Written by the Market Insights Team

Soft inflation helped markets recover

Boris Kovacevic – Global Macro Strategist

Wall Street had a strong week as cooling inflation eased concerns sparked by last week’s robust jobs report. Softer CPI and PPI data revived expectations of Fed rate cuts, lifting stocks and pushing yields lower. Some called the rally a “relief rally,” but the Fed has tangible reasons for optimism. Core inflation’s decline was driven by the long-stubborn service sector, signaling that labor costs are no longer fueling price pressures. Meanwhile, housing costs, a persistent inflation driver, saw their smallest increase since early 2022.

Despite the improving inflation picture, the Fed is unlikely to rush into rate cuts, staying on hold at its January 27-28 meeting. The economy remains strong, supported by resilient consumers and better-than-expected retail sales, industrial production, and housing data. Optimism around the new administration’s pro-growth policies may be adding to the momentum, but challenges loom. Higher tariffs and potential deportations could create headwinds that test the economy’s resilience in the months ahead.

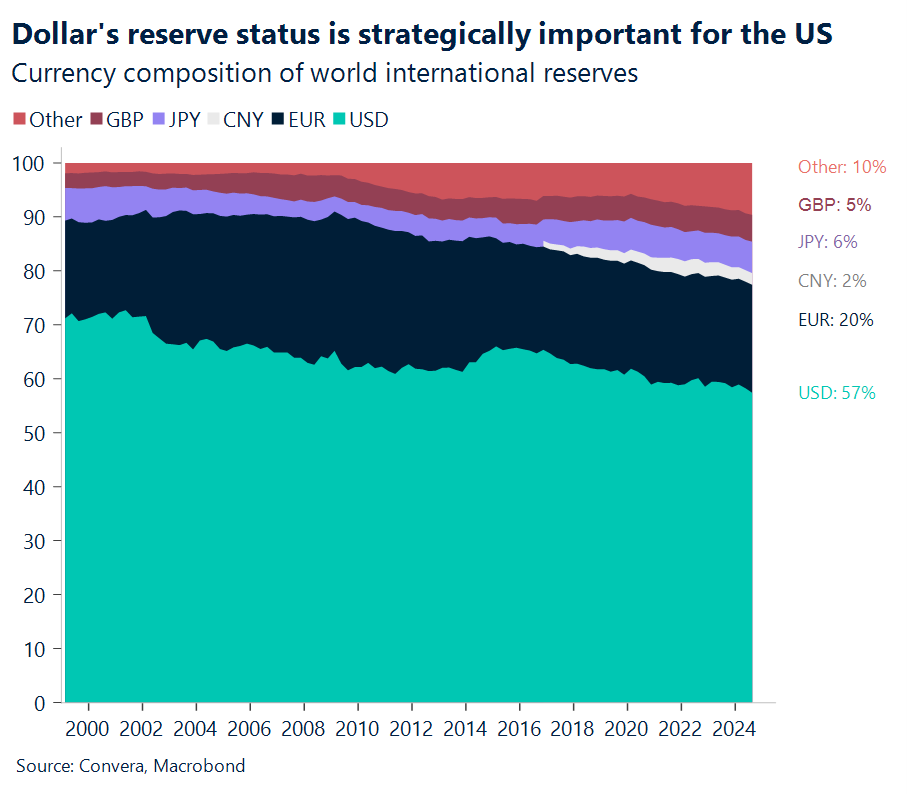

Now there is the geopolitical question surrounding the dollar as well. In the senate hearing last week, Scott Bessent emphasized the importance of maintaining the US dollar’s status as the world’s reserve currency. Trump’s nominee for Treasury Secretary stated that ensuring the dollar remains the global reserve asset is vital for US economic health and the nation’s future. That is the consensus view amongst economists, with papers and columns as recent as Jason Choi et. al. (2024) finding that the special status of the US and its currency increases maximal sustainable debt by around 22% of GDP. Tariffs have the opposite effect of moving buyers and debt issuance away from the dollar in the long term, while having beneficial short-term effects on the dollar’s value. This is a paradox the Trump administration and Bessent will have to address.

It’s all about politics in Canada these days

Kevin Ford – FX & Macro Strategist

Chrystia Freeland, former Canadian finance minister, whose resignation in December pushed Trudeau to cut short his time as Prime Minister, has officially joined the race to replace him, beginning March 24. She’ll fight Mark Carney, former Central Banker, who started his campaign last week. The major challenge for both will be the closed ties to Justin Trudeau’s economic team since 2015, which for some is a liability that won’t make a difference against the conservatives. On the other side, Pierre Poilievre, the leader of the Conservative party, keeping his pro-business rhetoric, promised that if elected will reverse the controversial capital gains inclusion rate. For now, with just a few hours away from Trump’s inauguration, and the political uncertainty lingering, the USD/CAD has been testing the upper trend of the three-week resistance line, closest to its highest level in 5 years.

