Written by Convera’s Market Insights team

Soft US jobs data

George Vessey – Lead FX Strategist

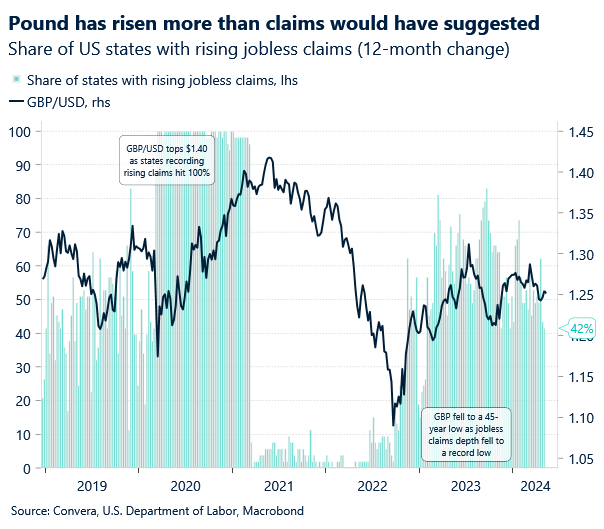

The US dollar index fell abruptly after a solid auction of 30-year Treasuries dragged yields lower, plus initial jobless claims unexpectedly soared to 8-month highs, offering further evidence the US labour market is softening. This helps pave the way for a Federal Reserve (Fed) interest rate cut as markets currently price a 68% chance of September pivot.

Comments from several Fed policymakers this week have been suggesting rates will stay elevated for some more time. It’s no surprise given the upside surprise in all inflation readings last quarter and the strength of US economy eroding expectations for how deeply the Fed will be able to cut rates this year. But the economic backdrop does appear to be moderating, with soft data, like PMIs, disappointing relative to expectations at a fast rate and the overall economic data surprise index trailing at 2022 lows. Moreover, further signs of a cooling labour market are starting to fan hopes of rate cuts once again, spurring a risk on rally with US benchmark equity indices up almost 2% this week.

Consumer and producer inflation data due next week should provide further clarity on price pressures. We think that perhaps the Fed’s meeting last week could be regarded as the peak Fed hawkishness, because it’s unlikely that the inflation surprises from Q1 can continue to such an extent in the coming quarters.

UK GDP outshines dovish BoE

George Vessey – Lead FX Strategist

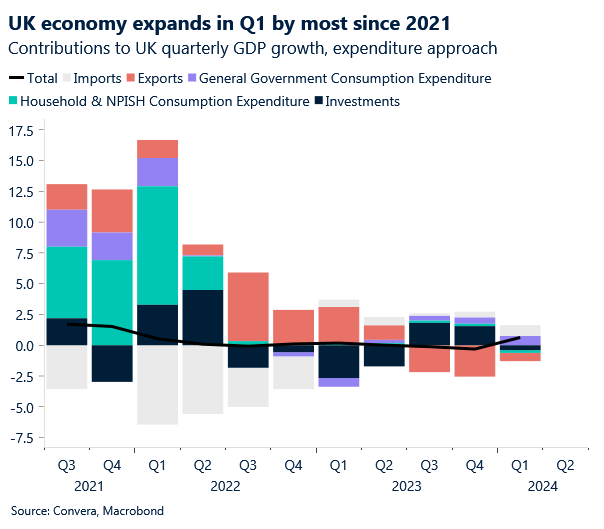

As expected, the Bank of England (BoE) left interest rates unchanged at 5.25%. Sterling fell to fresh 1-week lows versus the US dollar and euro. But data this morning showed the UK economy expanded by 0.6% in Q1, more than expected, and the fastest growth rate since 2021, boosting sterling across the board.

The pound’s initial negative reaction to the BoE’s decision was a result of a sizeable downgrade to medium-term inflation forecasts and an additional policymaker voting for a rate cut. Dave Ramsden joined Swati Dhingra in calling for a cut, thus shifting the vote split to 7-2 from 8-1 previously. The yield on the UK’s 2-year Gilt, a good measure of near-term policy rate expectations, retreated to its lowest level in a month as market pricing swung from showing a hold in June as the most likely outcome, to a cut being marginally more probable. This saw sterling decline across the board. During the presser, Bailey stated a June rate cut is ‘neither ruled out, nor fait accompli’ and the bank remains data dependent with two more inflation readings between now and then to digest. The BoE continues to emphasise the UK’s inflation outlook as quite different to the US as it downgraded its 2-year inflation forecast to 1.9% from 2.3% previously.

The bottom line: the BoE is edging ever closer towards a rate cut but it is keeping its options open amid the volatile nature of macroeconomic data. The April inflation figures in a couple of weeks’ time will therefore prove crucial. Should we see a big enough downside surprise in services inflation, the odds of a June cut (currently 50%) will spike and sterling risks sliding back towards $1.23 against the dollar and potentially testing €1.15 against the euro. Today’s GDP figures paint a rosier picture for the UK economy though and downside risks may be capped in the medium term as a result.

