USD gains as shares hit highs

The US dollar was strongly higher overnight, with the USD index hitting the highest level since mid-March, as better US data and hopes for a resolution to the US debt ceiling boosted financial markets.

US shares surged higher with the S&P 500 up 0.9% to reach the best level since August and the tech-focused Nasdaq up 1.8% to reach 12-month highs.

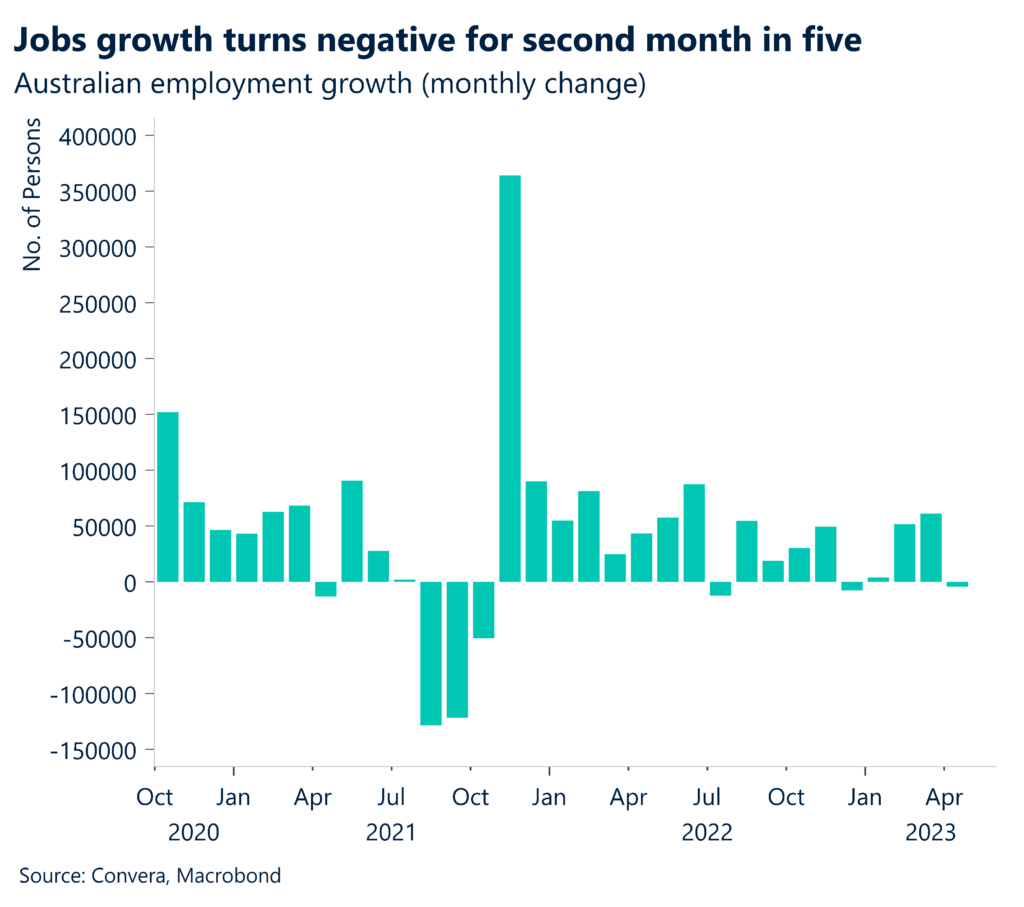

Aussie weaker after jobs

The Aussie underperformed, with the pair back near the lows of its recent trading range, after a disappointing local jobs report yesterday.

The Australian labour market fell by 4.3k in April with the unemployment rate climbing from 3.5% to 3.7%.

After Wednesday’s weaker than expected wages report, the Australian employment market looks to be cooling, reducing the need for the Reserve Bank of Australia to hike rate further.

The AUD/USD fell 0.6%.

PMIs key for regional FX

Looking ahead to next week, the monthly purchasing manager indexes will be key, with a clear divergence between strong services activity and weaker manufacturing weighing on regional currencies like the Australian dollar and Chinese yuan.

