Written by Convera’s Market Insights team

Sticky inflation vs. weakening growth

Boris Kovacevic – Global Macro Strategist

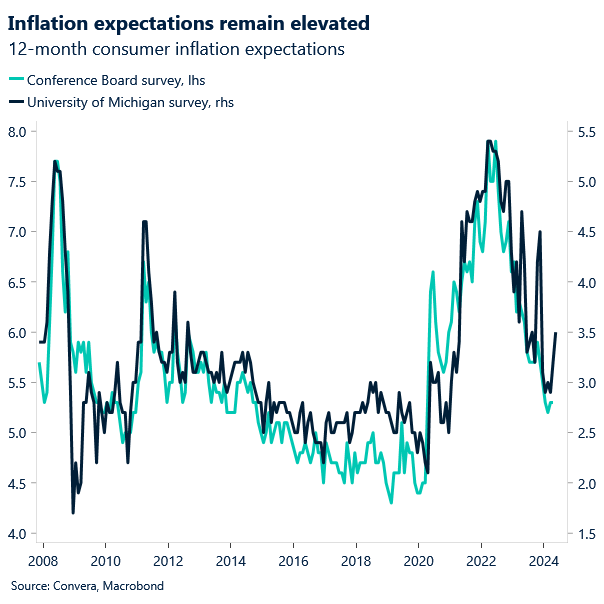

The macro data out of the US was mixed last week. Initial jobless claims released on Thursday rose by 22 thousand to an 8-month high of 231 thousand on the week ending May 4th. The data miss was followed by the Michigan University’s survey showing consumer confidence falling to a 6-month low. However, the same report indicated inflation expectations for the year ahead rose from 3.2% to a 6-month high of 3.5% in May. The US dollar’s reaction to this set of data tells us all we need to know about what is moving markets. Initially, the US dollar reacted negatively on the downside surprises on the narrative of a cooling economy. The rise in inflation expectations pushed the Greenback up again, leading the US Dollar Index to a positive weekly close. News on the consumer price front remain the dominant force shaping FX with other narratives playing second fiddle to inflation prints.

The week was still a strong one for equities. China came back from a 5-day break last week seemingly refreshed with investors pouring into equities, with the CSI 300 securing its fourth weekly rise in a row. European and US stock benchmarks followed suit as the S&P500 pushed higher for a third week while the Stoxx 600 reached a new record high. A strong earnings season and investors bringing back some of the policy easing bets priced out (Fed, BoE) during the last couple of weeks have given investors the green light to switch into a risk-on mode. The Swiss Central Bank started off the European dominated G10 easing cycle in Q1 with the Swedish Riksbank following up with a 25-basis point cut last week. Policy makers are cautiously trying to support their respective economies, which have suffered from benchmark rates at decade-highs.

Looking ahead, the upcoming week could paint a complex picture of the US economy that is experiencing high inflation and a continued divergence of soft vs. hard data. Both core and headline inflation are expected to have risen by 0.3% m/m in April with retail sales coming in at 0.4%. The producer price index has proved market moving as well in recent times, especially in weeks where the print was combined with other second-tier data to create a certain narrative. With Fed speak recently having shifted to a more hawkish undertone, policy makers could feel vindicated by such strong data and continue pushing the higher for longer narrative. Small businesses are suffering. At the same time, small business sentiment is expected to have dropped further in April, after reaching an 11-year low the month prior. Jobless claims, industrial production and the leading index will be closely watched as well.

UK jobs data in focus

George Vessey – Lead FX Strategist

It’s been a tough month for the British pound so far, appreciating against just 25% of its global peers as the odds of a June rate cut by the Bank of England (BoE) have risen to around 50% following the dovish 7-2 vote split and downgrades to the UK inflation outlook at last week’s BoE meeting. However, stronger than expected Q1 UK GDP results offered the pound some support last Friday as attention shifts to more hard data due over the coming days.