Euro surges to a 1-month high

Ruta Prieskienyte – FX Strategist

Euro bulls capitalised on a weak US labour market report, reversing a 1-week low touched earlier in the session to close at a 1-month high of $1.077 against the US dollar. European stocks continue to relish the prospects of lower policy rates, with the STOXX 50 index climbing to April highs, while the yield on the German 10-year Bund rose toward 2.5% from an over 3-week low of 2.42% hit earlier in the week.

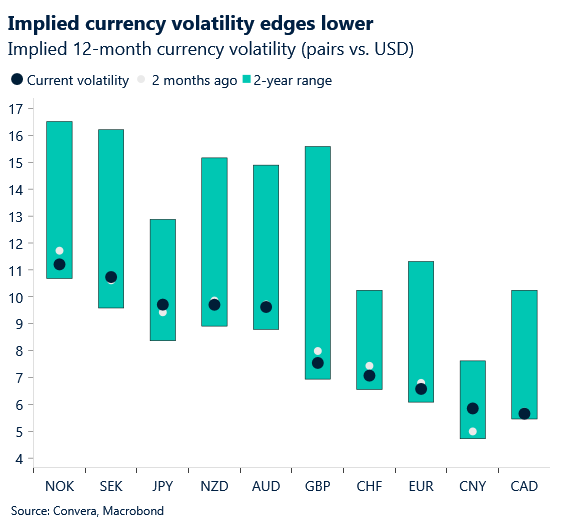

A slowdown in data cadence has depressed realized volatility across the major currency pairs. The short-term 1-week EUR/USD realized volatility edged below 5.3%, while the longer-term 1-month measure cooled to an over 2-week low. The pair is on track to post a fourth consecutive increase when measured on the basis of weekly closing prices, but technical indicators point to a range bound environment and signal that the pair may be running out of steam. EUR/USD is sandwiched in a triangle formation, bounded from above by 50- and 200-day SMAs situated just below $1.08, and supported from below by the 21-day SMA at the $1.07 level. Further dollar weakness is a necessary requirement for the pair to break higher above the $1.08 level, given the strong technical resistance barriers ahead. Elsewhere, EUR/GBP touched a 2-week high of £0.8622 after the dovish BoE decision. Having firmly closed above its 200-day moving average, the 1-week 25-delta risk reversal skew widened to 0.308% in favor of euro calls, the most bullish in 9 months, signalling further euro upside against its British counterpart is on the cards in the near term.

Looking ahead, as today’s domestic calendar is absent of data releases, EUR/USD’s trajectory will be largely determined by the US data due later this afternoon. In the meantime, several ECB policymakers are scheduled to speak, and we will also be getting a glimpse at the latest ECB minutes. Neither of the agenda items are expected to be market moving. The Governing Council members are expected to avoid comments on a specific interest rate outlook beyond the June meeting, while the latest minutes are expected to reconfirm the intent to cut in June, which is already fully priced in by the markets.

CAD directionless against the Greenback

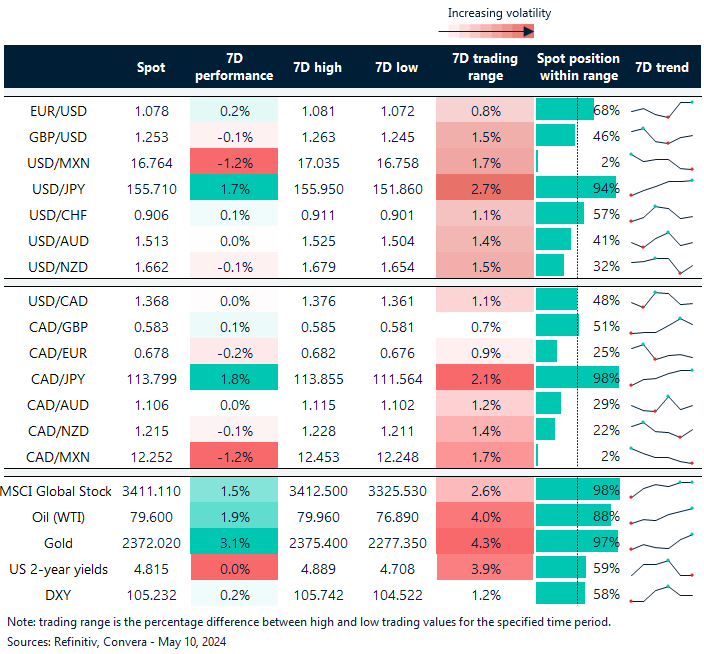

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 6-10

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.