The Canadian economy relies heavily on exports to the US, with 75% of all Canadian exports going there. A 25% tariff would worsen the already negative economic outlook. However, some believe Trump won’t impose a 25% tariff across the board, as it would undermine the USMCA, one of his key achievements from his first term. Instead, Trump might use the threat of tariffs to gain leverage in renegotiating parts of the USMCA when it comes up for review in mid-2026.

The positioning towards the Loonie (CAD) is cumulative short as traders betting against the currency expect to capitalize after Trump’s inauguration, helping a breakaway towards the 1.46 level. Asset managers are now less exposed to the Loonie after a brief positive period in early January, according to CFTC data. This aligns with the currency’s uneven performance and supports its positive outlook when market sentiment changes. Leveraged funds are also less exposed, matching the CAD’s weakening spot price since July last year.

The difference in monetary policies between the Bank of Canada (BoC) and the Federal Reserve (Fed) has been putting upward pressure on USD/CAD. But as the BoC approaches its neutral rate and the Fed adopts a more neutral-dovish stance, the pressure on the Canadian dollar might ease . However, it’s uncertain if tariff discussions will continue to keep the CAD on edge.

Small glimmer of hope for euro

George Vessey – FX Strategist

Despite hitting fresh 2-year lows against the dollar last week, the euro clocked its firstly weekly rise in three, supported by a broadly weaker USD on tariff news and mixed US data. That said, it was only EUR/USD’s third weekly rise since late September, down over 9% over this period. The common currency is still influenced negatively by Europe’s weak economic growth outlook. Moreover, geopolitical and trade uncertainties stemming from potential policies from President-elect Trump’s administration remains a key headwind at this stage.

EUR/USD has recently been undershooting levels normally suggested by short-term rate differentials though, which suggests the pair should be trading closer to $1.05. However, bearish EUR positions continue to swell with calls of parity still hanging over the pair and there lacks compelling evidence that we have hit the bottom of this downtrend given the weak economic and political backdrop weighing on the euro. The Eurozone continues to struggle with stagnation concerns with weak industrial production and sluggish demand. Flash PMI data this week is set to reveal whether manufacturing and services activity can rebound. The German ZEW investor survey will also be closely watched to gauge whether the region’s largest economy is stabilizing or heading for another contraction.

Improved cyclical headlines from China would support European exports and the euro, but we think a convincing reversal is dependent on a shift of the bullish-USD narrative. This would require softer US data and softer tariff headlines. Might we witness that this week? We note that since November 2024’s US election, EUR/USD has mostly moved in parallel to the 2016 US election aftermath. History doesn’t repeat, but it often rhymes.

Risk appetite supports sterling

George Vessey – FX Strategist

Upbeat global risk sentiment has lifted the pound against traditional safe haven peers, such as USD, JPY and CHF, this morning. GBP/USD has reclaimed the $1.22 handle after closing Friday out at its lowest weekly close since early November 2023. Domestic headwinds still linger though amidst the weak UK growth and sticky inflation outlook – increasing bets of Bank of England (BoE) rate cuts from one to almost three in 2025.

Sterling continues to exhibit and an inverse correlation with rates at this stage though, highlighted by the diverging paths of both GBP/USD and GBP/EUR relative to yield spreads, which reveals the negative structural challenges facing the UK economy. Options sentiment remains bearish GBP and volatility expectations elevated, though pricing has eased up from the multi-year extremes witnessed a couple of weeks back in the wake of the gilt market meltdown. Looking forward, positive GBP positioning adds to sterling’s headwinds, as speculators are still net long GBP (expecting GBP to rise). If these positions upwind sharply, it will have negative consequences for sterling’s spot price. Moreover, the trade-weighted GBP index has weakened from recent highs but remains above the average level since the mid-2016 Brexit vote – and well above the Truss-era record lows back in 2022.

The BoE will try to get some hints on the trajectory of the economy after the softer CPI print last week. The labour market report and flash PMI data this week will test whether consumer spending is holding up despite high borrowing costs. If growth disappoints, expectations for earlier rate cuts could build, weakening the pound further. Sterling needs a U-turn in USD sentiment and some positive news regarding tariffs, although this remains a key source of uncertainty given the unpredictability of President-elect Donald Trump, who will be inaugurated today.

