Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US sharemarket sell-off boosts greenback

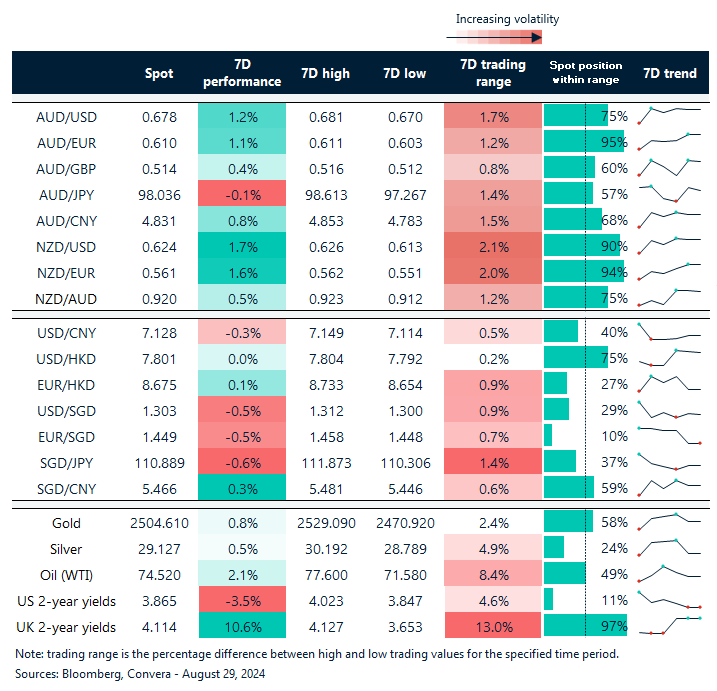

Key FX markets like the AUD/USD and USD/SGD reversed overnight as the US dollar rebounded driven by a sell-off in US sharemarkets.

US markets were initially disappointed after the all-important Nvidia results were seen as “good, not great” with the shares down more than 5.0% in the after-market according to Bloomberg. Nvidia, which makes chips for AI work, has been a key driver of the US sharemarket’s recent gains, so the disappointing result could spark further selling in the near term.

The US dollar gained as US shares fell with the USD index up 0.5% as it rebounded from 13-month lows.

