The European Central Bank (ECB) has raised its interest rate for the sixth time in the current hiking cycle. The 50-basis point increase, which had been promised at the last meeting in early February, has been the third consecutive such move and has lifted the deposit rate to its highest level since 2008.

The ECB stands ready to provide liquidity support to financial markets if needed. However, the renewed data-dependent stance leaves markets without any forward guidance for the next meeting in May. The ECB had told Ministers on Tuesday that some banks could be vulnerable and affected by the banking turmoil in the US, which tells us that there might be a trade-off between securing financial and price stability at the same time. Christine Lagarde did not acknowledge this trade-off in her press conference after the meeting and continued to primarily focus on bringing inflation back to 2%. Given that the newly released projections show inflation sitting above the 2% target through 2025, the probability of a hike in May cannot be ruled out and markets currently put a 50% probability on that scenario.

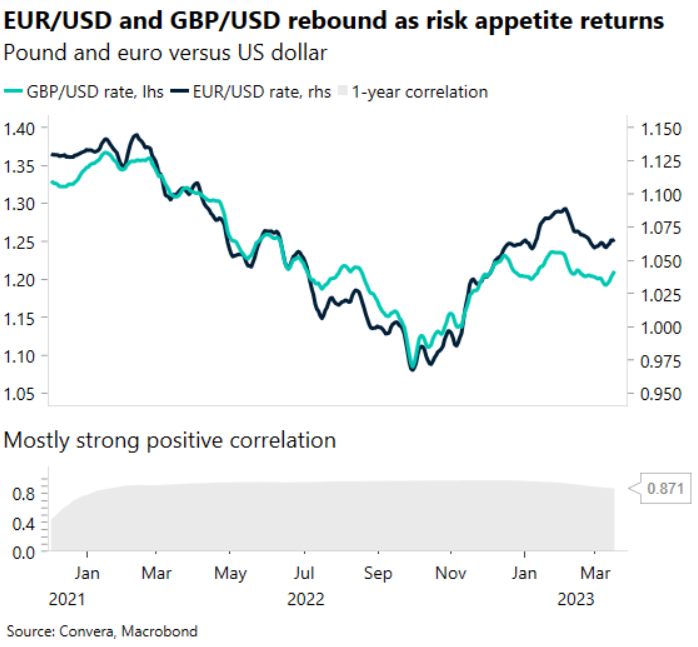

Today has started off with some hawkish ECB speak with both Madi Muller and Villeroy De Galhau saying that 1. inflation remains the priority and 2. that the inflation projection assumes more rate hikes to come. EUR/USD is up on the day and week and is almost trading like the turmoil regarding Credit Suisse never happened. The short-term range is now defined by the high and low before and during the crisis between $1.0750 and $1.0510.

