Written by George Vessey – Lead FX Strategist

The Bank of Japan delivered a widely touted interest rate hike, and raised its inflation forecasts, but the yen has surrendered early gains. Elsewhere, Trump surprised once again by saying he’d rather not hit China with tariffs and the Fed should drop interests rates – sending the USD sharply lower. Both the pound and euro are stretching to fresh multi-week highs as a result. Flash PMI data is eyed today ahead of next week’s rate decisions by the ECB and Fed .

Japanese yen swings after rate hike

The Bank of Japan (BoJ) delivered a well-telegraphed 25bps increase in interest rates earlier this morning, accompanied by a set of notably stronger inflation forecasts. The 2025 core CPI estimate was raised to 2.4% from 1.9%. Another 32bps of easing is priced in before year-end.

The yen initially strengthened but retraced after Ueda’s press conference. USD/JPY’s rebound before the press conference indicates Tokyo traders sense Ueda’s reluctance to urgently hike rates again. While this doesn’t undermine the yen’s potential strength in the longer term, it gives yen bulls reason for pause on Friday.

GBP/JPY is down 2% since the start of the year, but is up over 1% this week, hovering nearer the 192 handle.

Tariff policies drive FX market sentiment

Kevin Ford – FX & Macro Strategist

The main driver of sentiment and risk in North American FX markets has been tariff policies and their potential impact on the region. As the U.S. administration studies trade deficits with major partners and President Trump threatens tariffs on Canada and Mexico by February 1st, macro data has taken a backseat, with tariffs dominating FX market concerns.

1-month risk reversals show traders paying the highest premiums since October 2022 to protect against the Loonie’s gains, with a similar trend for the Mexican peso. The Bank of Canada’s upcoming rate decision adds to the nervousness, with options traders seeing greater potential for declines.

This week, President Trump’s tariff threats have taken a firm stance towards Canada and Mexico, while adopting a more measured approach towards China, and have now extended to Russia. His negotiation strategy appears to be rooted in the America First Trade Policy, while employing a tit-for-tat rhetoric in the media. This has led some skeptics to doubt the likelihood of tariffs being implemented by February 1st.

On the domestic front, tariffs could play a crucial role in Trump’s business agenda. During his inaugural speech, Trump promised to create an External Revenue Service. Some analysts believe that raising revenue from overseas may provide leverage for his first round of tax cuts, a flagship campaign promise. If that would be the case, Trump’s team would have to push for a faster review of the USMCA trade agreement, as revisions are only scheduled until 2026.

Currently, the USDCAD is hovering around the 1.435 level. Market participants are buckling up for a turbulent period, with tariffs taking center stage and monetary policy adding to the anticipated volatility in the coming days.

Dollar on for biggest weekly decline in months

The US dollar has come under renewed selling pressure as US President Donald Trump said he wants the Federal Reserve (Fed) to cut interest rates immediately. The US dollar index is set to record its biggest weekly decline in five months in line with an extended fall in US treasury yields.

At the World Economic Forum in Davos, Trump stated that “with oil prices going down, I’ll demand that interest rates drop immediately, and likewise they should be dropping all over the world”. Investors are now focused on next week’s Fed monetary policy meeting. After 100bp of rate cuts the Fed has signalled it needs evidence of economic weakness and more subdued inflation prints to justify further policy loosening. President Trump’s low tax, light-touch regulation policies should be good news for growth, while immigration controls and trade tariffs provide upside risk for prices, suggesting we might have a long wait for the next cut.

On the data front, initial claims in the US rose by 6,000 to 223,000 for the week ending Jan. 18, slightly above the 220,000 forecast. Continuing claims, representing people still on benefits who can’t find jobs, jumped to 1.9 million, the highest since November 2021, indicating longer job search times.

Euro almost 2% stronger this week

The euro has jumped closer towards $1.05 against the USD on Friday, primed for its biggest weekly rise in over a year, bolstered by renewed USD weakness as investors await more clarity on President Donald Trump’s policy plans. Flash PMIs will be closely eyed to determine whether the euro’s recovery can gather steam.

Early in his term, Trump avoided stricter trade penalties, easing fears of protectionist policies harming global growth and driving US inflation higher. His pro-business measures boosted investor sentiment, but tensions persist as he criticized the EU and hinted at tariffs. ECB President Christine Lagarde urged Europe to prepare for potential trade measures, praising Trump’s delay of blanket tariffs as “very smart.”

On the monetary policy front, the ECB is expected to maintain its easing stance, with markets anticipating a 25bps cut in the deposit rate next week. The Euro Area’s consumer confidence improved slightly to -14.2 in January 2025, aligning with market expectations. Consumers remain optimistic about further ECB rate cuts this year.

Pound pounces on dollar weakness

The British pound briefly dropped below $1.23 versus the US dollar yesterday, but has rebounded to a fresh 3-week high on Friday despite UK consumer confidence falling to a 14-month low and sentiment in the UK manufacturing sector marking its steepest decline in over two years. The climb in GBP/USD towards $1.24 is a result of fresh USD weakness as traders mull over Trump’s trade dialogue.

The British pound is still fated for more declines against the US dollar as stagflation concerns become starker though. Recent UK data, both soft and hard, has been disappointing, from sentiment surveys to retail sales and GDP. Inflation remains stubborn, and increased cost pressures were recently reported, with inflation in both domestic and export prices expected to rise significantly. This is clouding the monetary policy path for the Bank of England (BoE). For the pound to meaningfully recover into the higher realms of the $1.20s and to $1.30, UK data needs to start improving, alleviating the risk of stagnation or even recession. Today’s PMI figures will therefore be closely watched and could trigger increased volatility across the FX space.

GBP/USD’s fortunes are also at the mercy of the US dollar of course. A turn in the US dollar, cyclically or tariff driven, would provide a firmer footing for GBP/USD to reclaim $1.25 and break out of its 4-month downtrend. But to establish a meaningful recovery, the stars need to align on all fronts, so with the unpredictability of Trump and the ongoing underwhelming UK economy, it’s difficult to gauge when sterling’s troubles will ease.

Dollar index down 1.6% in a week

Table: 7-day currency trends and trading ranges

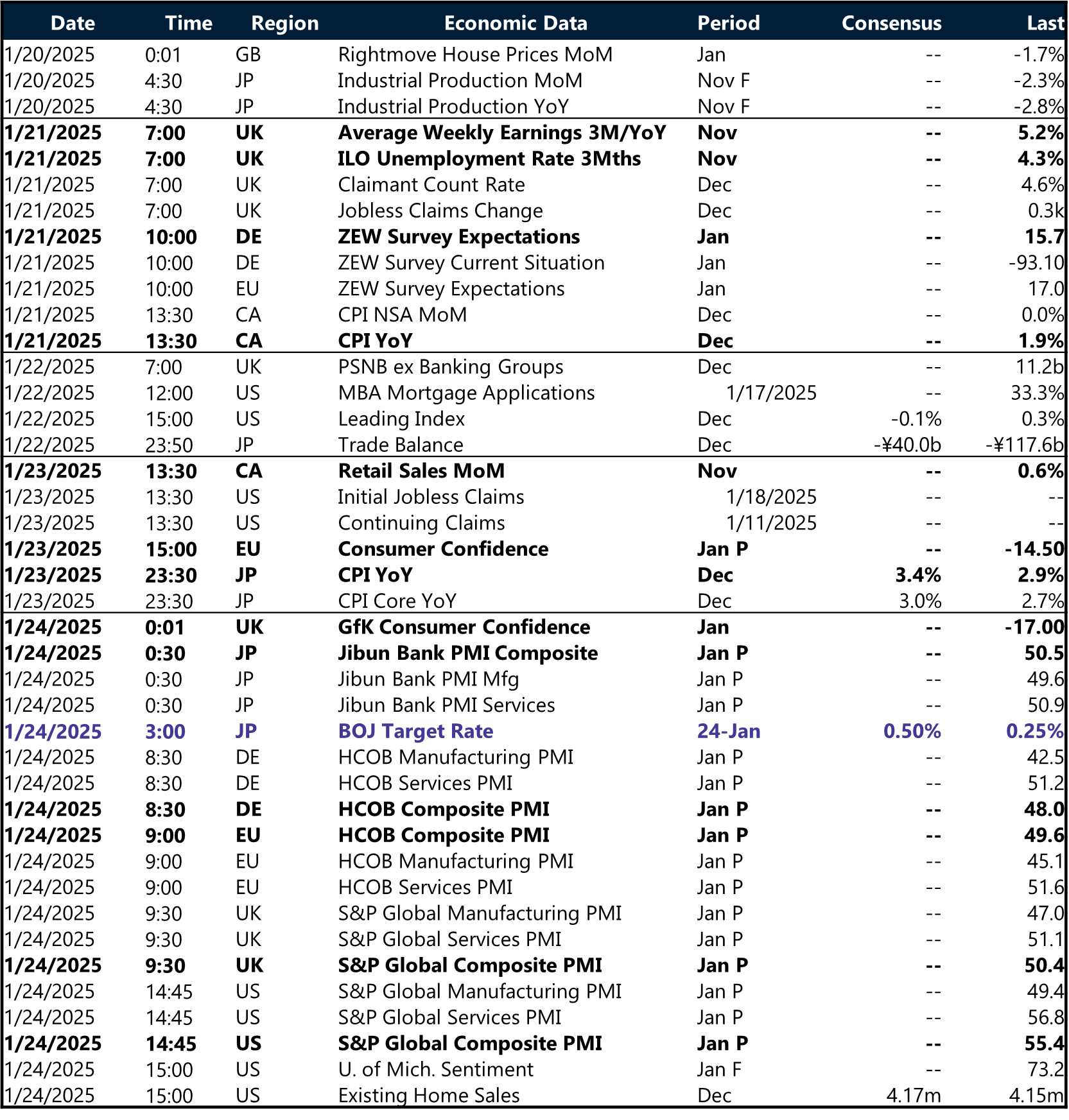

Key global risk events

Calendar: January 20-24

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.