Check out our latest Converge Podcast episode : When milliseconds matter: Preventing fraud in an instant payment world by Converge

Global overview

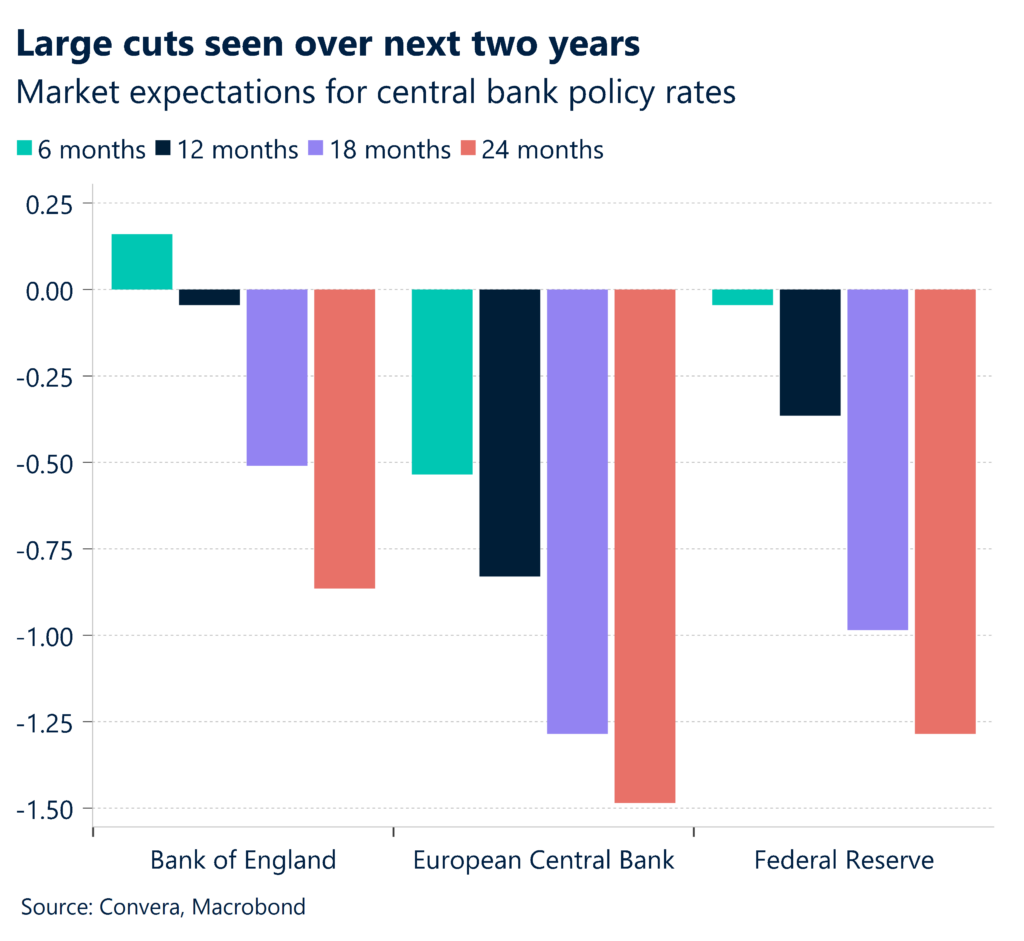

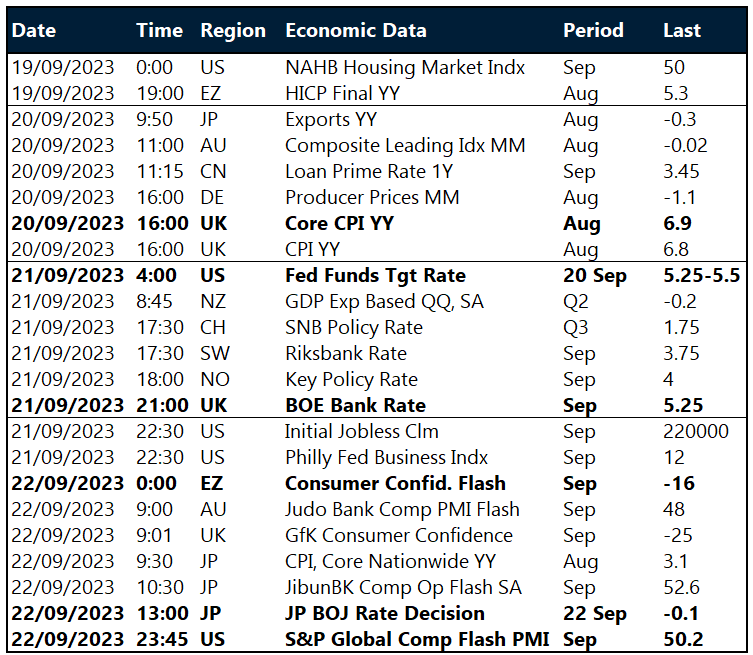

The British pound and Swiss franc were hammered lower overnight after their respective central banks surprised markets with decisions to keep rates on hold. The moves were in stark contrast to Thursday morning’s Fed statement that signaled more rate hikes are likely. The central bank show continues today with the Bank of Japan due.

BoE and SNB surprise markets

The British pound and Swiss franc fell sharply overnight as both the Bank of England and Swiss National Bank surprised markets by keeping interest rates on hold.

The Bank of England decision to hold rates steady was tight with a 5-4 split on the Monetary Policy Committee.

The previous day’s large drop in inflation – with core inflation down from 6.9% in July to 6.2% in August – was cited as a key reason to hold rates.

