Debt ceiling worries weigh on dollar

With volatility levels in FX markets relatively subdued ahead of next week’s central bank policy meetings, the US dollar has come under renewed selling pressure as traders continue to price in the prospect of rate cuts by the US Federal Reserve (Fed) before year-end amidst rising recession risks stoked by weak output data and debt ceiling concerns.

One growing headwind for the US dollar is the fact that US sovereign credit default swap spreads continue to rise as investors take out hedges against complex negotiations over the US debt ceiling. Essentially, the price of insuring against a US government default rose to its highest level since at least 2008 as traders position for a stand-off between the Republicans and Democrats over whether to extend the US debt ceiling. A default could accelerate the US economy’s slide toward a recession in the second half of 2023, which is one reason why at least two Fed rate cuts are being priced in by markets before year-end. This is weighing on the dollar as narrowing yield differentials prompt demand for the likes of the pound and euro instead.

Aside from today’s US consumer confidence data, investors will keep a close watch on corporate earnings amidst signs that companies are holding up well in this challenging macro environment, whilst eyes will also be on the House of Representatives, which is expected to vote on a Republican-led debt and spending bill at some point this week.

Pound buyers back in action

The UK data calendar is quieter this week, but the re-balancing out of short sterling positions appears to be lending support to GBP/USD. The latest statistics published by the Commodity Futures Trading Commission (CFTC) revealed that futures and options markets are now net buyers of pounds for the first time since February 2022.

There has been a steady increase in GBP long positions (betting on sterling appreciating) recently, rising to a 6-month high after slumping to a 14-month low at the end of March. In the space of three weeks, speculative bets on sterling appreciating have almost doubled and GBP/USD is edging back to the $1.25 handle. There are many contributing factors behind this shift in sentiment, such as recent UK data pointing to resilience in inflation and upside macro surprises boosting the outlook for the UK for the rest of 2023. This has also resulted in markets increasingly inclined to bet on Bank of England (BoE) rate hikes. A rate rise in May looks like a done deal, but markets are pricing three more hikes over the next four meetings, which would take the BoE’s terminal rate to 5%. The diverging UK-US interest rate outlook is a key catalyst behind the view that sterling will continue climbing.

Moreover, a low volatility climate generally benefits the risk-correlated pound. There tends to be a strong correlation between equity markets and GBP/USD and with equity volatility subdued of late, this dynamic also underpins sterling. Whether it has legs to test fresh 1-year highs above $1.2550 before the key central bank meetings next month remains to be seen.

Euro jumps on larger hike bets

EUR/USD is back above $1.10 after European Central Bank (ECB) board member Isabel Schnabel stated a 50-basis point rate hike was not off the table. Markets are currently pricing a 30% probability of such a hike, but a slew of key data, notably inflation figures, just days ahead of the ECB meeting could sway the decision.

There are certainly mixed views amongst ECB policymakers, with some calling for further hikes to be limited in number and size, but markets have focused on the fact that still more hikes are expected. In an environment of low volatility, despite the uncertain economic and monetary outlook, European currencies appear to be outperforming and with markets pricing at least three more hikes by the ECB this year and no rate cuts until 2024, the euro is catching a wave of fresh demand. Meanwhile, data yesterday showed the Ifo business climate indicator for Germany rose for the sixth consecutive period and to the highest level since February last year. The latest reading came in slightly below the consensus forecast but expectations for the coming months were less pessimistic.

The euro is also being supported by a delayed reaction to the news that the Eurozone’s April composite PMI points to a services-led recovery and more insights on GDP growth will be unveiled towards the end of this week. Amidst the move higher in EUR/USD, GBP/EUR is struggling to grip onto the €1.13 handle, printing lower daily highs for the past four days. A break of the €1.1280 support level could soon trigger a slide towards €1.12, especially if EUR/USD continues climbing north of $1.10.

Dollar slumps on low volatility

Table: 7-day currency trends and trading ranges

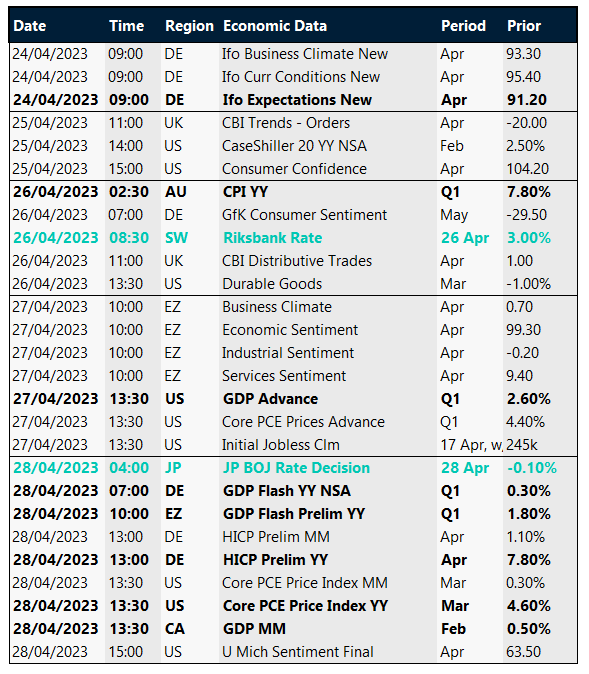

Key global risk events

Calendar: Apr 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.