Global overview

The greenback fell to one-week lows overnight but steadied ahead of today’s all-important readout on America’s job market. A late week slide knocked the dollar to one- and two-week lows versus the euro and sterling, respectively. Canada’s dollar climbed to its highest level in more than two weeks. Ahead of U.S. jobs data, the market mood brightened, helped by the U.S. Senate approving the deal to suspend the debt ceiling over the next two years. Markets are also cheering comments this week from Fed officials who dampened expectations for the central bank to raise rates in June. The prospect of the Fed delaying its next rate hike dealt a blow to the dollar, given the near certainty of both the European Central Bank and the Bank of England raising rates this month. The dollar index was on track for its first fall in four weeks with its nearly 1% slide on pace for one of its worst weekly performances of the year. Today’s jobs report will be key for the dollar. Another upside surprise would underscore the view that the Fed isn’t done tightening, while a miss to the downside could add to the dollar’s softening. Forecasts suggest U.S. hiring moderated to 190,000 jobs in May from 253,000 in April.

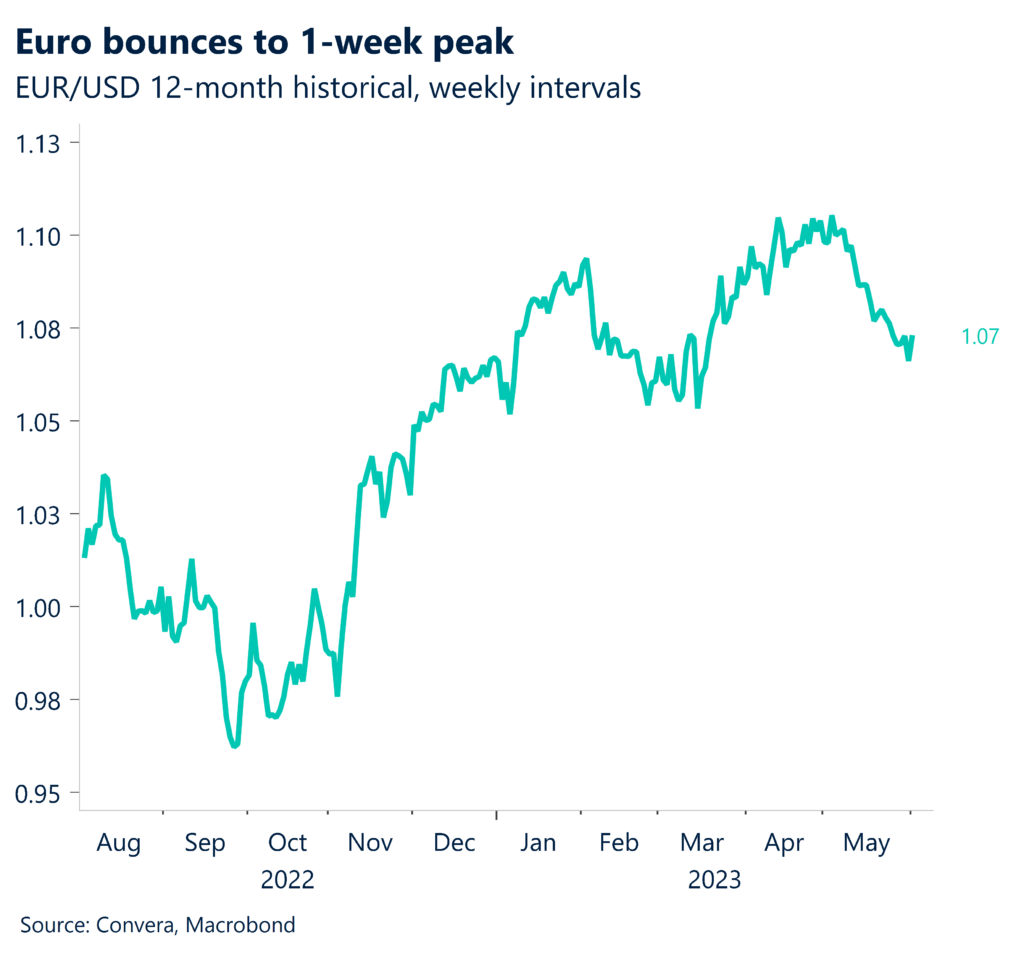

Euro’s losing streak in jeopardy

The euro rose to 9-day highs Friday and was on track for its first weekly gain against the U.S. dollar in a month. The euro found solid support this week from a reassessment in the outlook for global lending rates. Fed officials this week signaled an inclination to postpone the next rate hike to the second half of the year following a barrage of 10 straight increases that boosted borrowing costs by five percentage points in a little over a year. The euro’s bounce appears to be more a function of the softer dollar than a material brightening in sentiment toward the bloc’s shared currency, particularly after inflation rates among core euro zone nations surprised to the downside, suggesting fewer rate hikes on the ECB’s table.

