Written by the Market Insights Team

Doves take flight on tame CPI

Antonio Ruggiero – FX & Macro Strategist

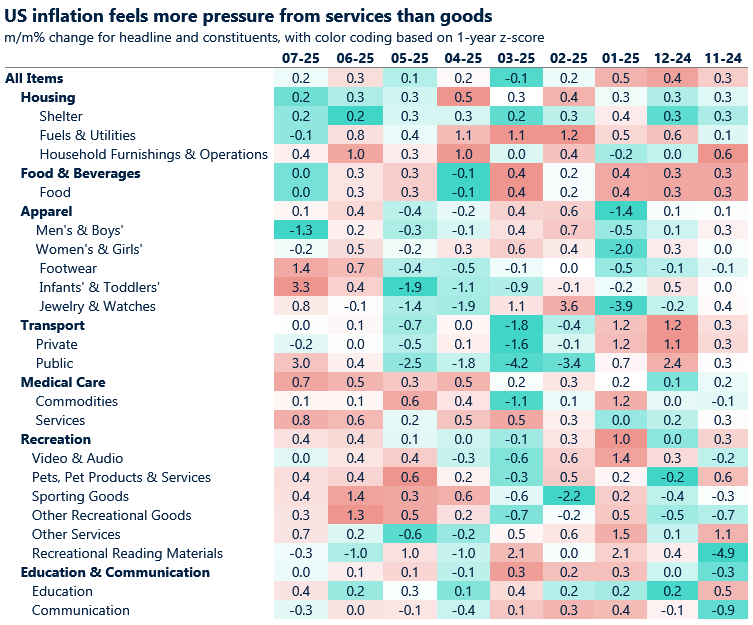

Markets had certainly been expecting something more shocking from the US inflation report yesterday. On a month-on-month basis, both headline and core CPI came in exactly as forecast—0.2% and 0.3%, respectively. The services component contributed most to price pressures in July, with shelter (index up 0.2%), transportation (airfares up 4%), and recreation being the key drivers.

However, services are not where analysts are currently focused. Instead, it is goods inflation that is under close watch in light of Trump’s tariff-centered policy agenda. In that regard, the report helped ease some concerns about the inflationary impact of tariffs. Among the most closely watched goods categories, household furnishings and operations slowed to 0.4% from the previous month, apparel rose just 0.1%—its lowest since May—and video and audio equipment remained flat.

With fears of a much hotter report, Treasuries rallied, sending two-year yields down 4 basis points to 3.73% as bets increased for a rate cut next month (now priced in at 90%). The dollar tumbled circa 0.4%.

These results suggest that American companies have so far managed to largely absorb price hikes within their profit margins. Retail sales data later this week will indicate whether these efforts have paid off as consumers continue spending without hesitation.

The report also opens the door to speculation about a more orderly PCE (Personal Consumption Expenditures) reading later this month, which could further support the case for a rate cut in September. Tomorrow’s Producer Price Index (PPI) data will offer additional insight into categories that feed into the PCE report.

It’s true, however, that recent months were dominated more by tariff threats and negotiations than by actual implementation, with rates largely held in check. This complicates matters for the Fed, as tariff-induced inflation – now that many of these higher rates have gone into effect – could still materialize in the coming months. Coupled with a cooling job market, the resulting stagflationary environment could exert further downward pressure on the greenback.

Euro rides the policy gap

George Vessey – Lead FX & Macro Strategist

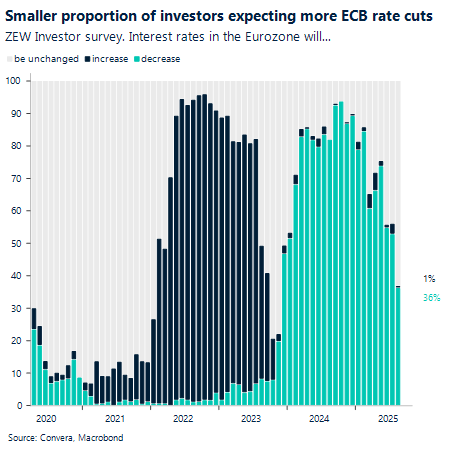

EUR/USD jumped towards a 2-week high on Tuesday, bolstered by the mixed US inflation report that failed to derail the market’s dovish Fed narrative. At the same time, money markets have pared wagers on future interest rate cuts by the ECB ever since President Christine Lagarde that officials have scope to pause their cutting cycle after holding rates steady at 2% last month. As such, the euro is benefiting from growing policy divergence between the ECB and the Fed.

That said, eurozone sentiment data is flashing warning signs. Germany’s ZEW survey for August showed a sharp deterioration in both the current situation (from -59.5 to -68.6) and the expectations gauge (from 52.7 to 34.7). While the ECB typically incorporates activity surveys into its policy outlook, the ZEW alone won’t move the needle. But if upcoming Ifo and PMI readings echo this weakness, September could bring renewed dovish dissent – especially with inflation still subdued across the bloc.