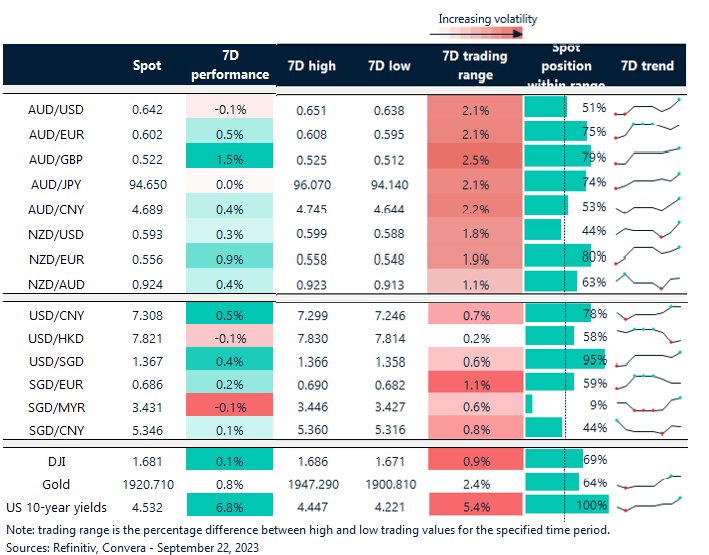

The pound tumbled on the news with the GBP/USD at the lowest level since March.

The Swiss franc also dropped with the market broadly expecting a hike from the Swiss National Bank as well. The USD/CHF hit a three-month high.

Greenback extends gains, USD/SGD at year’s highs

Across Asia, markets continued to react to yesterday’s Federal Reserve decision. While the Fed kept rates steady, forecasts for one more rate hike this year have hit sentiment and boosted the US dollar.

The AUD/USD fell sharply as it quickly backed away from the technical resistance seen at 0.6500.

The USD/CNY was moderately higher while the USD/SGD hit the highest level for 2023.

The New Zealand dollar was also weaker with markets waiting for the August trade balance data this morning.

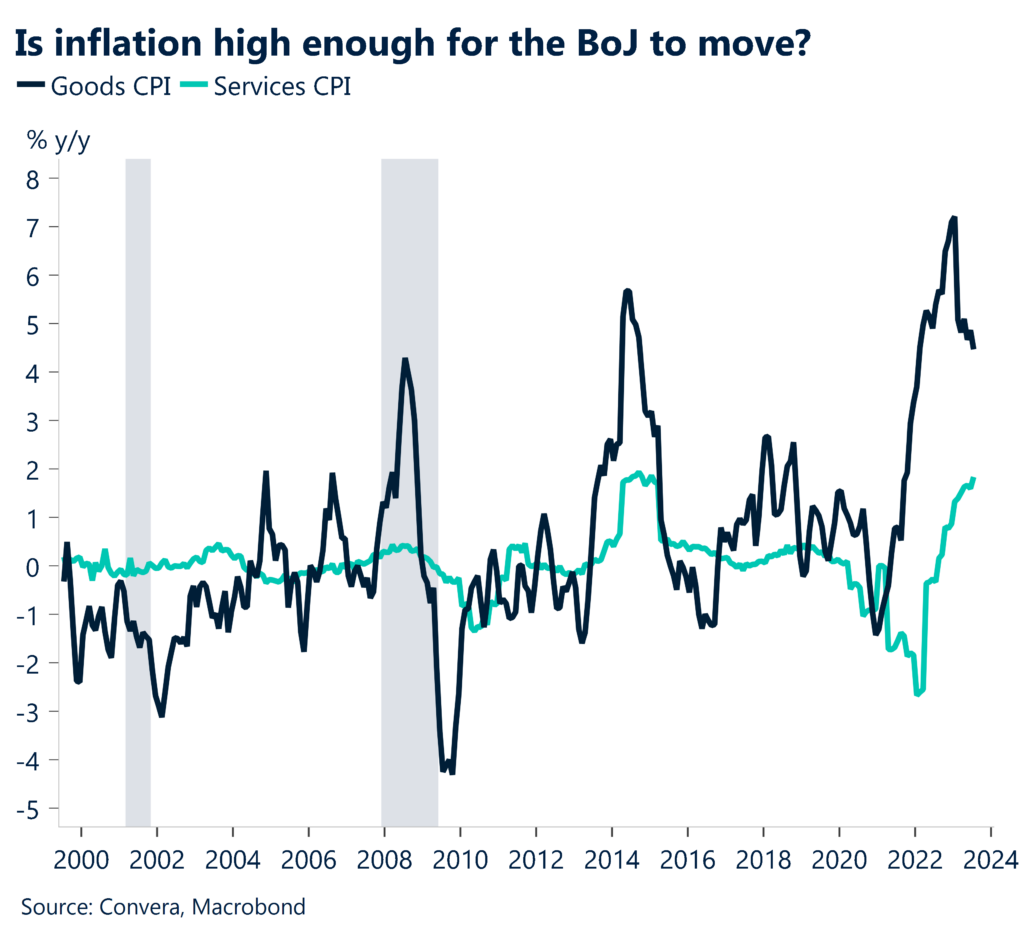

Crunch time for BoJ

The central bank excitement continues today with the Bank of Japan decision due around 1.00pm AEST (there’s no set time for release).

The Japanese yen remains broadly weak across major FX markets as Japan’s negative interest rate regime continues to pressure the currency.

The yen did see a brief jump in the middle of the month after Bank of Japan governor Kazuo Ueda said the central bank might have enough data by year-end to start lifting interest rates and end its negative interest rate policy.

The ongoing sensitivity in FX markets to any changes in interest-rate expectations means that any shift in the BoJ’s rhetoric could have a major impact in JPY markets, causing the JPY to potentially rapidly strengthen.

GBP, CHF drop after central bank decisions

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 18 – 22 September

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.