Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

The Daily Market Update will take a break over the holiday period – our final edition is on 20 December 2024. The report will return on 6 January 2025. Our offices will be open as usual but will observe local public holidays. Speak to your account representative for more information.

USD at 2 year highs as markets digest Fed’s hawkish tone

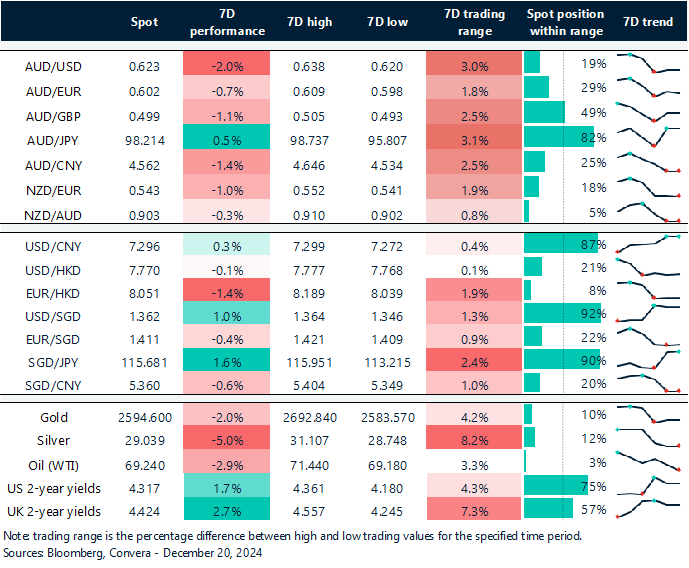

The USD surge to 2 year highs as markets continued to digest the Fed’s hawkish stance despite signaling rate cuts in 2024. US reported stronger Q3 GDP data that showed 3.1% growth versus 2.8% expected.

The pound saw sharp moves after the Bank of England kept rates steady at 4.75% in a more dovish 6-3 split vote.

The NZD weakened after New Zealand GDP unexpectedly contracted 1.0% in Q3, much worse than the -0.2% forecast, raising the chances of earlier RBNZ rate cuts.

Regional currencies traded mixed, with USD/JPY gained 1.7% to 157.44 and USD/SGD flat while USD/CNH edged 0.2% lower, after reaching 7.3249 highs on Wednesday. Focus turns to China’s loan prime rate decision due at 12:00pm AEDT.

