Will one recession lead to another?

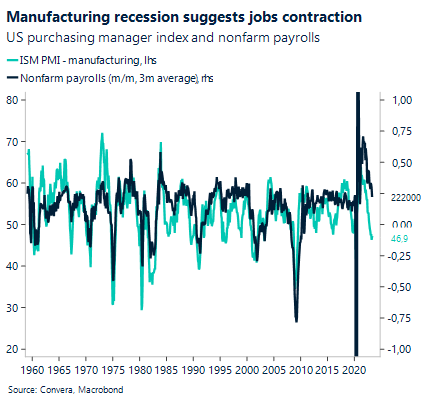

The US economy has held up reasonably well against the banking crisis and tightening shock, but some pockets of weakness have started to appear. The manufacturing sector remains deeply in contraction territory, with the purchasing manager index falling from 47.1 to 46.9. Cyclical leading sub-indicators like new orders are approaching the 40-mark, which has historically signaled an increased likelihood of a US recession.

Holding up the economy is the consumer and labour market. While cyclical and interest rate sensitive parts of the economy have already come under pressure from global headwinds and the tightening of monetary policy, the labour market is doing surprisingly well. Some leading indicators like quits rates, indeed job openings and survey based hiring expectations have started coming down, but they have so far failed to manifest in significantly weaker job growth. We continue to believe that the interest rate hikes by the Fed and weakening of the manufacturing sector should start impacting the labour market as well. Statistical adjustments, seasonality effects and a high noise to signal ratio make it hard to forecast today’s nonfarm payrolls report for the month of May, where economists are expecting a jobs growth slowdown from 253k to 190k. However, the medium term trends remain clearly negative as weaker demands and tighter lending conditions spill into weaker hiring.

A number below 200k should drag down the 3-month jobs growth average further down, in line with an ISM PMI number of below 50. Markets continue to see a pause at the June meeting as the most probable outcome, and are putting a 73% probability on that scenario. EUR/USD rebounded following hawkish ECB speak and the disappointing US PMI numbers and has recouped all the losses made during the week. The level around $1.08 remains fought over between bulls and bears, and the nonfarm payrolls report will add fuel to one or the other side.

How long can the ECB push back against cuts?

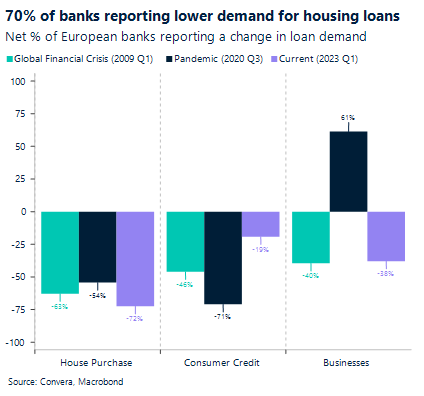

Core inflation in the Eurozone slowed for the second month in a row, rising by 5.3% during the last 12-month through May. Headline inflation has now fallen from 10.1% to 6.1% since October, and leading indicators like surveys on price setting and broader inflation indicators like commodity prices suggest further disinflation is in the pipeline. The European economy is clearly slowing, and higher interest rates are taking a toll on export oriented economies like Germany, which fell into a recession after contracting for two consecutive quarters.

The recent string of macro weakness has pushed the Euro down against most major currencies. However, while we wrote yesterday about how falling consumer prices will shift pressure from the ECB to the Euro, European policymakers have so far been hesitant to acknowledge the disinflationary forces. While not pushing back on the market assumption, that the central bank will be done raising rates after July, most governors see the speculation of rate cuts in 2024 as unrealistic.

President Christine Lagarde said that the ECB still has ground to cover in its inflation fight and that there are no signs that core inflation has peaked. ECB Vice President Luis Guindos did not want to declare victory over inflation as well, while French and Dutch council members Villeroy and Knot pushed back against priced in rate cuts for 2024. The unified attempt of central bankers to discourage these bets has seen EUR/USD rise in yesterday’s trading. GBP/EUR fell to $1.1640, after reaching a new yearly high for a brief moment at $1.1670.

British home prices fall by most since ‘09

The housing market in the United Kingdom remains under pressure from high inflation rates and bets on continued monetary policy tightening from the Bank of England. British home prices declined by the most since 2009 during the last twelve months through May, falling by 3.4%. At the end of the first quarter, the housing market started showing signs of some improvement.

Mortgage approvals had risen to just above 50 thousand in March, reaching a 5-month-high. However, continued inflation surprises have cemented the need for the Bank of England to push back against the underlying price pressures. With rates expected to remain at elevated levels, consumers pulled back their demand for mortgages in April, which coincided with a 0.4% month-on-month fall in home prices.

Consumers with fixed mortgage rates have so far been mostly shielded from the BoE’s tightening cycle. However, around 1.6 million British households are yet to face higher borrowing costs when their mortgage contractions roll over this or next year. This is why it will be definitely for the Bank of England to deliver the four priced in rate hikes against the backdrop of a weaker global growth outlook, falling household spending and other central banks likely starting to cut rates in 12 to 18 months. Especially given the correlation between the property and labour market.

Risk assets trend higher on Fed pausing bets

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 29- June 02

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.