Written by Convera’s Market Insights team

Employment slump drives yields lower

Boris Kovacevic – Global Macro Strategist

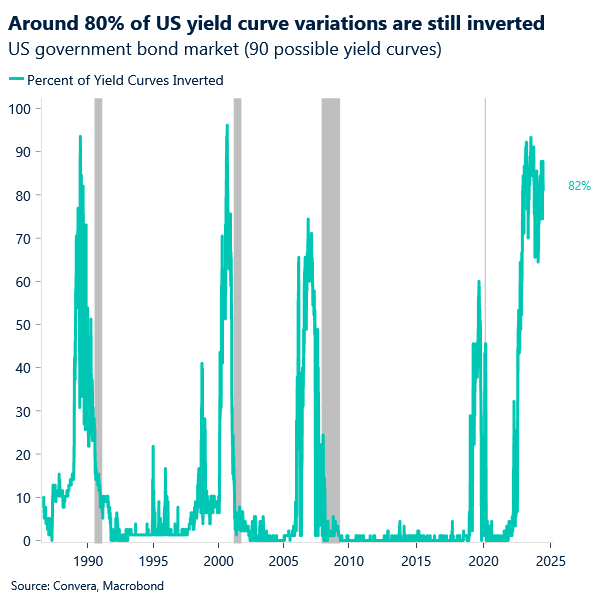

Surprisingly, sticky inflation and the delayed easing cycle from the Federal Reserve have anchored short-dated bond yields at elevated levels this year. Around 80% of possible yield curves constructed for the United States are inverted. While a strong recession signal in the past, fixed income has been largely ignored by investors in the current cycle with some throwing its predictive power into question. This has been the story for the better half of the past six months.

However, the recent string of data coming out of the US has disappointed expectations, throwing into question the narrative of US exceptionalism. The downside surprise on inflation on Friday, the ISM PMI miss on Monday and weaker than expected job openings yesterday added to the fall of government bond yields. The 2-year Treasury yield declined for a fifth consecutive day in a row, falling from 5.0% to 4.7%. The bets of the Fed policy easing increased since Friday with investors now seeing two rate cuts as the most likely scenario. The US dollar surprisingly withstood the downward pressure put on it through the macro data due to some safe-haven flows coming in from the surprise election result from India.

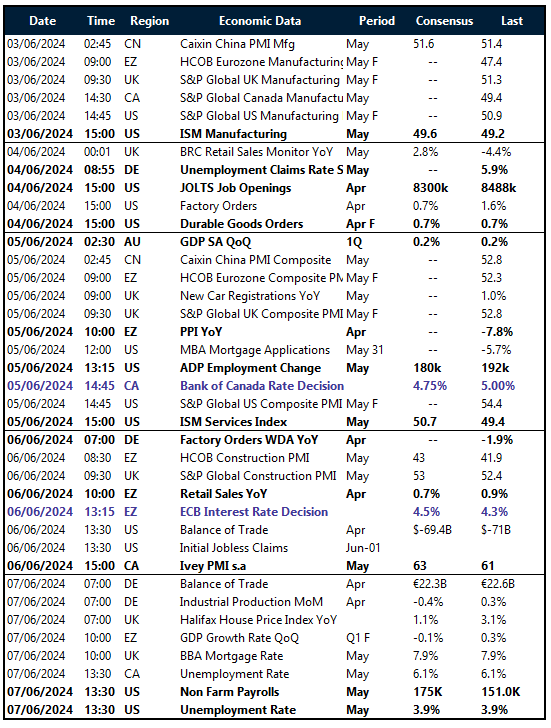

US job openings declined by short of 300 thousand to 8.06 million in April, coming in at the lowest level since 2021. Markets reacted sharply to the print given the context of the last non-farm payrolls report surprising the consensus to the downside as well. This now puts the attention on the ISM services report – especially the employment sub-component – today and the upcoming labor market report on Friday. The barometer is expected to have rebounded modestly in May. However, the recent Beige Book from the Fed clearly indicated hiring momentum slowing, which could result in the employment sub-index from the ISM PMI deteriorating as well. This would move markets.

Risk aversion ruffles the pound

George Vessey – Lead FX Strategist

The risk sensitive pound was at the mercy of renewed global risk aversion on Tuesday as investors sought safety in traditional safe haven currencies like the US dollar, Japanese yen and Swiss franc. Prompting the risk off flows was the surprising result from India’s election whereby Narendra Modi lost his parliamentary majority.

