Written by the Market Insights Team

Dollar’s feeble rebound

Kevin Ford – FX & Macro Strategist

Geopolitical risks will keep investors on edge this week and a slew of central bank meetings will add to the risks. Israel’s continued strikes on Iran’s nuclear sites, military leadership, and scientific community had an initial weak impact on financial markets beyond energy. Oil prices have surged around 12% since last week, reflecting both direct and indirect output vulnerabilities. However, after Iran retaliated, and geopolitical tensions heightened, broader markets had more difficulty in absorbing the shock with a sharper sell-off ending the week as risk-off sentiment took over.

Equities were broadly down around 1% across major indices, with resource-heavy benchmarks like the Canadian equity index, TSX showing slightly smaller declines. European sovereign bond yields have ticked higher across maturities, same as US Treasuries.

Price discovery during volatility spikes continues to affirm 2025’s dominant theme; investors have timidly rushed to the US dollar and have sought stability elsewhere amid geopolitical uncertainty. The Swiss franc has swept up most of the haven demand in the FX space, whilst Gold has once again outperformed, reinforcing its role as the year’s defensive cornerstone. Heading into the weekend, market sentiment remained cautious but controlled, favoring measured positioning over outright panic.

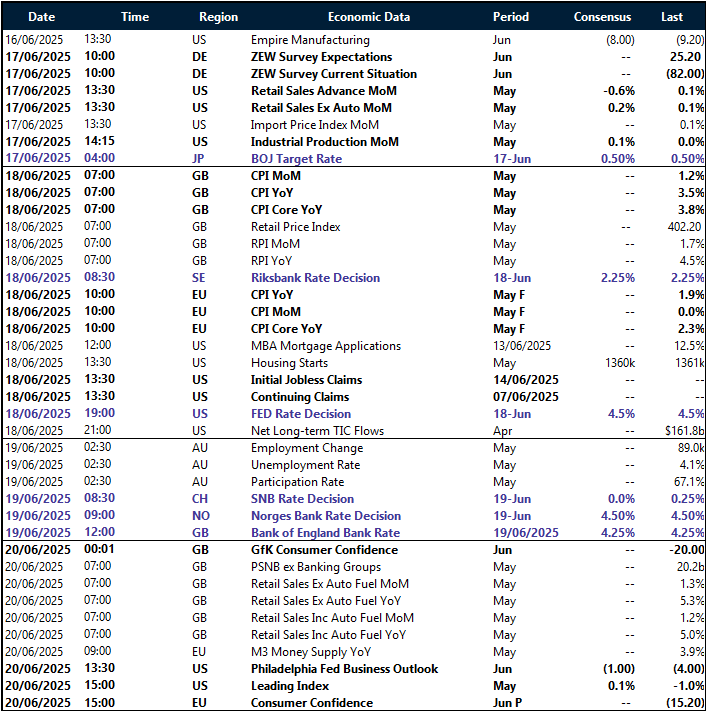

This week is shaping up to be a pivotal one for global markets, with six G10 central banks on deck, which will set the tone for markets. The US Federal Reserve (Fed) and Bank of England (BoE) are expected to hold rates steady despite markets recalibrating Fed cut expectations for at least two before the year end. The Swiss National Bank may cut by 50 basis points to counter franc appreciation, while Riksbank could reduce rates by 25 bps. Norway and Japan are likely to stay put. Investors will monitor US sentiment indicators for economic softness, while retail sales and industrial production will reveal consumer and factory activity.

Layer in the Middle East flare-up, which has sent oil prices surging and risk sentiment tumbling, and the result is a market environment riddled with cross-currents – where even small surprises could trigger outsized moves.

Euro slips on oil

George Vessey – Lead FX & Macro Strategist

The euro eased to $1.15 after hitting an over 3-year high of $1.1630 last week, as global markets were unsettled by escalating Middle East tensions, in which the euro suffered via the oil price channel. However, if geopolitical tensions ease, expect opportunistic buying in EUR/USD as traders reposition. The dollar’s fading haven demand has already started shifting flows, and a de-escalation would reinforce risk appetite, supporting a euro bounce.

For now, though, the rise in energy prices has in turn weighed on the currencies of energy dependent regions. This includes the euro as Europe is a net energy importer, so higher prices weigh on its terms of trade.

It’s also a burden to the European Central Bank (ECB), as muted inflation, previously supported by lower energy costs, now risks reversing. This would aggravate the already rising manufacturing sector concerns, and coupled with weak consumer and business confidence, could push the Eurozone toward a stagflationary outlook if geopolitical risks persist.

Adding to the euro’s woes, Eurozone industrial production for April saw its sharpest monthly contraction since July 2023, with output declines across all major categories. This week, markets will closely watch the final Eurozone inflation figures and the German ZEW surveys, which will provide insight into economic sentiment and outlook. But the geopolitical narrative will dominate the headlines and FX trends no doubt.