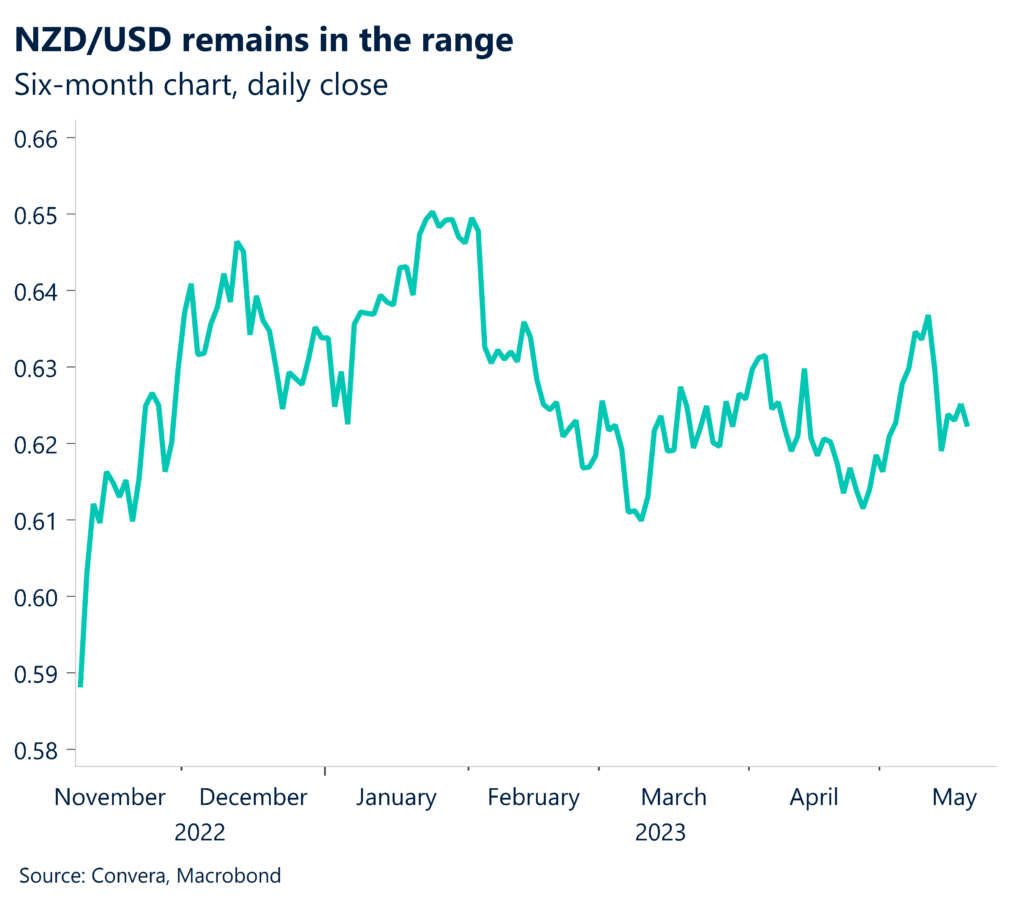

On Wednesday, all eyes will be on the Reserve Bank of New Zealand, with financial markets torn between a 25-basis point hike (seen as a 67% chance) and 50-basis point hike (seen as a 33% chance). Source: Refinitiv.

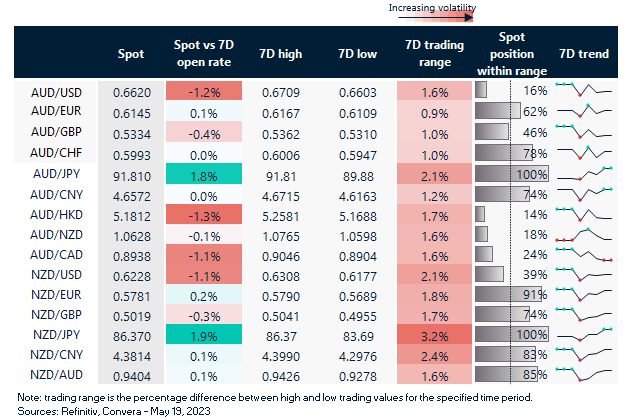

Greenback stages comeback

Table: seven-day rolling currency trends and trading ranges

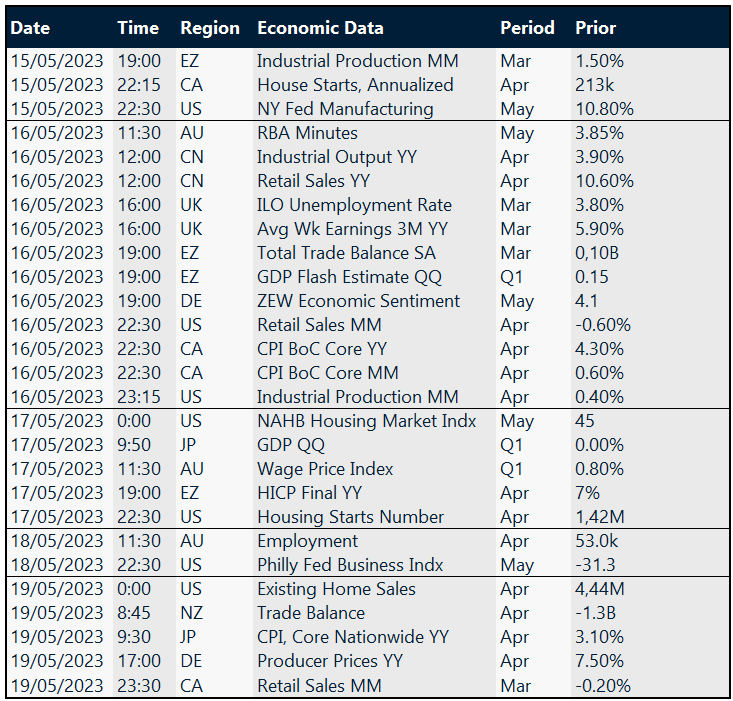

Key global risk events

Calendar: 15 – 19 May

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.