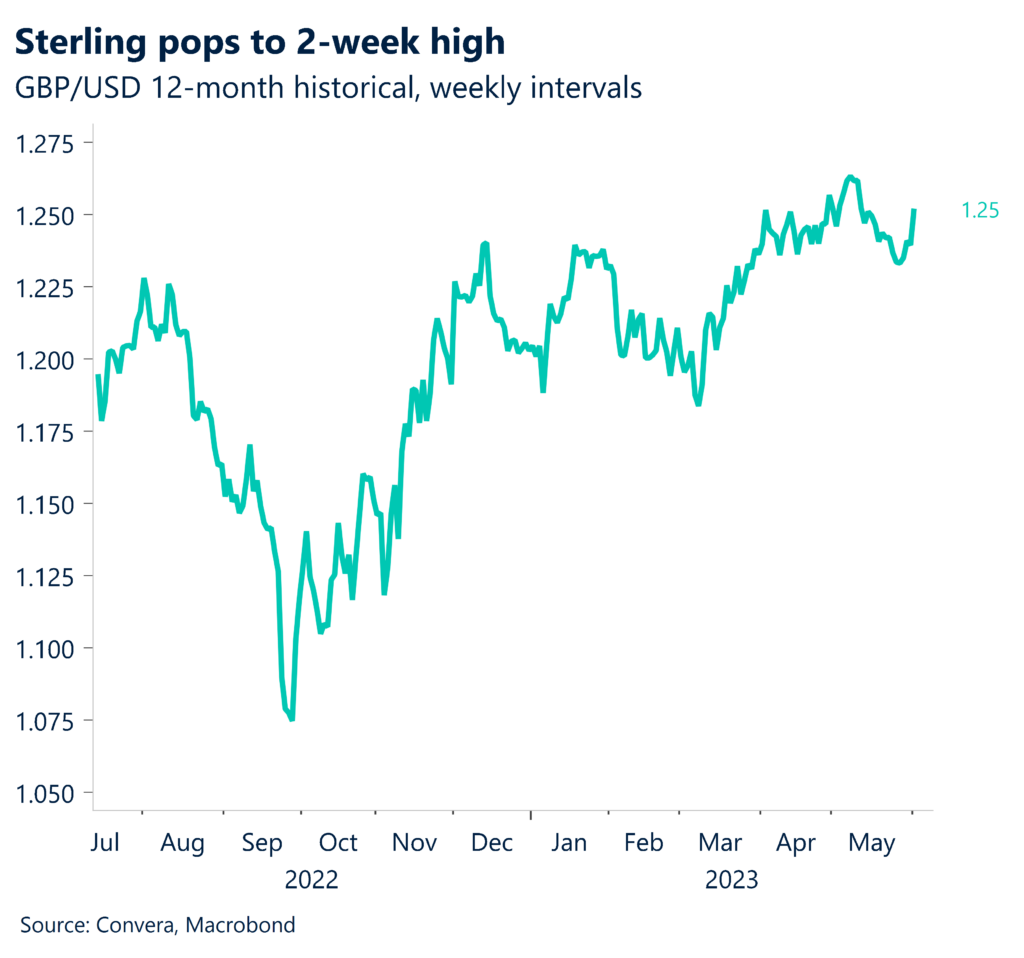

Sterling on track to snap 3-week slide

The UK pound climbed to 17-day highs as markets cheered news that Washington’s debt ceiling deal was all but signed, sealed and delivered. Improved market sentiment, along with a softening of the stronger dollar, helped sterling stage a late week surge back above 1.25, its first foray above that level since mid-May. Moreover, the outlook for global interest rates casts sterling in a more bullish light than the dollar, given expectations for U.S. lending rates to fall at a faster pace over the coming year than in the UK.

