100k, strengthening the credibility of other labor market indicators showing slowdown tendencies. This isn’t a freeze, but it’s definitely a chill. While the focus of the FOMC has recently shifted from inflation to the labor market, next week’s CPI could shed some light about which scenario will be more likely in two weeks’ time.

The net-dovish reaction to the report has pushed yields and the US dollar down, without lifting equities up meaningfully. What can explain the mismatch? Partially, it was about the positive effect of the repricing of the Fed’s policy path – markets going from pricing in 100bp to 125bp of cuts this year – being overshadowed by rising recession risks. This thesis is reflected by demand driven commodities such as Brent crude oil closing out the week at the lowest level since the end of 2021 at around $72 a barrel. The S&P 500 plunged by about 3.8%, recording its worst week since March 2023. The Fed finds itself at a crossroads. With mixed signals from the job market, they’re unlikely to commit to either a 25 or 50 basis point cut just yet. However, the exact amount of easing next week is irrelevant. What is important for the global sentiment is that the Fed is expected to ease policy aggressively over the next 6-12 months. This is reflected by the US 2-year yield dropping to 3.65%, whilst having traded at 5.00% just four months ago.

Euro momentum may soon be tested

Ruta Prieskienyte – FX Strategist

The euro has benefited from weaker-than-expected US labour market reports, gaining ~0.3% in the first week of September. European stocks closed nearly 3% lower for the week, following a global equity rout, while bonds remained in demand throughout. The German bond yield curve shifted downwards, with the front end falling over 15 basis points in a week.

