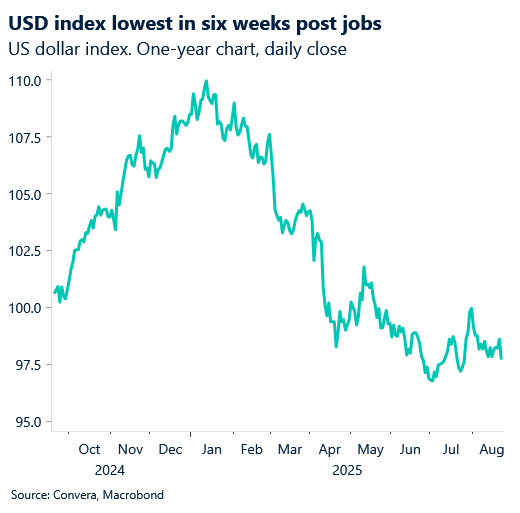

USD drops to six-week lows after another jobs miss

The US dollar slumped to six-week lows on Friday after another disappointing jobs report raised fresh concerns about the economy and fuelled speculation of a rate cut at next week’s Federal Reserve meeting.

Non-farm payrolls rose just 22k in August, well below the 75k expected. The unemployment rate ticked up from 4.2% to 4.3%, marking its highest level since October 2021, during the pandemic. The three-month rolling average for non-farm employment has now dropped to a worrying 29k.

Markets responded swiftly. Pricing for a 25bps Fed rate cut surged to 109%, signalling potential for a larger 50bps move. The USD index fell to its lowest level since 24 July.

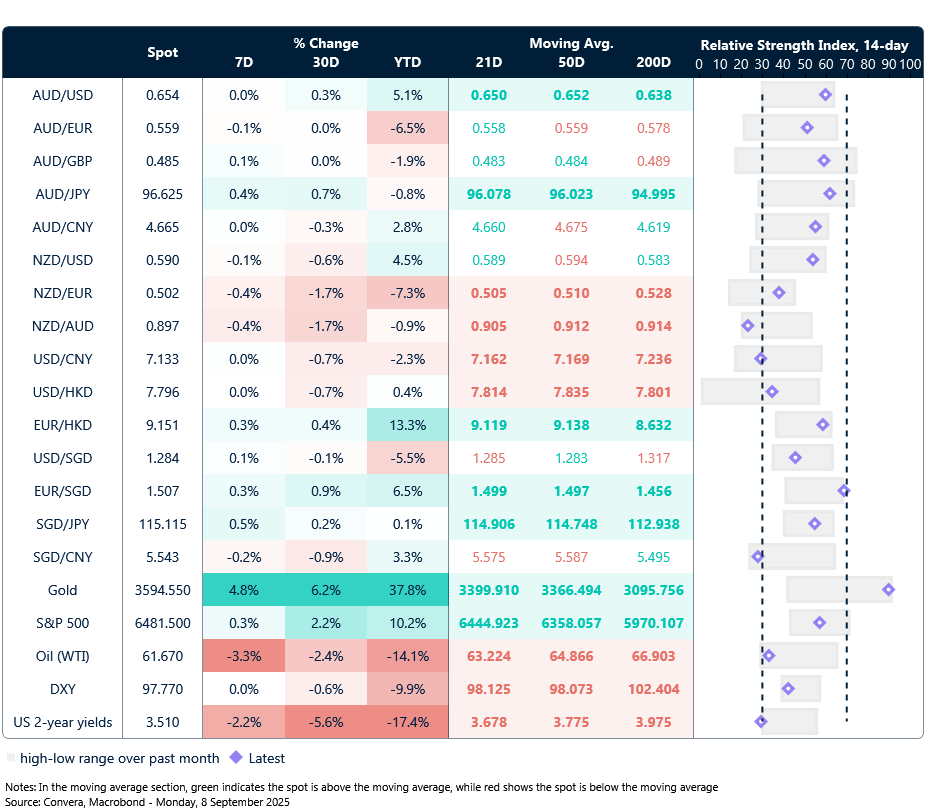

The Aussie rallied to six-week highs, jumping to the top of its 0.6400–0.6600 range before later easing, with AUD/USD up 0.6% on the day.

NZD/USD climbed 0.8% to three-week highs. USD/SGD slipped to two-week lows, while USD/CNH dropped to 15-month lows.

Aussie, kiwi eye breakout as Miran’s Fed bid stirs independence fears

Stephen Miran, nominated by former President Trump to fill Adriana Kugler’s seat on the Fed Board, told lawmakers he won’t resign from his current role as chair of the White House Council of Economic Advisers if confirmed. Instead, he plans to take unpaid leave during his Fed tenure, citing legal advice. If granted a full term, he says he’ll step down from the CEA.