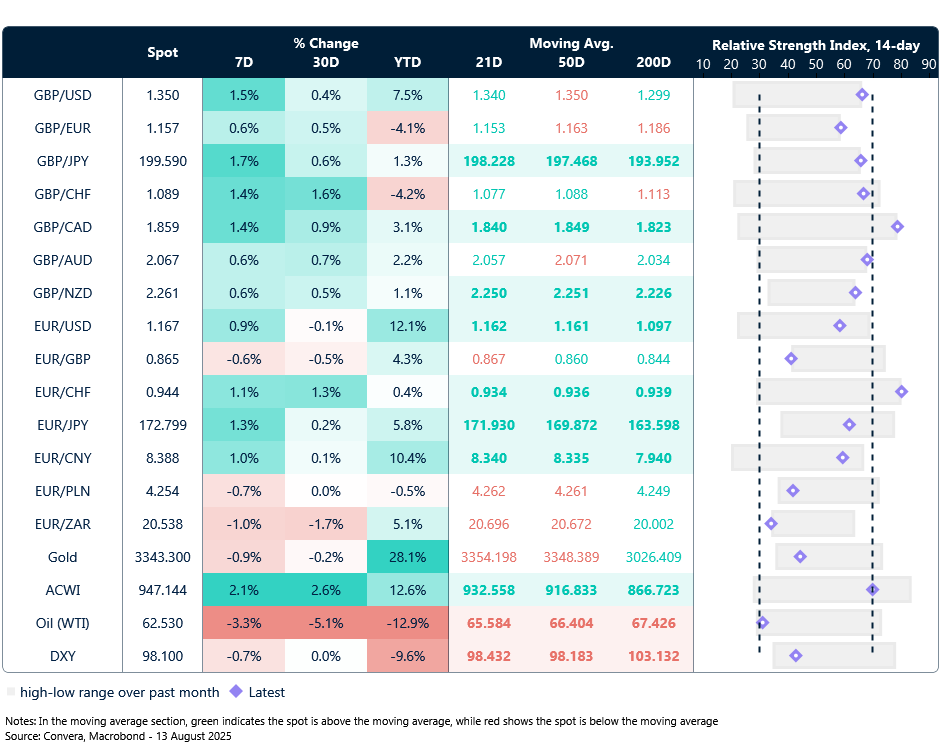

For now, though, the euro’s momentum is more about dollar softness than euro strength. The dollar index is down around 2% month-to-date, and EUR/USD has reclaimed ground above its 50-day moving average. Technicals are turning constructive, and real rate differentials continue to tilt in favour of the euro.

Geopolitical noise – particularly around Russia -U.S. tensions – remains a background risk but hasn’t materially dented euro sentiment. With ECB communication on pause through August, the path of least resistance for EUR/USD remains higher, at least until fresh eurozone data or Fed signals shift the narrative.

Sterling breaks out as Fed softens, BoE stands firm

Antonio Ruggiero – FX & Macro Strategist

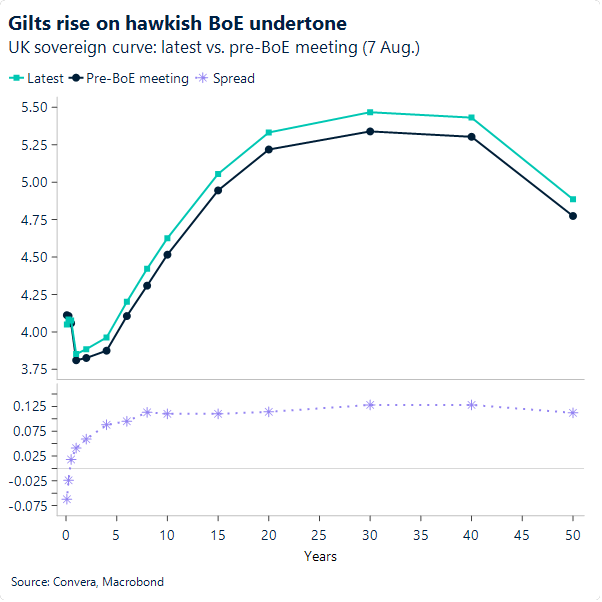

The pound had a strong session yesterday, rising against both the dollar and the euro after the UK jobs report showed a smaller-than-expected drop in payrolls last month. While the broader picture still points to a softening labour market, signs that the pace of loosening may be easing helped reinforce the hawkish tone from the Bank of England the previous week – despite its 25-basis-point rate cut. It may be that the adjustment to higher labour costs – driven by the rise in employer National Insurance contributions in April – has now been largely absorbed.

GBP/USD rose over 0.60% yesterday and is up more than 2% month-to-date. The Fed’s increasingly dovish tilt stands in stark contrast to the BoE’s: while markets are pricing in more than two cuts for the former, less than a 70% chance of a cut is priced in for the latter by year-end.

The pair broke through resistance at 1.3450 – a level that had been tested repeatedly in recent days – propelled by a tamer-than-expected U.S. inflation report. With recent policy rate developments from both countries now offering stronger fundamental support to sterling, the pair appears more comfortable in the 1.35 zone, which is likely to establish itself as a new support level going forward.

The pound now eyes 1.36 but awaits tomorrow’s quarter-on-quarter GDP figures and industrial production before making a move, while today it consolidates at the base of the 1.35 zone.

Oil drops ahead of Ukraine-Russia conflict talks

Table: 7-day currency trends and trading ranges

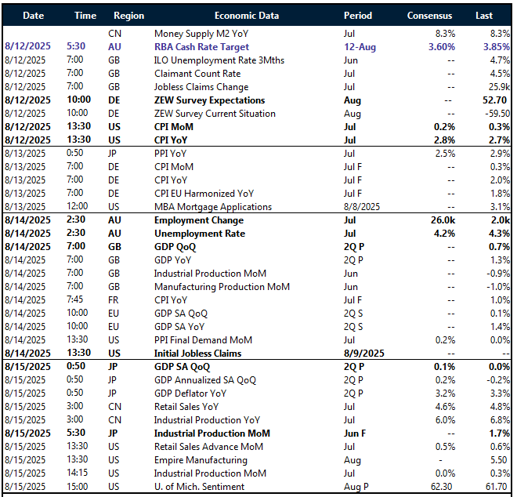

Key global risk events

Calendar: August 11-15

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.