USD extends comeback on housing data

The US dollar was mostly higher overnight as further good news from the US economy and hopes for a resolution to the debt ceiling talks boosted the USD.

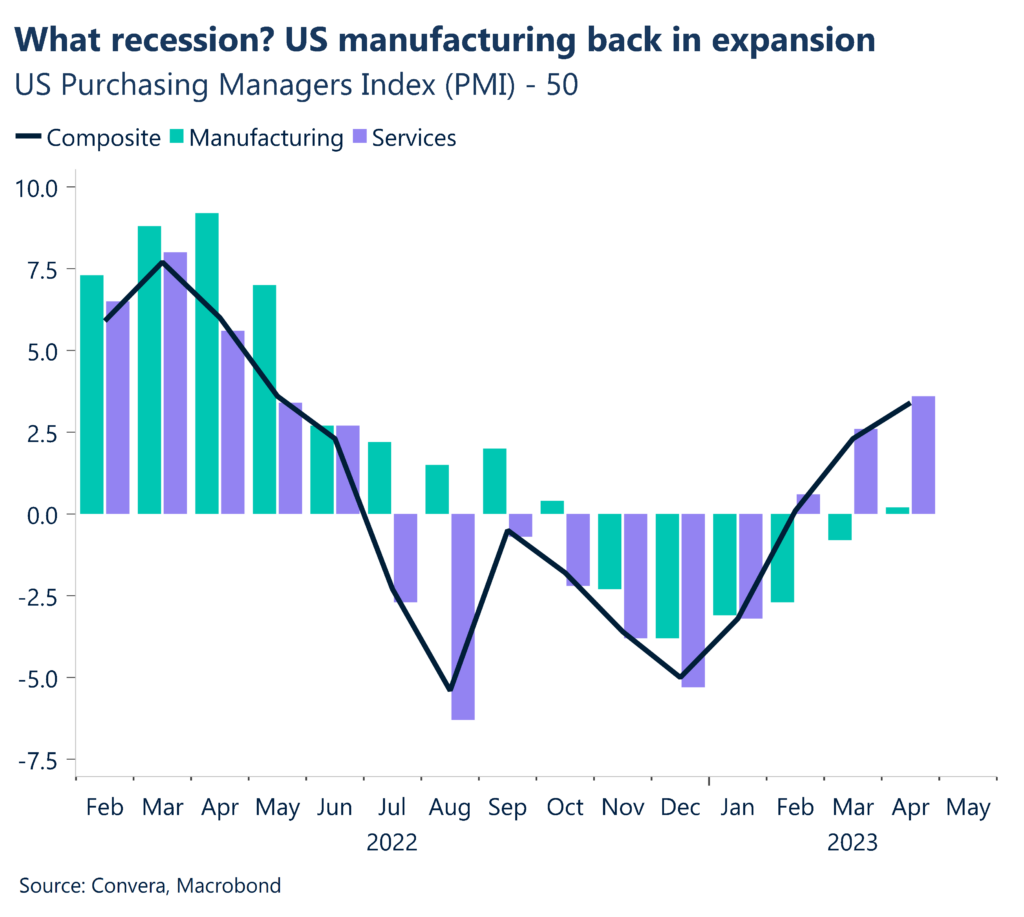

Overnight, US housing start data improved, adding to better manufacturing data seen earlier in the week.

Additionally, news that a new, dedicated team of negotiators had been allocated by the White House for debt ceiling talks also helped markets.

The US’s S&P 500 and Nasdaq both gained 1.2%.

The USD index extended recent gains, up 0.3%, as it reached the highest level since late March. The greenback’s best gains were against the Japanese yen.

Aussie still stuck in the range

The Australian and New Zealand dollars were able to make small gains versus the greenback as hopes for improving global economic growth boosted sentiment toward the currencies.

The NZD/USD gained 0.3%.

The Australian dollar underperformed after yesterday’s underwhelming March-quarter wage price data, which found annualised wage growth below expectations at 3.7% versus 3.8% expected, taking some of the pressure off the Reserve Bank of Australia to hike rates further.