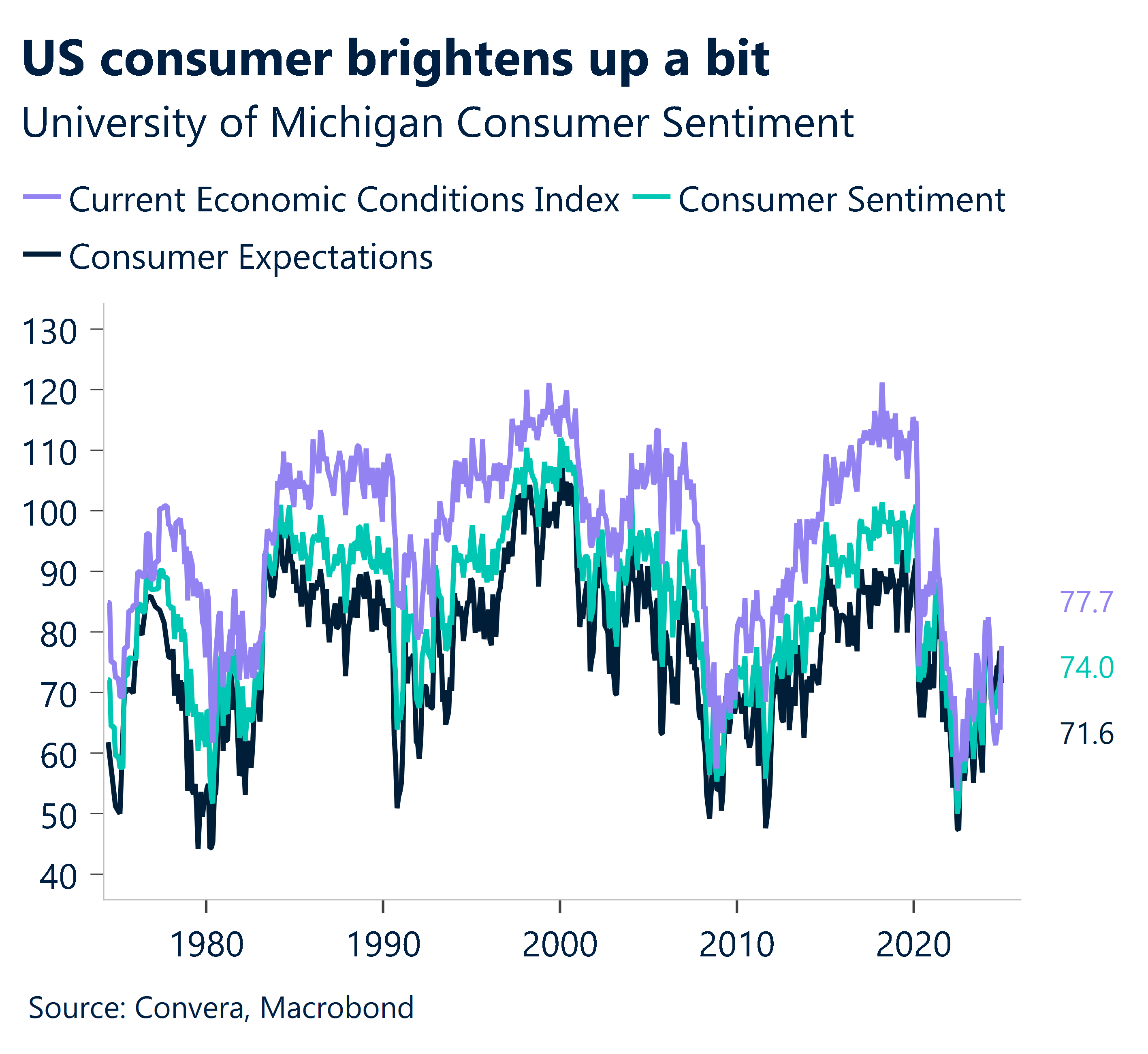

USD sentiment supported by consumer confidence

This Saturday at 2:00 AEDT, University of Michigan will be announced.

After an uptick in the preliminary print, we anticipate that the University of Michigan consumer mood index will finalise at 74.5 in December.

During the survey reference period, petrol prices dropped to a multi-year low while stock prices rose.

Furthermore, the poll reference period coincided with the publication of the November inflation data, which probably helped mood.

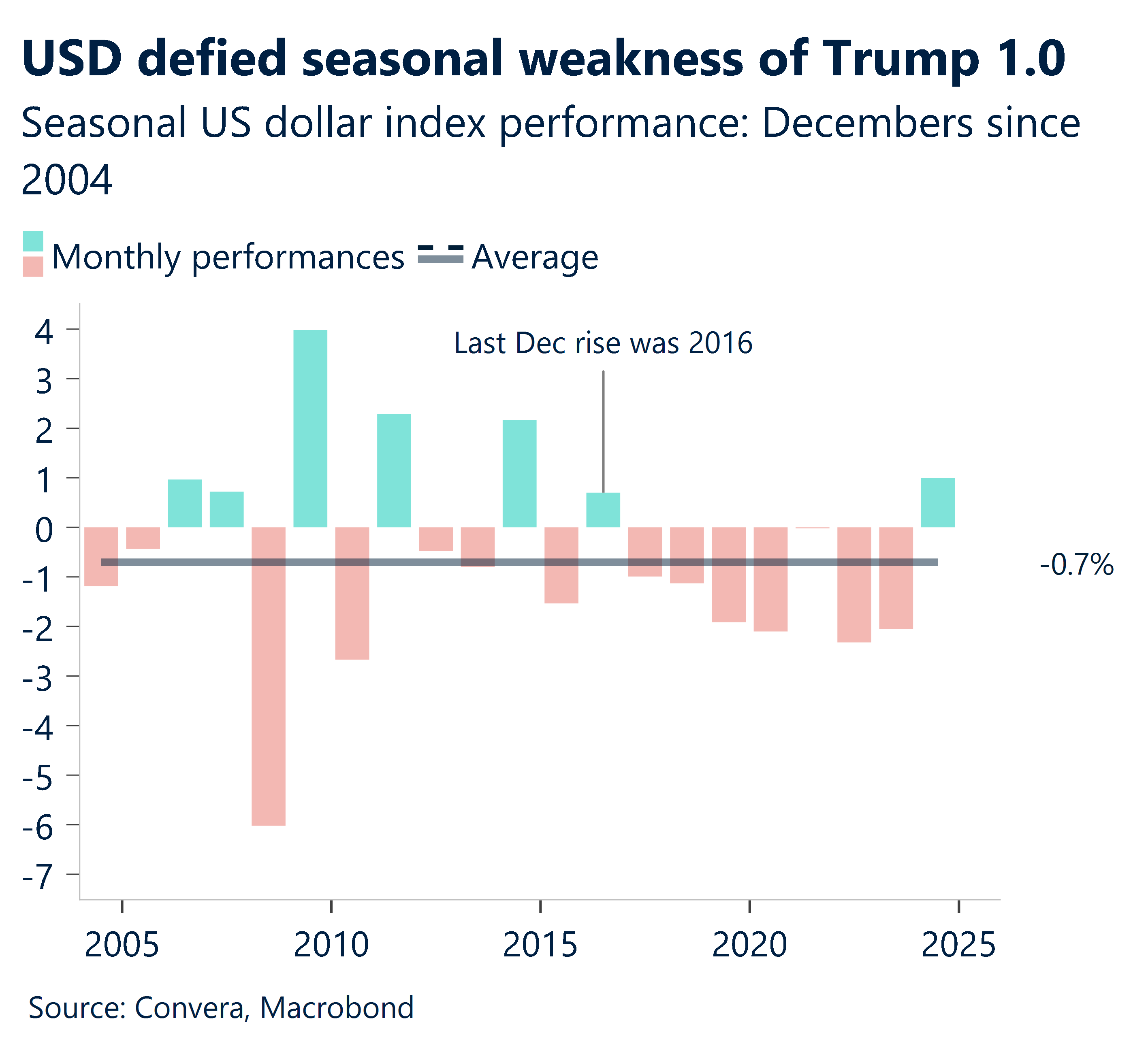

As we iterated before, we are positive on USD index and next strong key resistance will be 114.7780 (September 2022 highs).