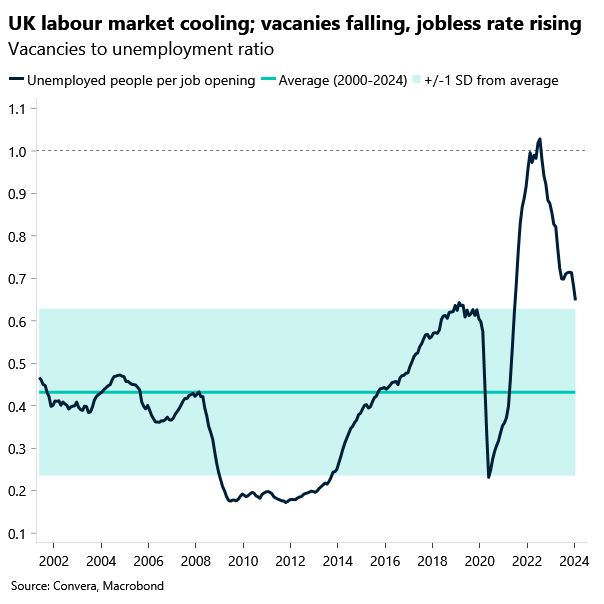

The yield on the UK’s 2-year Gilt, a good measure of near-term policy rate expectations, retreated to its lowest level in a month as total BoE easings bets for 2024 jumped from around 47 to 60 basis points. However, with overall G3 easing bets increasing of late, the pro-cyclical pound remains well supported, and despite falling to a fresh 1-week low, GBP/USD continues to gravitate towards its 200-day moving average at $1.2541. The weekly candlestick chart formation still reflects indecision though as market participants await a slew of key inflation prints from both the US and UK over the next couple of weeks to determine the policy paths of the Fed and BoE. UK labour market data, due tomorrow, is also key, with the unemployment rate expected to nudge higher, and wage growth to edge lower, and although the data’s reliability is still under question, a cooling labour market is also a green light for rate cuts.

If the odds of a June cut spike higher, sterling risks sliding back towards its 2024 low of $1.23 against the dollar whilst potentially testing €1.15 against the euro as rate differentials work against the UK currency.

Euro clocks fourth weekly advance

Ruta Prieskienyte – FX Strategist

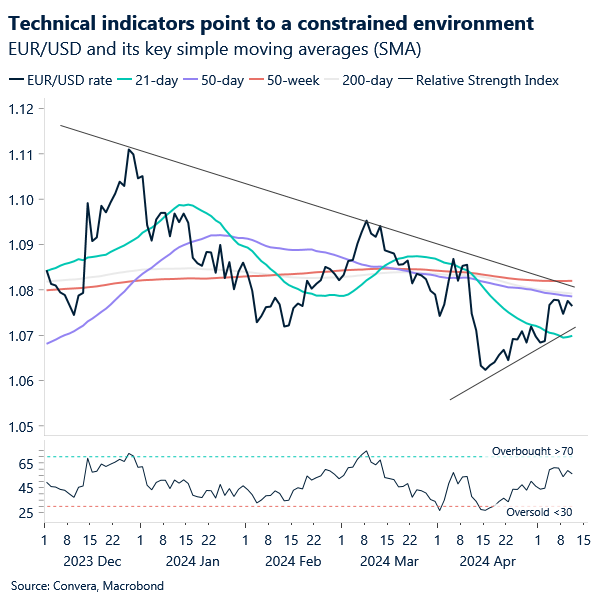

Last week’s euro performance was mixed, largely influenced by a slowdown in data releases, thus limiting trading opportunities for market participants. As 1-week realised intraday volatility plunged to September 2021 lows, EUR/USD bounced within a narrow range of $1.073 – $1.080 throughout the week. With investors buying into the weakening US economic and labour market narrative, the currency pair jumped to a 1-month high of $1.0780, thus clinching a fourth consecutive gain when compared on a weekly close basis.

