Kiwi tumbles after RBNZ

The New Zealand dollar slumped after the Reserve Bank of New Zealand cut interest rates by 25 basis points to 3.00% and flagged more easing ahead.

RBNZ governor Christian Hawkesby said the RBNZ’s current forecast “troughs at around 2.5% by the end of this year” while financial markets now have 37 basis points of cuts priced in by the end of 2025 (source: Bloomberg).

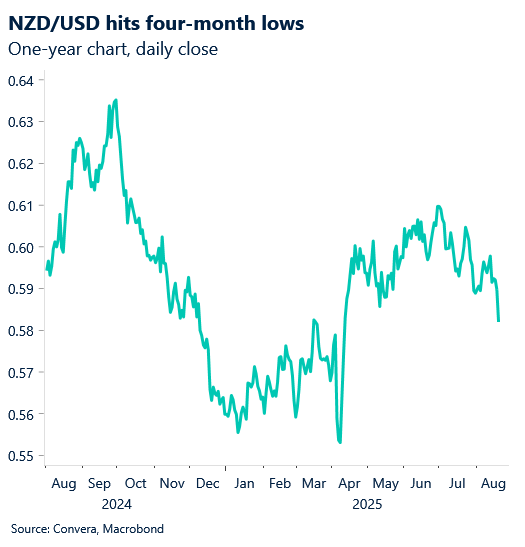

The NZD/USD dropped 1.2%, closing at its lowest since 11 April. The kiwi also weakened against the Aussie, with NZD/AUD down 0.9% to its lowest since 5 March.

Fed flags inflation as top concern

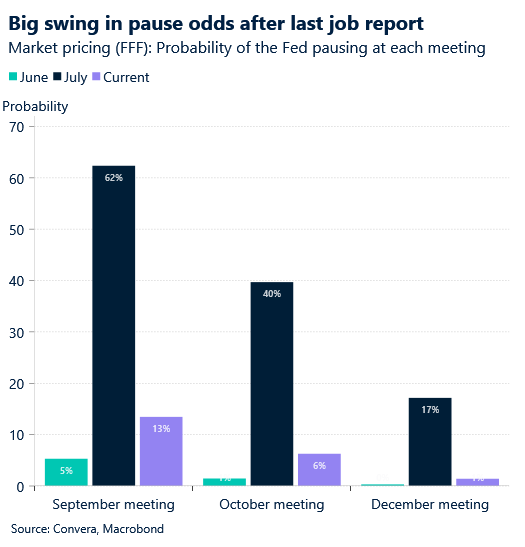

The US dollar gained after Federal Reserve minutes showed inflation remains the central bank’s top priority.

Most board members viewed inflation as a bigger risk than the labor market. However, the 29–30 July meeting took place before the latest jobs report missed expectations and earlier data was revised lower.

The stronger greenback pushed AUD/USD and GBP/USD down 0.3%, while EUR/USD held steady. In Asia, USD mostly rose, led by USD/JPY up 0.2%. USD/SGD was flat and USD/CNH dipped 0.1%.

PMIs in focus

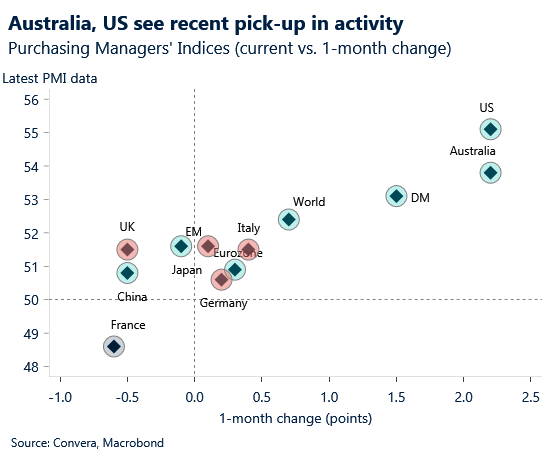

Markets now turn to global purchasing managers indexes – the most current snapshot of major economies.

Recent data shows a clear split: the US and Australia are seeing stronger momentum, while Europe continues to lag behind both global and developed market averages.

