Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD index nears three-month lows

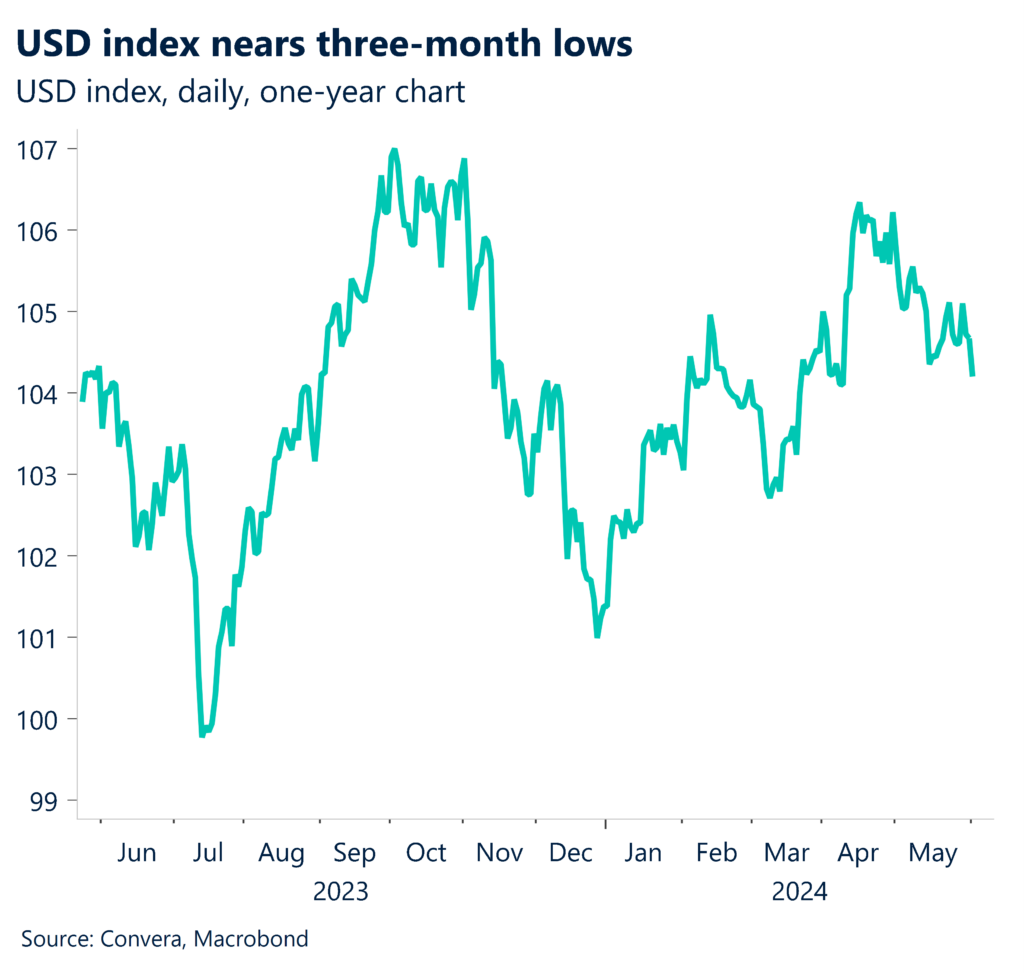

A big miss in US manufacturing numbers overnight caused the USD index to fall back toward three-month lows.

The US dollar experienced its first monthly loss in 2024 in May and the world’s most traded currency started June on a similar poor footing.

The most significant move was in the USD/JPY with the pair down 0.8% and falling to two-week lows.

The USD/SGD fell 0.3% while the USD/CNH lost 0.1% with a small improvement seen in China’s Caixin manufacturing index on Monday.

The kiwi gained well with the NZD/USD trading to new three-month highs.

The Aussie was also stronger but continues to find resistance at the four-month highs around 0.6700.

JOLTS to show further wage growth slowing

The next major US release is the key job openings and labor turnover series (JOLTS). We anticipate a minor reduction in the V-U (vacancy to unemployment) ratio to 1.30 from 1.33 in March, with job opportunities expected to drop to 8360k in April from 8488k in March.

The rates of hiring and firing, which are good leading indications of future pay increases, have leveled down below what they were before the epidemic.

The US dollar has recently slipped towards three-month lows but there remain reasons to be wary of renewed gains — due mainly to strong yields and a growth cushion.

USD/KRW outlook – stable amid disinflation

Due to consistent disinflation in goods prices, we anticipate inflation to decrease to 2.7% y-o-y in May from 2.9% in April. A gradual disinflation is anticipated to be sustained by a slower demand for goods consumption as the prices of energy and agricultural products stabilize.

We expect core inflation to slow to 2.1% y-o-y in May from 2.3% in April, reflecting the steady easing of core goods price inflation.

This suggests underlying price inflation will likely hit the BOK’s 2% target earlier than headline inflation, even though service price inflation was likely unchanged, reflecting strong service consumption.

The USD/KRW exchange rate has recently moved to 18-month highs but the gains have been somewhat muted due to continuous robust recovery in Korea’s external sector and the steady inflow of equity due to increased electronic profits.

USD hits bottom end of ranges

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 3 – 7 June

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]