Sterling staggers with sentiment slump

George Vessey – Lead FX & Macro Strategist

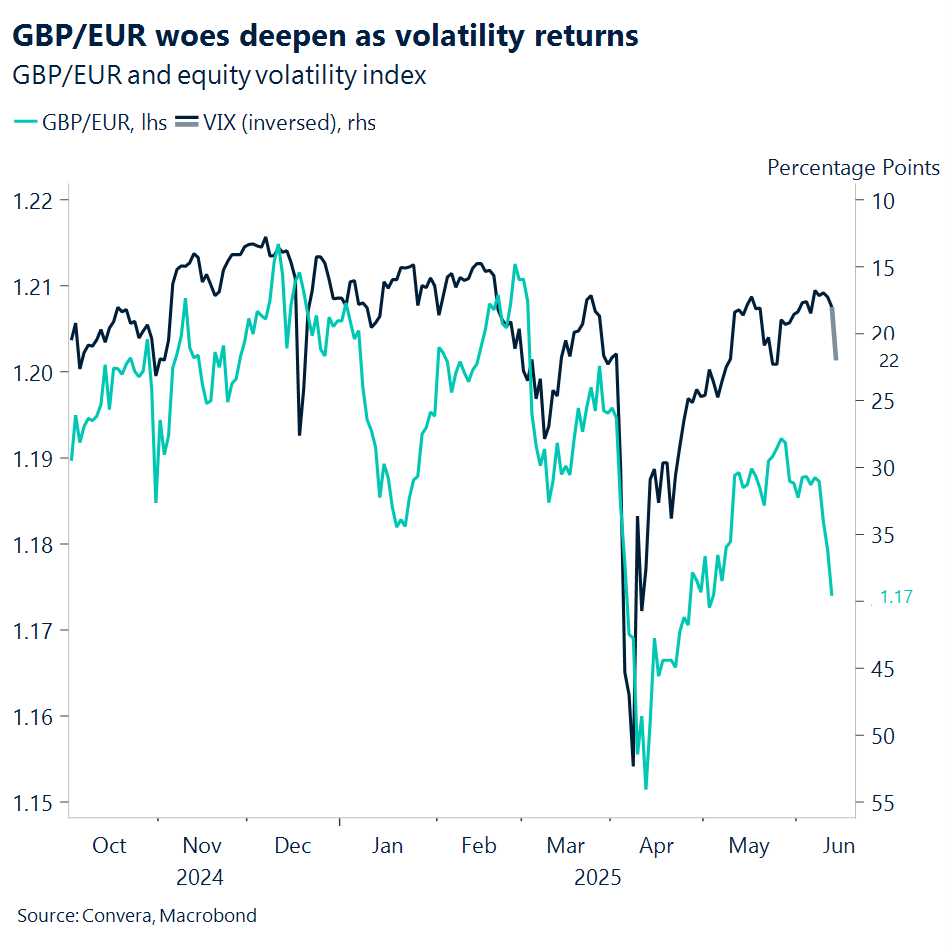

The British pound came under pressure at the back end of last week, with GBP/EUR sliding to a 4-week low, breaking below key technical levels and signaling further downside risks. Meanwhile, GBP/USD briefly touched a fresh 3-year high of $1.3632, but escalating Iran-Israel tensions, spiking oil prices, and deteriorating risk sentiment quickly reversed the move.

Sterling’s high sensitivity to risk appetite continues to work against it in volatile market conditions, with investors shifting into safe-haven assets like the Swiss franc, yen, and gold. At the same time, the UK-US economic surprise gap has narrowed, making it harder for GBP/USD to maintain traction above $1.36. Options traders are also trimming expectations for further GBP gains and are starting to position for longer-term weakness amidst concerns around domestic economic and fiscal risks.

Adding to the uncertainty, the BoE’s rate decision on Thursday will be a key event, with markets watching to see whether policymakers will reinforce expectations for two more rate cuts this year. No cut is expected on Thursday, but the vote split will be important. Since the last meeting, economic data has largely underwhelmed, especially the labour market. This has led money markets to ramp up BoE easing bets, dragging short-dated yields lower – which is another headwind for sterling.

For now, geopolitical stress dominates market sentiment, with traders reluctant to hold risk assets, wary of potential further escalations that could send FX markets into fresh turbulence.

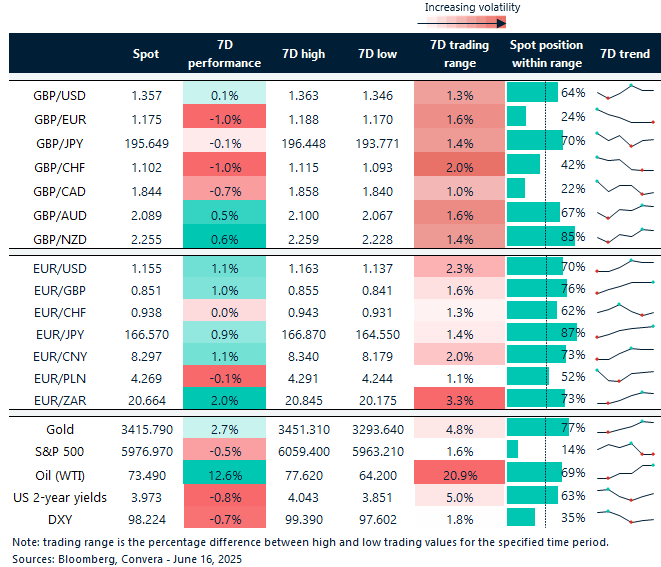

Oil jumps 12% in a week, safe haven Gold up 3%

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: June 16-20

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.