Debt ceiling talks due

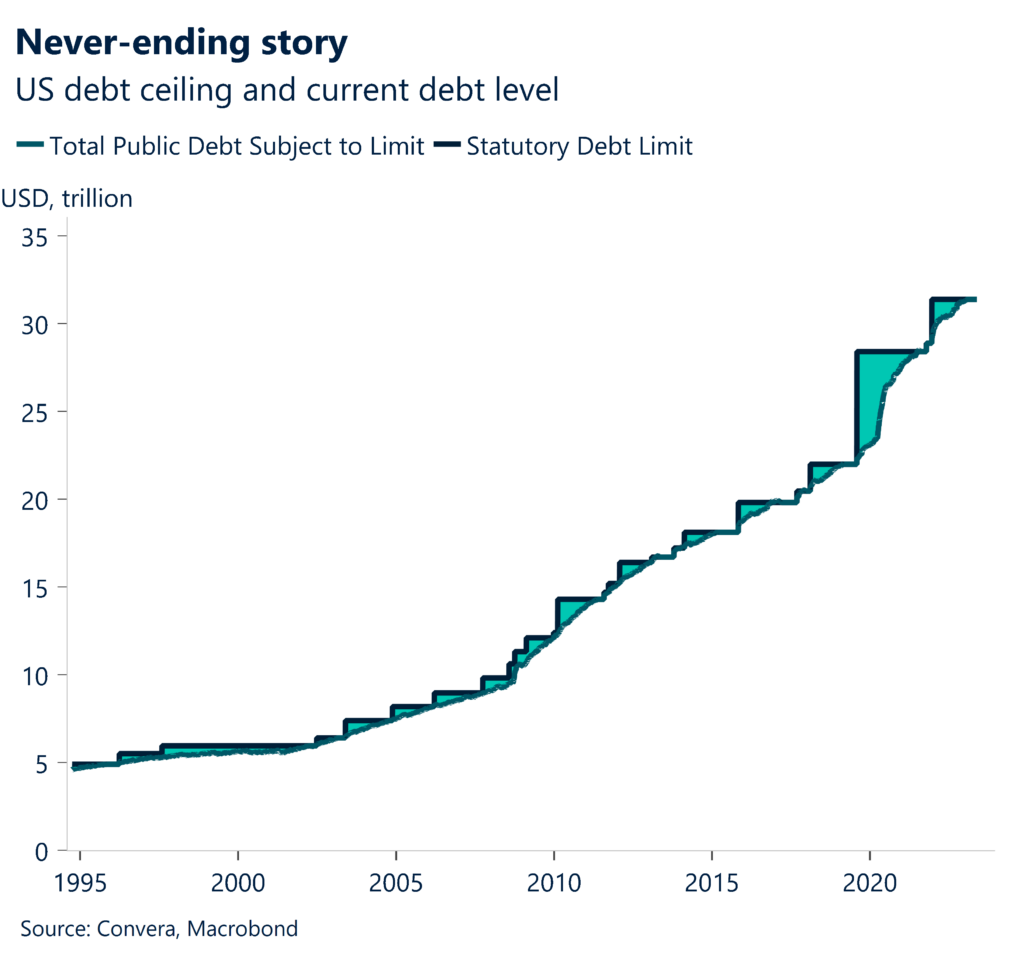

Global FX markets remained on edge overnight ahead of key talks on the US debt ceiling between US President Joe Biden and Republican leader Kevin McCarthy.

The US’s debt ceiling talks were suspended over the weekend as President Biden attended the G7 meeting in Japan with negotiations due to resume on Monday afternoon Washington time.

The US Treasury Secretary Janet Yellen again reiterated overnight that the US government would likely run out of cash by early June.

The US Treasury’s cash balance sat at USD60.7bln on Friday, up from USD57.3bln a day earlier.

FX markets on edge

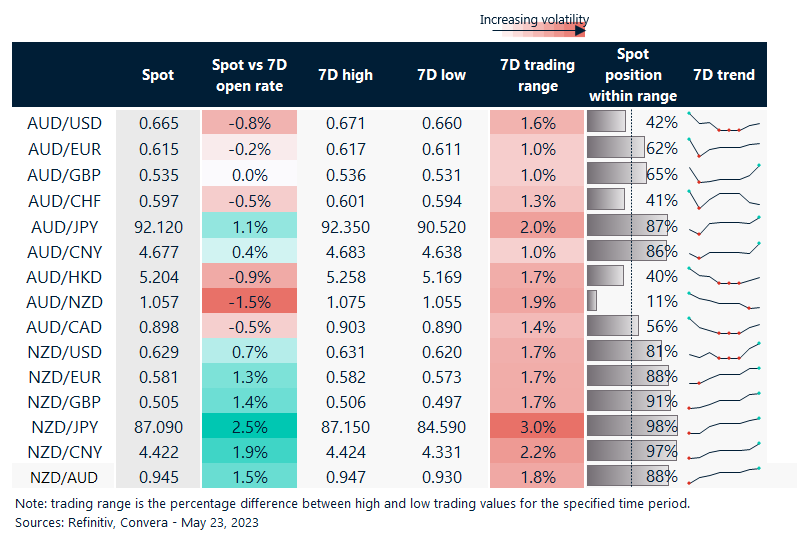

FX markets were broadly steady with the EUR/USD up 0.1% while the GBP/USD was flat.