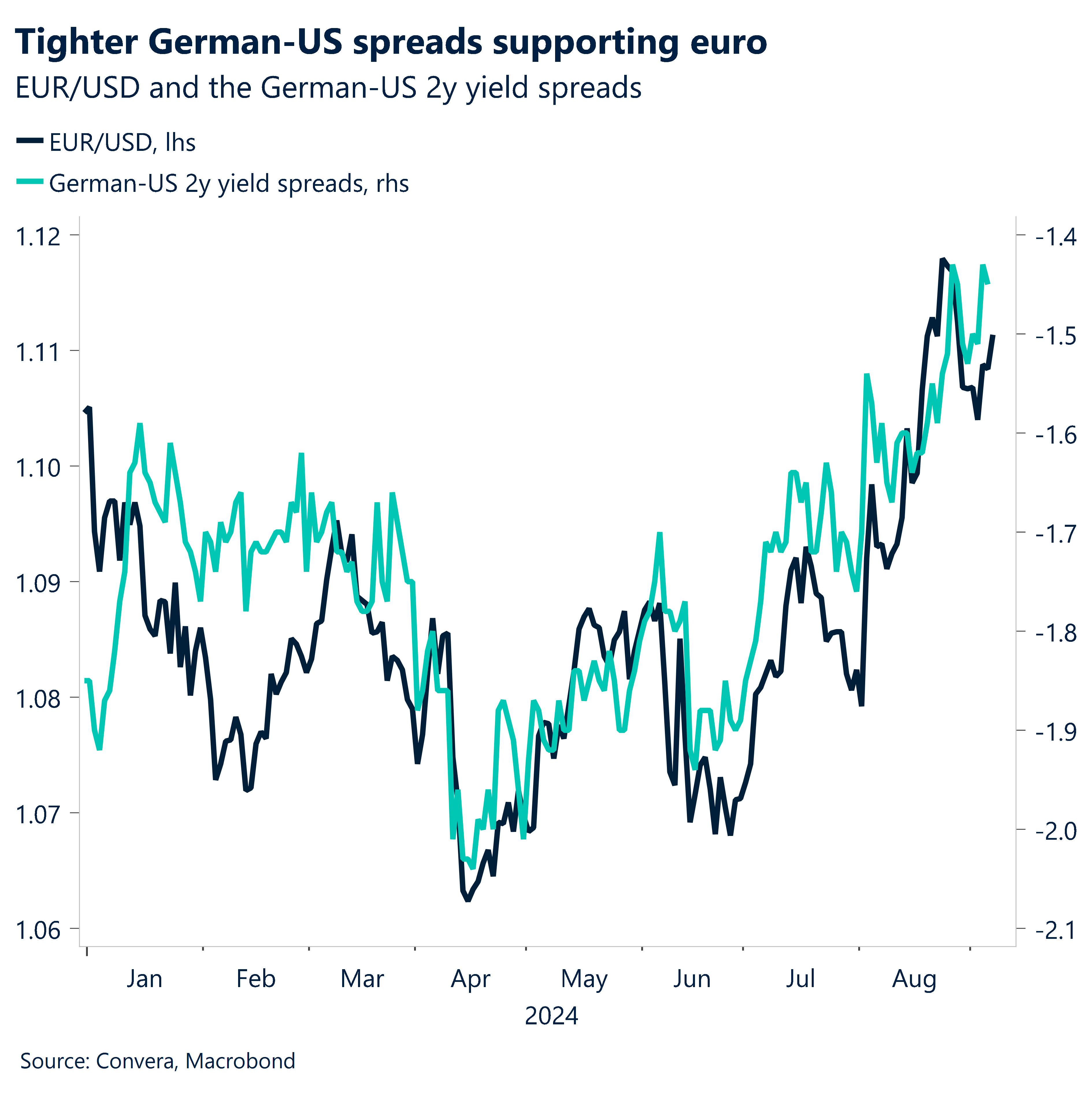

The euro’s momentum remains mildly bullish as the narrowing of the two-year Germany-US yield spread to a 16-month low continues to support the common currency. However, this trend may be tested as early as Thursday, with the ECB’s upcoming rate decision. The central bank is expected to cut rates by 25 basis points, but the primary focus will be on the communication and details of the ECB staff forecasts. Financial markets are currently pricing in one to two additional 25 basis point cuts, assuming a cut next week. Against this backdrop, we see three potential reasons for euro weakness this week: (1) the current pricing offers attractive levels for long positions, with only 60 basis points priced in by year-end, which arguably underestimates the risk premium for potential growth concerns or equity weakness in the coming months; (2) a shift in narrative from inflation to growth concerns could accelerate the rate-cutting cycle; (3) given the strong correlations between USD and EUR rates, risks are skewed towards dovish near-term moves, particularly in response to any soft comments from Lagarde next week.

In the lead-up to this risk event, one-week EUR/USD implied volatility retreated to 6.6%, down from the recent pre-NFP peak, but remains elevated compared to the year-to-date average. Similarly, 10-delta risk reversals, a measure of demand for tail risk, have eased from recent highs but remain elevated on an annual basis. Elsewhere, the domestic calendar is relatively quiet, with the final German CPI data due on Tuesday and Eurozone industrial production figures scheduled for Friday.

Pound flirts with August high

Ruta Prieskienyte – Lead FX Strategist

As we enter the final stretch of Q3, the British pound has demonstrated strength, buoyed by encouraging economic data suggesting that growth accelerated over the summer. This positive momentum, coupled with the Bank of England’s cautious approach to further rate cuts, has pushed GBP/USD closer to the $1.32 level, nearing 30-month highs. While GBP/USD remains in an uptrend, resistance is observed at $1.3265, with support at $1.3050.

