Written by Convera’s Market Insights team

Dollar advances to 2-week high

Boris Kovacevic – Global Macro Strategist

US bond yields are on the rise again and have helped the USD record its best day in a month as the correlation between the two continues climbing. The Treasury market rout has spooked investors, sending global equities sliding sharply and spurring a rush to the safest assets, with the US dollar index scaling a two-week peak this morning. EUR/USD is back under $1.08 while GBP/USD has slid under $1.27.

The rates market angst started with a slew of stronger-than-expected US economic data such as the Conference Board’s monthly survey showing consumer confidence pushed higher again in May. Demand for Treasury auctions has also been weak this week with the bid to cover ratio for the 2- 5- and 7-year government bonds falling short of expectation, setting multi-month lows. The large issuance of new debt and the quantitative tightening program of the US central bank continue to support higher yields under the conditions that economic momentum holds up in the coming quarters. One should not read too much into one week of weak demand for Treasuries. However, auctions have become market moving events and will have to be watched carefully for signs of falling demand.

The rush for cover in safe haven assets has also been evident by the appreciation of both the Swiss franc and Japanese yen, the latter around 0.5% stronger versus the USD, EUR and GBP this morning. US initial jobless claims and a second reading of Q1 GDP are the key risk events today ahead of the important PCE inflation data on Friday, which could trigger more volatility and further boost the dollar if it comes in hotter than expected.

Risk sensitive sterling feels the pinch

George Vessey – Lead FX Strategist

Tainted global risk sentiment has weighed heavily on the risk-sensitive pound over the last couple of days, with GBP/USD surrendering the $1.27 handle this morning after pulling back from around 10-week highs above $1.28 yesterday. GBP/JPY has also dropped sharply from near 16-year highs, down almost 1% this week and losing its grip on the ¥200.00 handle. Against the euro, sterling briefly touched its highest level since August 2022 as the common currency depreciated following weak German data.

Currency volatility has been well below its historic average this year despite the uncertainty about the path of both inflation and monetary policy. We have long argued that the expected divergence of central banks will not be enough to significantly increase price action in FX. However, one-off events on the geopolitical front and elections (Europe, UK, US) might. Investors are positioning for increased swings ahead. FX implied volatility measures can be used as a risk barometer, and the sterling volatility options market began whirring on rumours of the snap UK election, especially in the case of EUR/GBP, where the spread between 2-month and 1-month implied volatility popped to a near 13-month high due to the longer option contracts capturing the UK election in July.

Sterling may benefit if the business-friendly Labour Party wins a parliamentary majority in Britain’s general election on July 4, as opinion polls suggest, with scope for GBP/EUR to breach €1.18 and GBP/USD to rise to $1.30. However, the direction of the pound will likely be dictated more by fundamental economic drivers and by the timing and pace of Bank of England (BoE) rate cuts.

Easing German CPI weighs on euro

Ruta Prieskienyte – FX Strategist

Souring global risk sentiment sent the euro broadly lower against its G10 peer group. The STOXX50 index fell sharply to a 3-week low and European yields edged higher. The yield on the German 10-year benchmark bund rose to 2.68%, a 6-month high, and the 2s/10s curve steepened to -36bps, close to a 3-week high.

May’s preliminary report has the headline consumer inflation rate in Germany edging up to 2.4% y/y, in line with market consensus. Inflation rose for the first time in five months, driven by an uptick in services and food prices, while goods cost eased further. The core measure, which excludes volatile food and energy components, remained unchanged at 3% y/y. The monthly momentum surprised to the downside, easing to 0.1% m/m, down from 0.5% in the previous report, but the EU-harmonized inflation gauge surprised to the upside, rebounding to 2.8% y/y vs 2.7% expected by the markets. Although the upside surprise in the latter measure was not detrimental as to derail the anticipated rate cut by the ECB next Thursday, it fuels concerns regarding how much room the central bank has to ease in the second half of the year. The Governing Council appears to be conflicted on this matter. Most policymakers sound uncomfortable with a back-to-back cut in July, while France’s Villeroy said the ECB shouldn’t exclude such a policy move.

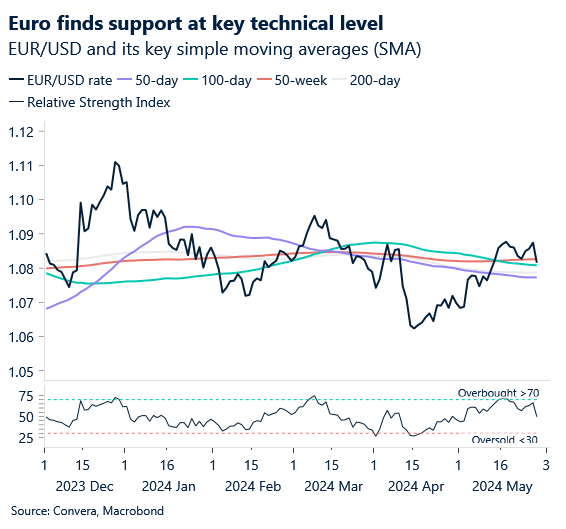

Across FX, EUR/GBP fell as much as 0.3% to 0.84838, the lowest since August 2022, before erasing losses, as the BoE is increasingly expected to trail the ECB in lowering interest rates. EUR/CHF eased from multi-month highs and EUR/USD shed over 0.4% value, its largest 1-day drop this month, but remains supported at its 100-day SMA. As we edge closer to the ECB rate decision on June 6, euro sentiment turns more bearish. The 1-week EUR/USD risk reversals are the most euro negative in close to 4-weeks.

US yields on a tear; global stocks down 1%

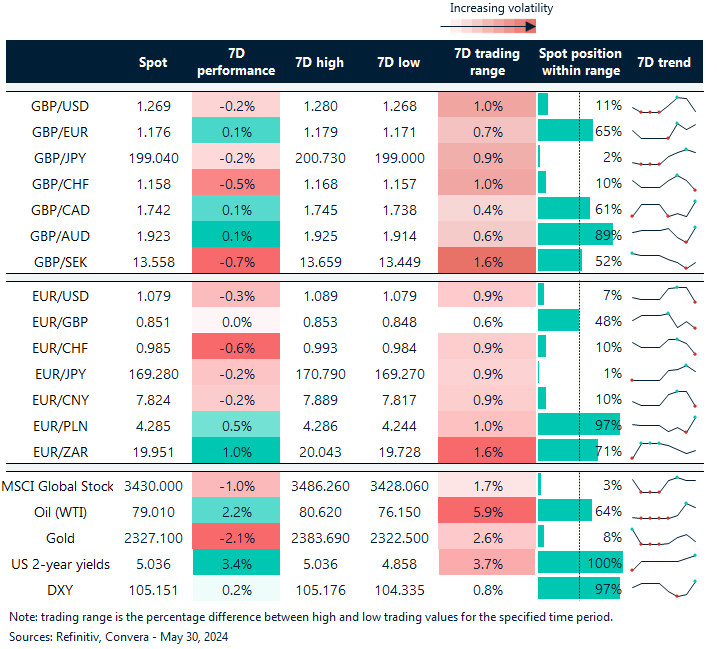

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.