Fed in focus next week

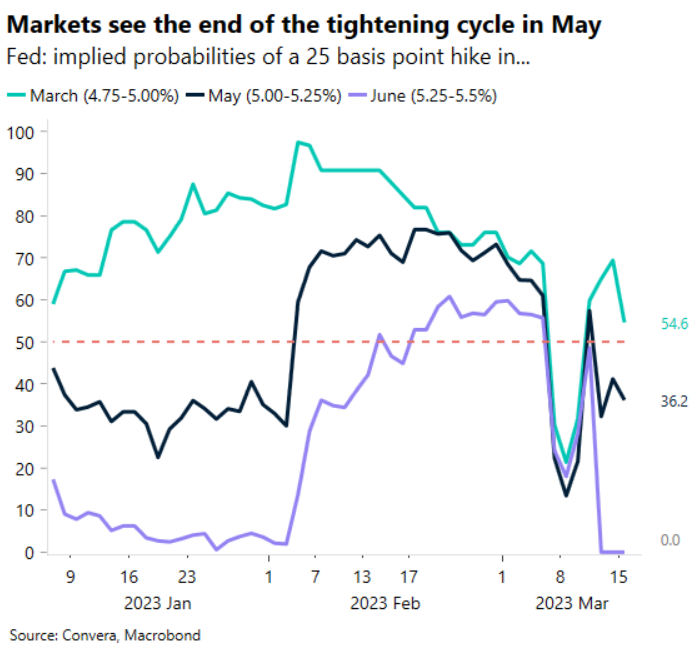

Volatility has surged this week, especially in bonds and interest rates. The probability of an incoming 50-basis point interest rate hike by the US Federal Reserve (Fed) was above 50% last week, but a rout in global markets after Silicon Valley Bank collapsed and a plunge in the share value of Credit Suisse have scuppered those bets. Now, markets are pricing an 80% chance the Fed will hike by 25-basis points and pause its tightening cycle in May.

The rapid repricing of interest rate expectations shows how swiftly markets can move when signs of systemic risks appear. But amid mixed economic data, rate expectations have been volatile for a while – driving short-term trends in exchange rates. The US dollar had erased its 2023 gains at the start of the week as the US banking crisis stood to tighten US credit conditions, increase recession risks, and accelerate the timing of the Fed easing cycle. However, the broader market upheaval, compounded by the issues at Credit Suisse, triggered a flight to safety into the US dollar despite tumbling US Treasury yields. Given the ongoing uncertainty in the banking sector and with core inflation not cooling fast enough, we are in line with market pricing of a 25-basis point hike next Wednesday, but a further tightening in financial conditions could reduce the degree of tightening necessary in the future.

In the meantime, the Fed’s balance sheet has grown by about $300bn in the past week as the central bank sought to backstop deposits at regional banks. This has bolstered confidence and supported a relief rally across financial markets. GBP/USD is climbing closer to $1.22 and EUR/USD closer to $1.07 this morning.

Sterling shines with sentiment, BoE eyed

The British pound has been taken on a wild ride by global events as opposed to domestic data and the UK Budget this week. In the absence of any top tier UK economic data today, risk sentiment will continue to drive sterling ahead of next week’s Bank of England (BoE) meeting and key UK data releases including inflation, retail sales and flash PMIs.

Sterling clipped fresh 2023 highs against a weaker euro this week and remains above €1.14 despite the ECB’s larger rate hike in the face of banking sector stress. But this is important as the BoE could follow suit and raise UK interest rates for the 11th consecutive time, though markets are pricing in a 40% probability of no change next Thursday. The UK Chancellor’s £22bn stimulus package unveiled this week might also keep the pressure on the BoE to tackle inflation, which is still running hot above 10%. In theory, a BoE rate hike should help support sterling, but since the BoE’s hiking cycle began, the pound has fallen an average of nearly 1% against the US dollar the day after each policy decision. Still, no change in interest rates would likely be worse for sterling, especially if the Fed follows the ECB by hiking next week as well.

If the BoE does decide to hold rates at 4%, GBP/USD could slide back towards 2023 lows near $1.18, whilst GBP/EUR could erase its gains this week and fall towards the lower levels of its year-to-date range of €1.1130 – €1.1470.

GBP/USD up 2% as risk appetite returns

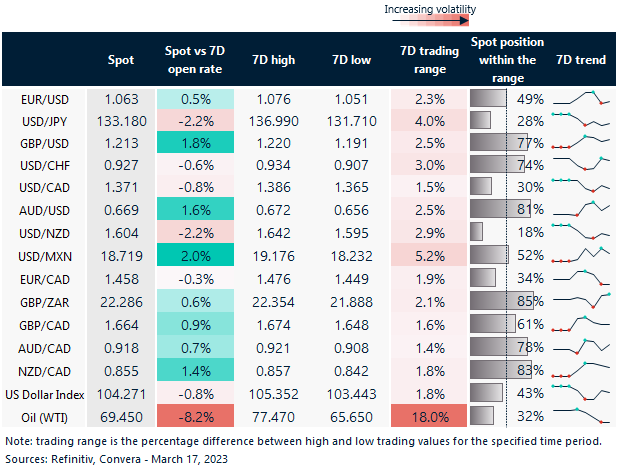

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: Mar 13 -Mar 17

Have a question? [email protected]