Written by Convera’s Market Insights team

Belt up for jobs data

George Vessey – Lead FX Strategist

The April US jobs report today will round out another packed week of event risks for financial markets. Attention shifts back to US data today after the Federal Reserve (Fed) meeting took some steam out of the stronger US dollar on Wednesday, especially when Chair Powell brushed off talk about another potential rate hike. US stocks are on the rise, with the Dow Jones ending yesterday over 300 points higher whilst 2-year Treasury yields fell to a 1-month low.

Economists expect a step down in job growth from around 300k in March to 240k in April. This is still a solid number and wouldn’t in any sense highlight a weak labour market, therefore presenting an upside risk to US yields and the dollar. But this hard data is very much at odds with the recent weakening of every possible leading employment indicator. Going into the later months of 2024, it seems increasingly possible that both job- and wage growth will moderate as the survey data suggests. This would pave the way for the Fed to cut more than is currently priced in (one cut towards year-end).

Hence, the neutral Fed meeting this week may have been the peak of hawkish sentiment towards the Fed, especially as the inflation surprises of Q1 are unlikely to continue to such an extreme extent over the coming quarters. With this in mind, the US dollar might be primed for an extension lower over the coming months.

Sterling faces seasonal headwinds

George Vessey – Lead FX Strategist

It’s been a relatively quiet week in terms of UK data and GBP volatility, although external events, particularly in the US and Japan, have caused a stir, with realised weekly volatility hitting 9% and 22% (annualised) respectively. Today’s US payrolls report could reignite GBP/USD downside risks if it crushes expectations as the pair flirts with its 200-day moving average resistance level around $1.2550.

April was a tough month for the pound, appreciating against just 34% of global peers, and seasonality trends over the spring months aren’t pretty either, especially in May. Sterling has posted losses against the US dollar during May in 11 out of the past 13 years, averaging a 1.7% decline over the month. Fundamentals are also unfavourable as there’s growing chatter around market expectations for the Bank of England’s (BoE) rate outlook being too hawkish, meaning a potential dovish repricing is in the offing. Currently around 40 basis points of cuts are priced in by year-end. That’s equivalent to less than two rate cuts.

With the BoE meeting looming next week, any dovish remarks will likely spur traders to put some policy easing (rate cut) bets back on the table, presenting an upside risk to UK Gilts and therefore a downside risk to UK yields and the pound. For now, sterling remains the second-best performing major currency year-to-date.

Euro lacks momentum despite improved mood

Ruta Prieskienyte – FX Strategist

The euro remains largely unchanged at the $1.07 level, stuck in its downward trend against the US dollar still, as investors maintain a soft bearish bias thanks to a relatively more dovish stance of the ECB compared to the Fed. Meanwhile, broad European stock equity index closed 0.5% lower for the third time this week, while France’s CAC 40 fell by close to 0.9%, its lowest point since February, as equity markets reopened following a midweek European holiday and dissected the Fed rate decision. Across the bonds, German yields fell across the yield curve, tracking US treasury movements.

While largely ignored by the markets, Eurozone manufacturing sectors was confirmed to have contracted for the 7th consecutive month contracted in April, its longest downturn since 2013. On the price front, both input costs and output charges extended their decrease, while business sentiment strengthened for a second successive month and reached its highest level since February 2022. Elsewhere in Europe, the Swiss franc rebounded sharply against the US dollar and the euro after hotter-than-expected inflation print drove markets to pare expectations on the extent of looser policy by the SNB. Annual inflation rose to 1.4% y/y in April from 2 ½ year low of 1% y/y in the previous month. Despite SNB’s warnings of bumpy recovery, the quick pace of acceleration in CPI inflation concerns that the rise may lead to second-round effects, easing expectations on whether the SNB may deliver another rate cut in June. Meanwhile, as expected the Czech National Bank cut its two-week repo rate by 50 bps to 5.25%, marking the third consecutive 50bps reduction as policymakers noted the continued disinflation pattern and weakened economy.

