Several factors weighing on USD

The US dollar retreated yesterday as data showed US capital goods spending fell more than expected, adding to fears of a US economic slowdown. Banking contagion risks in the US also grew after First Republic Bank shares plunged nearly 50% this week, and concerns worsened about a looming vote in Congress over the unresolved debt ceiling.

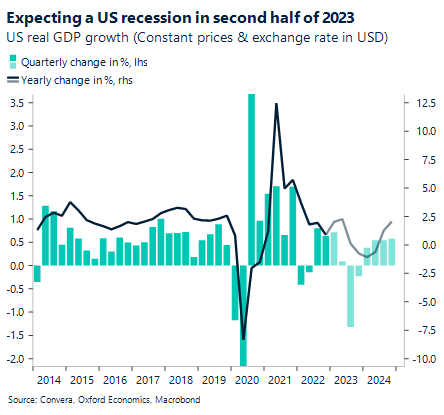

New orders for key US manufactured capital goods fell more than expected in March. The US manufacturing sector, which accounts for 11.3% of the US economy has been in recession for a while, hurt by the Federal Reserve’s (Fed) fastest interest rate hiking campaign since the 1980s. These increasing signs of an economic slowdown in the US are being made worse by the re-emerging tensions in the banking sector as bank deposit outflows from their peak are at their highest since 1975. This is driving US dollar weakness, allowing both EUR/USD and GBP/USD to climb higher. Although the Fed is widely expected to deliver another 25-basis point interest rate hike in May amid signs of persistent inflation, increasing recession fears and financial instability have fanned speculation that the Fed will be forced to cut interest rates several times before the end of 2023. This is USD negative. But if the Fed pushes back against such dovish pricing, the dollar could quickly recoup recent losses.

Investors now look ahead to first-quarter US GDP figures released this afternoon. The world’s largest economy is forecast to have grown by 2% on an annualised basis, which would mark a deceleration from the 2.6% pace registered in the final three months of last year.

Is pound primed for breakout?

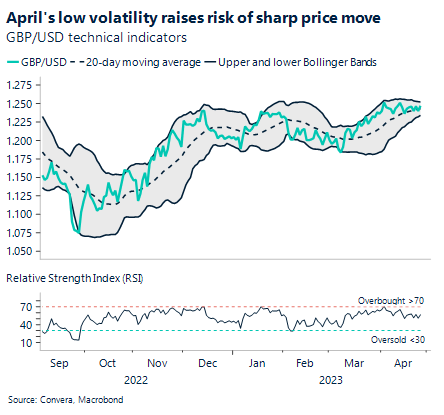

Sterling rallied off Tuesday’s lows to reclaim $1.25 against the US dollar briefly before reversing. The currency pair has been stuck in a two-cent range for the past month during a period of low volatility. Technical indicators suggest GBP/USD could be primed for a sharp price move in either direction as Bollinger Bands contract.

UK CBI data beat forecasts yesterday, hinting at a recovery in UK growth that may keep the Bank of England (BoE) on its current hiking cycle. This supported sterling demand yesterday, but GBP/USD is being largely driven by offshore factors, particularly from the US, which are putting downward pressure on the dollar. BoE rate expectations are moving further above those for the Fed into year-end as well as over the medium-term, which is giving the UK a significant advantage over US rates, proving bullish for GBP/USD. However, should global financial trouble heat up, dovish sounds from BoE policymakers may gain traction, softening the hawkish outlook. With that, it’s hard to pinpoint which direction GBP/USD could breakout from its current narrow trading range. Bollinger Bands are a technical indicator designed to measure volatility as the bands are plotted at a standard deviation level above and below a simple moving average of the price. Exchange rates have a tendency to bounce within the bands’ envelope. But when the bands tighten during a period of low volatility, it raises the likelihood of a sharp price move in either direction.

Could we see a break north of $1.25 and a retest of 11-month highs beyond $1.2550 soon? Overbought signals are not yet flashing red, and a close above the 2023 high would be a strong positive signal for further upside.