Despite this divergence, FX markets haven’t yet reflected the PMI trends. European currencies have outperformed the US and Australia so far this year.

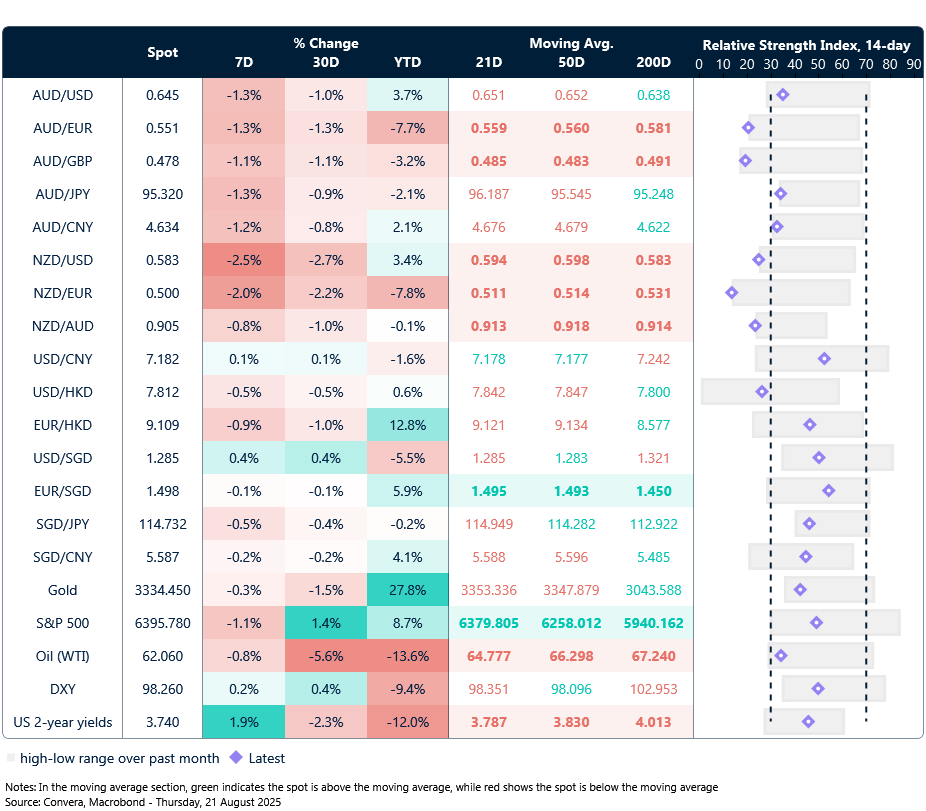

Aussie, kiwi pressured this week

Table: seven-day rolling currency trends and trading ranges

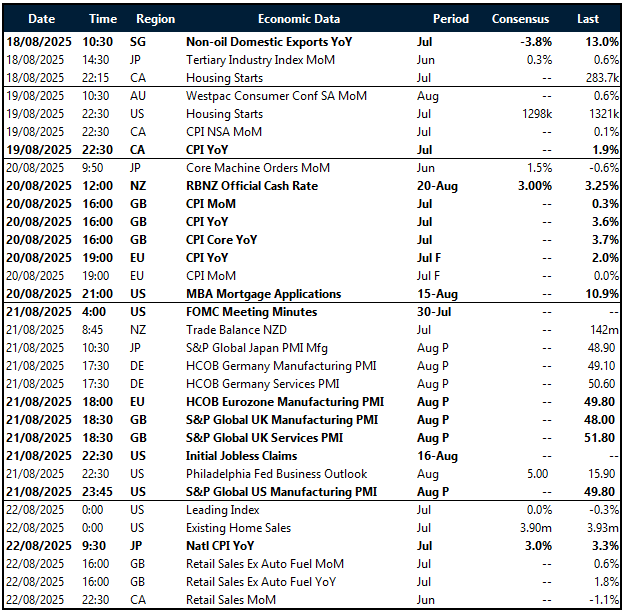

Key global risk events

Calendar: 18 – 22 August

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.ve a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.