The USD/JPY was the only major FX market to see any significant movement – up 0.5%.

Locally, the AUD/USD fell 0.1%, while the AUD/EUR and AUD/GBP were flat. The AUD/JPY gained 0.5%.

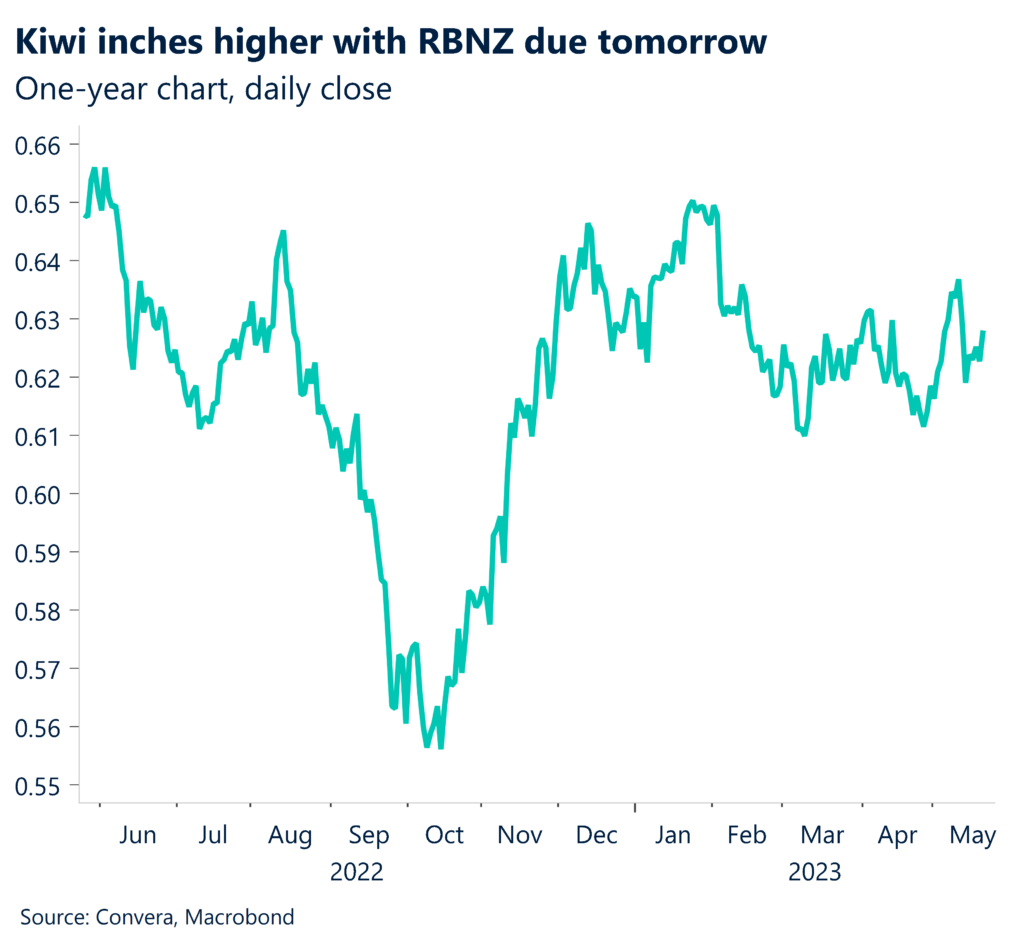

The NZD/USD climbed less than 0.1% with the pair supported ahead of tomorrow’s Reserve Bank of New Zealand decision.