The move has sparked backlash, especially from Democrats, who argue that remaining tied to the White House—even on leave—could compromise his independence and expose him to political pressure. Senator Chris Van Hollen warned that Miran’s approach undermines the neutrality expected of a Fed governor.

With questions swirling around Fed autonomy, expect more market volatility.

In FX, AUD/USD approached technical resistance at 0.6600 before easing, but upward momentum is building.

NZD/USD continues to drift with low momentum, forming a descending wedge pattern, which is often a precursor to an upside breakout. If confirmed, watch resistance at 0.5888 (21-day average) and 0.5920 (50-day average).

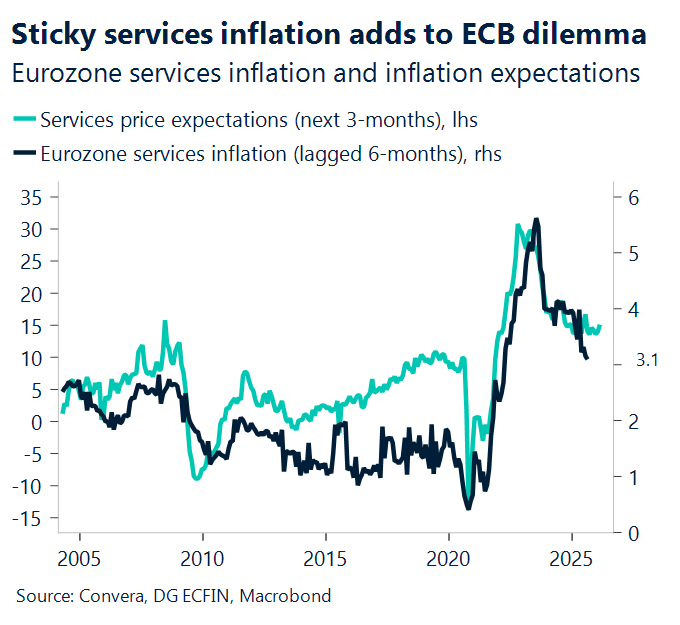

Euro in the crosshairs: CPI prints and ECB talk set the tone

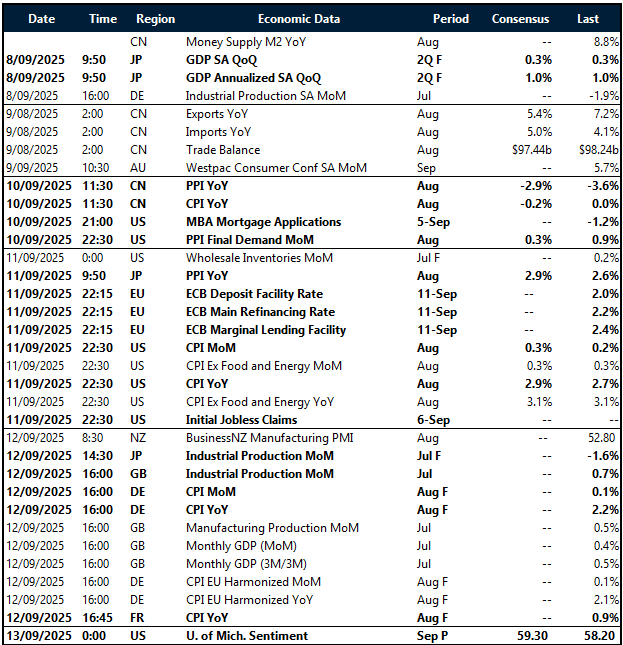

This week’s FX focus shifts to inflation data and a key ECB meeting. The US August CPI report (Thursday) is the headline event, with consensus pointing to a 0.3% m/m and 2.9% y/y rise in headline inflation. Core measures will also be closely watched as markets reassess the Fed’s policy outlook.

In Europe, final August CPI prints from Germany, France, and the UK (Friday) will offer fresh insight into price pressures ahead of Thursday’s ECB meeting. While no rate change is expected, the ECB’s tone and forward guidance will be key for EUR volatility.

Asia also features prominently. Japan releases final Q2 GDP and current account data (Monday), while China’s August trade (Tuesday) and inflation (Wednesday) figures will provide a read on regional growth and price trends. JPY and CNY remain sensitive to signs of deflation and weak demand.

The week rounds out with UK monthly GDP, manufacturing, and industrial production data (Friday), plus euro area industrial production throughout the week. In the US, jobless claims.

USD nears 10% loss for year-to-date

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 8 – 13 September

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.