Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD lower on intervention fears

The US dollar’s monster rally reversed overnight with the greenback turning as it neared 16-month highs.

The USD index is up 4.0% over the last six weeks as markets came to the realisation that strong jobs growth and hot inflation means the US Federal Reserve is unlikely to cut interest rates at its June meeting.

The USD eased after a key meeting between the US, Japan and South Korea yesterday raised concerns about the USD’s rapid gains and the pressure on the Japanese yen and Korean won.

In a post-meeting statement, the three countries said they would “consult closely on foreign exchange market developments […] acknowledging serious concerns of Japan and the Republic of Korea about the recent sharp depreciation of the Japanese yen and the Korean won.”

The meeting raises the spectre of further intervention in FX markets.

Australian jobs due

The Australian March employment figures are due today with three big beats, one big miss and a flat result over the last five releases.

After a 116k spike in employment growth in February, the market is looking for flat job growth in March. The previous spike was probably caused by seasonality disruptions and this might “wash out” in March.

The unemployment rate looks likely to rise again to 3.9%, reversing around half of last month’s fall to 3.7%, and that the participation rate will likely remain mostly steady at 66.7%.

Australian leading indicators point to a slowing labor market and if we see a broadly flat result in the upcoming jobs report, trend employment growth will decline.

The AUD/USD fell to 2024 lows this week but the losses paused in Wednesday’s session providing the potential for a short-term rally to 0.6480 and then 0.6510.

US labour market key for greenback

The US dollar has been boosted by high inflation, but the strong labour market has also been crucial.

Looking to tonight’s weekly unemployment claims, jobless claims look likely to remain muted. With some advantageous seasonal changes for the Easter break, initial claims last week decreased.

Still, the number of ongoing claims increased to its highest level since January. Springtime usually brings noisy weekly claims data because of erratic holiday dates and seasonal changes.

After the strong US rally over the last few weeks, tonight’s weekly unemployment claims might set the short-term tone for direction.

Greenback weaker in Asia

Table: seven-day rolling currency trends and trading ranges

Key global risk events

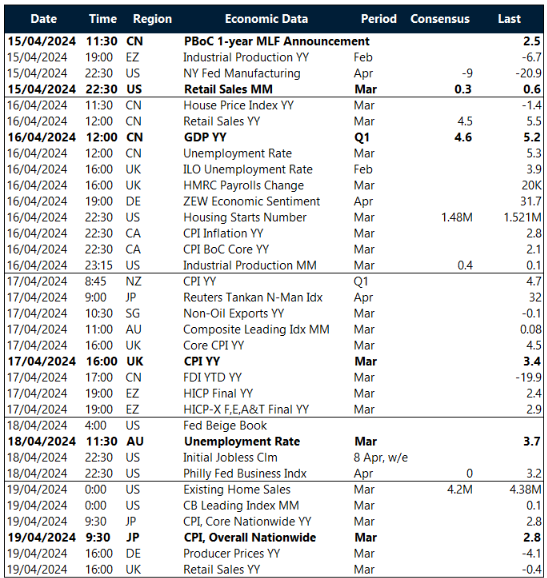

Calendar: 15 – 19 April

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]

Take a deep dive into the trends shaping cross-border payments with our podcast, Converge.