The macro data from last week confirmed the thesis that the Eurozone economic recovery is underway. Eurozone PMIs for April were revised higher thanks to an upward revision in the services sector and taking the composite headline index to an 11-month high. On the demand side, consumer spending also displayed signs of recovery. March retail sales across the bloc recorded the sharpest monthly increase in the past 18 months. However, the German manufacturing sector continues to struggle, albeit less so than markets are expecting, as it marked the first contraction so far this year when measured on a monthly basis.

As the European Central Bank edges closer to a rate cut in June, as confirmed by the latest monetary policy minutes released on Friday, markets continue to focus on upcoming data releases for further clues on economic health. Final Eurozone inflation figures for April are due on Friday, with key figures from Germany and Spain expected on Tuesday. Additionally, Wednesday brings Eurozone industrial output data for March, providing insights into the sector’s recent performance. French first-quarter unemployment data will be released on Friday, along with the latest German ZEW survey for May on Tuesday, offering further insights into the Eurozone’s economic health.

In terms FX trends, the near-term outlook for EUR/USD suggests a potential continuation of range-bound trading in the immediate future. EUR/USD is currently confined within a triangle formation, with resistance from the 50- and 200-day SMAs just below $1.08 and support from the 21-day SMA around the $1.07 level. Thus, further weakness in the US dollar is a necessary condition for the pair to break above the $1.08 level, given the formidable technical barriers ahead.

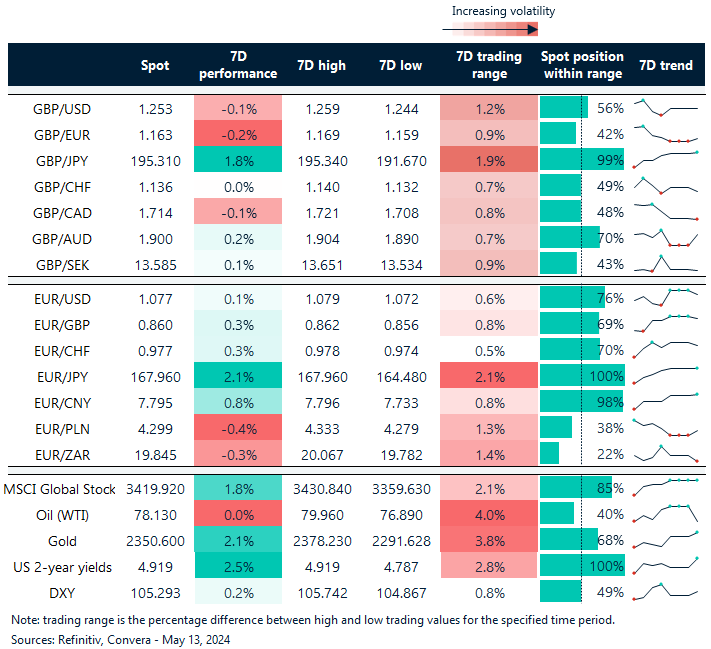

Japanese yen still under pressure, around 2% lower in a week

Table: 7-day currency trends and trading ranges

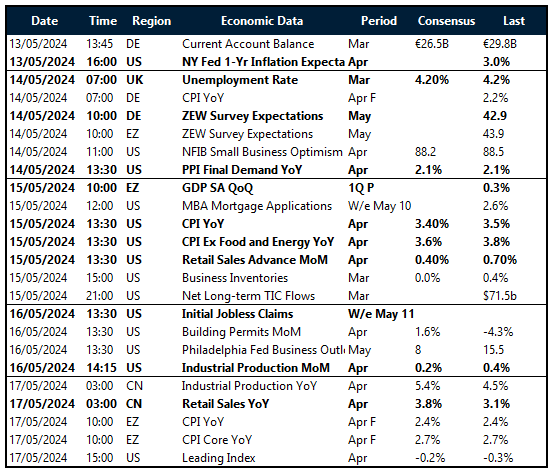

Key global risk events

Calendar: May 13-17

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.