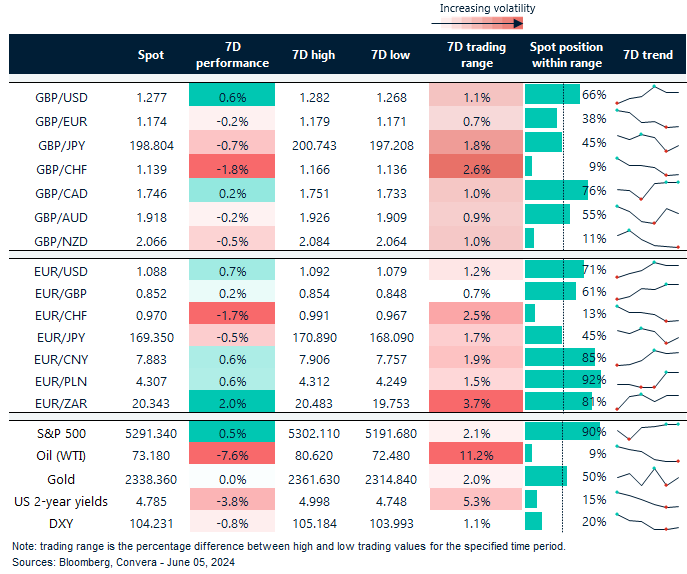

The market had been expecting a landslide win as predicted in exit polls, but it just goes to show that you can’t always trust the polls. In the end, the vote was much closer than most thought possible and the shock coalition result triggered a wave of safe haven demand supporting the Japanese yen. The yen was also buoyed by hawkish comments from a Bank of Japan (BoJ) official hinting at the central bank scaling back bond purchases at its upcoming meeting this month. Yen risk reversals swung toward calls (betting on JPY appreciating) across several tenors, indicating the most bullish shift in weeks. USD/JPY fell to 2-week lows whilst GBP/JPY and EUR/JPY posted their biggest daily drop in over a month, the former falling from ¥200 to almost ¥197. The yen has given up most of those gains this morning, but volatility is picking up and further JPY strength may be on the horizon amidst monetary policy divergences and political events.

The reverberation across financial markets as a result of the surprise political and monetary policy developments this week point to how sensitive certain currencies can be. Big swings in a short space of time can, and do, unfold – particularly when it comes to the yen. The British pound, a risk sensitive currency, is also prone to large swings, especially bouts of weakness amidst heightened risk aversion – something to bear in mind with the looming central bank meetings this month and upcoming elections in Europe, the UK and the US.

Attention on the ECB

Boris Kovacevic – Global Macro Strategist

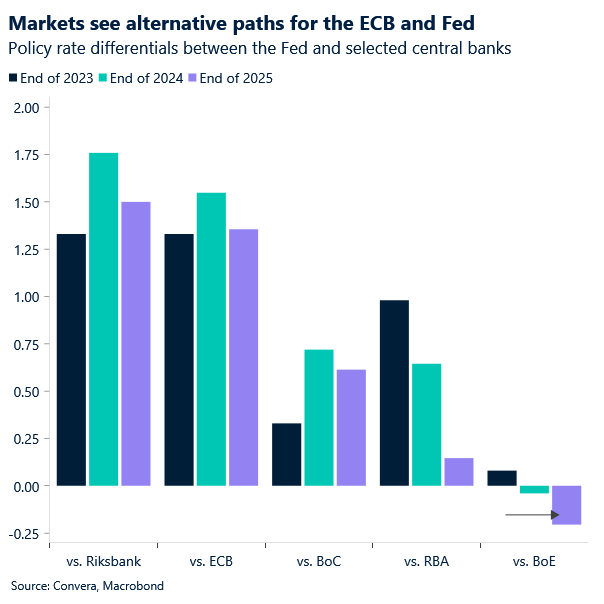

The euro depreciated for the first time since last Wednesday as risk-off safe-haven flows dominated markets. German unemployment claims rose unexpectedly by 25 thousand compared to the 10 thousand expected. The unemployment rate remained unchanged at 5.9%. Still, investors have pared back bets of policy easing coming from the European Central Bank this year, mainly on the upside surprise of inflation over the past two months. The uptick of inflation in May prompted some policy makers to strike a more hawkish tone, throwing into question the potential of a back-to-back cut in July.

Some central bankers, particularly the German ones, seem to have put the July meeting off the table when it comes to easing policy. However, pricing for the ECB continues to follow the Fed. This means that a potential downturn in the US economy and waving US exceptionalism would be able to put back some of the priced-out rate cuts from some weeks ago. The euro is still on track to appreciate for seven out of the last eight weeks on the lingering effect of last week’s sticky inflation report.

EUR/USD is holding above the $1.0880 level but momentum will have to be confirmed by todays US ISM PMI and Thursday’s ECB rate decision. Any positioning will be light and limited before the US labor market report on Friday, though.

Safe havens are swinging

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: June 3-7

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.