JPY plunges on Takaichi win

The US dollar was stronger in early trade across Asia as the Japanese yen fell after a weekend election win for Japanese politician Sanae Takaichi caused the USD/JPY to jump higher.

Conservative candidate Takaichi won the leadership of the ruling Liberal Democrat Party (LDP) and is likely to become Japan’s first female prime minister. Takaichi is seen a supporter of so-called Abenomics policies that see increases in government spending and lower interest rates.

The USD/JPY jumped 1.5% while Nikkei 225 sharemarket future surged 4.5%.

The AUD/JPY jumped 1.0% to the highest level since January. The JPY was lower in most other markets.

Shutdown delays data

The US government shutdown continues into its sixth day on Monday with last week’s critical jobs report not released, even though the data was reportedly collected.

All official labour statistics were postponed last week, but private figures showed a slowdown in layoffs, with job cuts down 25.8% year-on-year according to the Challenger, Gray & Christmas survey.

The AUD/USD and NZD/USD were both lower as the USD strengthened.

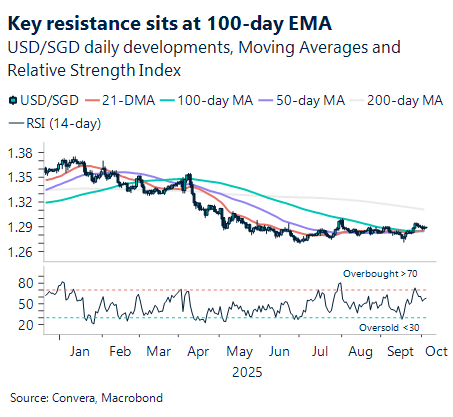

In Asia, USD/SGD has rebounded over the past two sessions. The market also gained in early Monday trade in line with the move higher in USD/JPY.

On USD/SGD, the next key resistance level sits at 100-day EMA of 1.2905, near the 100-day moving average. Dollar buyers may look to take advantage.

Central bank decisions dominate quiet calendar

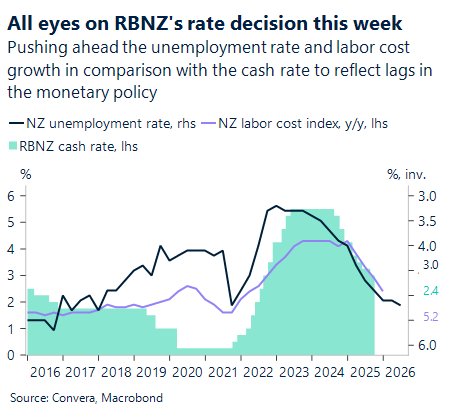

Looking forward, we have a light economic calendar with Reserve Bank of New Zealand in focus. The economic calendar remains relatively subdued heading into the first full week of October, with the Reserve Bank of New Zealand’s rate decision on Wednesday taking centre stage.

The RBNZ is widely expected to cut interest rates with market pricing seeing a 130% probability of a 25bps cut – signalling the chance for a 50bps cut (source: Bloomberg).

Beyond this key event, the week features a smattering of second-tier data releases across major economies.