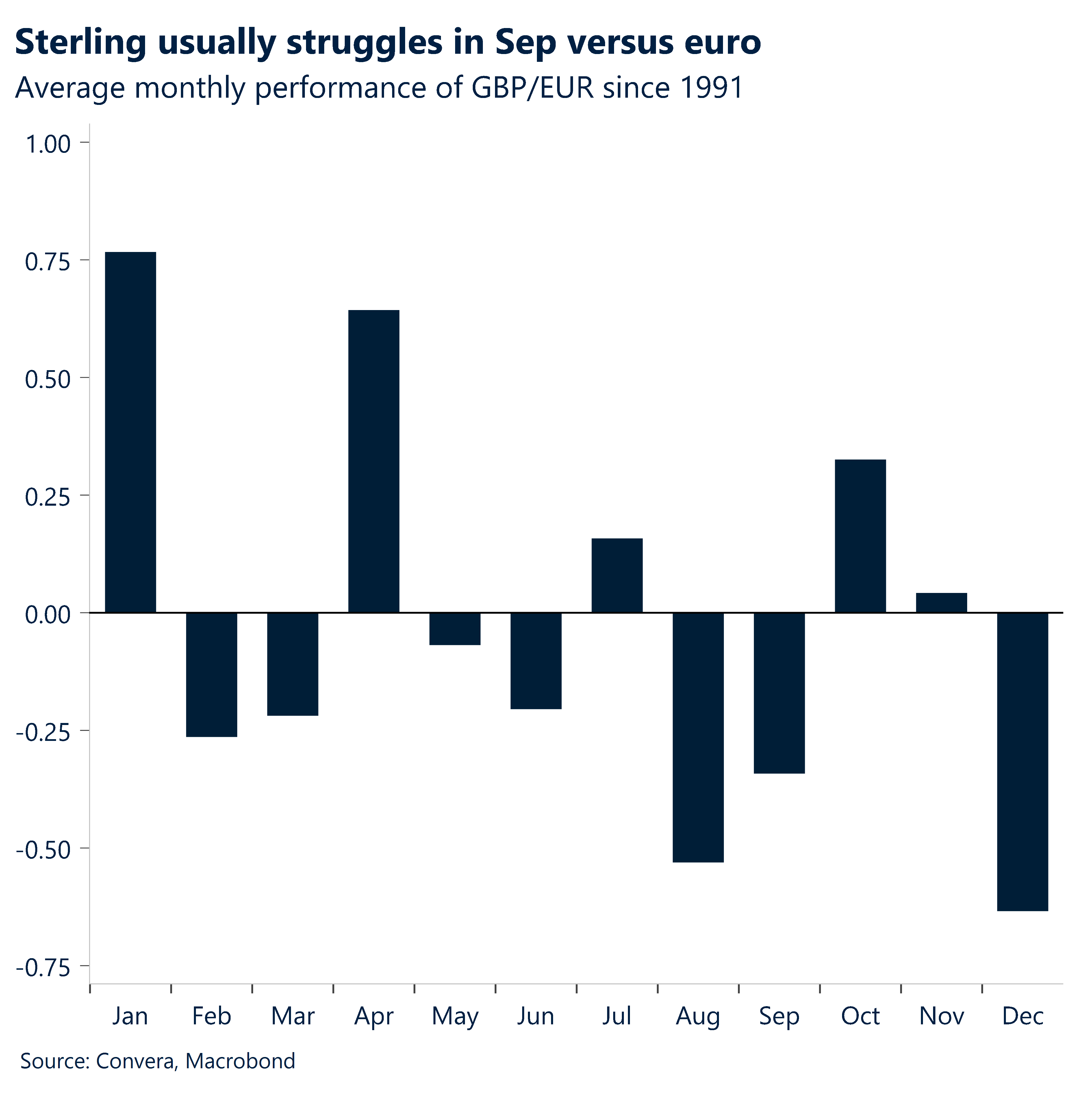

The pound saw its strongest gains against commodity currencies, particularly the AUD, NOK, and NZD, but lagged against safe-haven currencies such as the Japanese yen and Swiss franc, ultimately causing the Pound Index to close 0.2% lower for the week. Meanwhile, the pound has recouped its August losses against the euro, moving closer to the mid-€1.18 level and edging near 2024 highs. Despite the impending ECB rate decision this week, seasonality in the second half of the year tends to be unfavourable for the pound, which may limit further gains, even if the ECB shifts its focus towards growth concerns. Nonetheless, one-week EUR/GBP implied volatility ahead of the event has reached a three-week high.

Key upcoming data releases, including UK employment figures on Tuesday and July GDP on Wednesday, will be crucial in shaping the pound’s short-term trajectory.

JPY softens on GDP miss

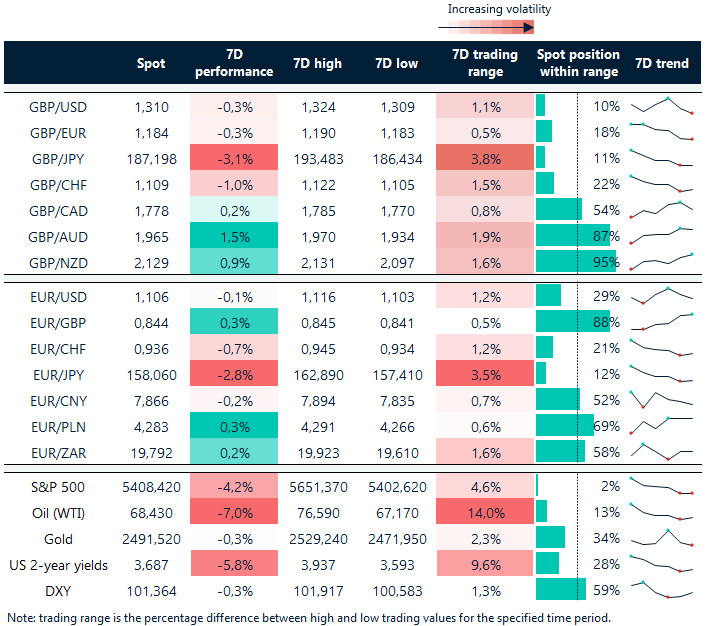

Table: 7-day currency trends and trading ranges

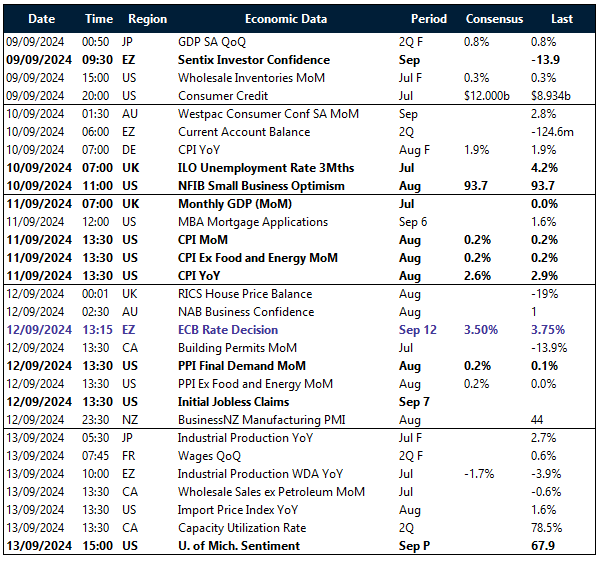

Key global risk events

Calendar: September 9-13

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.