We’re producing a single, global edition of the Daily Market Update this week with the Market Insights team on conference. We’ll resume our usual publication schedule next week.

Continued US exceptionalism

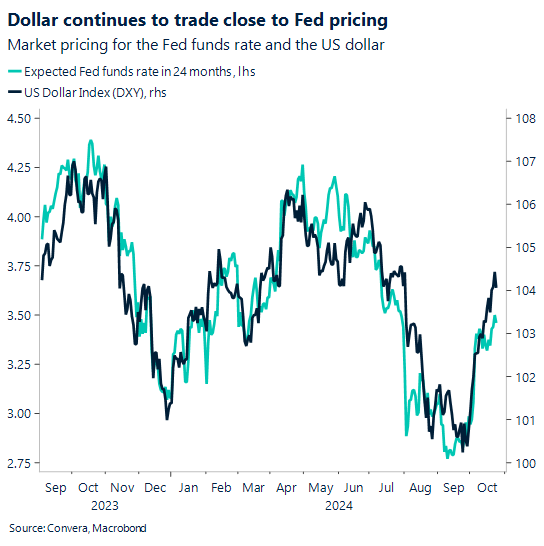

US economic exceptionalism, reduced Federal Reserve (Fed) easing expectations and improved polling for Donald Trump to win the US election have made for volatile trading of late. The US dollar thus secured its fourth consecutive weekly gain against the backdrop of rising bond yields and equities treading water.

The diverging macro picture has led some investors to rethink their positioning as it relates to the future policy path of the respective central banks. Markets are split on the possibility of a large 50 basis point cut from the European Central Bank (ECB) at the December meeting. In the UK, overnight indexed swaps are still hesitant to price in two full rate cuts from the Bank of England (BoE) for the remainder of 2024. And across the Atlantic, the chances of a 50-basis point cut from the Fed are slim. Markets are pricing in two 25 basis point cuts for November and December.

Across Asia, the greenback has also strengthened. The AUD/USD and NZD/USD fell to two-month lows last week. The USD/SGD and USD/CNH have both climbed to two-month highs.

In terms of the US election, three channels under which the next US administration would impact markets are: domestic policy, trade policy, and foreign policy. Protectionism would be the most obvious channel through which the dollar continues to strengthen. Then the question remains, would this spark a global risk off wave, weighing on all pro cyclical currencies or would it result in more regionalism, impacting countries that have free trade agreements with the US.

Pound outperforming euro

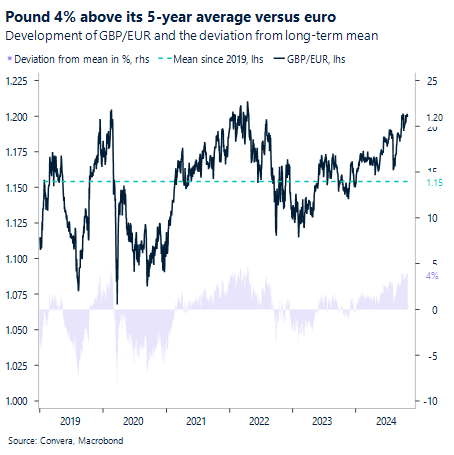

The British pound continues to grapple with the €1.20 handle versus the euro, buoyed by relative growth and rate differentials favouring sterling. UK-German 2-year yield spreads are at +200bps – their highest in over a year as GBP/EUR trades at a premium of 4% relative to its 5-year average rate. Could the UK Budget this week reverse the trend or drive the pair higher?

The surge in yields globally has seen the 10-year UK gilt yield rise to 16-week highs, helped by reports suggesting UK finance minister Rachel Reeves may allow more borrowing in the upcoming budget on Wednesday, which could delay BoE rate cuts. Meanwhile, German bund yields slipped after October’s PMI data showed business activity in Europe’s largest economy remains in contraction, whereas the UK remains in expansion. The weak Eurozone economic backdrop supports expectations that the ECB will “out-cut” the BoE. Moreover, inflation, namely core and services, has also been falling rapidly in the Eurozone, more so than the UK, supporting dovish ECB pricing compared to the BoE. Flash inflation estimates from Europe for September will thus be closely scrutinised this week.

All eyes are on the UK Budget as well. In terms of GDP, increased investment spending, even funded by borrowing, would likely be positive for UK growth, and could work in the pound’s favour against the euro. Versus the US dollar though, the outlook is muddied by ongoing US economic exceptionalism and the prospect of Donald Trump winning the US election. Both are bullish USD factors, which could drag GBP/USD back towards $1.29 this week.

Data-heavy week ahead with focus on US jobs

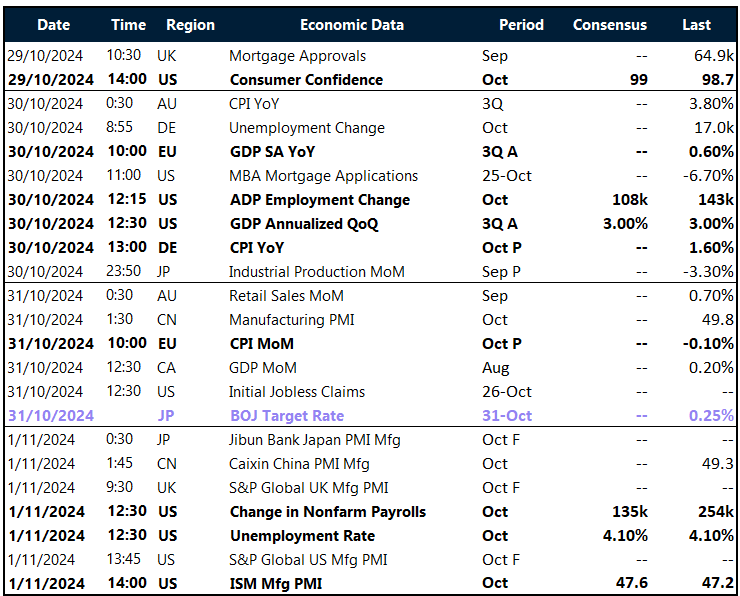

FX markets will be monitoring a busy economic calendar this week with preliminary Q3 GDP readings from major economies and inflation data taking center stage.

However, the US’s monthly job report, due Friday, will no doubt be the week’s highlight.

European economies will release their flash GDP estimates this Wednesday, with France, Spain, Italy and Germany all reporting Q3 numbers. The broader Eurozone GDP flash estimate will be closely watched.

Inflation readings will also be in focus with German CPI expected at 1.6% year-over-year, while Eurozone’s CPI is forecast at -0.1% month-over-month.

In Asia, Japanese job market data kicks off the week with the unemployment rate forecast at 2.5%. Later in the week, China’s official manufacturing PMI will provide insights into the world’s second-largest economy’s factory activity.

USD extends gains

Table: Latest spot prices. Full table not available, apologies.

Key global risk events

Calendar: 28 October – 1 November

All times GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.