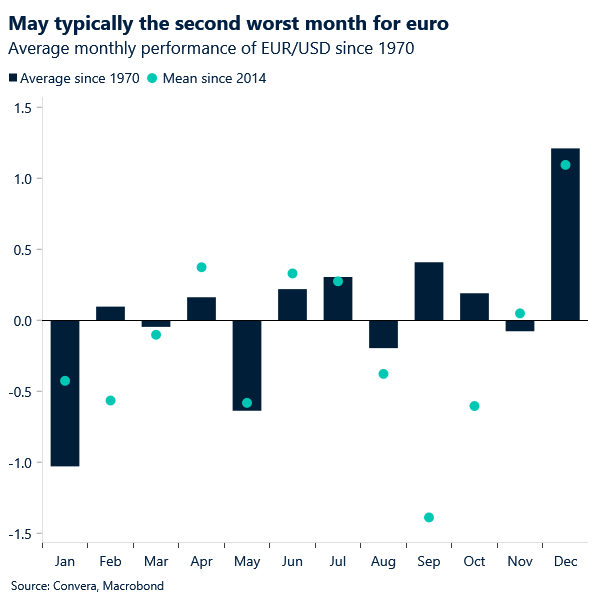

The short term technicals point that EUR/USD has moved into a new range bound regime since Mar 23rd, sandwiched in a ± 50pip range centred around $1.07. For now, 21-day SMA at $1.0715 appears to dampen further euro gains while the 100-week SMA at $1.0630 acts as a strong support level. However, this regime could be threatened by seasonal trends as euro has a history of losses in May, depreciating by an average of 0.68% since 1971 against the Greenback.

JPY poised for best week in a year

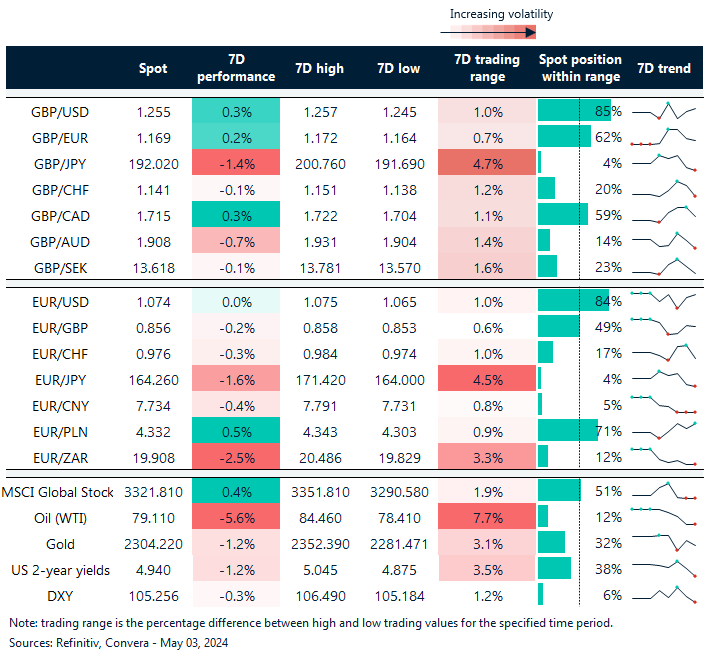

Table: 7-day currency trends and trading ranges

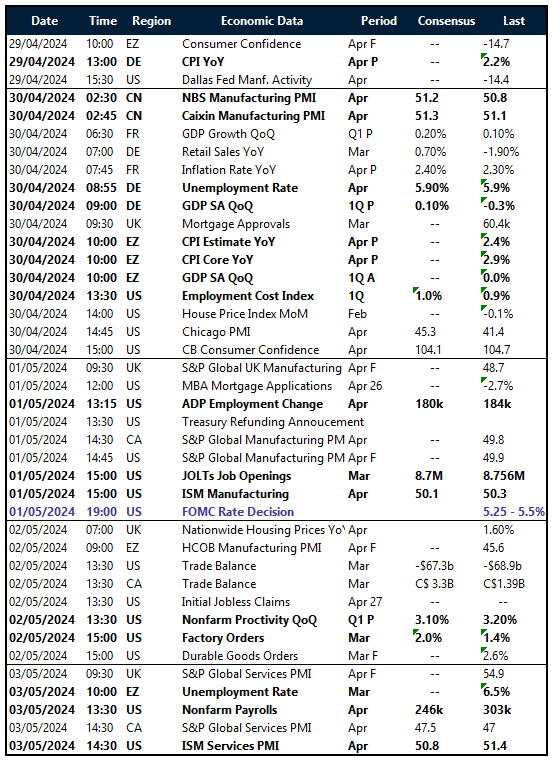

Key global risk events

Calendar: April 29 – May 3

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.