Equities rally, yields and dollar fall

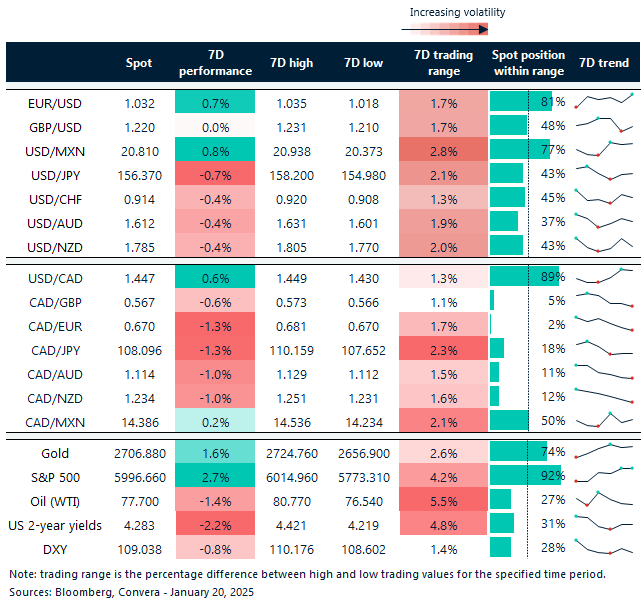

Table: 7-day currency trends and trading ranges

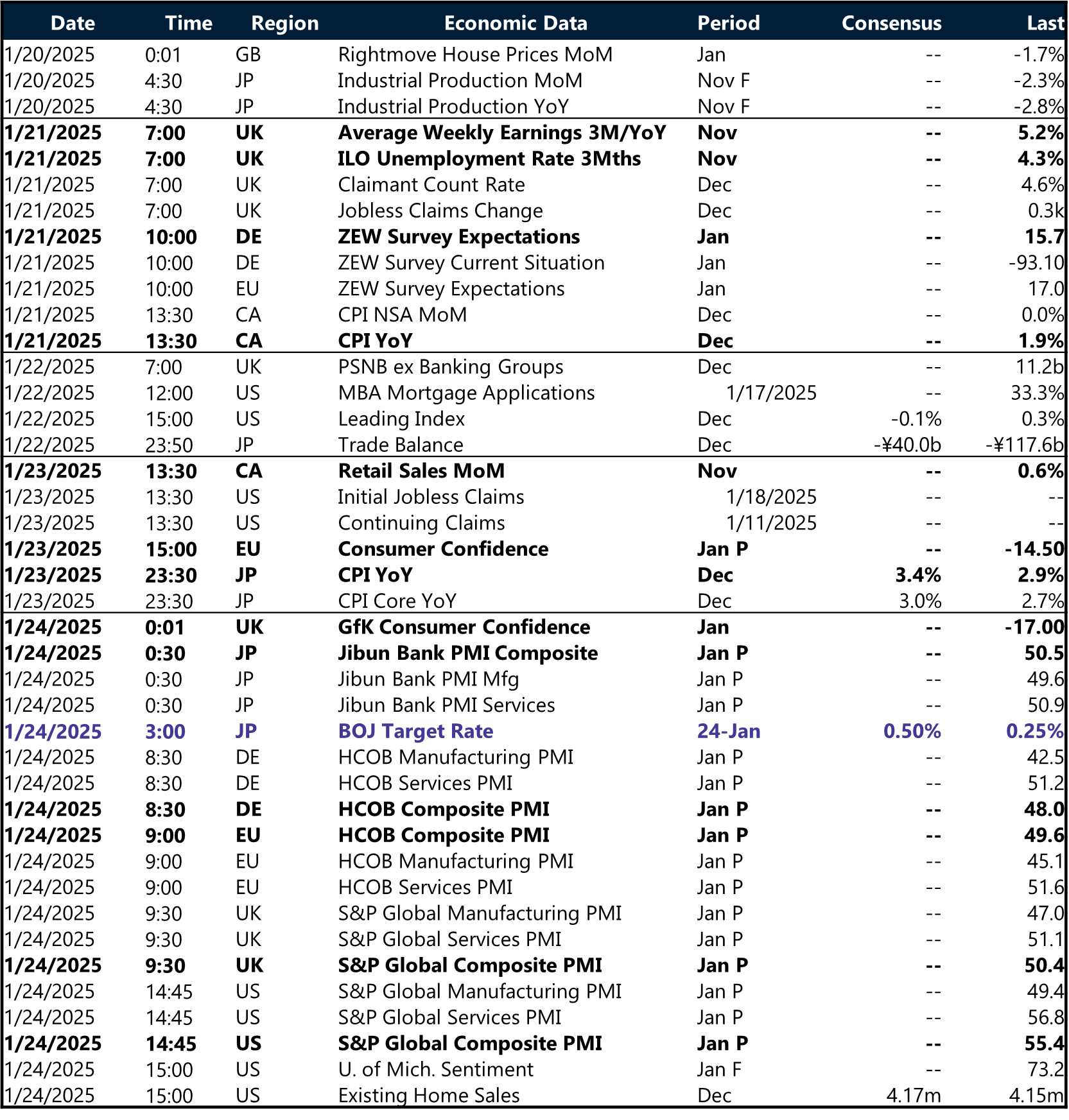

Key global risk events

Calendar: January 20-24

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.