USD hit by Fed comments

The US dollar was lower on Friday after Federal Reserve chair Jerome Powell suggested the US central bank might not need to raise rates as much as previously anticipated.

A slowdown in negotiations round the US debt ceiling also weighed on the USD.

Most importantly, Powell said that a tightening in credit conditions means, “our policy rate may not need to rise as much as it would have otherwise to achieve our goals.” The news weighed on the USD which has recently gained – up 2.6% in two weeks – as the euro and Japanese yen fell.

Aussie, kiwi still stuck in their ranges

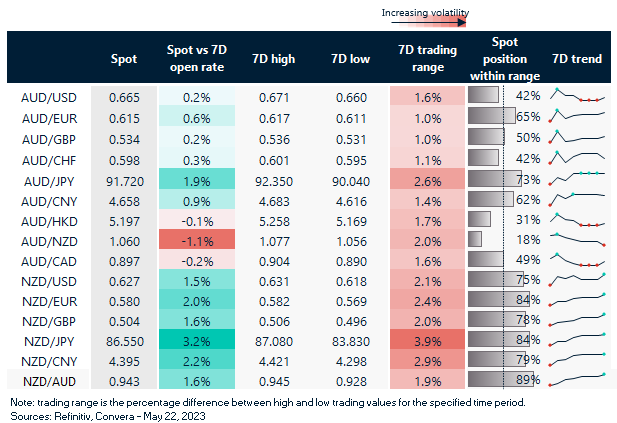

The Australian and New Zealand dollars remain stuck in their recent trading ranges.

The AUD/USD gained 0.5%, helped by the weaker greenback.

The Aussie was moderately higher in other markets with the AUD/EUR up 0.2%. The AUD/JPY was flat.

The kiwi outperformed ahead of this week’s critical Reserve Bank of New Zealand decision. Market pricing is broadly split 53-47 in favour of a 25-basis point hike rate rather than a 50-basis point increase.

The NZD/USD gained 0.9%.

RBNZ, PCE in focus this week

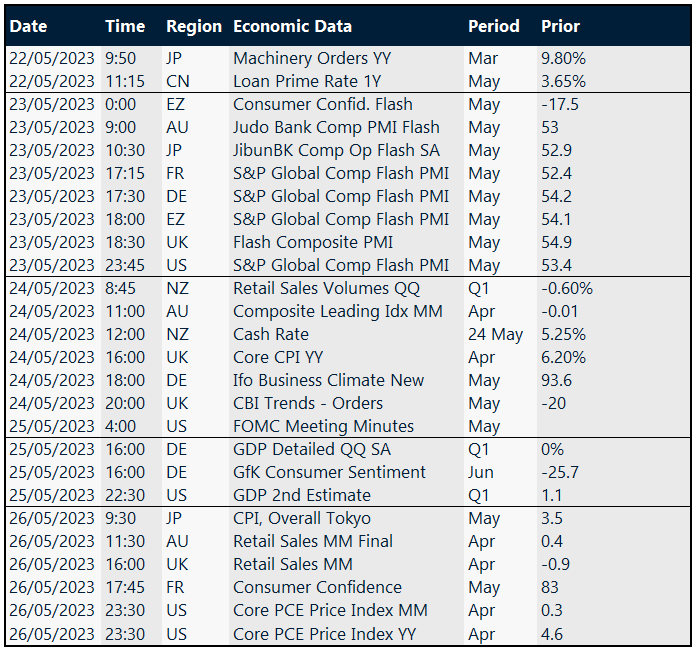

Apart from the RBNZ decision, the focus this week will be on Chinese rates, global PMI numbers and the US PCE inflation numbers.

Today, the People’s Bank of China announces its monthly decision on the benchmark loan prime rate—with the one-year currently at 3.65%. No change is expected but a recent slowdown in Chinese activity means some type of stimulus might be seen soon.

Tuesday sees the global PMI numbers – purchasing manager indexes – which provide the most up to date reading of the global manufacturing and services parts of the economy.

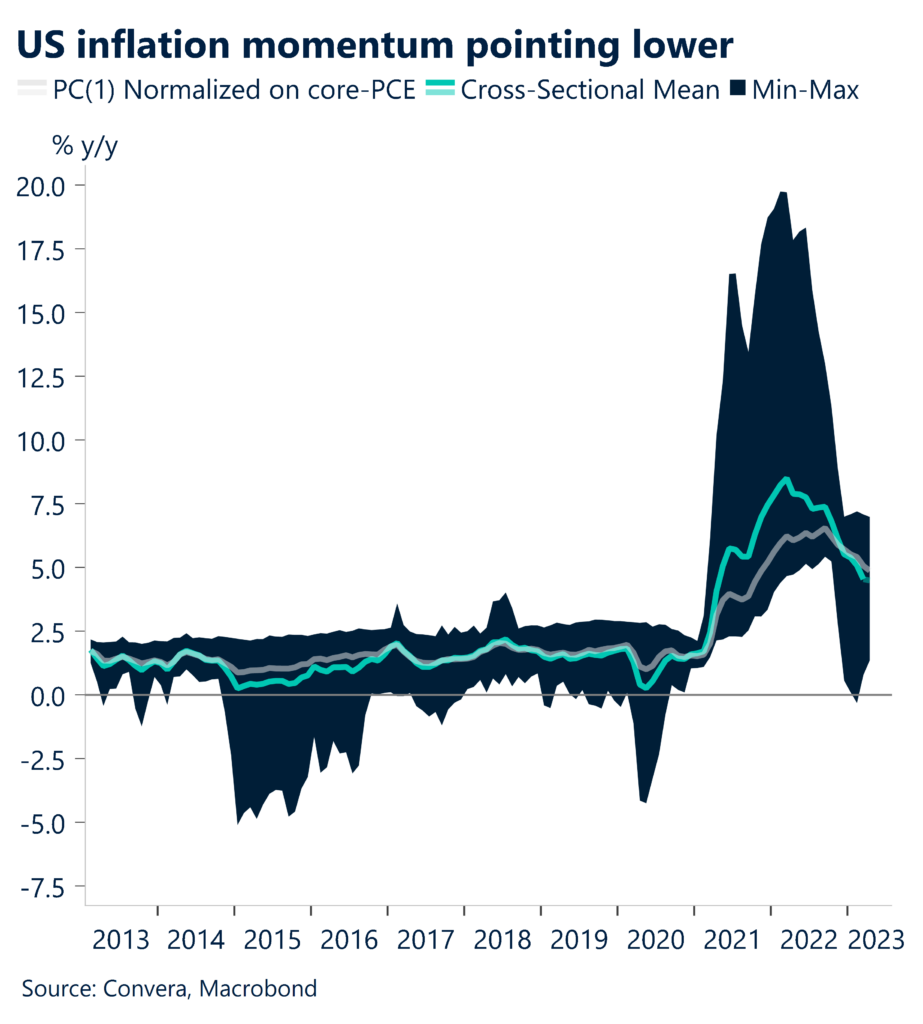

On Friday, the US’s personal consumption and expenditure numbers are released – the Fed’s preferred measure of inflation. A sharp slowdown in the reading has taken some of the pressure off the Fed – another lower number could weigh on the USD.

Greenback lower

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 22 – 26 May

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.