Markets don’t need much to rally

Equity benchmarks across the globe rose in yesterday’s session in advance of the highly anticipated CPI report later today, which will be seen as the last data point available for the Federal Reserve to consider before the rate decision on Wednesday. Risk assets have been coming into the week with a bullish bias, given the broad expectations of a continued slowdown of headline and core inflation rates.

Economists expect US consumer prices to have risen by 4.1% in the last 12 months through May. This would not only constitute the 11th yearly decline of inflation since peaking in June 2022, it would also be the lowest print in more than two years. Normalizing supply chains, falling commodity and property prices and peaking rents will most likely continue putting downward pressure on headline inflation. According to the Federal Reserve Bank of New York, consumer inflation expectations fell by 0.3% to 4.1% in March, setting a two-year low. The decline had been accompanied by the first fall of household’s earnings expectations in five months.

Investors took conform in the only data point available at the beginning of the week and have boosted the Nasdaq to the highest level since April 2022. This singular disinflationary evidence has been enough to drag down market expectations of a 25 basis point hike at tomorrow’s FOMC meeting from 30% to around 22%. The US Dollar Index was less impressed and began the week range bound around the 103.50 mark.

Hot labor market pushes pound higher

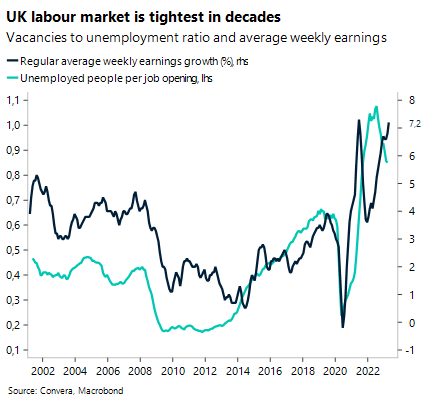

The British pound jumped against most peers in early trading today, after the latest labor market report confirmed market suspicion that more needs to be done on the monetary policy front to fight inflation. The drop in the unemployment rate to 3.8% and wage growth excluding bonuses coming in at 7.2% all but set in stone another 25 basis point hike by the Bank of England.

Demand for workers in not weakening as expected and could lead underlying inflation to remain sticky. While the 12 consecutive rate increases have impacted pro cyclical and rate sensitive parts of the economy like manufacturing and housing, post-pandemic effects are continuing to put pressure on the labor market. While the number of vacancies fell from 1.09 to 1.05 million, it is still around 25% higher than pre-pandemic levels. Markets have been bolstered in their beliefs, that the BoE will have to increase interest rates by four more times and hold the policy rate at elevated levels for longer. Rate cuts are not priced in for 2024, which stands in stark contrast to the European and US central banks.

Sterling recovered all the losses suffered during yesterday’s rout and is once again positioned well above $1.25. GBP/USD is trending slightly upwards, with the levels around $1.24 and $1.2670 defining the current range. GBP/EUR has come off from its 9-month high but remains elevated at €1.1640.

PBoC coming to the Euro’s rescue

The Euro is edging closer to the $1.08 mark on the back of expectations that today’s inflation report won’t surprise to the upside, which would support the Federal Reserve’s plans to pause its tightening cycle on Wednesday. The uptick in global risk sentiment has been carried into the European session following the surprise rare cut announcement by the Peoples Bank of China.

China’s central bank cut its short-term policy rate, known as the seven-day reserve repurchase rate, by 10 basis points to 1.9%. Not only does the cut constitute the first easing of policy rates since August 2022. It has added fuel to the speculation that more monetary support is on the way. So far, the Chinese reopening has not held up to expectations. While the loosening up of restrictions saw metro traffic and road congestion reach post-pandemic highs, leading indicators continue pointing to a slowdown in economic activity. The latest data on the second-largest economy in the world showed worse than expected numbers for new loans, imports, retail sales and industrial production.

Fiscal and monetary support out of China might have a positive effect on the Euro. As we discussed previously, all four periods of Euro strength from 2010 to 2021 have occurred while the Chinese manufacturing sector has been expanding. This explains the positive reaction EUR/USD had after the surprise rate cut.

Euro close to $1.08

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: June 12- June 16

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.