Fed signals “skip”

The US dollar extended this week’s reversal from two-month highs overnight as key Federal Reserve officials signaled a so-called “skip” at the June policy meeting.

Over the last 24 hours, Philadelphia Fed president, Pat Harker, and Philip Jefferson, recently nominated to vice-chair at the Fed, both said the Federal Reserve should hold rates steady at the June meeting and then reassess in July.

The pricing for a 25-basis point hike from the US Fed in June fell from near 60% at the start of the week to 30% overnight (source: Refinitiv).

Meanwhile, worries about the US debt ceiling also receded, as the House of Representatives passed measures for a two-year extension to the debt ceiling by 314-117.

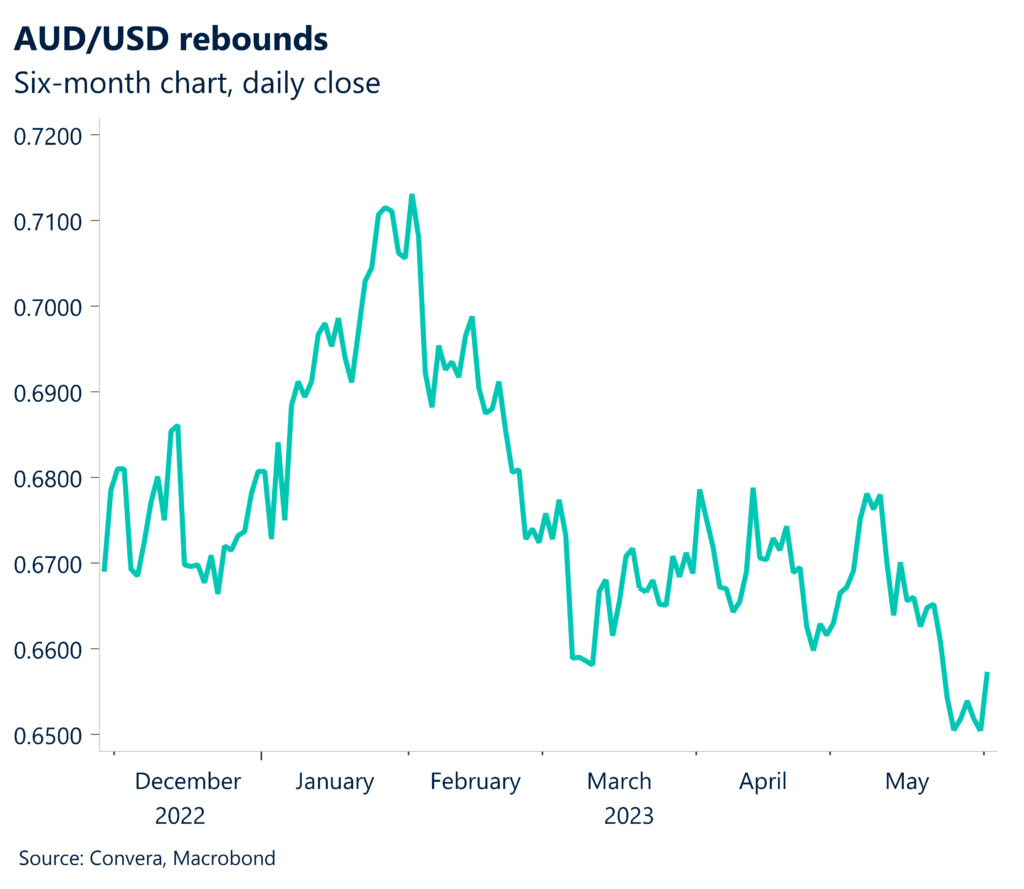

Aussie stronger on weaker greenback

The weaker US dollar saw big moves across the region overnight.

Most notably, the AUD/USD surged higher, up 1.1%, as it rebounded from six-month lows.

The Aussie was stronger in other markets with the AUD/EUR up 0.5% and the AUD/JPY up 0.7%.

The kiwi was also higher, up 0.8%, also climbing from six-month lows.

The USD/SGD fell 0.4% while the USD/CNH dropped 0.2%.

US jobs in focus

The US’s non-farm employment number is today’s major release.

The US labour market has continued to outperform with this release beating expectations at every report since April 2022.

Overnight, the private-sector ADP jobs report saw 278k new jobs – well above the 173k expected – while the weekly unemployment claims also beat forecasts at 232k. Both numbers signal a still-strong jobs market.

Tonight, the market is looking for 195k new jobs with the unemployment rate forecast to rise from 3.4% to 3.5%.

USD weaker on “skip”

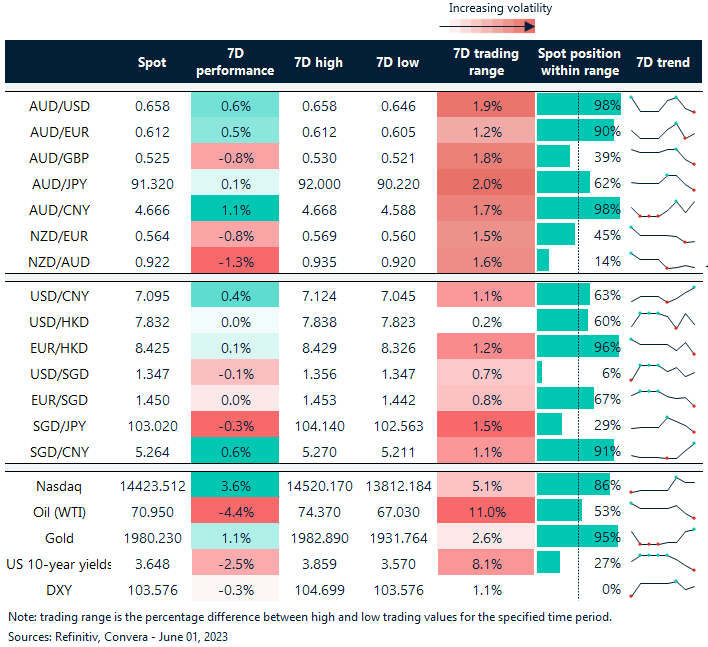

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 29 May – 2 June

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.