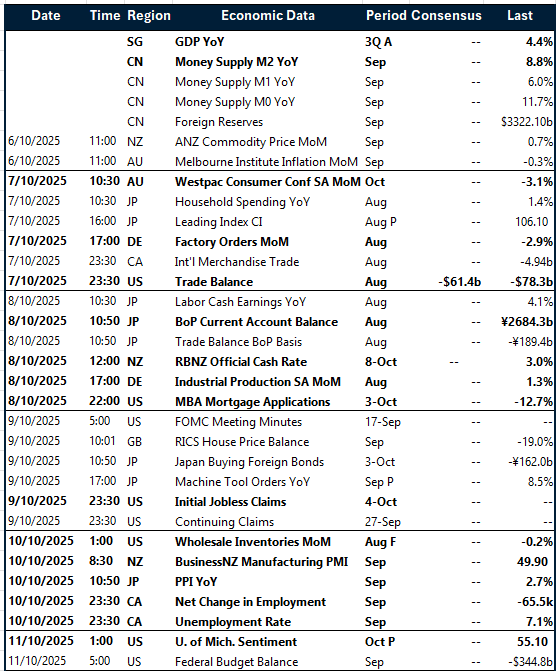

Trade data and industrial production readings. Several key trade metrics are scheduled, with the US releasing its August trade balance on Tuesday, expected to narrow to -$61.4b from -$78.3b . This will be complemented by Canadian international merchandise trade data the same day.

Germany’s industrial production figures on Wednesday will offer insights into Europe’s manufacturing sector, while Japan’s current account balance on Wednesday rounds out the trade-focused releases .

Growth indicators remain sparse. The absence of major GDP releases from larger economies may keep volatility contained, though markets will closely watch forward-looking indicators like Germany’s factory orders on Tuesday for signs of economic momentum .

FOMC minutes provide retrospective insights. The Federal Reserve’s meeting minutes from the September 17 decision will be released on Thursday . While backward-looking, these minutes could provide important context about the Fed’s thinking on the pace of future rate adjustments, particularly given recent market volatility and evolving inflation dynamics.

USD resilient despite shutdown

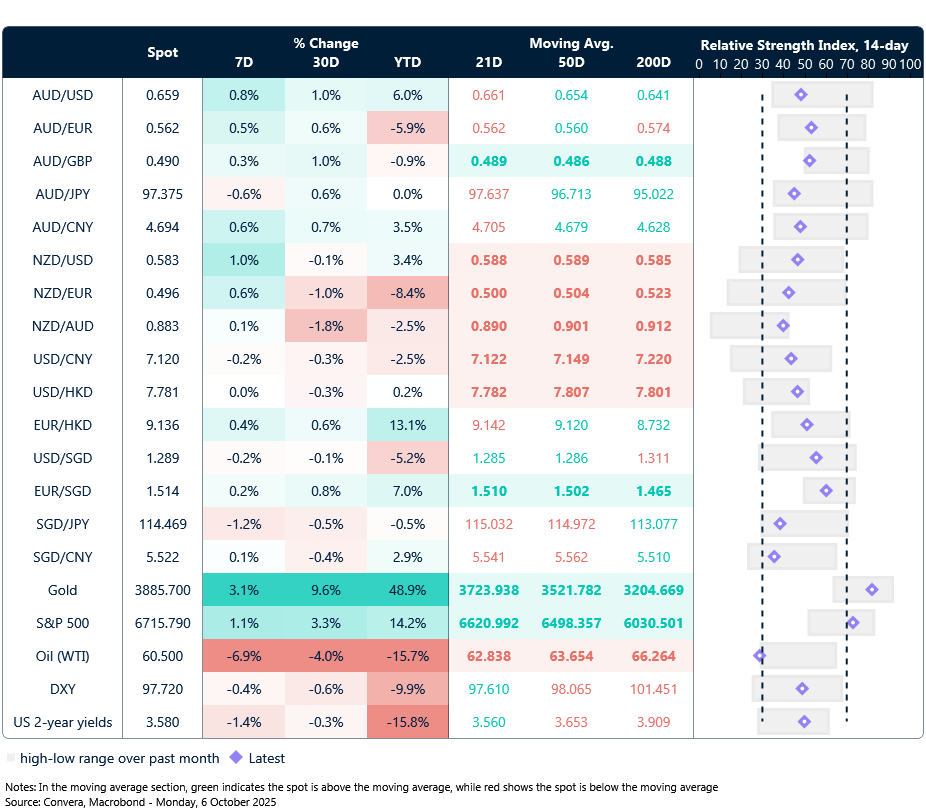

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 6 – 11 October

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer