USD: Immune to noise, hungry for data

The dollar advanced yesterday, with the DXY index moving higher 0.3%, now eyeing the 99 handle. The move was largely driven by a weaker yen – second in command within the DXY basket. Selling pressure intensified across London and New York sessions, after Sanae Takaichi won the parliamentary vote yesterday to become Japan’s prime minister.

Sentiment was further buoyed by optimism surrounding the upcoming meeting between Xi and Trump in South Korea, with the latter declaring, “China and I will have a really fair and really great trade deal together,” while also reiterating his threat to follow through on tariff hikes on Chinese goods “if there isn’t a deal” by the 1 November deadline. Such remarks have helped soothe investor fears in recent days that no deal would be reached.

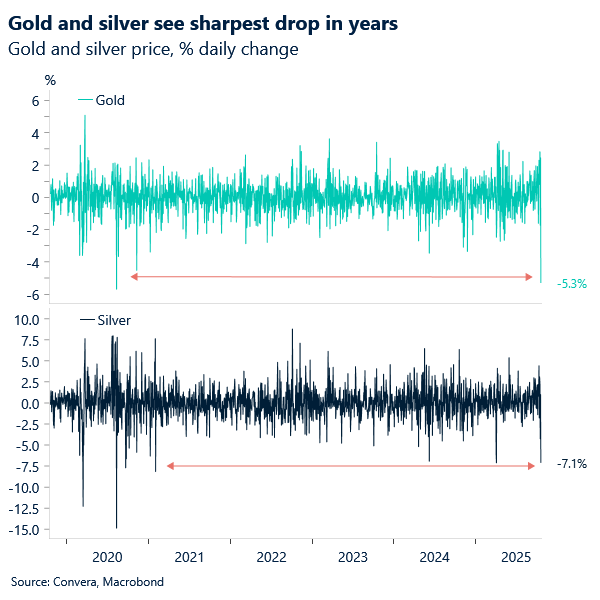

Another lens on the dollar’s resilience came via gold and silver, which fell 5.3% and 7.1% respectively in a single day – marking one of their sharpest drops in nearly five years. Haven demand for precious metals has cooled somewhat amid an improved Sino-American trade outlook, while a stronger dollar makes them more expensive and even less appealing.

Recent USD price action, however, remains outsized. The lack of fresh data has left the dollar dis-anchored from the Fed’s relatively softer tone compared to its DXY peers. In fact, investors are in desperate need of new data to make sense of the Fed’s recent dovish signals – re-anchoring the dollar either in support of that tone, or in rejection of it.

Overall, recent price action continues to underscore the dollar’s growing numbness to headline noise – be it trade or credit-related tensions. Meanwhile, investors are treating resilient corporate earnings across the S&P 500 as a proxy for broader economic strength. That resilience remains the dollar’s beacon of hope, suggesting its recent gains could evolve into more sustained upside once real economy data returns to the spotlight.

EUR: France risk meets 1.16

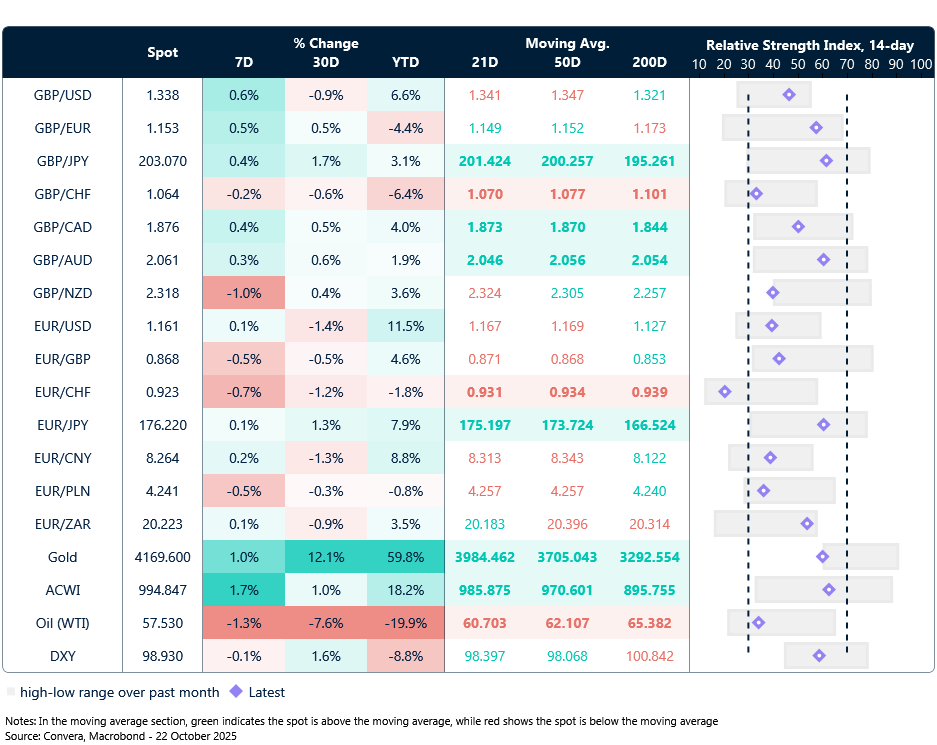

The euro slid toward the 1.16 support level yesterday and is down 0.4% so far this week against the dollar. Euro-centric weakness is perhaps better evinced in EUR/CHF, which slipped beneath the 0.93–0.94 range that capped downside for much of the past year, now hovering just above 0.92.

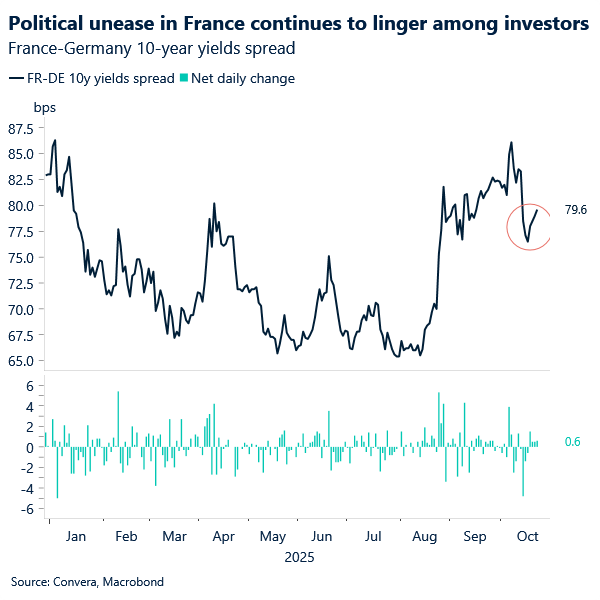

That’s the pair where France’s political premium comes through more clearly, reflecting lingering concerns around its fragile backdrop. FR–DE spreads continue to hover near the 80bp mark. The breakthrough held up despite Lecornu’s swift re-election and this week’s strong French corporate earnings, which helped offset some of the political drag – French equities even rose above their May 2024 record high. From here, investors remain cautious, with attention turning to how the political impasse may stall economic momentum, potentially eroding sentiment further if spillovers take hold.

Looking ahead, while the bar is high for further short-term euro weakness tied to France’s political drama this week, the next key catalyst is Friday’s US inflation report. A surprise to the upside would likely see EUR/USD breach the 1.16 level.

GBP: Soft prints, softer sterling

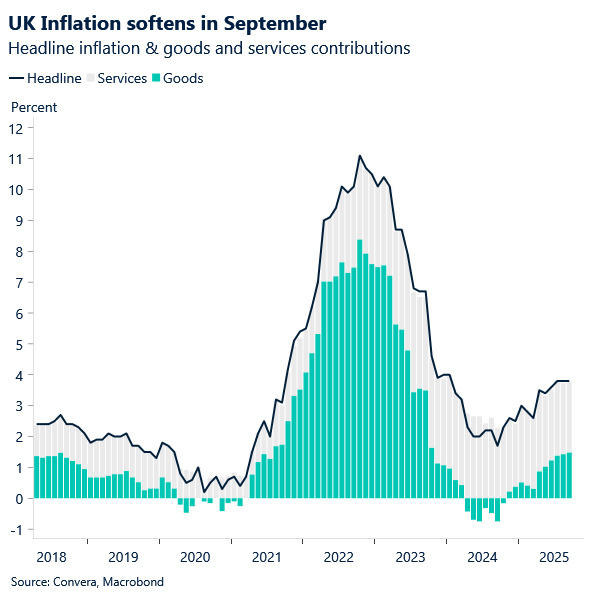

UK inflation fell across the board yesterday, undershooting expectations on both the headline and core fronts. Services inflation – stickier than goods and closely monitored by the Bank of England – held steady, rising by the same pace as in August (4.7% y/y), below the 4.8% forecast. We flagged this potential undershoot in yesterday’s note. Core inflation, which strips out volatile food and energy prices, also came in below what economists had predicted 3.5% vs. 3.7%. Meanwhile, food inflation – a point of concern given its persistent stickiness – slowed for the first time since March, easing from 5.3% to 4.9%.

With expectations tilted toward a stickier print, the contrarian nature of the data triggered a sharper bearish reaction in GBP price action – like a coiled spring unwinding. Sterling is currently trading 0.3% lower against the dollar, showing broad-based weakness across the G10 space as well. The move was amplified by persistent softness in the labour market, helping unify voices around a more cohesive – and softening – BoE policy path, which now puts a December rate cut back on the table.

Sterling bulls have had little to justify a break above the 21-day moving average, which continues to cap GBP/USD’s descent from mid-September highs of 1.3726. The pair is now down ~2% from those levels, and recent data only reinforces the bearish momentum.

EUR crosses lose momentum

Table: Currency trends, trading ranges and technical indicators

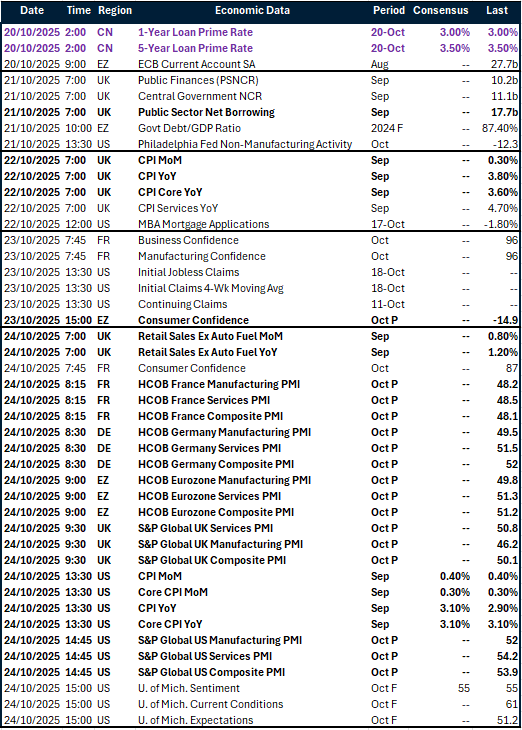

Key global risk events

Calendar: September 20-24

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.