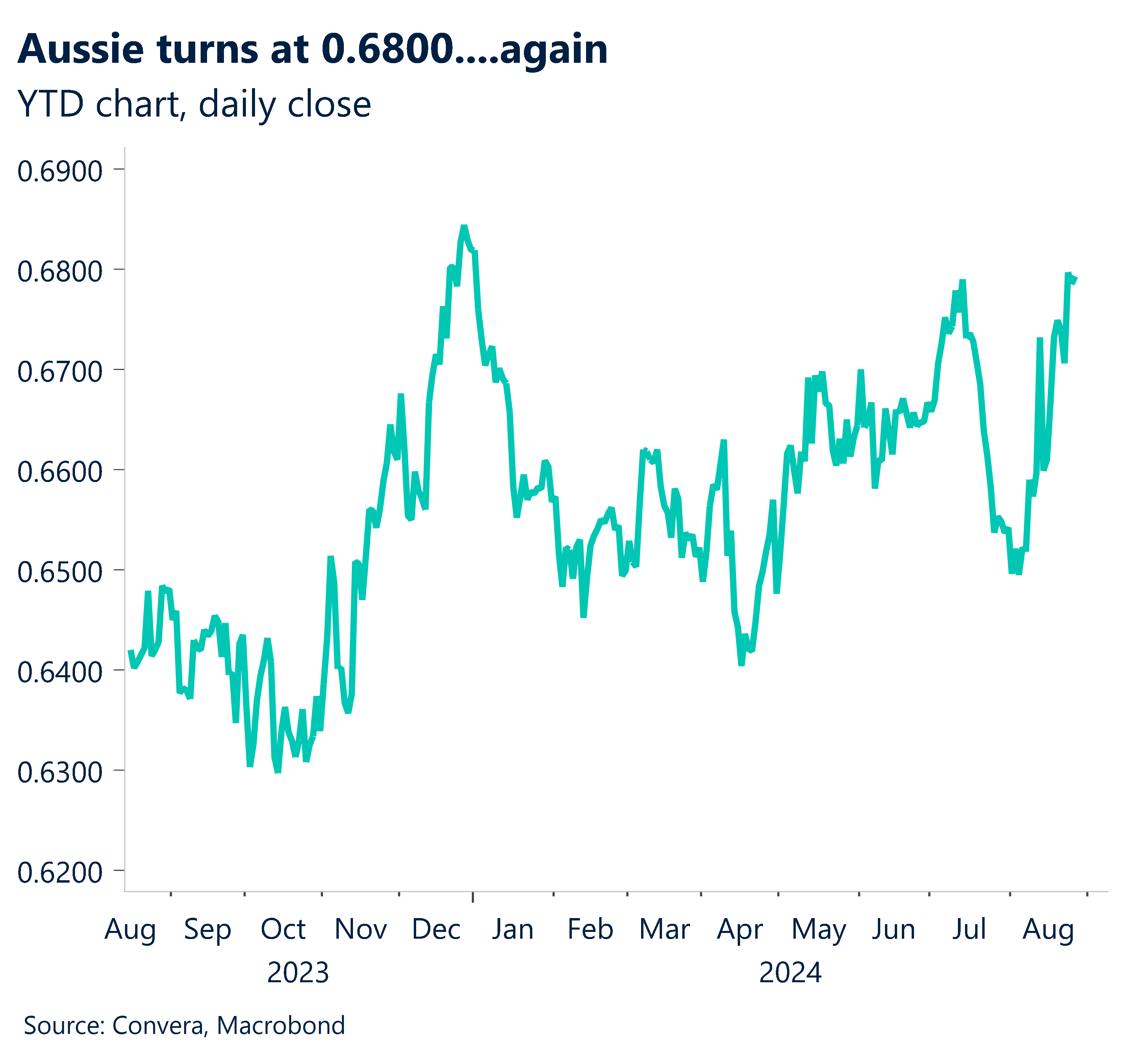

The AUD/USD fell 0.1% as it dropped from eight-month highs, but the Aussie was supported after Australian monthly inflation was reported at 3.5% — a little over the 3.4% expected. The NZD/USD lost 0.2% as it also fell from eight-month highs.

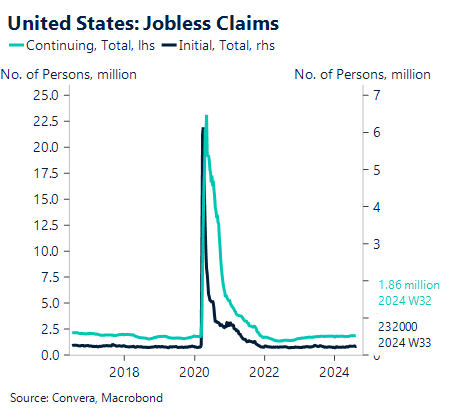

US jobless claims scrutinized for labor market health

This week’s initial and ongoing claims statistics increased somewhat but remained muted.

A modest increase in continuing claims is in line with a cooling labor market and an increasing unemployment rate; nevertheless, the slowdown is expected to be moderate in the absence of an increase in layoffs. We anticipate that claims data won’t change.

Although other numbers since then have been good, the US job market is worsening.

The threshold for further rates-driven USD depreciation is higher from here, particularly in light of more balanced posture and what has already been priced into rates.

EU economic confidence gauge to reflect regional disparities

From the year’s beginning, economic confidence has been circling about 95.9 (above chart shows another survey from ZEW financial market report).

We believe that August may also bypass due to Germany’s weakness, while the Olympics are expected to boost the Insee.

The unexpected range breach in January-Aug has kept the short-term trend bias for EUR/USD optimistic for the time being. A significant resistant level is located above at 1.125–1.1297.

Aussie, kiwi turn from highs

Table: seven-day rolling currency trends and trading ranges

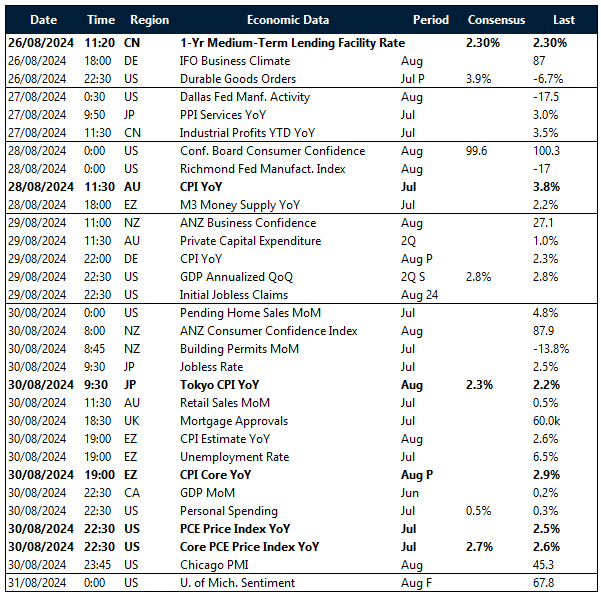

Key global risk events

Calendar: 26 – 31 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]