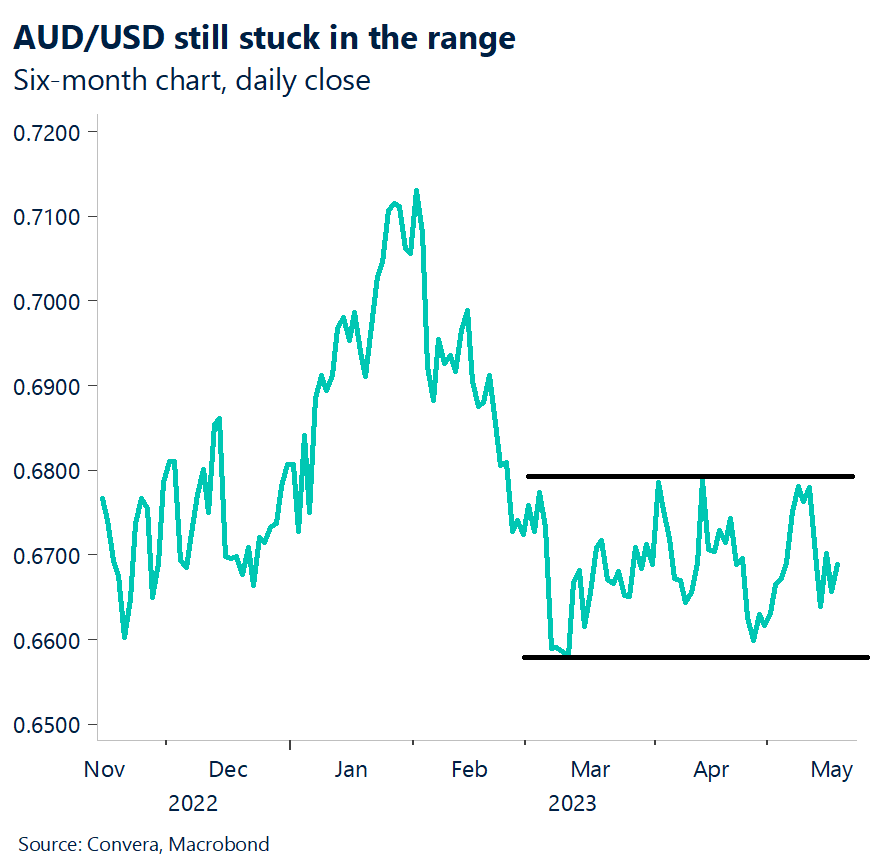

The AUD/USD gained 0.1%. The pair remains resolutely stuck in a clear trading range between 0.6650 and 0.6800.