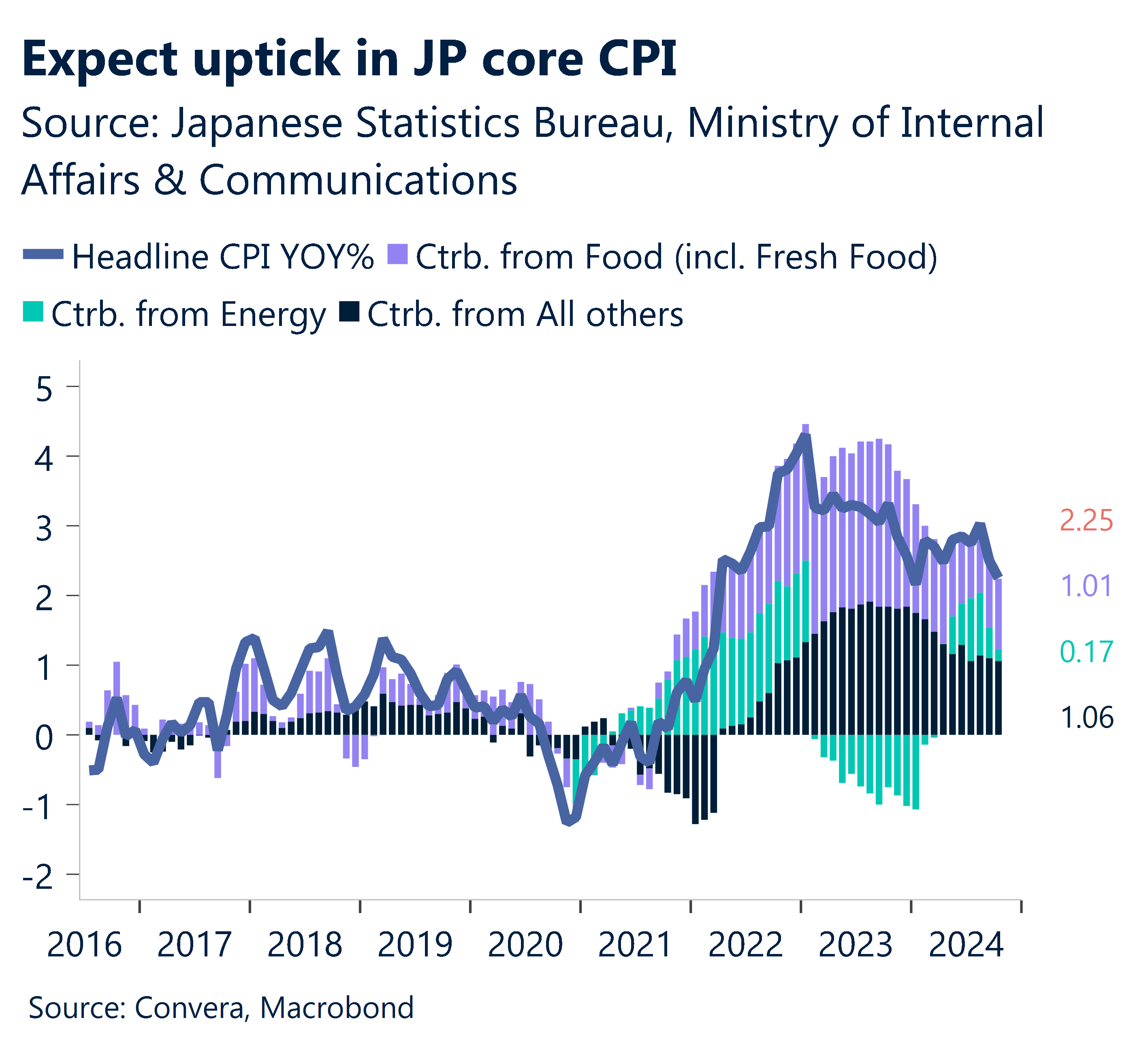

JPY outlook hinges on BoJ stance

At 10:30 AEDT today, the Japan core CPI will be revealed.

We predict that all-Japan core CPI inflation will increase by 2.6% year over year in November, up from 2.3% in October.

Our prediction for the BOJ’s core-core CPI inflation is +2.3%. Inflation in the Tokyo ku-area core CPI for November (which has already been released) increased from 1.8% in October to 2.2% year over year.

As BoJ kept rates on hold, now market pricing indicates measured expectations for immediate action, with March 2025 emerging as a key timeline for potential policy shifts.

Technically, USD/JPY price action momentum looks strong with next key resistance at 159.88

Aussie crosses still under pressure

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 16 – 21 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.