Euro clips fresh 1-year high

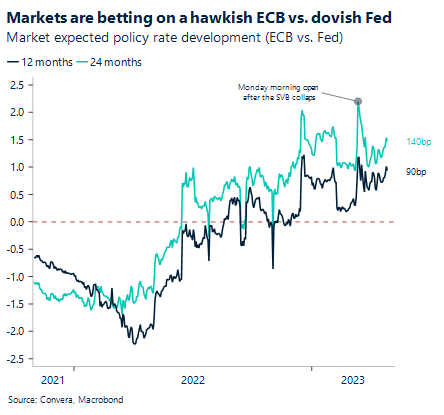

The euro is on track to record its eighth weekly gain out of nine against the US dollar, is up nearly 5% from its year-to-date low and clinched a fresh 1-year high late yesterday as sentiment across the bloc improves, economic growth remains resilient, and the European Central Bank (ECB) remains more hawkish than the Fed. The euro remains an attractive bet.

Underlying inflation, particularly in the services sector, remains sticky across Europe, cementing the view that the ECB will hike interest rates again this time next week. But markets are weighing up the possibility of a larger 50-basis point hike, dependent on the slew of economic data that will be released ahead of the next meeting, which could tilt the scales in favour of such a hike. Either way, whatever size rate rise next week is unlikely to be the last. Absent renewed banking-sector stress spilling into Europe, the ECB is expected to hike at least three more times before year-end, which has resulted in a narrowing of US-EZ rate differentials, favouring EUR/USD to climb higher. As this is the most traded currency pair in the world, flows from one currency into another often have an impact on other EUR or USD denominated currency pairs such as GBP/EUR. The stronger demand for euros recently has dragged GBP/EUR back under €1.13 and a break below €1.1250 could trigger an extension lower with €1.12 and the year-to-date low of €1.1130 potential downside targets in the short term.

On the data side, the Eurozone’s calendar includes business confidence and economic sentiment data today and individual countries’ inflation figures will start to be published tomorrow.

Commodity currencies are under pressure

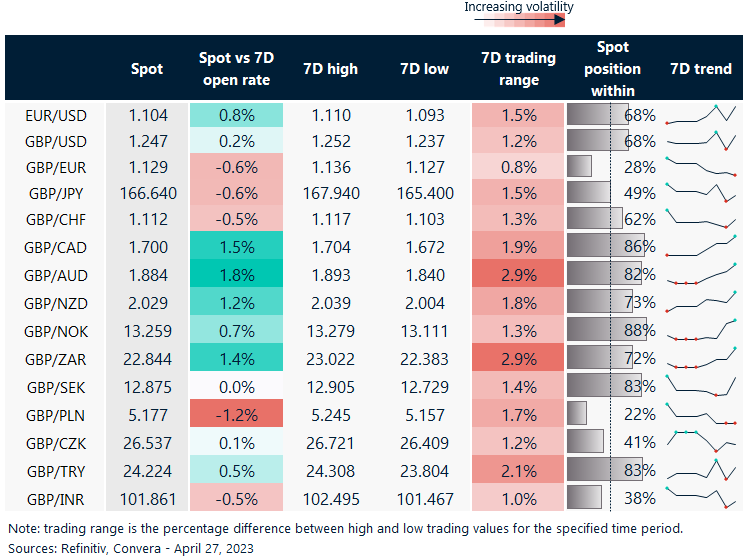

Table: 7-day currency trends and trading ranges

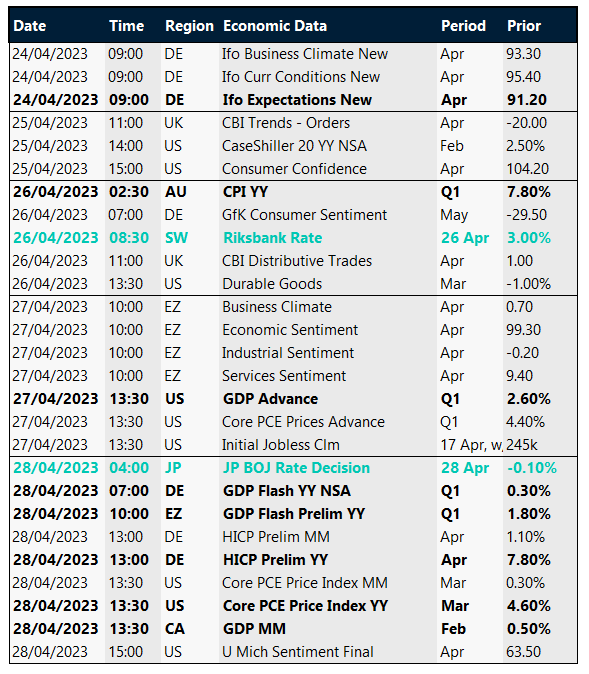

Key global risk events

Calendar: Apr 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.