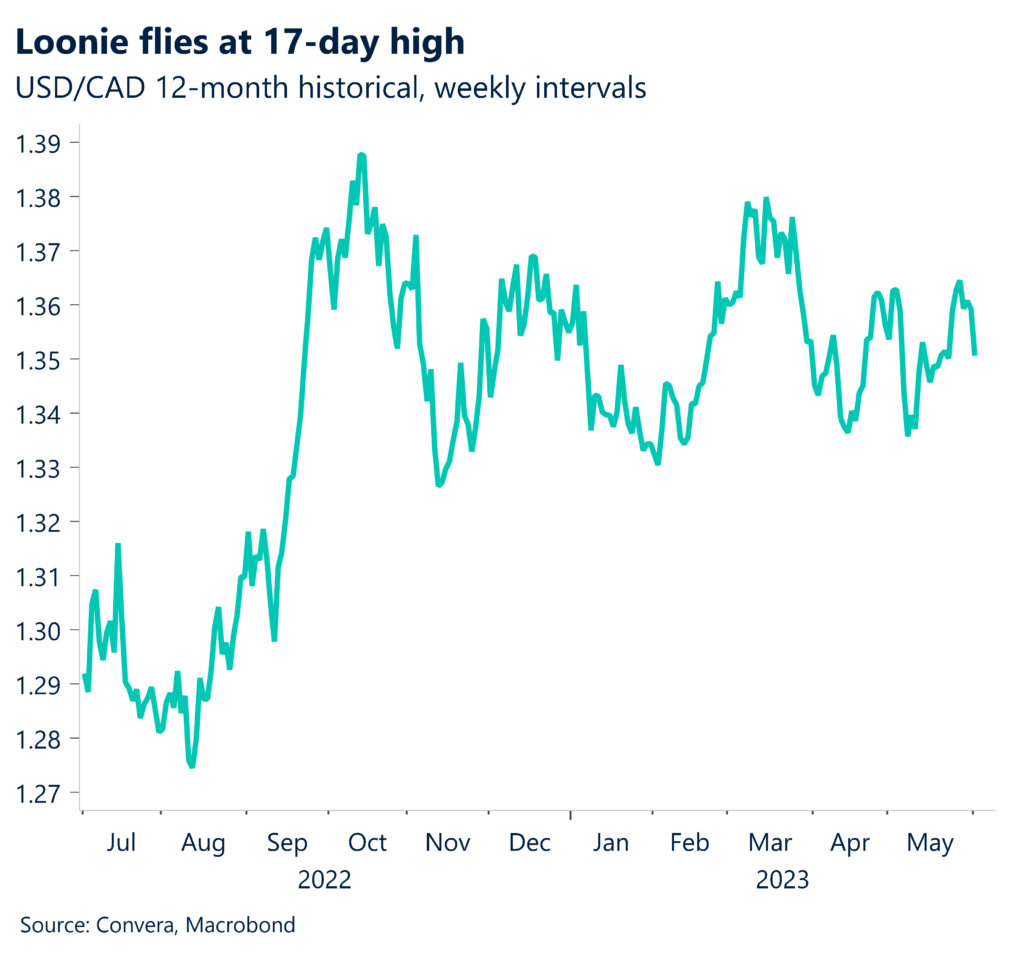

Loonie flies; U.S. hiring accelerated by 339K in May

Stronger global stocks, a weaker greenback, and oil back above $70 all converged to lift the Canadian dollar to more than two-week highs. The loonie also is enjoying a residual boost from news this week that Canada’s economy fared stronger than expected over the first quarter, news that opened the door wider for Ottawa to restart rate hikes as soon as next week. It’s considered a closer call whether the BOC on June 7 will raise rates by 25 basis points from 4.50%. Elsewhere, the U.S. dollar pared declines following mixed data on America’s labor market. Nonfarm payrolls surprised again to the upside with a brisk gain of 339,000 in May while revisions showed that hiring in March and April was upgraded by a combined 93,000 jobs. The data came with a fly in the ointment, however, as unemployment ticked up to 3.7% from 3.4%. The solid increase in the trend rate of hiring keeps the Fed on track to raise rates by July, and likely sound more hawkish at its mid-June meeting.