PMI numbers due

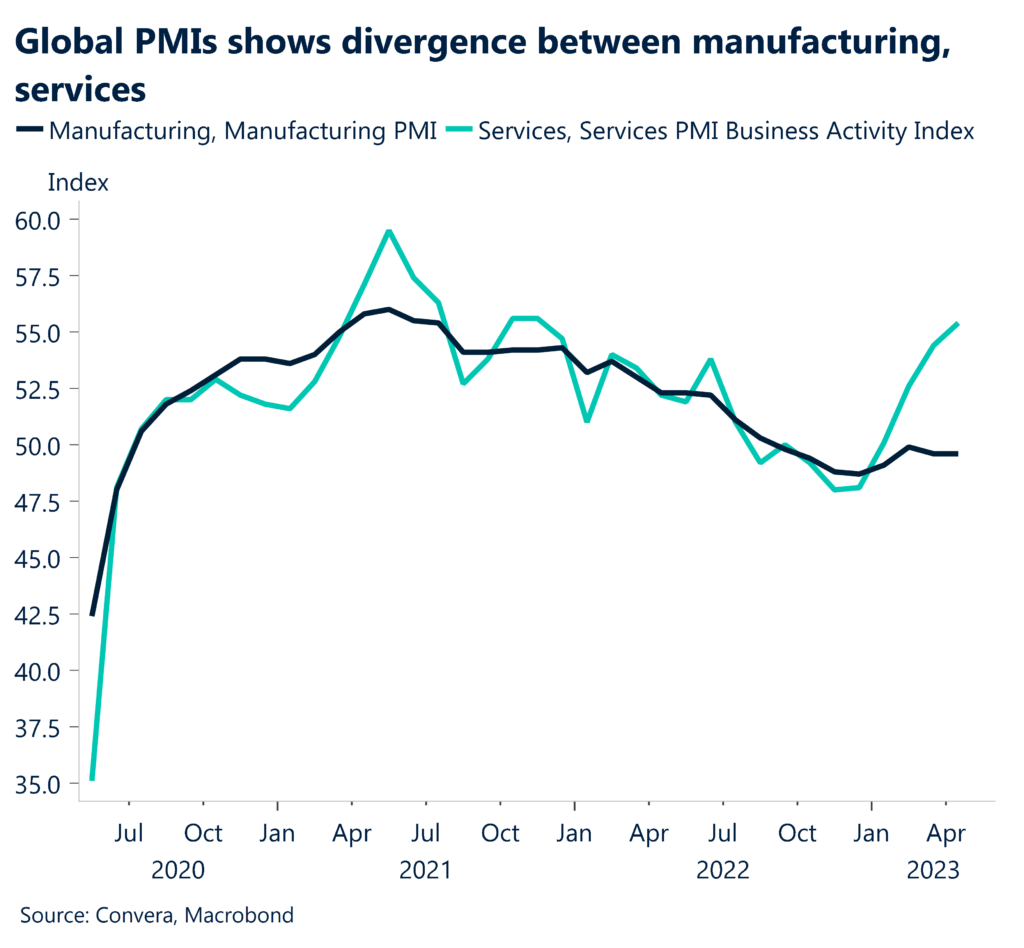

Away from US politics, today’s major focus is on the sequence of PMI releases due over the next 24 hours.

The purchasing manager indexes are the most up-to-date reading of the global economy with releases due from Australia, Japan, Europe and the US. (Chinese numbers are due next week.)

Notably, we have seen a marked divergence in 2023 as manufacturing activity data wanes while services data outperforms.

The divergence is likely driven by the aftershocks of the pandemic with consumers still suffering a hangover after a manufactured goods buying-binge during lockdowns, while still happy to spend money on eating out, entertainment and travel. The slowdown in manufacturing industry is a clear negative for the Australian dollar and Chinese yuan.

Kiwi at highs ahead of RBNZ

Table: seven-day rolling currency trends and trading ranges

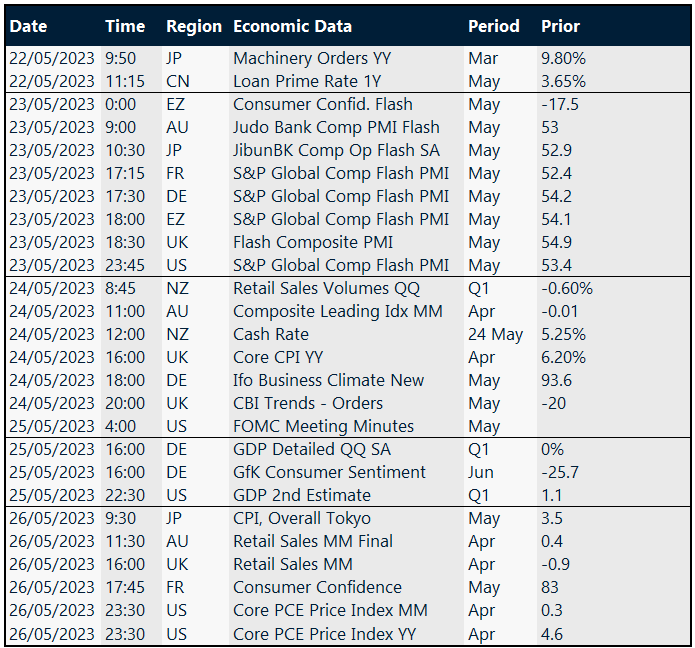

Key global risk events

Calendar: 22 – 26 May

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.