Aussie jobs due

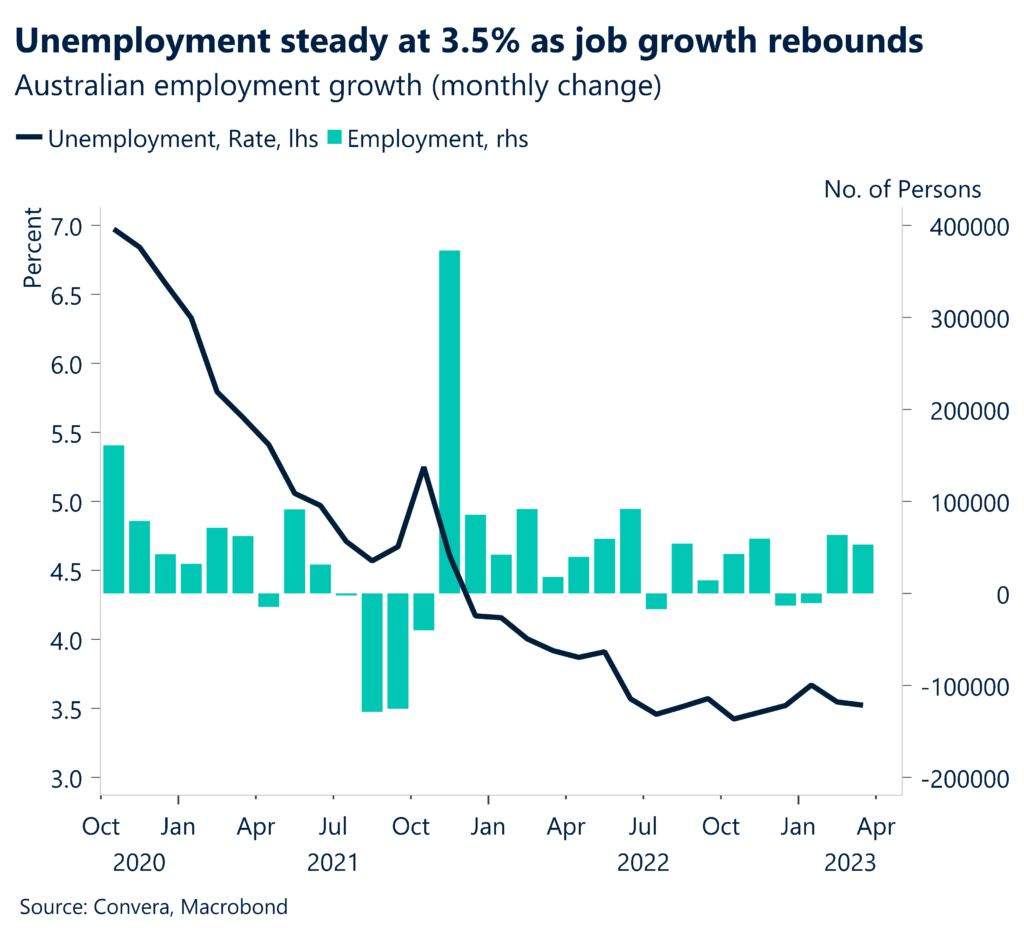

Australian jobs data is due today after a solid rebound in the last two months helped keep unemployment broadly steady at 3.5%.

This month, markets are looking for 25k new jobs with the unemployment rate forecast at 3.5%.

The Australian employment report is due at 11.30am AEST.

USD stronger overnight, but AUD, NZD eke out gains

Table: seven-day rolling currency trends and trading ranges

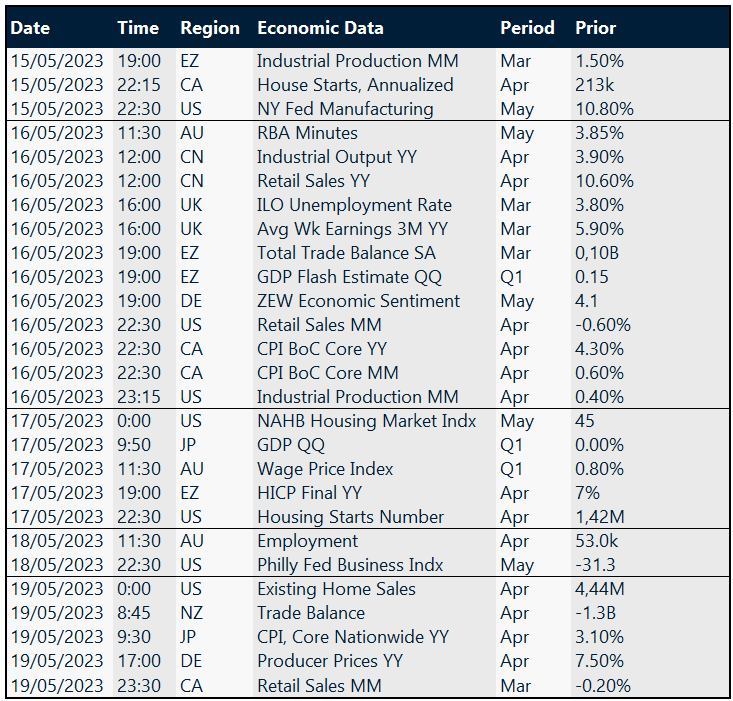

Key global risk events

Calendar: 15 – 19 May

All times AEST

Have a question? [email protected]