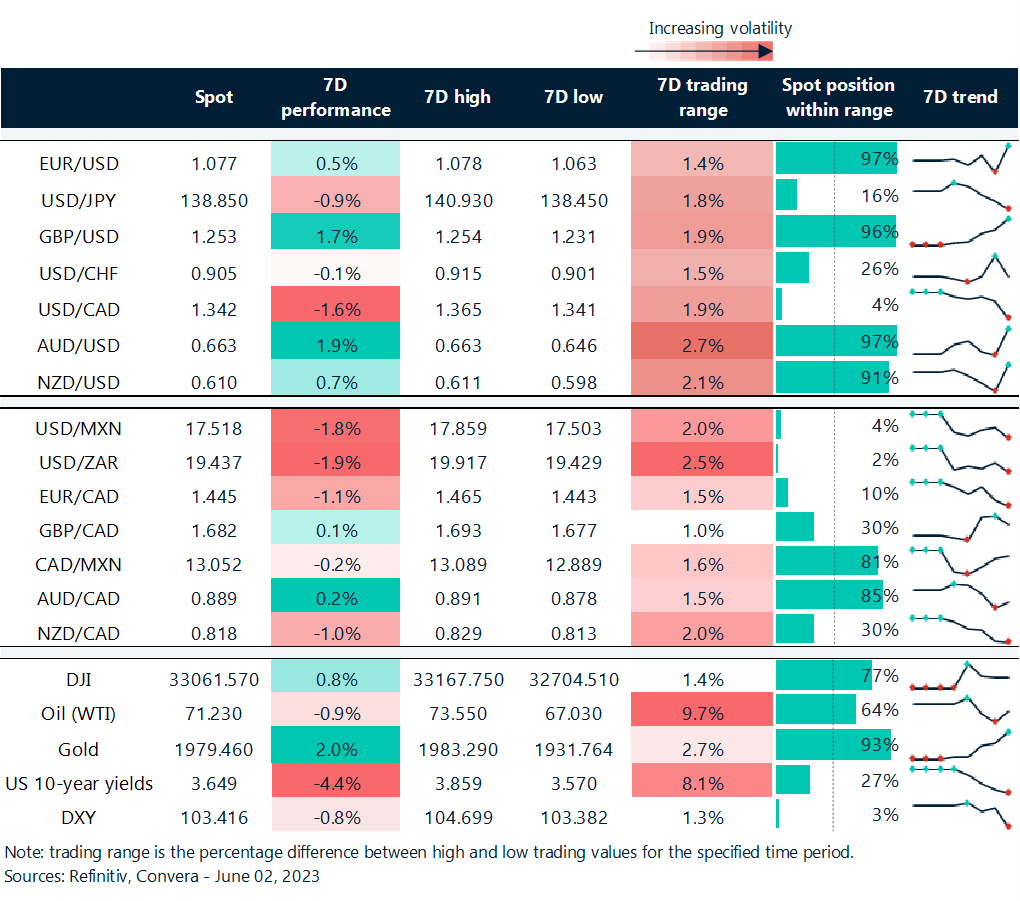

Dollar knocked to bottom of weekly range

Table: rolling 7-day currency trends and trading ranges

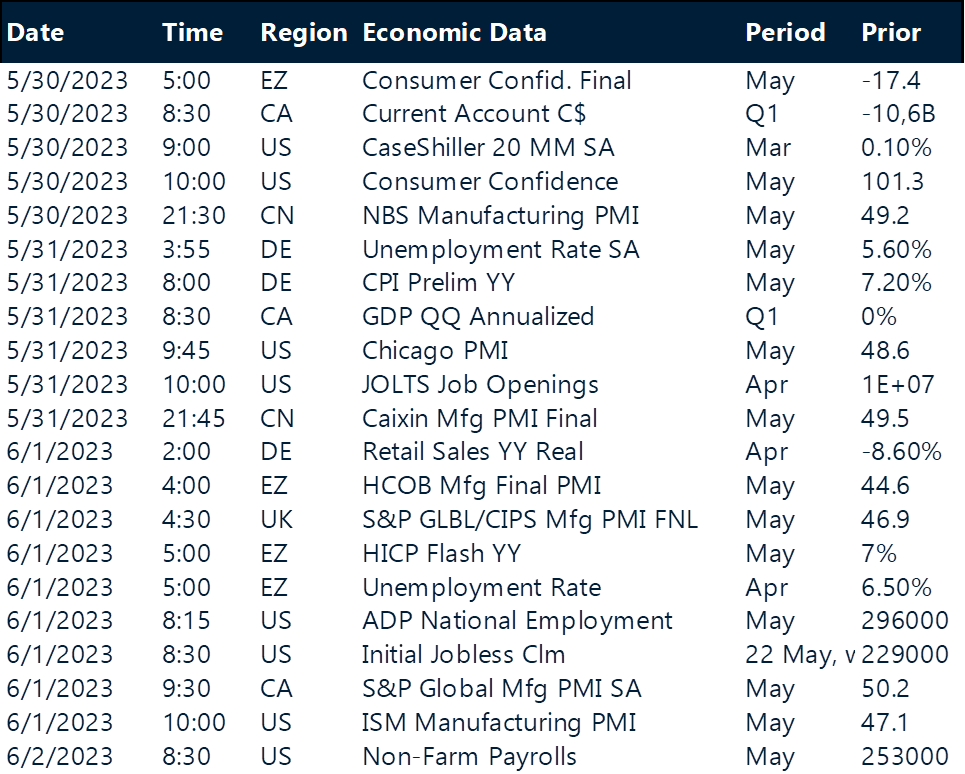

Key global risk events

Calendar: May 29-Jun 2

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.